Email

Unemployment Data Update: March 2020 through August 7, 2021

| From | Center for Jobs and the Economy <[email protected]> |

| Subject | Unemployment Data Update: March 2020 through August 7, 2021 |

| Date | August 12, 2021 11:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] Unemployment Data Update: March 2020 through August 7, 2021 Unemployment Insurance Claims

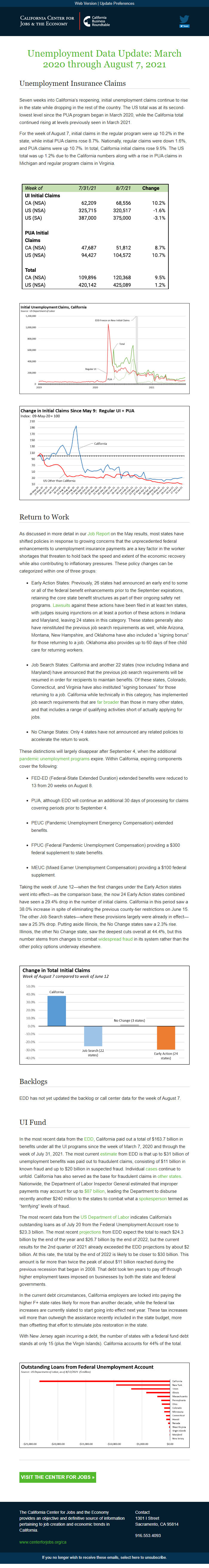

Seven weeks into California’s reopening, initial unemployment claims continue to rise in the state while dropping in the rest of the country. The US total was at its second-lowest level since the PUA program began in March 2020, while the California total continued rising at levels previously seen in March 2021.

For the week of August 7, initial claims in the regular program were up 10.2% in the state, while initial PUA claims rose 8.7%. Nationally, regular claims were down 1.6%, and PUA claims were up 10.7%. In total, California initial claims rose 9.5%. The US total was up 1.2% due to the California numbers along with a rise in PUA claims in Michigan and regular program claims in Virginia.

Return to Work

As discussed in more detail in our Job Report [[link removed]] on the May results, most states have shifted policies in response to growing concerns that the unprecedented federal enhancements to unemployment insurance payments are a key factor in the worker shortages that threaten to hold back the speed and extent of the economic recovery while also contributing to inflationary pressures. These policy changes can be categorized within one of three groups:

Early Action States: Previously, 26 states had announced an early end to some or all of the federal benefit enhancements prior to the September expirations, retaining the core state benefit structures as part of their ongoing safety net programs. Lawsuits [[link removed]] against these actions have been filed in at least ten states, with judges issuing injunctions on at least a portion of these actions in Indiana and Maryland, leaving 24 states in this category. These states generally also have reinstituted the previous job search requirements as well, while Arizona, Montana, New Hampshire, and Oklahoma have also included a “signing bonus” for those returning to a job. Oklahoma also provides up to 60 days of free child care for returning workers.

Job Search States: California and another 22 states (now including Indiana and Maryland) have announced that the previous job search requirements will be resumed in order for recipients to maintain benefits. Of these states, Colorado, Connecticut, and Virginia have also instituted “signing bonuses” for those returning to a job. California while technically in this category, has implemented job search requirements that are far broader [[link removed]] than those in many other states, and that includes a range of qualifying activities short of actually applying for jobs.

No Change States: Only 4 states have not announced any related policies to accelerate the return to work.

These distinctions will largely disappear after September 4, when the additional pandemic unemployment programs [[link removed]] expire. Within California, expiring components cover the following:

FED-ED (Federal-State Extended Duration) extended benefits were reduced to 13 from 20 weeks on August 8.

PUA, although EDD will continue an additional 30 days of processing for claims covering periods prior to September 4.

PEUC (Pandemic Unemployment Emergency Compensation) extended benefits.

FPUC (Federal Pandemic Unemployment Compensation) providing a $300 federal supplement to state benefits.

MEUC (Mixed Earner Unemployment Compensation) providing a $100 federal supplement.

Taking the week of June 12—when the first changes under the Early Action states went into effect—as the comparison base, the now 24 Early Action states combined have seen a 29.4% drop in the number of initial claims. California in this period saw a 38.0% increase in spite of eliminating the previous county-tier restrictions on June 15. The other Job Search states—where these provisions largely were already in effect—saw a 25.3% drop. Putting aside Illinois, the No Change states saw a 2.3% rise. Illinois, the other No Change state, saw the deepest cuts overall at 44.4%, but this number stems from changes to combat widespread fraud [[link removed]] in its system rather than the other policy options underway elsewhere.

Backlogs

EDD has not yet updated the backlog or call center data for the week of August 7.

UI Fund

In the most recent data from the EDD [[link removed]], California paid out a total of $163.7 billion in benefits under all the UI programs since the week of March 7, 2020 and through the week of July 31, 2021. The most current estimate [[link removed]] from EDD is that up to $31 billion of unemployment benefits was paid out to fraudulent claims, consisting of $11 billion in known fraud and up to $20 billion in suspected fraud. Individual cases [[link removed]] continue to unfold. California has also served as the base for fraudulent claims in other states [[link removed]]. Nationwide, the Department of Labor Inspector General estimated that improper payments may account for up to $87 billion [[link removed]], leading the Department to disburse recently another $240 million to the states to combat what a spokesperson [[link removed]] termed as “terrifying” levels of fraud.

The most recent data from the US Department of Labor [[link removed]] indicates California’s outstanding loans as of July 20 from the Federal Unemployment Account rose to $23.3 billion. The most recent projections [[link removed]] from EDD expect the total to reach $24.3 billion by the end of the year and $26.7 billion by the end of 2022, but the current results for the 2nd quarter of 2021 already exceeded the EDD projections by about $2 billion. At this rate, the total by the end of 2022 is likely to be closer to $30 billion. This amount is far more than twice the peak of about $11 billion reached during the previous recession that began in 2008. That debt took ten years to pay off through higher employment taxes imposed on businesses by both the state and federal governments.

In the current debt circumstances, California employers are locked into paying the higher F+ state rates likely for more than another decade, while the federal tax increases are currently slated to start going into effect next year. These tax increases will more than outweigh the assistance recently included in the state budget, more than offsetting that effort to stimulate jobs restoration in the state.

With New Jersey again incurring a debt, the number of states with a federal fund debt stands at only 15 (plus the Virgin Islands). California accounts for 44% of the total.

visit the center for jobs » [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Seven weeks into California’s reopening, initial unemployment claims continue to rise in the state while dropping in the rest of the country. The US total was at its second-lowest level since the PUA program began in March 2020, while the California total continued rising at levels previously seen in March 2021.

For the week of August 7, initial claims in the regular program were up 10.2% in the state, while initial PUA claims rose 8.7%. Nationally, regular claims were down 1.6%, and PUA claims were up 10.7%. In total, California initial claims rose 9.5%. The US total was up 1.2% due to the California numbers along with a rise in PUA claims in Michigan and regular program claims in Virginia.

Return to Work

As discussed in more detail in our Job Report [[link removed]] on the May results, most states have shifted policies in response to growing concerns that the unprecedented federal enhancements to unemployment insurance payments are a key factor in the worker shortages that threaten to hold back the speed and extent of the economic recovery while also contributing to inflationary pressures. These policy changes can be categorized within one of three groups:

Early Action States: Previously, 26 states had announced an early end to some or all of the federal benefit enhancements prior to the September expirations, retaining the core state benefit structures as part of their ongoing safety net programs. Lawsuits [[link removed]] against these actions have been filed in at least ten states, with judges issuing injunctions on at least a portion of these actions in Indiana and Maryland, leaving 24 states in this category. These states generally also have reinstituted the previous job search requirements as well, while Arizona, Montana, New Hampshire, and Oklahoma have also included a “signing bonus” for those returning to a job. Oklahoma also provides up to 60 days of free child care for returning workers.

Job Search States: California and another 22 states (now including Indiana and Maryland) have announced that the previous job search requirements will be resumed in order for recipients to maintain benefits. Of these states, Colorado, Connecticut, and Virginia have also instituted “signing bonuses” for those returning to a job. California while technically in this category, has implemented job search requirements that are far broader [[link removed]] than those in many other states, and that includes a range of qualifying activities short of actually applying for jobs.

No Change States: Only 4 states have not announced any related policies to accelerate the return to work.

These distinctions will largely disappear after September 4, when the additional pandemic unemployment programs [[link removed]] expire. Within California, expiring components cover the following:

FED-ED (Federal-State Extended Duration) extended benefits were reduced to 13 from 20 weeks on August 8.

PUA, although EDD will continue an additional 30 days of processing for claims covering periods prior to September 4.

PEUC (Pandemic Unemployment Emergency Compensation) extended benefits.

FPUC (Federal Pandemic Unemployment Compensation) providing a $300 federal supplement to state benefits.

MEUC (Mixed Earner Unemployment Compensation) providing a $100 federal supplement.

Taking the week of June 12—when the first changes under the Early Action states went into effect—as the comparison base, the now 24 Early Action states combined have seen a 29.4% drop in the number of initial claims. California in this period saw a 38.0% increase in spite of eliminating the previous county-tier restrictions on June 15. The other Job Search states—where these provisions largely were already in effect—saw a 25.3% drop. Putting aside Illinois, the No Change states saw a 2.3% rise. Illinois, the other No Change state, saw the deepest cuts overall at 44.4%, but this number stems from changes to combat widespread fraud [[link removed]] in its system rather than the other policy options underway elsewhere.

Backlogs

EDD has not yet updated the backlog or call center data for the week of August 7.

UI Fund

In the most recent data from the EDD [[link removed]], California paid out a total of $163.7 billion in benefits under all the UI programs since the week of March 7, 2020 and through the week of July 31, 2021. The most current estimate [[link removed]] from EDD is that up to $31 billion of unemployment benefits was paid out to fraudulent claims, consisting of $11 billion in known fraud and up to $20 billion in suspected fraud. Individual cases [[link removed]] continue to unfold. California has also served as the base for fraudulent claims in other states [[link removed]]. Nationwide, the Department of Labor Inspector General estimated that improper payments may account for up to $87 billion [[link removed]], leading the Department to disburse recently another $240 million to the states to combat what a spokesperson [[link removed]] termed as “terrifying” levels of fraud.

The most recent data from the US Department of Labor [[link removed]] indicates California’s outstanding loans as of July 20 from the Federal Unemployment Account rose to $23.3 billion. The most recent projections [[link removed]] from EDD expect the total to reach $24.3 billion by the end of the year and $26.7 billion by the end of 2022, but the current results for the 2nd quarter of 2021 already exceeded the EDD projections by about $2 billion. At this rate, the total by the end of 2022 is likely to be closer to $30 billion. This amount is far more than twice the peak of about $11 billion reached during the previous recession that began in 2008. That debt took ten years to pay off through higher employment taxes imposed on businesses by both the state and federal governments.

In the current debt circumstances, California employers are locked into paying the higher F+ state rates likely for more than another decade, while the federal tax increases are currently slated to start going into effect next year. These tax increases will more than outweigh the assistance recently included in the state budget, more than offsetting that effort to stimulate jobs restoration in the state.

With New Jersey again incurring a debt, the number of states with a federal fund debt stands at only 15 (plus the Virgin Islands). California accounts for 44% of the total.

visit the center for jobs » [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor