| From | USAFacts <[email protected]> |

| Subject | Data on the nation's veterans |

| Date | November 9, 2021 2:19 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Plus, how much have homeowners claimed in SALT deductions?

Not displaying correctly? View this email in your browser ([link removed]) .

[link removed]

** Delta's summer surge by the numbers

------------------------------------------------------------

Coronavirus cases are down 59% from the Delta variant's recent peak. Declining cases and the start of vaccinations for children 5 and up are promising signs at this point in the pandemic, but cases are still six times higher than they were in June. It's proven difficult to know what the future holds with this virus, but as the summer Delta surge subsides, USAFacts has six new charts ([link removed]) for perspective on COVID-19 in the second half of 2021. Here's a sneak peek:

* Alaska ([link removed]) had the highest caseload during the four-month Delta surge, with 8% of its population infected. Maryland ([link removed]) and Connecticut ([link removed]) had the lightest caseloads, with just over 1% of their populations contracting COVID-19.

[link removed]

* Before July, New Jersey ([link removed]) had the country's highest cumulative COVID-19 death rate, with 297 deaths per 100,000 people. The Delta surge drove cumulative death rates in Mississippi ([link removed]) , Alabama ([link removed]) , and Louisiana ([link removed]) over 300 per 100,000 residents. By then, New Jersey had the nation's lowest COVID-19 death rate: two deaths per 100,000.

* The unvaccinated infection rate hit a Delta surge peak in the week ending August 21, when 737 out of 100,000 unvaccinated people were infected. The vaccinated infection rate that week was 121 new cases per 100,000 vaccinated people. See the chart below for cases among vaccination types.

[link removed]

* The infection rate gap for vaccinated and unvaccinated Americans was the widest for those ages 12 to 17. For the week ending August 28, the weekly case rate among the unvaccinated in this group was 887 per 100,000 people. It was with 85 cases per 100,000 for vaccinated teenagers.

How are infection rates shifting for teens now? Or for the elderly? Click here for the data ([link removed]) sorted by vaccinated and unvaccinated populations.

Celebrating Veterans Day

Thursday, November 11 is Veterans Day. What started as a day to commemorate the armistice that ended World War I has evolved in the United States to celebrate the service of thousands of men and women. Decades later, what's life like for American veterans? USAFacts has a data snapshot of veterans ([link removed]) nationwide.

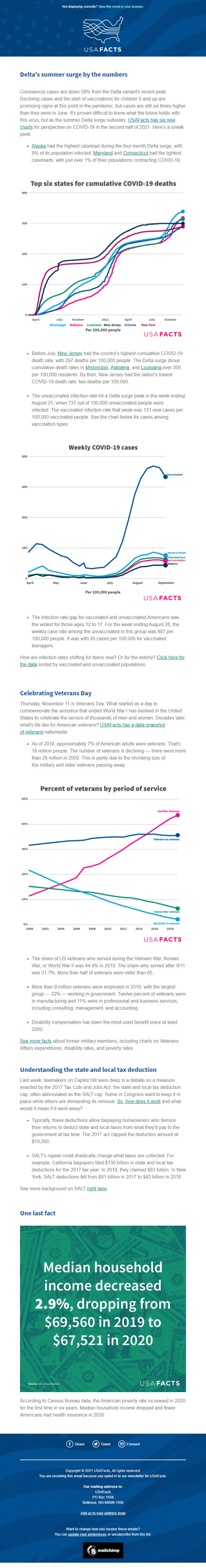

* As of 2019, approximately 7% of American adults were veterans. That's 18 million people. The number of veterans is declining — there were more than 26 million in 2000. This is partly due to the shrinking size of the military and older veterans passing away.

[link removed]

* The share of US veterans who served during the Vietnam War, Korean War, or World War II was 44.4% in 2019. The share who served after 9/11 was 21.7%. More than half of veterans were older than 65.

* More than 9 million veterans were employed in 2019, with the largest group — 22% — working in government. Twelve percent of veterans were in manufacturing and 11% were in professional and business services, including consulting, management, and accounting.

* Disability compensation has been the most-used benefit since at least 2000.

See more facts ([link removed]) about former military members, including charts on Veterans Affairs expenditures, disability rates, and poverty rates.

Understanding the state and local tax deduction

Last week, lawmakers on Capitol Hill were deep in a debate on a measure enacted by the 2017 Tax Cuts and Jobs Act: the state and local tax deduction cap, often abbreviated as the SALT cap. Some in Congress want to keep it in place while others are demanding its removal. So, how does it work ([link removed]) and what would it mean if it went away?

* Typically, these deductions allow taxpaying homeowners who itemize their returns to deduct state and local taxes from what they'd pay to the government at tax time. The 2017 act capped the deduction amount at $10,000.

* SALT's repeal could drastically change what taxes are collected. For example, California taxpayers filed $130 billion in state and local tax deductions for the 2017 tax year. In 2018, they claimed $83 billion. In New York, SALT deductions fell from $81 billion in 2017 to $42 billion in 2018.

See more background on SALT right here ([link removed]) .

One last fact

According to Census Bureau data, the American poverty rate increased in 2020 for the first time in six years. Median household income dropped and fewer Americans had health insurance in 2020.

============================================================

** Share ([link removed])

** Share ([link removed])

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FhMJKMz)

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FhMJKMz)

** Forward ([link removed])

** Forward ([link removed])

Copyright © 2021 USAFacts, All rights reserved.

You are receiving this email because you opted in to our newsletter for USAFacts.

Our mailing address is:

USAFacts

PO Box 1558

Bellevue, WA 98009-1558

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Not displaying correctly? View this email in your browser ([link removed]) .

[link removed]

** Delta's summer surge by the numbers

------------------------------------------------------------

Coronavirus cases are down 59% from the Delta variant's recent peak. Declining cases and the start of vaccinations for children 5 and up are promising signs at this point in the pandemic, but cases are still six times higher than they were in June. It's proven difficult to know what the future holds with this virus, but as the summer Delta surge subsides, USAFacts has six new charts ([link removed]) for perspective on COVID-19 in the second half of 2021. Here's a sneak peek:

* Alaska ([link removed]) had the highest caseload during the four-month Delta surge, with 8% of its population infected. Maryland ([link removed]) and Connecticut ([link removed]) had the lightest caseloads, with just over 1% of their populations contracting COVID-19.

[link removed]

* Before July, New Jersey ([link removed]) had the country's highest cumulative COVID-19 death rate, with 297 deaths per 100,000 people. The Delta surge drove cumulative death rates in Mississippi ([link removed]) , Alabama ([link removed]) , and Louisiana ([link removed]) over 300 per 100,000 residents. By then, New Jersey had the nation's lowest COVID-19 death rate: two deaths per 100,000.

* The unvaccinated infection rate hit a Delta surge peak in the week ending August 21, when 737 out of 100,000 unvaccinated people were infected. The vaccinated infection rate that week was 121 new cases per 100,000 vaccinated people. See the chart below for cases among vaccination types.

[link removed]

* The infection rate gap for vaccinated and unvaccinated Americans was the widest for those ages 12 to 17. For the week ending August 28, the weekly case rate among the unvaccinated in this group was 887 per 100,000 people. It was with 85 cases per 100,000 for vaccinated teenagers.

How are infection rates shifting for teens now? Or for the elderly? Click here for the data ([link removed]) sorted by vaccinated and unvaccinated populations.

Celebrating Veterans Day

Thursday, November 11 is Veterans Day. What started as a day to commemorate the armistice that ended World War I has evolved in the United States to celebrate the service of thousands of men and women. Decades later, what's life like for American veterans? USAFacts has a data snapshot of veterans ([link removed]) nationwide.

* As of 2019, approximately 7% of American adults were veterans. That's 18 million people. The number of veterans is declining — there were more than 26 million in 2000. This is partly due to the shrinking size of the military and older veterans passing away.

[link removed]

* The share of US veterans who served during the Vietnam War, Korean War, or World War II was 44.4% in 2019. The share who served after 9/11 was 21.7%. More than half of veterans were older than 65.

* More than 9 million veterans were employed in 2019, with the largest group — 22% — working in government. Twelve percent of veterans were in manufacturing and 11% were in professional and business services, including consulting, management, and accounting.

* Disability compensation has been the most-used benefit since at least 2000.

See more facts ([link removed]) about former military members, including charts on Veterans Affairs expenditures, disability rates, and poverty rates.

Understanding the state and local tax deduction

Last week, lawmakers on Capitol Hill were deep in a debate on a measure enacted by the 2017 Tax Cuts and Jobs Act: the state and local tax deduction cap, often abbreviated as the SALT cap. Some in Congress want to keep it in place while others are demanding its removal. So, how does it work ([link removed]) and what would it mean if it went away?

* Typically, these deductions allow taxpaying homeowners who itemize their returns to deduct state and local taxes from what they'd pay to the government at tax time. The 2017 act capped the deduction amount at $10,000.

* SALT's repeal could drastically change what taxes are collected. For example, California taxpayers filed $130 billion in state and local tax deductions for the 2017 tax year. In 2018, they claimed $83 billion. In New York, SALT deductions fell from $81 billion in 2017 to $42 billion in 2018.

See more background on SALT right here ([link removed]) .

One last fact

According to Census Bureau data, the American poverty rate increased in 2020 for the first time in six years. Median household income dropped and fewer Americans had health insurance in 2020.

============================================================

** Share ([link removed])

** Share ([link removed])

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FhMJKMz)

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FhMJKMz)

** Forward ([link removed])

** Forward ([link removed])

Copyright © 2021 USAFacts, All rights reserved.

You are receiving this email because you opted in to our newsletter for USAFacts.

Our mailing address is:

USAFacts

PO Box 1558

Bellevue, WA 98009-1558

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: USAFacts

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp