|

Friends,

This week, the U.S. Senate passed the historic bipartisan infrastructure package. I believe that one of the few core responsibilities of the government is to provide safe and efficient infrastructure throughout North Carolina and across the country. Over the past several months I have been working with my Senate colleagues to develop a bipartisan framework to modernize America’s infrastructure in a smart and responsible way, without raising taxes.

While the bipartisan infrastructure legislation is not perfect, I supported it because it’s good for North Carolina. Below is a summary of what is in the bill and where the funding goes.

Unfortunately, there is a lot of misinformation about what is in the legislation and what it does or does not do. I wanted to take a moment to address some of the questions I have been receiving over the last few weeks.

Does this legislation address our core infrastructure needs?

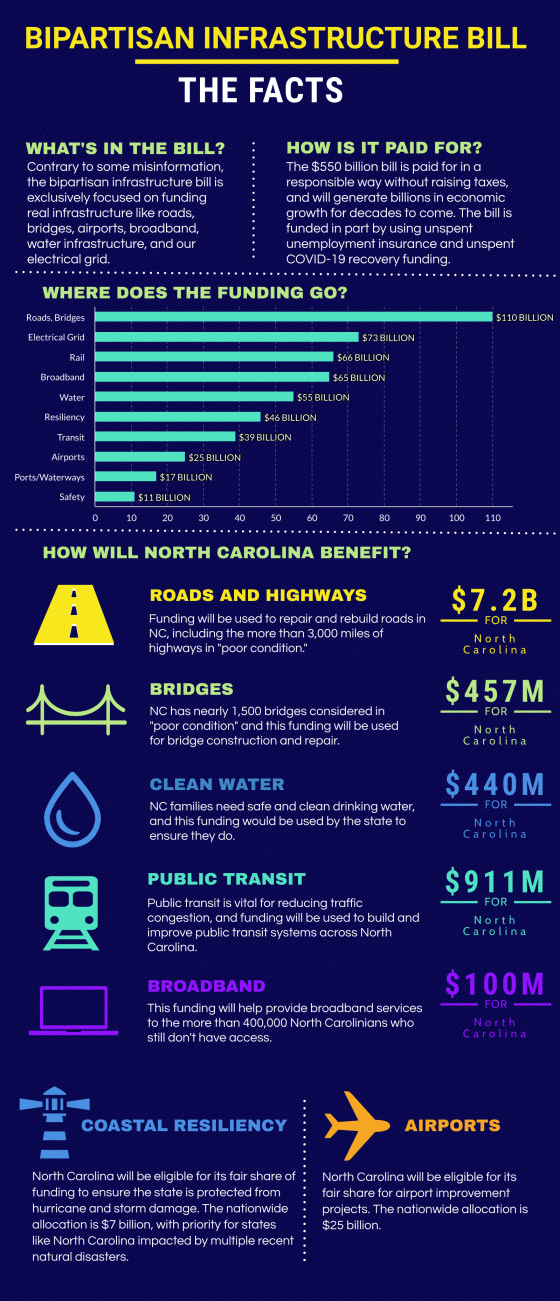

To be clear, this is an infrastructure bill that funds hard infrastructure. The $550 billion in funding goes towards building and repairing roads, bridges and highways, modernizing our electrical grid, ensuring the safety of our nation’s water infrastructure, supporting coastal resiliency, improving airports, and expanding broadband access.

Why participate in the bipartisan infrastructure negotiations?

My main priority in taking part in this bipartisan group is to ensure it met the needs of our state, including investments in North Carolina’s roads, highways, and bridges. I also wanted to ensure that the legislation did not include some of the left-wing policies proposed by the President and some House members, including parts of the Green New Deal. I was pleased that the final product focuses on hard infrastructure and is a significant win for North Carolina. Furthermore, had there not been a bipartisan effort on infrastructure, the Senate Majority would have used that as an excuse to eliminate the filibuster, meaning they could pass far-left policies without needing a single vote from the Minority.

Does this legislation add hundreds of billions to the national debt?

The $550 billion bipartisan infrastructure bill is responsibly paid for without raising any taxes. Funding streams for this legislation include repurposing unspent COVID relief funds, and these investments will generate billions in economic output for decades to come. The reality is that the Congressional Budget Office (CBO) is limited in how and what they can calculate in their score. For example, the CBO didn’t give credit for the $53 billion of funding that comes from repurposing unused unemployment insurance.

Does this legislation include a mileage tax?

There is no mileage tax in the bill or any other tax increase in the bill – it is only a very limited study in the form of a voluntary pilot program. There have also been a lot of misconceptions about what a mileage tax is intended to do. It is an attempt to solve the problem of electric car owners who pay no gas taxes, which are used by the government to repair roads. That means currently, owners of regular cars are subsidizing the owners of electric cars, and are paying more in taxes. With car manufacturers expected to produce more electric cars in the coming years, this pilot program was designed to simply explore ways to address the unfairness of electric car owners paying no taxes to repair our roads.

Does this legislation mandate breathalyzers in cars?

The claim that the bill requires breathalyzers or ignition interlock devices to be installed in cars is false. The mandate some are referring to is for completely passive safety technology that warns drivers when they aren’t paying attention to the road, are fatigued, or are impaired. The changes that will impact drivers that purchase a new car are new requirements for safety features to save lives, which include emergency braking, crash avoidance systems, and other features that will help prevent serious injury during a collision.

Does this legislation include the ‘Green New Deal’?

Absolutely not, this legislation focuses on our core infrastructure needs. There is a false claim circulating that only 23% of this legislation supports core infrastructure, and the rest is ‘Green New Deal’ excess spending. To believe this false claim, one would have to view investments in water infrastructure, the electrical grid, coastal resiliency/flood mitigation, broadband, airports, rails, public transit, and road safety as outside the definition of core infrastructure. You can see the spending breakdown below.

While my colleagues on the other side of the aisle have played fast and loose with the definition of infrastructure, I firmly believe these provisions constitute the definition of modern infrastructure, and I would never support legislation that included the Green New Deal.

Is this legislation part of the Biden Administration’s $3.5 trillion spending plan?

This bipartisan agreement is completely separate from the Majority party’s proposed $3.5 trillion tax and spending plan, which the Majority plans to ram through on a partisan basis this year.

The upcoming tax and spending plan includes various left-wing provisions I firmly oppose, including job-killing tax increases, Green New Deal regulations, and amnesty for millions of illegal immigrants under the intentionally vague definition of “human infrastructure.” I strongly oppose the tax and spending spree and I am committed to working with my colleagues to fight it.

As you can see, the bipartisan infrastructure bill will benefit North Carolinians by improving our roads and highways, ensuring we have safe drinking water, and providing our rural communities access to broadband internet.

Thank you for reading, and as always, please reach out to my office if you have any questions or need help with a federal agency. God bless.

All the best,

|