| From | Senator Mike Crapo <[email protected]> |

| Subject | A Message from Mike: Outraged at IRS Reporting Scheme |

| Date | October 28, 2021 12:57 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

United States Senator Mike Crapo - Idaho

*A Message from Mike:

Outraged at IRS Reporting Scheme*

There is a proposal under

consideration by the Administration and congressional allies, as part

of their reckless tax-and-spending plan, to create a reporting scheme

where financial intermediaries report to the Internal Revenue Service

(IRS) on customer "inflows and outflows."

Under this dragnet, local

banks, credit unions and payment providers will essentially be turned

into agents of the IRS, monitoring and reporting on inflows and

outflows of deposits and withdrawals made in private accounts.

This

proposal would create serious financial privacy concerns, increase tax

preparation costs for individuals and small businesses, and create

significant operational challenges for financial institutions,

affecting virtually all taxpayers and Idahoans from all walks of

life.

*Americans are rightly concerned. *

Americans are rightly

concerned about this scheme, with recent polling [link 1] showing that

67 percent of voters oppose the IRS reporting proposal.

[image =

[link removed]]

Earlier

this month, I joined Idaho leaders, concerned constituents, and

business and financial leaders for a roundtable discussion [link 2] on

this proposal.

Privacy concerns were paramount among all

participants.

Small business owners added that it is already difficult

to comply with existing tax laws; community banks and credit unions

highlighted concerns from data security at the IRS to increased

complexity and compliance costs.

[image =

[link removed]]

[link 3]

In Washington, D.C., I led a press conference [link 4] with

members of the Senate Finance Committee and Senate Banking Committee

to highlight this flawed proposal, and to share our constituents'

concerns.

In response to growing backlash, the Administration issued a

"fact sheet" on an as yet unrevealed new version of their proposal,

with two updates: increasing the reporting threshold to $10,000 from

$600, and including carve-outs for wage and salary earners and federal

program beneficiaries.

*These updates do nothing to address privacy

invasion, due process and/or data security concerns.

They just make

things even more complex.*

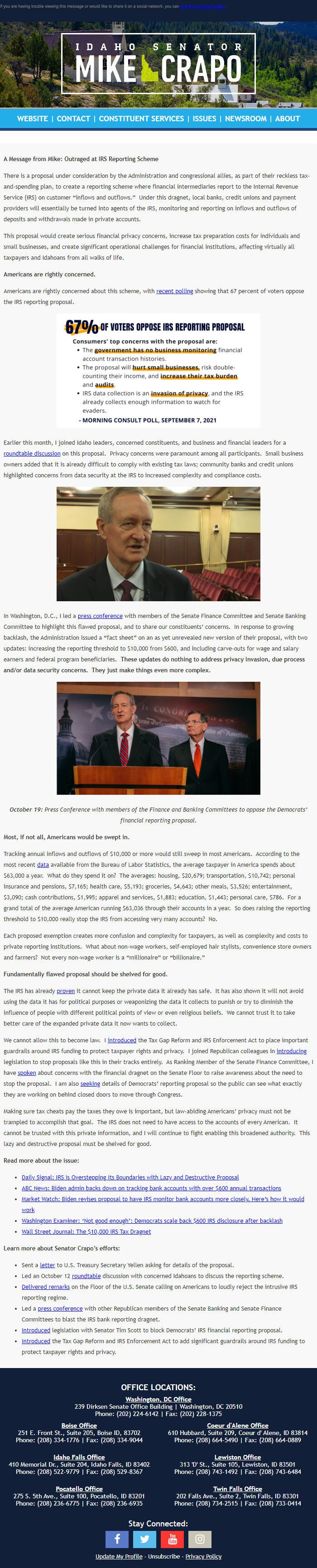

[image =

[link removed]]

**October

19: ***Press Conference with members of the Finance and Banking

Committees to oppose the Democrats' financial reporting

proposal.*

*Most, if not all, Americans would be swept in.

*

Tracking annual inflows and outflows of $10,000 or more would still

sweep in most Americans.

According to the most recent data [link 5]

available from the Bureau of Labor Statistics, the average taxpayer in

America spends about $63,000 a year.

What do they spend it on?

The

averages: housing, $20,679; transportation, $10,742; personal

insurance and pensions, $7,165; health care, $5,193; groceries,

$4,643; other meals, $3,526; entertainment, $3,090; cash

contributions, $1,995; apparel and services, $1,883; education,

$1,443; personal care, $786.

For a grand total of the average American

running $63,036 through their accounts in a year.

So does raising the

reporting threshold to $10,000 really stop the IRS from accessing very

many accounts?

No.

Each proposed exemption creates more confusion and

complexity for taxpayers, as well as complexity and costs to private

reporting institutions.

What about non-wage workers, self-employed

hair stylists, convenience store owners and farmers?

Not every

non-wage worker is a "millionaire" or "billionaire."

*Fundamentally

flawed proposal should be shelved for good. *

The IRS has already

proven [link 6] it cannot keep the private data it already has

safe.

It has also shown it will not avoid using the data it has for

political purposes or weaponizing the data it collects to punish or

try to diminish the influence of people with different political

points of view or even religious beliefs.

We cannot trust it to take

better care of the expanded private data it now wants to collect.

We

cannot allow this to become law.

I introduced [link 7] the Tax Gap

Reform and IRS Enforcement Act to place important guardrails around

IRS funding to protect taxpayer rights and privacy.

I joined

Republican colleagues in introducing [link 8] legislation to stop

proposals like this in their tracks entirely.

As Ranking Member of the

Senate Finance Committee, I have spoken [link 9] about concerns with

the financial dragnet on the Senate Floor to raise awareness about the

need to stop the proposal.

I am also seeking [link 10] details of

Democrats' reporting proposal so the public can see what exactly they

are working on behind closed doors to move through Congress.

Making

sure tax cheats pay the taxes they owe is important, but law-abiding

Americans' privacy must not be trampled to accomplish that goal.

The

IRS does not need to have access to the accounts of every American.

It

cannot be trusted with this private information, and I will continue

to fight enabling this broadened authority.

This lazy and destructive

proposal must be shelved for good.

*Read more about the issue: *

-

Daily Signal: IRS Is Overstepping Its Boundaries with Lazy and

Destructive Proposal [link 11]

-

ABC News: Biden admin backs down on

tracking bank accounts with over $600 annual transactions [link 12]

-

Market Watch: Biden revises proposal to have IRS monitor bank accounts

more closely. Here's how it would work [link 13]

-

Washington

Examiner: 'Not good enough': Democrats scale back $600 IRS disclosure

after backlash [link 14]

-

Wall Street Journal: The $10,000 IRS Tax

Dragnet [link 15]

*Learn more about Senator Crapo's efforts: *

-

Sent a letter [link 16] to U.S. Treasury Secretary Yellen asking for

details of the proposal.

-

Led an October 12 roundtable [link 17]

discussion with concerned Idahoans to discuss the reporting scheme.

-

Delivered remarks [link 18] on the Floor of the U.S. Senate calling on

Americans to loudly reject the intrusive IRS reporting regime.

-

Led

a press conference [link 19] with other Republican members of the

Senate Banking and Senate Finance Committees to blast the IRS bank

reporting dragnet.

-

Introduced [link 20] legislation with Senator

Tim Scott to block Democrats' IRS financial reporting proposal.

-

Introduced [link 21] the Tax Gap Reform and IRS Enforcement Act to add

significant guardrails around IRS funding to protect taxpayer rights

and privacy.

----------------------

footnotes

----------------------

[link 1]

[link removed]

[link

2]

[link removed]

[link

3]

[link removed]

[link

4]

[link removed]

[link

5]

[link removed]

[link

6]

[link removed]

[link

7]

[link removed]

[link

8]

[link removed]

[link

9]

[link removed]

[link

10]

[link removed]

[link

11]

[link removed]

[link

12]

[link removed]

[link

13]

[link removed]

[link

14]

[link removed]

[link

15]

[link removed]

[link

16]

[link removed]

[link

17]

[link removed]

[link

18]

[link removed]

[link

19]

[link removed]

[link

20]

[link removed]

[link

21]

[link removed]

Contact

Information:

Website:

Offices:

239 Dirksen Senate

Building

Washington D.C., 20510

Phone: (202) 224-6142

Idaho Falls

410 Memorial Drive

Suite 205

Idaho Falls, ID 83402

Phone: (208)

522-9779

Boise

251 East Front Street

Suite 205

Boise, ID 83702

Phone: (208) 334-1776

Lewiston

313 'D' Street

Suite 105

Lewiston,

ID 83501

Phone: (208) 743-1492

Caldwell

524 East Cleveland

Blvd.

Suite 220

Caldwell, ID 83605

Phone: (208) 455-0360

Pocatello

275 South 5th Avenue

Suite 100

Pocatello, ID 83201

Phone: (208)

236-6775

Coeur d' Alene

610 Hubbard Street

Suite 209

Coeur d'

Alene, ID 83814

Phone: (208) 664-5490

Twin Falls

202 Falls

Avenue

Suite 2

Twin Falls, ID 83301

Phone: (208) 734-2515

Unsubscribe:

[link removed]

Privacy

Policy:

[link removed]

*A Message from Mike:

Outraged at IRS Reporting Scheme*

There is a proposal under

consideration by the Administration and congressional allies, as part

of their reckless tax-and-spending plan, to create a reporting scheme

where financial intermediaries report to the Internal Revenue Service

(IRS) on customer "inflows and outflows."

Under this dragnet, local

banks, credit unions and payment providers will essentially be turned

into agents of the IRS, monitoring and reporting on inflows and

outflows of deposits and withdrawals made in private accounts.

This

proposal would create serious financial privacy concerns, increase tax

preparation costs for individuals and small businesses, and create

significant operational challenges for financial institutions,

affecting virtually all taxpayers and Idahoans from all walks of

life.

*Americans are rightly concerned. *

Americans are rightly

concerned about this scheme, with recent polling [link 1] showing that

67 percent of voters oppose the IRS reporting proposal.

[image =

[link removed]]

Earlier

this month, I joined Idaho leaders, concerned constituents, and

business and financial leaders for a roundtable discussion [link 2] on

this proposal.

Privacy concerns were paramount among all

participants.

Small business owners added that it is already difficult

to comply with existing tax laws; community banks and credit unions

highlighted concerns from data security at the IRS to increased

complexity and compliance costs.

[image =

[link removed]]

[link 3]

In Washington, D.C., I led a press conference [link 4] with

members of the Senate Finance Committee and Senate Banking Committee

to highlight this flawed proposal, and to share our constituents'

concerns.

In response to growing backlash, the Administration issued a

"fact sheet" on an as yet unrevealed new version of their proposal,

with two updates: increasing the reporting threshold to $10,000 from

$600, and including carve-outs for wage and salary earners and federal

program beneficiaries.

*These updates do nothing to address privacy

invasion, due process and/or data security concerns.

They just make

things even more complex.*

[image =

[link removed]]

**October

19: ***Press Conference with members of the Finance and Banking

Committees to oppose the Democrats' financial reporting

proposal.*

*Most, if not all, Americans would be swept in.

*

Tracking annual inflows and outflows of $10,000 or more would still

sweep in most Americans.

According to the most recent data [link 5]

available from the Bureau of Labor Statistics, the average taxpayer in

America spends about $63,000 a year.

What do they spend it on?

The

averages: housing, $20,679; transportation, $10,742; personal

insurance and pensions, $7,165; health care, $5,193; groceries,

$4,643; other meals, $3,526; entertainment, $3,090; cash

contributions, $1,995; apparel and services, $1,883; education,

$1,443; personal care, $786.

For a grand total of the average American

running $63,036 through their accounts in a year.

So does raising the

reporting threshold to $10,000 really stop the IRS from accessing very

many accounts?

No.

Each proposed exemption creates more confusion and

complexity for taxpayers, as well as complexity and costs to private

reporting institutions.

What about non-wage workers, self-employed

hair stylists, convenience store owners and farmers?

Not every

non-wage worker is a "millionaire" or "billionaire."

*Fundamentally

flawed proposal should be shelved for good. *

The IRS has already

proven [link 6] it cannot keep the private data it already has

safe.

It has also shown it will not avoid using the data it has for

political purposes or weaponizing the data it collects to punish or

try to diminish the influence of people with different political

points of view or even religious beliefs.

We cannot trust it to take

better care of the expanded private data it now wants to collect.

We

cannot allow this to become law.

I introduced [link 7] the Tax Gap

Reform and IRS Enforcement Act to place important guardrails around

IRS funding to protect taxpayer rights and privacy.

I joined

Republican colleagues in introducing [link 8] legislation to stop

proposals like this in their tracks entirely.

As Ranking Member of the

Senate Finance Committee, I have spoken [link 9] about concerns with

the financial dragnet on the Senate Floor to raise awareness about the

need to stop the proposal.

I am also seeking [link 10] details of

Democrats' reporting proposal so the public can see what exactly they

are working on behind closed doors to move through Congress.

Making

sure tax cheats pay the taxes they owe is important, but law-abiding

Americans' privacy must not be trampled to accomplish that goal.

The

IRS does not need to have access to the accounts of every American.

It

cannot be trusted with this private information, and I will continue

to fight enabling this broadened authority.

This lazy and destructive

proposal must be shelved for good.

*Read more about the issue: *

-

Daily Signal: IRS Is Overstepping Its Boundaries with Lazy and

Destructive Proposal [link 11]

-

ABC News: Biden admin backs down on

tracking bank accounts with over $600 annual transactions [link 12]

-

Market Watch: Biden revises proposal to have IRS monitor bank accounts

more closely. Here's how it would work [link 13]

-

Washington

Examiner: 'Not good enough': Democrats scale back $600 IRS disclosure

after backlash [link 14]

-

Wall Street Journal: The $10,000 IRS Tax

Dragnet [link 15]

*Learn more about Senator Crapo's efforts: *

-

Sent a letter [link 16] to U.S. Treasury Secretary Yellen asking for

details of the proposal.

-

Led an October 12 roundtable [link 17]

discussion with concerned Idahoans to discuss the reporting scheme.

-

Delivered remarks [link 18] on the Floor of the U.S. Senate calling on

Americans to loudly reject the intrusive IRS reporting regime.

-

Led

a press conference [link 19] with other Republican members of the

Senate Banking and Senate Finance Committees to blast the IRS bank

reporting dragnet.

-

Introduced [link 20] legislation with Senator

Tim Scott to block Democrats' IRS financial reporting proposal.

-

Introduced [link 21] the Tax Gap Reform and IRS Enforcement Act to add

significant guardrails around IRS funding to protect taxpayer rights

and privacy.

----------------------

footnotes

----------------------

[link 1]

[link removed]

[link

2]

[link removed]

[link

3]

[link removed]

[link

4]

[link removed]

[link

5]

[link removed]

[link

6]

[link removed]

[link

7]

[link removed]

[link

8]

[link removed]

[link

9]

[link removed]

[link

10]

[link removed]

[link

11]

[link removed]

[link

12]

[link removed]

[link

13]

[link removed]

[link

14]

[link removed]

[link

15]

[link removed]

[link

16]

[link removed]

[link

17]

[link removed]

[link

18]

[link removed]

[link

19]

[link removed]

[link

20]

[link removed]

[link

21]

[link removed]

Contact

Information:

Website:

Offices:

239 Dirksen Senate

Building

Washington D.C., 20510

Phone: (202) 224-6142

Idaho Falls

410 Memorial Drive

Suite 205

Idaho Falls, ID 83402

Phone: (208)

522-9779

Boise

251 East Front Street

Suite 205

Boise, ID 83702

Phone: (208) 334-1776

Lewiston

313 'D' Street

Suite 105

Lewiston,

ID 83501

Phone: (208) 743-1492

Caldwell

524 East Cleveland

Blvd.

Suite 220

Caldwell, ID 83605

Phone: (208) 455-0360

Pocatello

275 South 5th Avenue

Suite 100

Pocatello, ID 83201

Phone: (208)

236-6775

Coeur d' Alene

610 Hubbard Street

Suite 209

Coeur d'

Alene, ID 83814

Phone: (208) 664-5490

Twin Falls

202 Falls

Avenue

Suite 2

Twin Falls, ID 83301

Phone: (208) 734-2515

Unsubscribe:

[link removed]

Privacy

Policy:

[link removed]

Message Analysis

- Sender: Mike Crapo

- Political Party: Republican

- Country: United States

- State/Locality: Idaho

- Office: United States Senate