Email

Weekly Market Report: Bond Bears & Debt Ceiling

| From | Irving Wilkinson <[email protected]> |

| Subject | Weekly Market Report: Bond Bears & Debt Ceiling |

| Date | September 27, 2021 2:16 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Market Research Reports 9-27

Good morning,

I hope you enjoyed your weekend. Sorry for the delay this morning, I

have Covid and recovering thanks to the brave doctors at Front Line

[[link removed]].

Below is a small excerpt from the _ABS ADVISOR MARKET INTELLIGENCE

REPORT_ [[link removed]]. It is published every

Monday morning to help conservative financial advisors and investors

save time and outperform. We hope you enjoy it, and please feel free

to forward it to your friends.

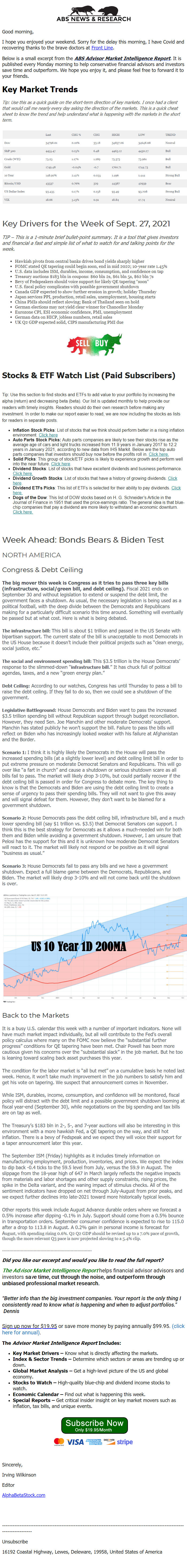

KEY MARKET TRENDS

_Tip: Use this as a quick guide on the short-term direction of key

markets. I once had a client that would call me nearly every day

asking the direction of the markets. This is a quick cheat sheet to

know the trend and help understand what is happening with the markets

in the short term._

__

KEY DRIVERS FOR THE WEEK OF SEPT. 27, 2021

_TIP – This is a 1-minute brief bullet-point summary. It is a tool

that gives investors and financial a fast and simple list of what to

watch for and talking points for the week._

* Hawkish pivots from central banks drives bond yields sharply higher

* FOMC stated QE tapering could begin soon, end in mid 2022; 10-year

rate 1.45%

* U.S. data includes ISM, durables, income, consumption, and

confidence on tap

* Treasury auctions $183 bln in coupons: $60 bln 2s, $61 bln 5s, $62

bln 7s

* Bevy of Fedspeakers should voice support for likely QE tapering

“soon”

* U.S. fiscal policy complicates with possible government shutdown

* Canada GDP expected to show further erosion in growth; holiday

Thursday

* Japan services PPI, production, retail sales, unemployment, housing

starts

* China PMIs should reflect slowing; Bank of Thailand seen on hold

* German elections may not yield clear winner for Chancellor Monday

* Eurozone CPI, ESI economic confidence, PMI, unemployment

* German data on HICP, jobless numbers, retail sales

* UK Q2 GDP expected solid, CIPS manufacturing PMI due

STOCKS & ETF WATCH LIST (PAID SUBSCRIBERS)

Tip: Use this section to find stocks and ETFs to add value to your

portfolio by increasing the alpha (return) and decreasing beta (beta).

Our list is updated monthly to help provide our readers with timely

insights. Readers should do their own research before making any

investment. In order to make our report easier to read, we are now

including the stocks as lists for readers in separate posts.

* INFLATION STOCK PICKS: List of stocks that we think should perform

better in a rising inflation environment. Click here

[[link removed]]

* AUTO PARTS STOCK PICKS: Auto parts companies are likely to see

their stocks rise as the average age of cars and light trucks

increased from 11.9 years in January 2017 to 12.2 years in January

2021, according to new data from IHS Markit. Below are the top auto

parts companies that investors should buy now before the profits roll

in. Click here.

[[link removed]]

* SOLID PICKS: This group of stock/ETF picks is likely to experience

growth and perform well into the near future. Click here

[[link removed]].

* DIVIDEND STOCKS: List of stocks that have excellent dividends and

business performance. Click here.

[[link removed]]

* DIVIDEND GROWTH STOCKS: List of stocks that have a history of

growing dividends. Click here

[[link removed]].

* DIVIDEND ETFS PICKS: This list of ETFs is selected for their

ability to pay dividends. Click here.

[[link removed]]

* DOGS OF THE DOW: This list of DOW stocks based on H. G.

Schneider’s Article in the Journal of Finance in 1951 that used the

price-earnings ratio. The general idea is that blue-chip companies

that pay a dividend are more likely to withstand an economic downturn.

Click here. [[link removed]]

WEEK AHEAD: BONDS BEARS & BIDEN TEST

NORTH AMERICA

CONGRESS & DEBT CEILING

THE BIG MOVER THIS WEEK IS CONGRESS AS IT TRIES TO PASS THREE KEY

BILLS (INFRASTRUCTURE, SOCIAL/GREEN BILL, AND DEBT CEILING). Fiscal

2021 ends on September 30 and without legislation to extend or suspend

the debt limit, the government faces a shutdown. As usual, the

necessary legislation is being used as a political football, with the

deep divide between the Democrats and Republicans making for a

particularly difficult scenario this time around. Something will

eventually be passed but at what cost. Here is what is being debated.

THE INFRASTRUCTURE BILL: This bill is about $1 trillion and passed in

the US Senate with bipartisan support. The current state of the bill

is unacceptable to most Democrats in the US House because it doesn’t

include their political projects such as “clean energy, social

justice, etc.”

THE SOCIAL AND ENVIRONMENT SPENDING BILL: This $3.5 trillion is the

House Democrats’ response to the slimmed-down “INFRASTRUCTURE

BILL.” It has chuck full of political agendas, taxes, and a new

“green energy plan.”

DEBT CEILING: According to our watches, Congress has until Thursday

to pass a bill to raise the debt ceiling. If they fail to do so, then

we could see a shutdown of the government.

LEGISLATIVE BATTLEGROUND: House Democrats and Biden want to pass the

increased $3.5 trillion spending bill without Republican support

through budget reconciliation. However, they need Sen. Joe Manchin and

other moderate Democrats’ support. Manchin has stated publicly he

won’t support the bill. Failure to pass the bills will reflect on

Biden who has increasingly looked weaker with his failure at

Afghanistan and the Border.

SCENARIO 1: I think it is highly likely the Democrats in the House

will pass the increased spending bills (at a slightly lower level) and

debt ceiling limit bill in order to put extreme pressure on moderate

Democrat Senators and Republicans. This will go over like “a fart in

church” and cause a shutdown or serious shutdown scare as all bills

fail to pass. The market will likely drop 3-10%, but could partially

recover if the debt ceiling bill is passed in order for Congress to

debate more. The key thing to know is that the Democrats and Biden are

using the debt ceiling limit to create a sense of urgency to pass

their spending bills. They will not want to give this away and will

signal defeat for them. However, they don’t want to be blamed for a

government shutdown.

SCENARIO 2: House Democrats pass the debt ceiling bill,

infrastructure bill, and a much lower spending bill (say $1 trillion

vs. $3.5) that Democrat Senators can support. I think this is the best

strategy for Democrats as it allows a much-needed win for both them

and Biden while avoiding a government shutdown. However, I am unsure

that Pelosi has the support for this and it is unknown how moderate

Democrat Senators will react to it. The market will likely not respond

or be positive as it will signal “business as usual.”

SCENARIO 3: House Democrats fail to pass any bills and we have a

government shutdown. Expect a full blame game between the Democrats,

Republicans, and Biden. The market will likely drop 3-10% and will not

come back until the shutdown is over.

BACK TO THE MARKETS

It is a busy U.S. calendar this week with a number of important

indicators. None will have much market impact individually, but all

will contribute to the Fed’s overall policy calculus where many on

the FOMC now believe the “substantial further progress” conditions

for QE tapering have been met. Chair Powell has been more cautious

given his concerns over the “substantial slack” in the job market.

But he too is leaning toward scaling back asset purchases this year.

The condition for the labor market is “all but met” on a

cumulative basis he noted last week. Hence, it won’t take much

improvement in the job numbers to satisfy him and get his vote on

tapering. We suspect that announcement comes in November.

While ISM, durables, income, consumption, and confidence will be

monitored, fiscal policy will distract with the debt limit and a

possible government shutdown looming at fiscal year-end (September

30), while negotiations on the big spending and tax bills are on tap

as well.

The Treasury’s $183 bln in 2-, 5-, and 7-year auctions will also be

interesting in this environment with a more hawkish Fed, a QE tapering

on the way, and still hot inflation. There is a bevy of Fedspeak and

we expect they will voice their support for a taper announcement later

this year.

The September ISM (Friday) highlights as it includes timely

information on manufacturing employment, production, inventories, and

prices. We expect the index to dip back -0.4 ticks to the 59.5 level

from July, versus the 59.9 in August. The slippage from the 18-year

high of 647 in March largely reflects the negative impacts from

materials and labor shortages and other supply constraints, rising

prices, the spike in the Delta variant, and the waning impact of

stimulus checks. All of the sentiment indicators have dropped on net

through July-August from prior peaks, and we expect further declines

into late-2021 toward more historically typical levels.

Other reports this week include August Advance durable orders where we

forecast a 0.5% increase after dipping -0.1% in July. Support should

come from a 0.5% bounce in transportation orders. September consumer

confidence is expected to rise to 115.0 after a drop to 113.8 in

August. A 0.2% gain in personal income is forecast for August, with

spending rising 0.6%. Q2 Q2 GDP should be revised up to a 7.0% pace of

growth, though the more relevant Q3 pace is now projected slowing to a

5.4% clip.

---------------------------------------------------------------

_DID YOU LIKE OUR EXCERPT AND WOULD YOU LIKE TO READ THE FULL

REPORT?__ _

_THE ADVISOR MARKET INTELLIGENCE REPORT_ helps financial advisor

advisors and investors SAVE TIME, CUT THROUGH THE NOISE, AND

OUTPERFORM THROUGH UNBIASED PROFESSIONAL MARKET RESEARCH.

_“Better info than the big investment companies. Your report is the

only thing I consistently read to know what is happening and when to

adjust portfolios.” Dennis_

_Sign up now for $19.95_ [[link removed]]_ or __save

more money by paying annually $99.95. (click here for annual)

[[link removed]].

_

THE _ADVISOR MARKET INTELLIGENCE REPORT _INCLUDES:

* KEY MARKET DRIVERS – Know what is directly affecting the

markets.

* INDEX & SECTOR TRENDS – Determine which sectors or areas are

trending up or down.

* GLOBAL MARKET ANALYSIS – Get a high-level picture of the US and

global economy.

* STOCKS TO WATCH – High-quality blue-chip and dividend income

stocks to watch.

* ECONOMIC CALENDAR – Find out what is happening this week.

* SPECIAL REPORTS – Get critical insider insight on key market

movers such as inflation, tax bills, and unique events.

[[link removed]]

Sincerely,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Good morning,

I hope you enjoyed your weekend. Sorry for the delay this morning, I

have Covid and recovering thanks to the brave doctors at Front Line

[[link removed]].

Below is a small excerpt from the _ABS ADVISOR MARKET INTELLIGENCE

REPORT_ [[link removed]]. It is published every

Monday morning to help conservative financial advisors and investors

save time and outperform. We hope you enjoy it, and please feel free

to forward it to your friends.

KEY MARKET TRENDS

_Tip: Use this as a quick guide on the short-term direction of key

markets. I once had a client that would call me nearly every day

asking the direction of the markets. This is a quick cheat sheet to

know the trend and help understand what is happening with the markets

in the short term._

__

KEY DRIVERS FOR THE WEEK OF SEPT. 27, 2021

_TIP – This is a 1-minute brief bullet-point summary. It is a tool

that gives investors and financial a fast and simple list of what to

watch for and talking points for the week._

* Hawkish pivots from central banks drives bond yields sharply higher

* FOMC stated QE tapering could begin soon, end in mid 2022; 10-year

rate 1.45%

* U.S. data includes ISM, durables, income, consumption, and

confidence on tap

* Treasury auctions $183 bln in coupons: $60 bln 2s, $61 bln 5s, $62

bln 7s

* Bevy of Fedspeakers should voice support for likely QE tapering

“soon”

* U.S. fiscal policy complicates with possible government shutdown

* Canada GDP expected to show further erosion in growth; holiday

Thursday

* Japan services PPI, production, retail sales, unemployment, housing

starts

* China PMIs should reflect slowing; Bank of Thailand seen on hold

* German elections may not yield clear winner for Chancellor Monday

* Eurozone CPI, ESI economic confidence, PMI, unemployment

* German data on HICP, jobless numbers, retail sales

* UK Q2 GDP expected solid, CIPS manufacturing PMI due

STOCKS & ETF WATCH LIST (PAID SUBSCRIBERS)

Tip: Use this section to find stocks and ETFs to add value to your

portfolio by increasing the alpha (return) and decreasing beta (beta).

Our list is updated monthly to help provide our readers with timely

insights. Readers should do their own research before making any

investment. In order to make our report easier to read, we are now

including the stocks as lists for readers in separate posts.

* INFLATION STOCK PICKS: List of stocks that we think should perform

better in a rising inflation environment. Click here

[[link removed]]

* AUTO PARTS STOCK PICKS: Auto parts companies are likely to see

their stocks rise as the average age of cars and light trucks

increased from 11.9 years in January 2017 to 12.2 years in January

2021, according to new data from IHS Markit. Below are the top auto

parts companies that investors should buy now before the profits roll

in. Click here.

[[link removed]]

* SOLID PICKS: This group of stock/ETF picks is likely to experience

growth and perform well into the near future. Click here

[[link removed]].

* DIVIDEND STOCKS: List of stocks that have excellent dividends and

business performance. Click here.

[[link removed]]

* DIVIDEND GROWTH STOCKS: List of stocks that have a history of

growing dividends. Click here

[[link removed]].

* DIVIDEND ETFS PICKS: This list of ETFs is selected for their

ability to pay dividends. Click here.

[[link removed]]

* DOGS OF THE DOW: This list of DOW stocks based on H. G.

Schneider’s Article in the Journal of Finance in 1951 that used the

price-earnings ratio. The general idea is that blue-chip companies

that pay a dividend are more likely to withstand an economic downturn.

Click here. [[link removed]]

WEEK AHEAD: BONDS BEARS & BIDEN TEST

NORTH AMERICA

CONGRESS & DEBT CEILING

THE BIG MOVER THIS WEEK IS CONGRESS AS IT TRIES TO PASS THREE KEY

BILLS (INFRASTRUCTURE, SOCIAL/GREEN BILL, AND DEBT CEILING). Fiscal

2021 ends on September 30 and without legislation to extend or suspend

the debt limit, the government faces a shutdown. As usual, the

necessary legislation is being used as a political football, with the

deep divide between the Democrats and Republicans making for a

particularly difficult scenario this time around. Something will

eventually be passed but at what cost. Here is what is being debated.

THE INFRASTRUCTURE BILL: This bill is about $1 trillion and passed in

the US Senate with bipartisan support. The current state of the bill

is unacceptable to most Democrats in the US House because it doesn’t

include their political projects such as “clean energy, social

justice, etc.”

THE SOCIAL AND ENVIRONMENT SPENDING BILL: This $3.5 trillion is the

House Democrats’ response to the slimmed-down “INFRASTRUCTURE

BILL.” It has chuck full of political agendas, taxes, and a new

“green energy plan.”

DEBT CEILING: According to our watches, Congress has until Thursday

to pass a bill to raise the debt ceiling. If they fail to do so, then

we could see a shutdown of the government.

LEGISLATIVE BATTLEGROUND: House Democrats and Biden want to pass the

increased $3.5 trillion spending bill without Republican support

through budget reconciliation. However, they need Sen. Joe Manchin and

other moderate Democrats’ support. Manchin has stated publicly he

won’t support the bill. Failure to pass the bills will reflect on

Biden who has increasingly looked weaker with his failure at

Afghanistan and the Border.

SCENARIO 1: I think it is highly likely the Democrats in the House

will pass the increased spending bills (at a slightly lower level) and

debt ceiling limit bill in order to put extreme pressure on moderate

Democrat Senators and Republicans. This will go over like “a fart in

church” and cause a shutdown or serious shutdown scare as all bills

fail to pass. The market will likely drop 3-10%, but could partially

recover if the debt ceiling bill is passed in order for Congress to

debate more. The key thing to know is that the Democrats and Biden are

using the debt ceiling limit to create a sense of urgency to pass

their spending bills. They will not want to give this away and will

signal defeat for them. However, they don’t want to be blamed for a

government shutdown.

SCENARIO 2: House Democrats pass the debt ceiling bill,

infrastructure bill, and a much lower spending bill (say $1 trillion

vs. $3.5) that Democrat Senators can support. I think this is the best

strategy for Democrats as it allows a much-needed win for both them

and Biden while avoiding a government shutdown. However, I am unsure

that Pelosi has the support for this and it is unknown how moderate

Democrat Senators will react to it. The market will likely not respond

or be positive as it will signal “business as usual.”

SCENARIO 3: House Democrats fail to pass any bills and we have a

government shutdown. Expect a full blame game between the Democrats,

Republicans, and Biden. The market will likely drop 3-10% and will not

come back until the shutdown is over.

BACK TO THE MARKETS

It is a busy U.S. calendar this week with a number of important

indicators. None will have much market impact individually, but all

will contribute to the Fed’s overall policy calculus where many on

the FOMC now believe the “substantial further progress” conditions

for QE tapering have been met. Chair Powell has been more cautious

given his concerns over the “substantial slack” in the job market.

But he too is leaning toward scaling back asset purchases this year.

The condition for the labor market is “all but met” on a

cumulative basis he noted last week. Hence, it won’t take much

improvement in the job numbers to satisfy him and get his vote on

tapering. We suspect that announcement comes in November.

While ISM, durables, income, consumption, and confidence will be

monitored, fiscal policy will distract with the debt limit and a

possible government shutdown looming at fiscal year-end (September

30), while negotiations on the big spending and tax bills are on tap

as well.

The Treasury’s $183 bln in 2-, 5-, and 7-year auctions will also be

interesting in this environment with a more hawkish Fed, a QE tapering

on the way, and still hot inflation. There is a bevy of Fedspeak and

we expect they will voice their support for a taper announcement later

this year.

The September ISM (Friday) highlights as it includes timely

information on manufacturing employment, production, inventories, and

prices. We expect the index to dip back -0.4 ticks to the 59.5 level

from July, versus the 59.9 in August. The slippage from the 18-year

high of 647 in March largely reflects the negative impacts from

materials and labor shortages and other supply constraints, rising

prices, the spike in the Delta variant, and the waning impact of

stimulus checks. All of the sentiment indicators have dropped on net

through July-August from prior peaks, and we expect further declines

into late-2021 toward more historically typical levels.

Other reports this week include August Advance durable orders where we

forecast a 0.5% increase after dipping -0.1% in July. Support should

come from a 0.5% bounce in transportation orders. September consumer

confidence is expected to rise to 115.0 after a drop to 113.8 in

August. A 0.2% gain in personal income is forecast for August, with

spending rising 0.6%. Q2 Q2 GDP should be revised up to a 7.0% pace of

growth, though the more relevant Q3 pace is now projected slowing to a

5.4% clip.

---------------------------------------------------------------

_DID YOU LIKE OUR EXCERPT AND WOULD YOU LIKE TO READ THE FULL

REPORT?__ _

_THE ADVISOR MARKET INTELLIGENCE REPORT_ helps financial advisor

advisors and investors SAVE TIME, CUT THROUGH THE NOISE, AND

OUTPERFORM THROUGH UNBIASED PROFESSIONAL MARKET RESEARCH.

_“Better info than the big investment companies. Your report is the

only thing I consistently read to know what is happening and when to

adjust portfolios.” Dennis_

_Sign up now for $19.95_ [[link removed]]_ or __save

more money by paying annually $99.95. (click here for annual)

[[link removed]].

_

THE _ADVISOR MARKET INTELLIGENCE REPORT _INCLUDES:

* KEY MARKET DRIVERS – Know what is directly affecting the

markets.

* INDEX & SECTOR TRENDS – Determine which sectors or areas are

trending up or down.

* GLOBAL MARKET ANALYSIS – Get a high-level picture of the US and

global economy.

* STOCKS TO WATCH – High-quality blue-chip and dividend income

stocks to watch.

* ECONOMIC CALENDAR – Find out what is happening this week.

* SPECIAL REPORTS – Get critical insider insight on key market

movers such as inflation, tax bills, and unique events.

[[link removed]]

Sincerely,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a