| From | Berrett <[email protected]> |

| Subject | Fwd: REALLY bad omen. |

| Date | November 3, 2021 11:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

I wanted to make sure you saw this, John.

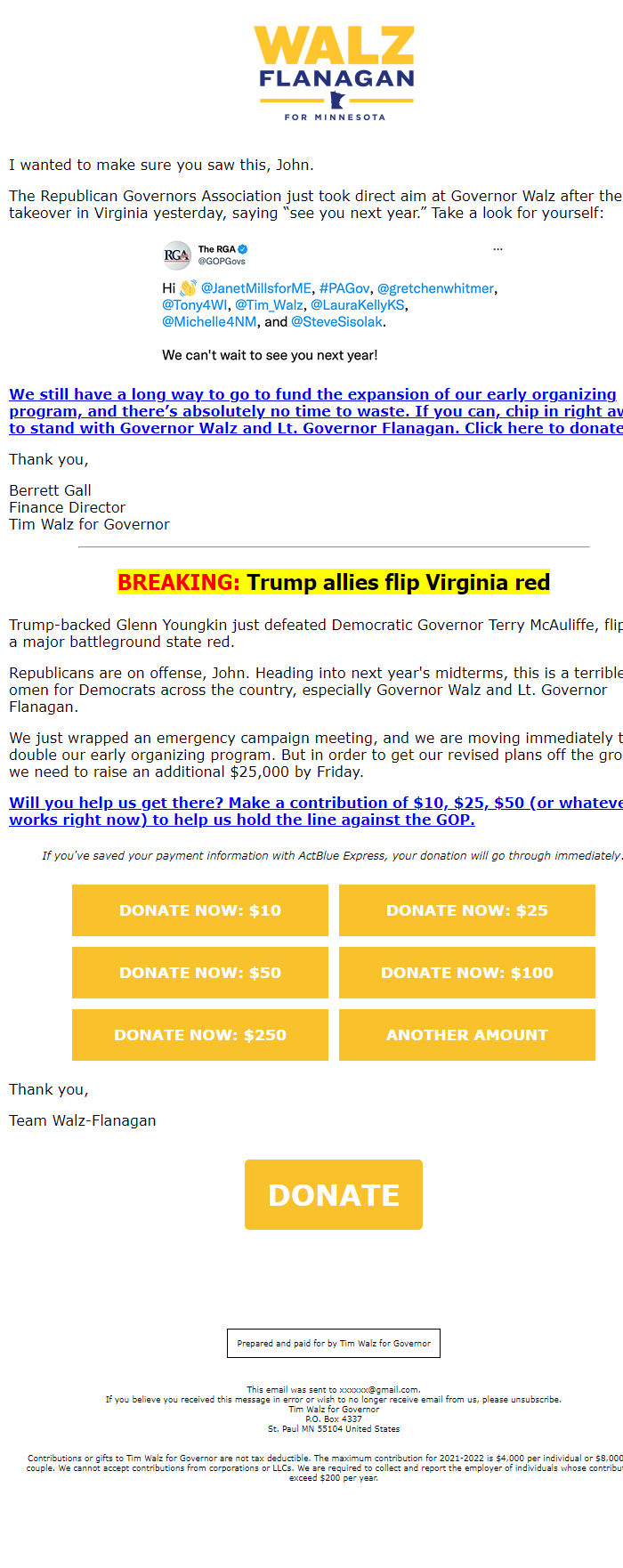

The Republican Governors Association just took direct aim at Governor Walz after the GOP takeover in Virginia yesterday, saying “see you next year.” Take a look for yourself:

Tweet from @GOPGovs (The Republican Governor's Association)

"Hi @JanetMillsforME, #PAGov, @gretchenwhitmer, @Tony4WI, @Tim_Walz, @LauraKellyKS, @Michelle4NM, and @SteveSisolak.

We can't wait to see you next year!"

We still have a long way to go to fund the expansion of our early organizing program, and there’s absolutely no time to waste. If you can, chip in right away to stand with Governor Walz and Lt. Governor Flanagan. Click here to donate.

Thank you,

Berrett Gall

Finance Director

Tim Walz for Governor

DONATE: [link removed]

________________________________________________

BREAKING: Trump allies flip Virginia red

Trump-backed Glenn Youngkin just defeated Democratic Governor Terry McAuliffe, flipping a major battleground state red.

Republicans are on offense, John. Heading into next year's midterms, this is a terrible omen for Democrats across the country, especially Governor Walz and Lt. Governor Flanagan.

We just wrapped an emergency campaign meeting, and we are moving immediately to double our early organizing program. But in order to get our revised plans off the ground, we need to raise an additional $25,000 by Friday.

Will you help us get there? Make a contribution of $10, $25, $50 (or whatever works right now) to help us hold the line against the GOP.

Thank you,

Team Walz-Flanagan

DONATE: [link removed]

Prepared and paid for by Tim Walz for Governor

This email was sent to [email protected].

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Tim Walz for Governor

P.O. Box 4337

St. Paul, MN 55104

Contributions or gifts to Tim Walz for Governor are not tax deductible. The maximum contribution for 2021-2022 is $4,000 per individual or $8,000 per couple. We cannot accept contributions from corporations or LLCs. We are required to collect and report the employer of individuals whose contributions exceed $200 per year.

The Republican Governors Association just took direct aim at Governor Walz after the GOP takeover in Virginia yesterday, saying “see you next year.” Take a look for yourself:

Tweet from @GOPGovs (The Republican Governor's Association)

"Hi @JanetMillsforME, #PAGov, @gretchenwhitmer, @Tony4WI, @Tim_Walz, @LauraKellyKS, @Michelle4NM, and @SteveSisolak.

We can't wait to see you next year!"

We still have a long way to go to fund the expansion of our early organizing program, and there’s absolutely no time to waste. If you can, chip in right away to stand with Governor Walz and Lt. Governor Flanagan. Click here to donate.

Thank you,

Berrett Gall

Finance Director

Tim Walz for Governor

DONATE: [link removed]

________________________________________________

BREAKING: Trump allies flip Virginia red

Trump-backed Glenn Youngkin just defeated Democratic Governor Terry McAuliffe, flipping a major battleground state red.

Republicans are on offense, John. Heading into next year's midterms, this is a terrible omen for Democrats across the country, especially Governor Walz and Lt. Governor Flanagan.

We just wrapped an emergency campaign meeting, and we are moving immediately to double our early organizing program. But in order to get our revised plans off the ground, we need to raise an additional $25,000 by Friday.

Will you help us get there? Make a contribution of $10, $25, $50 (or whatever works right now) to help us hold the line against the GOP.

Thank you,

Team Walz-Flanagan

DONATE: [link removed]

Prepared and paid for by Tim Walz for Governor

This email was sent to [email protected].

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Tim Walz for Governor

P.O. Box 4337

St. Paul, MN 55104

Contributions or gifts to Tim Walz for Governor are not tax deductible. The maximum contribution for 2021-2022 is $4,000 per individual or $8,000 per couple. We cannot accept contributions from corporations or LLCs. We are required to collect and report the employer of individuals whose contributions exceed $200 per year.

Message Analysis

- Sender: Tim Walz

- Political Party: Democratic

- Country: United States

- State/Locality: Minnesota

- Office: State Governor

-

Email Providers:

- NGP VAN