Email

New report: Tracking the companies that have a lock on sending funds to incarcerated people

| From | Prison Policy Initiative <[email protected]> |

| Subject | New report: Tracking the companies that have a lock on sending funds to incarcerated people |

| Date | November 9, 2021 5:14 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

How much it would cost you to send money to an incarcerated loved one?

Prison Policy Initiative updates for November 9, 2021 Showing how mass incarceration harms communities and our national welfare

Show me the money: Tracking the companies that have a lock on sending funds to incarcerated people [[link removed]] We looked at all fifty state departments of corrections to figure out which companies hold the contracts to provide money-transfer services and what the fees are to use these services. [[link removed]]

by Stephen Raher and Tiana Herring

As people in prison are increasingly expected to pay for everyday costs [[link removed]] (food, hygiene items, correspondence, etc.), the mechanics of how people send money to incarcerated people assumes heightened importance. Family members used to mail a money order to a PO box, and a day or two later, the money would be in the recipient's trust account. In those days, the most common complaint from family members and incarcerated recipients used to be about delays in processing money orders. Quick to use consumer psychology to turn a buck, a whole industry arose to provide faster--but vastly more expensive--electronic money transfers to incarcerated people.

This "correctional banking" industry includes specialized services like release cards [[link removed]], but at its core the industry makes money off the simple (but highly lucrative [[link removed]]) business of facilitating transfers from friends and family members to incarcerated recipients. The industry relentlessly crows about the speed of electronic transfers, while conveniently glossing over the high fees that typically accompany these services. To get a better sense of the landscape, we looked at all fifty state departments of corrections and tried to figure out which companies (if any) hold the contract(s) to provide money-transfer services for each prison system. When possible, we tried to figure out what the fees are to use these services.

In a new report published today, called Show Me the Money [[link removed]], we provide the results of our review, identify notable trends in this realm, and highlight steps families of people who are incarcerated, regulators, procurement officials, and companies can take to make money transfers more convenient, affordable, and easy to understand. See the full version of this report [[link removed]] for tables with state-by-state data, footnotes, and more analysis of the payment options in California.

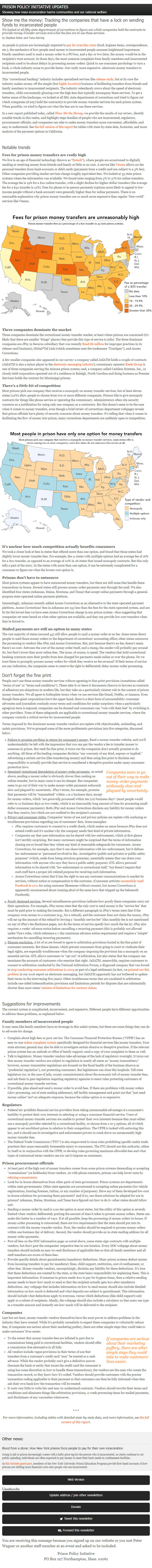

Notable trends Fees for prison money transfers are really high

We live in an age of financial technology (known as “ fintech [[link removed]]”), where people are accustomed to digitally sending or receiving money from friends and family at little or no cost. A service like Venmo [[link removed]] allows no-fee personal transfers from bank accounts or debit cards (payments from a credit card are subject to a 3% fee). Other companies providing similar services charge roughly equivalent fees. We looked at 33 state prison systems where fee information was available. We found rates ranging from 5% to 37% for online transfers. The average fee is 19% for a $20 online transfer, with a slight decline for higher-dollar transfers (the average fee for a $50 transfer is 12%). Fees for phone or in-person payments (options more likely to appeal to low-income people without a bank account) were generally higher than for online payments. There is no reasonable explanation why prison money transfers are so much more expensive than regular “free world” services like Venmo.

[[link removed]]

Three companies dominate the market

Three companies dominate the correctional money-transfer market, at least where prisons are concerned (it’s likely that there are smaller “fringe” players that provide this type of service to jails). The three dominant companies are JPay (a Securus subsidiary that was recently fined $6 million [[link removed]] for improper practices in its release-card business), Global*Tel Link (which sometimes uses the tradename “Touchpay”), and Access Corrections.

A few smaller companies also appeared in our survey: a company called JailATM holds a couple of contracts (JailATM is also a minor player in the electronic messaging industry [[link removed]]); commissary operator Keefe Group [[link removed]] is one of three companies serving the Arizona prison system; and, a company called Cashless Systems, Inc., (a closely-held corporation operated out of a residence in Raleigh, North Carolina and doing business as Premier Services) holds the contract for Mississippi prisons.

There’s a little bit of competition

Most prisons pick one company that receives a monopoly on money-transfer services, but at least eleven states (22%) allow people to choose from two or more different companies. Prisons like to give monopoly contracts for things like phone service or operating the commissary. Administrators often cite security concerns as a justification for using only one company as a contractor. But this doesn’t seem to be the case when it comes to money transfers, even though a brief review of corrections-department webpages reveals that prison officials have plenty of security concerns about money transfers. It’s telling that when it comes to facilitating the flow of money into prison, many corrections departments are suddenly open to competition.

It’s unclear how much competition actually benefits consumers

We took a closer look at fees in states that offered more than one option, and found that those states had slightly lower money-transfer fees. For example, the 11 states with multiple options had an average fee of 16% for a $20 transfer, as opposed to an average of 20% in 26 states that issued monopoly contracts. But this only tells a part of the story. In the states with more than one option, it can be extremely complicated for a consumer to figure out what the lowest-cost option is.

Prisons don’t have to outsource

Most prison systems appear to have outsourced money transfers, but there are still some that handle these transactions in-house. Several states still process money-order payments sent through the mail. We also identified four states (Arkansas, Maine, Montana, and Texas) that accept online payments through a general-purpose state-operated online payment platform.

Interestingly, Arkansas recently added Access Corrections as an alternative to the state-operated payment platform. Access Corrections’ fees in Arkansas are 25¢ less than the fees for the state-operated system, and are by far the lowest fees we have seen Access Corrections charge in any prison system—thus suggesting that companies set rates based on what other options are available, and they can provide low-cost transfers when they’re forced to.

Mailed payments are still an option in many states

The vast majority of states (around 45) still allow people to mail a money order at no fee. Some states direct people to mail those money orders to the department of corrections’ accounting office; other states outsource the processing to vendors like JPay and Access Corrections. But, just because there’s no fee, doesn’t mean there’s no cost—between the cost of the money order itself, and a stamp, the sender will probably pay around $2, but that’s lower than most online fees. The issue, of course, is speed. The vendors that hold correctional banking contracts earn their profits from fees charged for payments made online or over the phone. Do we trust them to promptly process money orders for which they receive no fee revenue? If their terms of service are any indication, the companies seem to reserve the right to deliberately delay money-order processing.

Don't forget the fine print

People can't use these money-transfer services without agreeing to fine-print provisions (sometimes called "terms of use" or "terms and conditions"). These take-it-or-leave it documents (known to lawyers as contracts of adhesion) are ubiquitous in modern life, but they take on a particularly sinister role in the context of prison money transfers. We all agree to boilerplate terms when we use services like Gmail, Netflix, or Amazon. Even though these giant corporations have the upper hand, there is a faint form of accountability: consumer advocates and journalists routinely scour terms and conditions for unfair surprises; when a particularly egregious term is exposed, companies can be shamed and consumers can "vote with their feet" by switching to other providers. None of these safeguards are applicable to correctional money-transfer services, where the company controls a critical service for incarcerated people.

Terms imposed by the dominant money-transfer vendors are replete with objectionable, misleading, and unfair provisions. We've grouped some of the more problematic provisions into five categories, discussed below.

Failure to promise anything in return for consumer's money. Read a money-transfer website, and you'll understandably be left with the impression that you can pay the vendor a fee to transfer money to someone in prison. But read the fine print, it turns out the companies don't actually promise to do anything. All three of the leading companies disclaim "any warranty of any kind, express or implied." Advertising a certain service (like transferring money) and then using fine print to disclaim any responsibility to actually provide that service is considered a deceptive practice under many consumer-protection laws. Companies seem to go out of their way to make money-order payments arduously slow and plagued by uncertainty. Seemingly intentional degradation of money-order payments. As noted above, sending a money order is obviously slower than making an online transfer, but in many cases it can be cheaper. But companies seem to go out of their way to make money-order payments arduously slow and plagued by uncertainty. JPay's terms, for example, promise that payments will be "transmitted" within 1 or 2 business days, except for money-orders, which "are generally processed within ten (10) business days" (most people would refer to 10 business days as two weeks, which is an inexcusably long amount of time for processing small-dollar consumer payments). Both JPay and Access Corrections disclaim any liability for money orders that they receive, but which are not credited to the recipient's account. Privacy and consumer rights. Companies' terms of use and privacy policies are replete with confusing or troublesome provisions regarding use of customers' data. Some examples: JPay requires customers to consent to a credit check, which makes no sense because JPay does not extend credit and it's unclear why the company needs that kind of private information. Companies say that user information can be shared with law enforcement, which at first glance isn't terribly surprising. But many customers might be surprised that the terms of information sharing are so broad that they vitiate any kind of reasonable safeguards for consumers. Access Corrections, for example, says that it can share information with law enforcement, but it defines law enforcement as "personnel involved in the...investigative (public and private) or public safety purposes" (which, aside from being atrocious grammar, essentially means they can share your information with anyone who says they have a public safety purpose). GTL allows personal information to be shared with "law enforcement or correctional staff," but doesn't require that such staff have a proper job-related purpose for receiving such information. Access Corrections states that it has the right to use any customer communications to market its services, without notice or compensation to the customer. (Consumer activists successfully sued Facebook in 2011 [[link removed]] for using customer likenesses without consent, but Access Corrections is apparently unconcerned about running afoul of the same laws that tripped up the behemoth Facebook). Poorly designed services. Several miscellaneous provisions indicate how poorly these companies carry out their operations. For example, JPay terms state that the only cost to send money is the "service fee" that must be paid prior to making the transfer. But a different paragraph in JPay's terms state that if the company owes money to a customer (e.g., for a refund), and the customer does not claim the money, JPay will eat up the amount of the refund by levying a "monthly service fee" (this monthly fee is not mentioned on any of JPay's fee disclosure pages, nor do the terms of service specify how much the fee is). JPay also requires 2 weeks' advance notice before cancelling a recurring payment (this is probably not allowed under Visa's rules, which reference a 7-day maximum advance notice requirement and require a "simple" mechanism for cancelling recurring payments). Dispute resolution. A lot of us are forced to agree to arbitration provisions buried in the fine print of consumer contracts. But these clauses, which prevent consumers from going to court to vindicate their legal rights, are especially troublesome when the company imposing the provision has a monopoly on an essential service. GTL allows customers to "opt out" of arbitration, but also states that the company can terminate the accounts of customers who exercise that right. JailATM, meanwhile, requires customers to consent to arbitration conducted by the National Arbitration Forum, a disgraced company that was forced to stop conducting consumer arbitrations in 2009 [[link removed]] as part of a legal settlement (in fact, we pointed out this problem [[link removed]] in our 2016 report on electronic messaging, but JailATM apparently has not bothered to update their terms in the intervening five years). Other troublesome terms that are unrelated to arbitration include one-sided indemnification provisions and limitations periods for disputes that are substantially shorter than most states' statutes of limitations for contract claims [[link removed]].

Suggestions for improvements

The current system is complicated, inconvenient, and expensive. Different people have different opportunities to address these problems, as explained below.

Family members of incarcerated people

It may seem like family members have no leverage in this unfair system, but there are some things they can do to advocate for change.

Complain about high fees or poor service. The Consumer Financial Protection Bureau ("CFPB") has an easy-to-use online complaint system [[link removed]] specifically designed for financial services like money transfers. Your state attorney general may also be able to investigate certain abusive or deceptive practices. If the relevant prison system has an ombuds or office of family support, send a copy of your complaint to them as well. Talk to legislators. Money-transfer vendors take advantage of the lack of regulatory oversight. It turns out that money-transfer vendors are subject to regulation in nearly all states as "money-transmitters;" however, money-transmitter regulations are focused on the fiscal health of the business (known as "prudential regulation"), not protecting consumers. But legislatures can close this loophole. Tell state legislators (or, in the case of jails, county commissioners) about the economic toll of money-transfer fees, and ask them to pass legislation requiring regulatory agencies to enact rules protecting customers of correctional money-transfer services. If possible, plan ahead and send a money order to avoid fees. If there are problems with money orders (slow processing, out of state mailing addresses), tell facility management and point out that "just send money online" isn't an adequate response, because the online option is so expensive. Regulators Federal law prohibits financial service providers from taking unreasonable advantage of a consumer's inability to protect their own interests in selecting or using a consumer financial service. Users of correctional money-transfer services are unable to protect their own interests because they must either use a monopoly provider selected by a correctional facility, or choose from 2 or 3 options, all of which appear to set exorbitant prices in relation to their competitors. The CFPB is tasked with enforcing this law, and it should use its investigative and enforcement powers to crack down on unreasonably high money-transfer fees. The Federal Trade Commission ("FTC") is also empowered to issue rules prohibiting specific unfair trade practices that cause reasonably foreseeable injury to consumers. The FTC should use this authority, either by itself or in conjunction with the CFPB, to develop rules governing maximum allowable fees and what types of contractual terms vendors can (or can't) impose on customers. Prison procurement officials At least part of the high cost of money transfers comes from some prison systems demanding or accepting "commissions" (or kickbacks) from vendors. As with phone contracts, prisons can help lower costs by refusing commissions [[link removed]]. Look for in-house alternatives from other parts of state government. Prison systems are departments within state governments. Other state agencies are accustomed to accepting online payments (for vehicle registrations, hunting licenses, tuition, or any number of purposes). Have any of them developed low-cost in-house solutions for processing these payments? And if so, can those solutions be adapted for use in prisons? Arkansas, Maine, Montana, and Texas have figured out how to do it--other states should follow suit. Sending a money order by mail is a no-fee option in most states, but the utility of this option is severely limited when vendors deliberately prolong the amount of time it takes to process money orders. States can make this better in a number of ways. If at all possible, keep the processing of money orders in-house. If money-order processing is outsourced, there are two requirements that the state should put into its contract with the money-transfer vendor. First, the vendor should be required to process money orders within one business day of delivery. Second, the vendor should provide an in-state mailing address for all money order payments. Post all fees on the DOC information page: as noted above, some states sign contracts with multiple vendors, but don't post the companies' respective fees in one location. Every DOC webpage about money transfers should include an easy-to-read disclosure of applicable fees so that all family members and all staff members are aware of these fees. Provide specific details about garnishments/mandatory deductions. Many prison systems deduct money from incoming transfers to pay for mandatory fines, child support, restitution, cost of confinement, or other fees. Money-transfer vendors, unsurprisingly, disclaim any liability for these deductions. It's true that these deductions are created by the state, so the state bears responsibility for explaining them. This is important information: if someone in prison needs $20 to pay for hygiene items, then a relative sending money needs to know how much to send so that the recipient actually gets $20 after mandatory deductions. Any webpage that includes information on how to send money should also include detailed information on how much is deducted and what deposits are subject to garnishment. This information should include what deductions apply to everyone, versus which deductions (like child support) only apply to a subset of recipients. Ideally, the webpage should also include a calculator so that users can type in a transfer amount and instantly see how much will be delivered to the recipient. Companies

Last but not least, money-transfer vendors themselves have the most power to address problems in the industry they have created. While it's probably unrealistic to expect these companies to voluntarily reduce fees, if companies are serious about their marketing puffery, there are other simple steps they could take to make customers' lives easier.

If companies are serious about their marketing puffery, there are other simple steps they could take to make customers' lives easier.To the extent that money-transfer fees are inflated in part due to commissions being paid to correctional facilities, vendors should offer a commission-free alternative in all bids. All vendors include vague provisions in their terms of use that transfers from a customer's credit card "may" be treated as a cash advance. While the vendor probably can't give a definitive answer (because the bank or entity that issues the credit card the consumer is using has some discretion in how to handle these transactions), the vendors are the ones who create the transaction record, so they know how it's coded. Vendors should provide customers with the precise transaction coding applicable to their payment so that customers can then be fully informed when they ask their own bank how the transaction will be treated. It costs very little to write fair and easy-to-understand contracts. Vendors should rewrite their terms and conditions and eliminate things like arbitration provisions, 2-week processing times for mailed payments, and disclaimers of any warranties whatsoever.

* * *

For more information, including tables with detailed state-by-state data, and more information, see the full version of this report [[link removed]].

Please support our work [[link removed]]

Our work is made possible by private donations. Can you help us keep going? We can accept tax-deductible gifts online [[link removed]] or via paper checks sent to PO Box 127 Northampton MA 01061. Thank you!

Other news: Blood from a stone: How New York prisons force people to pay for their own incarceration [[link removed]]

Going to jail or prison increasingly comes with a hefty price tag for the person who is incarcerated. As states continue to cut public spending, individuals are often expected to pay money to meet their basic needs in confinement facilities.

In this October guest post, [[link removed]] members of the New York University Prison Education Program provide first-hand accounts of how prisons are shifting more financial costs onto people who are incarcerated.

Please support our work [[link removed]]

Our work is made possible by private donations. Can you help us keep going? We can accept tax-deductible gifts online [[link removed]] or via paper checks sent to PO Box 127 Northampton MA 01061. Thank you!

Our other newsletters Ending prison gerrymandering ( archives [[link removed]]) Criminal justice research library ( archives [[link removed]])

Update which newsletters you get [link removed].

You are receiving this message because you signed up on our website [[link removed]] or you met Peter Wagner or another staff member at an event and asked to be included.

Prison Policy Initiative [[link removed]]

PO Box 127

Northampton, Mass. 01061

Web Version [link removed] Unsubscribe [link removed] Update address / join other newsletters [link removed] Donate [[link removed]] Tweet this newsletter [link removed] Forward this newsletter [link removed]

You are receiving this message because you signed up on our website or you met Peter Wagner or another staff member at an event and asked to be included.

Prison Policy Initiative

PO Box 127 Northampton, Mass. 01061

Did someone forward this to you? If you enjoyed reading, please subscribe! [[link removed]] Web Version [link removed] | Update address [link removed] | Unsubscribe [link removed] | Share via: Twitter [link removed] Facebook [[link removed] Email [link removed]

Prison Policy Initiative updates for November 9, 2021 Showing how mass incarceration harms communities and our national welfare

Show me the money: Tracking the companies that have a lock on sending funds to incarcerated people [[link removed]] We looked at all fifty state departments of corrections to figure out which companies hold the contracts to provide money-transfer services and what the fees are to use these services. [[link removed]]

by Stephen Raher and Tiana Herring

As people in prison are increasingly expected to pay for everyday costs [[link removed]] (food, hygiene items, correspondence, etc.), the mechanics of how people send money to incarcerated people assumes heightened importance. Family members used to mail a money order to a PO box, and a day or two later, the money would be in the recipient's trust account. In those days, the most common complaint from family members and incarcerated recipients used to be about delays in processing money orders. Quick to use consumer psychology to turn a buck, a whole industry arose to provide faster--but vastly more expensive--electronic money transfers to incarcerated people.

This "correctional banking" industry includes specialized services like release cards [[link removed]], but at its core the industry makes money off the simple (but highly lucrative [[link removed]]) business of facilitating transfers from friends and family members to incarcerated recipients. The industry relentlessly crows about the speed of electronic transfers, while conveniently glossing over the high fees that typically accompany these services. To get a better sense of the landscape, we looked at all fifty state departments of corrections and tried to figure out which companies (if any) hold the contract(s) to provide money-transfer services for each prison system. When possible, we tried to figure out what the fees are to use these services.

In a new report published today, called Show Me the Money [[link removed]], we provide the results of our review, identify notable trends in this realm, and highlight steps families of people who are incarcerated, regulators, procurement officials, and companies can take to make money transfers more convenient, affordable, and easy to understand. See the full version of this report [[link removed]] for tables with state-by-state data, footnotes, and more analysis of the payment options in California.

Notable trends Fees for prison money transfers are really high

We live in an age of financial technology (known as “ fintech [[link removed]]”), where people are accustomed to digitally sending or receiving money from friends and family at little or no cost. A service like Venmo [[link removed]] allows no-fee personal transfers from bank accounts or debit cards (payments from a credit card are subject to a 3% fee). Other companies providing similar services charge roughly equivalent fees. We looked at 33 state prison systems where fee information was available. We found rates ranging from 5% to 37% for online transfers. The average fee is 19% for a $20 online transfer, with a slight decline for higher-dollar transfers (the average fee for a $50 transfer is 12%). Fees for phone or in-person payments (options more likely to appeal to low-income people without a bank account) were generally higher than for online payments. There is no reasonable explanation why prison money transfers are so much more expensive than regular “free world” services like Venmo.

[[link removed]]

Three companies dominate the market

Three companies dominate the correctional money-transfer market, at least where prisons are concerned (it’s likely that there are smaller “fringe” players that provide this type of service to jails). The three dominant companies are JPay (a Securus subsidiary that was recently fined $6 million [[link removed]] for improper practices in its release-card business), Global*Tel Link (which sometimes uses the tradename “Touchpay”), and Access Corrections.

A few smaller companies also appeared in our survey: a company called JailATM holds a couple of contracts (JailATM is also a minor player in the electronic messaging industry [[link removed]]); commissary operator Keefe Group [[link removed]] is one of three companies serving the Arizona prison system; and, a company called Cashless Systems, Inc., (a closely-held corporation operated out of a residence in Raleigh, North Carolina and doing business as Premier Services) holds the contract for Mississippi prisons.

There’s a little bit of competition

Most prisons pick one company that receives a monopoly on money-transfer services, but at least eleven states (22%) allow people to choose from two or more different companies. Prisons like to give monopoly contracts for things like phone service or operating the commissary. Administrators often cite security concerns as a justification for using only one company as a contractor. But this doesn’t seem to be the case when it comes to money transfers, even though a brief review of corrections-department webpages reveals that prison officials have plenty of security concerns about money transfers. It’s telling that when it comes to facilitating the flow of money into prison, many corrections departments are suddenly open to competition.

It’s unclear how much competition actually benefits consumers

We took a closer look at fees in states that offered more than one option, and found that those states had slightly lower money-transfer fees. For example, the 11 states with multiple options had an average fee of 16% for a $20 transfer, as opposed to an average of 20% in 26 states that issued monopoly contracts. But this only tells a part of the story. In the states with more than one option, it can be extremely complicated for a consumer to figure out what the lowest-cost option is.

Prisons don’t have to outsource

Most prison systems appear to have outsourced money transfers, but there are still some that handle these transactions in-house. Several states still process money-order payments sent through the mail. We also identified four states (Arkansas, Maine, Montana, and Texas) that accept online payments through a general-purpose state-operated online payment platform.

Interestingly, Arkansas recently added Access Corrections as an alternative to the state-operated payment platform. Access Corrections’ fees in Arkansas are 25¢ less than the fees for the state-operated system, and are by far the lowest fees we have seen Access Corrections charge in any prison system—thus suggesting that companies set rates based on what other options are available, and they can provide low-cost transfers when they’re forced to.

Mailed payments are still an option in many states

The vast majority of states (around 45) still allow people to mail a money order at no fee. Some states direct people to mail those money orders to the department of corrections’ accounting office; other states outsource the processing to vendors like JPay and Access Corrections. But, just because there’s no fee, doesn’t mean there’s no cost—between the cost of the money order itself, and a stamp, the sender will probably pay around $2, but that’s lower than most online fees. The issue, of course, is speed. The vendors that hold correctional banking contracts earn their profits from fees charged for payments made online or over the phone. Do we trust them to promptly process money orders for which they receive no fee revenue? If their terms of service are any indication, the companies seem to reserve the right to deliberately delay money-order processing.

Don't forget the fine print

People can't use these money-transfer services without agreeing to fine-print provisions (sometimes called "terms of use" or "terms and conditions"). These take-it-or-leave it documents (known to lawyers as contracts of adhesion) are ubiquitous in modern life, but they take on a particularly sinister role in the context of prison money transfers. We all agree to boilerplate terms when we use services like Gmail, Netflix, or Amazon. Even though these giant corporations have the upper hand, there is a faint form of accountability: consumer advocates and journalists routinely scour terms and conditions for unfair surprises; when a particularly egregious term is exposed, companies can be shamed and consumers can "vote with their feet" by switching to other providers. None of these safeguards are applicable to correctional money-transfer services, where the company controls a critical service for incarcerated people.

Terms imposed by the dominant money-transfer vendors are replete with objectionable, misleading, and unfair provisions. We've grouped some of the more problematic provisions into five categories, discussed below.

Failure to promise anything in return for consumer's money. Read a money-transfer website, and you'll understandably be left with the impression that you can pay the vendor a fee to transfer money to someone in prison. But read the fine print, it turns out the companies don't actually promise to do anything. All three of the leading companies disclaim "any warranty of any kind, express or implied." Advertising a certain service (like transferring money) and then using fine print to disclaim any responsibility to actually provide that service is considered a deceptive practice under many consumer-protection laws. Companies seem to go out of their way to make money-order payments arduously slow and plagued by uncertainty. Seemingly intentional degradation of money-order payments. As noted above, sending a money order is obviously slower than making an online transfer, but in many cases it can be cheaper. But companies seem to go out of their way to make money-order payments arduously slow and plagued by uncertainty. JPay's terms, for example, promise that payments will be "transmitted" within 1 or 2 business days, except for money-orders, which "are generally processed within ten (10) business days" (most people would refer to 10 business days as two weeks, which is an inexcusably long amount of time for processing small-dollar consumer payments). Both JPay and Access Corrections disclaim any liability for money orders that they receive, but which are not credited to the recipient's account. Privacy and consumer rights. Companies' terms of use and privacy policies are replete with confusing or troublesome provisions regarding use of customers' data. Some examples: JPay requires customers to consent to a credit check, which makes no sense because JPay does not extend credit and it's unclear why the company needs that kind of private information. Companies say that user information can be shared with law enforcement, which at first glance isn't terribly surprising. But many customers might be surprised that the terms of information sharing are so broad that they vitiate any kind of reasonable safeguards for consumers. Access Corrections, for example, says that it can share information with law enforcement, but it defines law enforcement as "personnel involved in the...investigative (public and private) or public safety purposes" (which, aside from being atrocious grammar, essentially means they can share your information with anyone who says they have a public safety purpose). GTL allows personal information to be shared with "law enforcement or correctional staff," but doesn't require that such staff have a proper job-related purpose for receiving such information. Access Corrections states that it has the right to use any customer communications to market its services, without notice or compensation to the customer. (Consumer activists successfully sued Facebook in 2011 [[link removed]] for using customer likenesses without consent, but Access Corrections is apparently unconcerned about running afoul of the same laws that tripped up the behemoth Facebook). Poorly designed services. Several miscellaneous provisions indicate how poorly these companies carry out their operations. For example, JPay terms state that the only cost to send money is the "service fee" that must be paid prior to making the transfer. But a different paragraph in JPay's terms state that if the company owes money to a customer (e.g., for a refund), and the customer does not claim the money, JPay will eat up the amount of the refund by levying a "monthly service fee" (this monthly fee is not mentioned on any of JPay's fee disclosure pages, nor do the terms of service specify how much the fee is). JPay also requires 2 weeks' advance notice before cancelling a recurring payment (this is probably not allowed under Visa's rules, which reference a 7-day maximum advance notice requirement and require a "simple" mechanism for cancelling recurring payments). Dispute resolution. A lot of us are forced to agree to arbitration provisions buried in the fine print of consumer contracts. But these clauses, which prevent consumers from going to court to vindicate their legal rights, are especially troublesome when the company imposing the provision has a monopoly on an essential service. GTL allows customers to "opt out" of arbitration, but also states that the company can terminate the accounts of customers who exercise that right. JailATM, meanwhile, requires customers to consent to arbitration conducted by the National Arbitration Forum, a disgraced company that was forced to stop conducting consumer arbitrations in 2009 [[link removed]] as part of a legal settlement (in fact, we pointed out this problem [[link removed]] in our 2016 report on electronic messaging, but JailATM apparently has not bothered to update their terms in the intervening five years). Other troublesome terms that are unrelated to arbitration include one-sided indemnification provisions and limitations periods for disputes that are substantially shorter than most states' statutes of limitations for contract claims [[link removed]].

Suggestions for improvements

The current system is complicated, inconvenient, and expensive. Different people have different opportunities to address these problems, as explained below.

Family members of incarcerated people

It may seem like family members have no leverage in this unfair system, but there are some things they can do to advocate for change.

Complain about high fees or poor service. The Consumer Financial Protection Bureau ("CFPB") has an easy-to-use online complaint system [[link removed]] specifically designed for financial services like money transfers. Your state attorney general may also be able to investigate certain abusive or deceptive practices. If the relevant prison system has an ombuds or office of family support, send a copy of your complaint to them as well. Talk to legislators. Money-transfer vendors take advantage of the lack of regulatory oversight. It turns out that money-transfer vendors are subject to regulation in nearly all states as "money-transmitters;" however, money-transmitter regulations are focused on the fiscal health of the business (known as "prudential regulation"), not protecting consumers. But legislatures can close this loophole. Tell state legislators (or, in the case of jails, county commissioners) about the economic toll of money-transfer fees, and ask them to pass legislation requiring regulatory agencies to enact rules protecting customers of correctional money-transfer services. If possible, plan ahead and send a money order to avoid fees. If there are problems with money orders (slow processing, out of state mailing addresses), tell facility management and point out that "just send money online" isn't an adequate response, because the online option is so expensive. Regulators Federal law prohibits financial service providers from taking unreasonable advantage of a consumer's inability to protect their own interests in selecting or using a consumer financial service. Users of correctional money-transfer services are unable to protect their own interests because they must either use a monopoly provider selected by a correctional facility, or choose from 2 or 3 options, all of which appear to set exorbitant prices in relation to their competitors. The CFPB is tasked with enforcing this law, and it should use its investigative and enforcement powers to crack down on unreasonably high money-transfer fees. The Federal Trade Commission ("FTC") is also empowered to issue rules prohibiting specific unfair trade practices that cause reasonably foreseeable injury to consumers. The FTC should use this authority, either by itself or in conjunction with the CFPB, to develop rules governing maximum allowable fees and what types of contractual terms vendors can (or can't) impose on customers. Prison procurement officials At least part of the high cost of money transfers comes from some prison systems demanding or accepting "commissions" (or kickbacks) from vendors. As with phone contracts, prisons can help lower costs by refusing commissions [[link removed]]. Look for in-house alternatives from other parts of state government. Prison systems are departments within state governments. Other state agencies are accustomed to accepting online payments (for vehicle registrations, hunting licenses, tuition, or any number of purposes). Have any of them developed low-cost in-house solutions for processing these payments? And if so, can those solutions be adapted for use in prisons? Arkansas, Maine, Montana, and Texas have figured out how to do it--other states should follow suit. Sending a money order by mail is a no-fee option in most states, but the utility of this option is severely limited when vendors deliberately prolong the amount of time it takes to process money orders. States can make this better in a number of ways. If at all possible, keep the processing of money orders in-house. If money-order processing is outsourced, there are two requirements that the state should put into its contract with the money-transfer vendor. First, the vendor should be required to process money orders within one business day of delivery. Second, the vendor should provide an in-state mailing address for all money order payments. Post all fees on the DOC information page: as noted above, some states sign contracts with multiple vendors, but don't post the companies' respective fees in one location. Every DOC webpage about money transfers should include an easy-to-read disclosure of applicable fees so that all family members and all staff members are aware of these fees. Provide specific details about garnishments/mandatory deductions. Many prison systems deduct money from incoming transfers to pay for mandatory fines, child support, restitution, cost of confinement, or other fees. Money-transfer vendors, unsurprisingly, disclaim any liability for these deductions. It's true that these deductions are created by the state, so the state bears responsibility for explaining them. This is important information: if someone in prison needs $20 to pay for hygiene items, then a relative sending money needs to know how much to send so that the recipient actually gets $20 after mandatory deductions. Any webpage that includes information on how to send money should also include detailed information on how much is deducted and what deposits are subject to garnishment. This information should include what deductions apply to everyone, versus which deductions (like child support) only apply to a subset of recipients. Ideally, the webpage should also include a calculator so that users can type in a transfer amount and instantly see how much will be delivered to the recipient. Companies

Last but not least, money-transfer vendors themselves have the most power to address problems in the industry they have created. While it's probably unrealistic to expect these companies to voluntarily reduce fees, if companies are serious about their marketing puffery, there are other simple steps they could take to make customers' lives easier.

If companies are serious about their marketing puffery, there are other simple steps they could take to make customers' lives easier.To the extent that money-transfer fees are inflated in part due to commissions being paid to correctional facilities, vendors should offer a commission-free alternative in all bids. All vendors include vague provisions in their terms of use that transfers from a customer's credit card "may" be treated as a cash advance. While the vendor probably can't give a definitive answer (because the bank or entity that issues the credit card the consumer is using has some discretion in how to handle these transactions), the vendors are the ones who create the transaction record, so they know how it's coded. Vendors should provide customers with the precise transaction coding applicable to their payment so that customers can then be fully informed when they ask their own bank how the transaction will be treated. It costs very little to write fair and easy-to-understand contracts. Vendors should rewrite their terms and conditions and eliminate things like arbitration provisions, 2-week processing times for mailed payments, and disclaimers of any warranties whatsoever.

* * *

For more information, including tables with detailed state-by-state data, and more information, see the full version of this report [[link removed]].

Please support our work [[link removed]]

Our work is made possible by private donations. Can you help us keep going? We can accept tax-deductible gifts online [[link removed]] or via paper checks sent to PO Box 127 Northampton MA 01061. Thank you!

Other news: Blood from a stone: How New York prisons force people to pay for their own incarceration [[link removed]]

Going to jail or prison increasingly comes with a hefty price tag for the person who is incarcerated. As states continue to cut public spending, individuals are often expected to pay money to meet their basic needs in confinement facilities.

In this October guest post, [[link removed]] members of the New York University Prison Education Program provide first-hand accounts of how prisons are shifting more financial costs onto people who are incarcerated.

Please support our work [[link removed]]

Our work is made possible by private donations. Can you help us keep going? We can accept tax-deductible gifts online [[link removed]] or via paper checks sent to PO Box 127 Northampton MA 01061. Thank you!

Our other newsletters Ending prison gerrymandering ( archives [[link removed]]) Criminal justice research library ( archives [[link removed]])

Update which newsletters you get [link removed].

You are receiving this message because you signed up on our website [[link removed]] or you met Peter Wagner or another staff member at an event and asked to be included.

Prison Policy Initiative [[link removed]]

PO Box 127

Northampton, Mass. 01061

Web Version [link removed] Unsubscribe [link removed] Update address / join other newsletters [link removed] Donate [[link removed]] Tweet this newsletter [link removed] Forward this newsletter [link removed]

You are receiving this message because you signed up on our website or you met Peter Wagner or another staff member at an event and asked to be included.

Prison Policy Initiative

PO Box 127 Northampton, Mass. 01061

Did someone forward this to you? If you enjoyed reading, please subscribe! [[link removed]] Web Version [link removed] | Update address [link removed] | Unsubscribe [link removed] | Share via: Twitter [link removed] Facebook [[link removed] Email [link removed]

Message Analysis

- Sender: Prison Policy Initiative

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor