| From | Reveal <[email protected]> |

| Subject | How Trump cronies got rich off America’s housing crash: The Weekly Reveal |

| Date | October 21, 2019 11:18 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Got five minutes? We would love your help filling out our annual audience survey. For a limited time, we’re entering all survey takers into the running for our brand-new “FACTS” tote bag. Check it out below!

TAKE THE SURVEY ([link removed])

[link removed]

Meet the ‘Homewreckers’

When 8 million people lost their homes during the Great Recession, a small group of ultra-wealthy people – several of them members of President Donald Trump’s inner circle – stepped in and made a killing.

On this week’s new episode ([link removed]) , reporter Aaron Glantz explains how this collection of “Homewreckers” – including Treasury Secretary Steve Mnuchin and former Trump inaugural committee chairman Tom Barrack Jr. – took advantage of a rigged system.

In some cases, they even got the government’s help. Now, with Trump in office, they are reshaping the very rules they exploited.

It’s possible to understand this entire operation through the prism of just one house: a 1,500-square-foot single-family unit in western Los Angeles. During the housing boom of the early 2000s, its owners, Dick and Patricia Hickerson, signed up for something called a reverse mortgage.

The agreement allowed the Hickersons to extract immediate cash from the home’s total value. But it also stipulated that when they died, the bank would end up in possession of the house.

When the financial crisis hit, this bank, IndyMac, went under. Suddenly, the U.S. government owned it, and it was eager to sell. Enter Mnuchin, whose investment firm acquired IndyMac – along with all its loans, including billions of dollars’ worth of reverse mortgages – for no money.

From there, the Hickersons’ home was purchased at auction by Colfin AI-5 California LLC, one of more than 300 shell companies run by Barrack. In the midst of the housing crisis, these companies amassed more than 30,000 homes, some of them on the market due to foreclosures. The process effectively evicted struggling homeowners, then forced them to rent the properties they had spent years paying off. In a speech at the University of Chicago, Barrack called it “the greatest thing I’ve ever done in my professional life, honestly.”

Just like with Mnuchin, the U.S. government stepped in to lend Barrack a hand. By 2011, its newly formed Federal Housing Finance Agency was overwhelmed with 200,000 homes it didn’t want. But rather than selling these homes to nonprofit agencies dedicated to missions such as preventing blight, it began pursuing the simpler option: unloading them to private equity firms at a steep discount.

“We held a big fire sale,” said Julia Gordon, who worked at the Federal Housing Finance Agency. “We sold mortgages at pennies on the dollar to the private equity infrastructure of the country.”

The first deal was with Barrack’s company, Colony Capital. It paid $34 million to buy a controlling interest in 1,000 homes across Los Angeles, Las Vegas and Phoenix. The deal was a steal. An independent appraiser valued those homes at more than $150 million.

Again, the government took a hands-off approach. It could have imposed conditions on these purchases, such as giving the homes’ former owners first dibs on trying to buy them back. Instead, as Aaron points out in our episode, “the auction was only for people who wanted to bid on 1,000 homes across three states.”

HEAR THE EPISODE ([link removed])

[link removed]

More on this topic ...

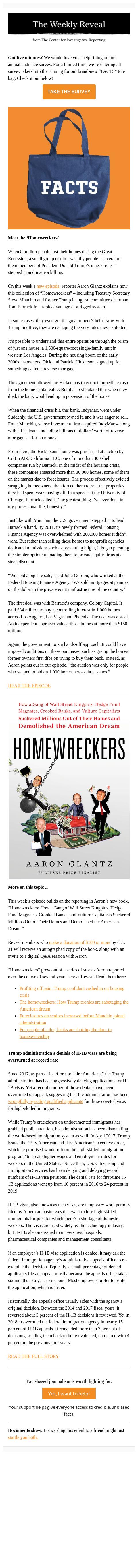

This week’s episode builds on the reporting in Aaron’s new book, “Homewreckers: How a Gang of Wall Street Kingpins, Hedge Fund Magnates, Crooked Banks, and Vulture Capitalists Suckered Millions Out of Their Homes and Demolished the American Dream.”

Reveal members who make a donation of $100 or more ([link removed]) by Oct. 31 will receive an autographed copy of the book, along with an invite to a digital Q&A session with Aaron.

“Homewreckers” grew out of a series of stories Aaron reported over the course of several years here at Reveal. Read them here:

* Profiting off pain: Trump confidant cashed in on housing crisis ([link removed])

* The homewreckers: How Trump cronies are sabotaging the American dream ([link removed])

* Foreclosures on seniors increased before Mnuchin joined administration ([link removed])

* For people of color, banks are shutting the door to homeownership ([link removed])

Trump administration’s denials of H-1B visas are being overturned at record rate

Since 2017, as part of its efforts to “hire American,” the Trump administration has been aggressively denying applications for H-1B visas. Yet a record number of those denials have been overturned on appeal, suggesting that the administration has been wrongfully rejecting qualified applicants ([link removed]) for these coveted visas for high-skilled immigrants.

While Trump’s crackdown on undocumented immigrants has grabbed public attention, his administration has been dismantling the work-based immigration system as well. In April 2017, Trump issued the “Buy American and Hire American” executive order, which he promised would reform the high-skilled immigration program “to create higher wages and employment rates for workers in the United States.” Since then, U.S. Citizenship and Immigration Services has been denying and delaying record numbers of H-1B visa petitions. The denial rate for first-time H-1B applications went up from 10 percent in 2016 to 24 percent in 2019.

H-1B visas, also known as tech visas, are temporary work permits filed by American businesses that want to hire high-skilled immigrants for jobs for which there’s a shortage of domestic workers. The visas are used widely by the technology industry, but H-1Bs also are issued to universities, hospitals, pharmaceutical companies and management consultants.

If an employer’s H-1B visa application is denied, it may ask the federal immigration agency’s administrative appeals office to re-examine the decision. Typically, a small percentage of denied applicants file an appeal, mostly because the appeals office takes six months to a year to respond. Most employers prefer to refile the application, which is faster.

Historically, the appeals office usually sides with the agency’s original decision. Between the 2014 and 2017 fiscal years, it reversed about 3 percent of the H-1B decisions it reviewed. Yet in 2018, it overruled the federal immigration agency in nearly 15 percent of H-1B appeals. It remanded more than 7 percent of decisions, sending them back to be re-evaluated, compared with 4 percent in the previous four years.

READ THE FULL STORY ([link removed])

Fact-based journalism is worth fighting for.

Yes, I want to help! ([link removed])

Your support helps give everyone access to credible, unbiased facts.

Documents show: Forwarding this email to a friend might just startle you both. ([link removed])

============================================================

This email was sent to [email protected] (mailto:[email protected])

why did I get this? ([link removed]) unsubscribe from this list ([link removed]) update subscription preferences ([link removed])

The Center for Investigative Reporting . 1400 65th St., Suite 200 . Emeryville, CA 94608 . USA

TAKE THE SURVEY ([link removed])

[link removed]

Meet the ‘Homewreckers’

When 8 million people lost their homes during the Great Recession, a small group of ultra-wealthy people – several of them members of President Donald Trump’s inner circle – stepped in and made a killing.

On this week’s new episode ([link removed]) , reporter Aaron Glantz explains how this collection of “Homewreckers” – including Treasury Secretary Steve Mnuchin and former Trump inaugural committee chairman Tom Barrack Jr. – took advantage of a rigged system.

In some cases, they even got the government’s help. Now, with Trump in office, they are reshaping the very rules they exploited.

It’s possible to understand this entire operation through the prism of just one house: a 1,500-square-foot single-family unit in western Los Angeles. During the housing boom of the early 2000s, its owners, Dick and Patricia Hickerson, signed up for something called a reverse mortgage.

The agreement allowed the Hickersons to extract immediate cash from the home’s total value. But it also stipulated that when they died, the bank would end up in possession of the house.

When the financial crisis hit, this bank, IndyMac, went under. Suddenly, the U.S. government owned it, and it was eager to sell. Enter Mnuchin, whose investment firm acquired IndyMac – along with all its loans, including billions of dollars’ worth of reverse mortgages – for no money.

From there, the Hickersons’ home was purchased at auction by Colfin AI-5 California LLC, one of more than 300 shell companies run by Barrack. In the midst of the housing crisis, these companies amassed more than 30,000 homes, some of them on the market due to foreclosures. The process effectively evicted struggling homeowners, then forced them to rent the properties they had spent years paying off. In a speech at the University of Chicago, Barrack called it “the greatest thing I’ve ever done in my professional life, honestly.”

Just like with Mnuchin, the U.S. government stepped in to lend Barrack a hand. By 2011, its newly formed Federal Housing Finance Agency was overwhelmed with 200,000 homes it didn’t want. But rather than selling these homes to nonprofit agencies dedicated to missions such as preventing blight, it began pursuing the simpler option: unloading them to private equity firms at a steep discount.

“We held a big fire sale,” said Julia Gordon, who worked at the Federal Housing Finance Agency. “We sold mortgages at pennies on the dollar to the private equity infrastructure of the country.”

The first deal was with Barrack’s company, Colony Capital. It paid $34 million to buy a controlling interest in 1,000 homes across Los Angeles, Las Vegas and Phoenix. The deal was a steal. An independent appraiser valued those homes at more than $150 million.

Again, the government took a hands-off approach. It could have imposed conditions on these purchases, such as giving the homes’ former owners first dibs on trying to buy them back. Instead, as Aaron points out in our episode, “the auction was only for people who wanted to bid on 1,000 homes across three states.”

HEAR THE EPISODE ([link removed])

[link removed]

More on this topic ...

This week’s episode builds on the reporting in Aaron’s new book, “Homewreckers: How a Gang of Wall Street Kingpins, Hedge Fund Magnates, Crooked Banks, and Vulture Capitalists Suckered Millions Out of Their Homes and Demolished the American Dream.”

Reveal members who make a donation of $100 or more ([link removed]) by Oct. 31 will receive an autographed copy of the book, along with an invite to a digital Q&A session with Aaron.

“Homewreckers” grew out of a series of stories Aaron reported over the course of several years here at Reveal. Read them here:

* Profiting off pain: Trump confidant cashed in on housing crisis ([link removed])

* The homewreckers: How Trump cronies are sabotaging the American dream ([link removed])

* Foreclosures on seniors increased before Mnuchin joined administration ([link removed])

* For people of color, banks are shutting the door to homeownership ([link removed])

Trump administration’s denials of H-1B visas are being overturned at record rate

Since 2017, as part of its efforts to “hire American,” the Trump administration has been aggressively denying applications for H-1B visas. Yet a record number of those denials have been overturned on appeal, suggesting that the administration has been wrongfully rejecting qualified applicants ([link removed]) for these coveted visas for high-skilled immigrants.

While Trump’s crackdown on undocumented immigrants has grabbed public attention, his administration has been dismantling the work-based immigration system as well. In April 2017, Trump issued the “Buy American and Hire American” executive order, which he promised would reform the high-skilled immigration program “to create higher wages and employment rates for workers in the United States.” Since then, U.S. Citizenship and Immigration Services has been denying and delaying record numbers of H-1B visa petitions. The denial rate for first-time H-1B applications went up from 10 percent in 2016 to 24 percent in 2019.

H-1B visas, also known as tech visas, are temporary work permits filed by American businesses that want to hire high-skilled immigrants for jobs for which there’s a shortage of domestic workers. The visas are used widely by the technology industry, but H-1Bs also are issued to universities, hospitals, pharmaceutical companies and management consultants.

If an employer’s H-1B visa application is denied, it may ask the federal immigration agency’s administrative appeals office to re-examine the decision. Typically, a small percentage of denied applicants file an appeal, mostly because the appeals office takes six months to a year to respond. Most employers prefer to refile the application, which is faster.

Historically, the appeals office usually sides with the agency’s original decision. Between the 2014 and 2017 fiscal years, it reversed about 3 percent of the H-1B decisions it reviewed. Yet in 2018, it overruled the federal immigration agency in nearly 15 percent of H-1B appeals. It remanded more than 7 percent of decisions, sending them back to be re-evaluated, compared with 4 percent in the previous four years.

READ THE FULL STORY ([link removed])

Fact-based journalism is worth fighting for.

Yes, I want to help! ([link removed])

Your support helps give everyone access to credible, unbiased facts.

Documents show: Forwarding this email to a friend might just startle you both. ([link removed])

============================================================

This email was sent to [email protected] (mailto:[email protected])

why did I get this? ([link removed]) unsubscribe from this list ([link removed]) update subscription preferences ([link removed])

The Center for Investigative Reporting . 1400 65th St., Suite 200 . Emeryville, CA 94608 . USA

Message Analysis

- Sender: Reveal News

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp