Email

Weekly Market Intelligence Report: Delta Dents Global Growth

| From | Irving Wilkinson <[email protected]> |

| Subject | Weekly Market Intelligence Report: Delta Dents Global Growth |

| Date | July 26, 2021 12:26 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Market Research Reports 7-29

Good morning,

I hope you enjoyed your weekend. Below is a small excerpt from

the _ABS ADVISOR MARKET INTELLIGENCE REPORT_

[[link removed]]. It is published every Monday

morning to help financial advisors and investors save time and

outperform. We hope you enjoy it, and please feel free to forward it

to your friends.

KEY MARKET TRENDS

_Tip: Use this as a quick guide on the short-term direction of key

markets. I once had a client that would call me nearly every day

asking the direction of the markets. This is a quick cheat sheet to

know the trend and help understand what is happening with the markets

in the short term._

__

KEY DRIVERS FOR THE WEEK OF JULY 12, 2021

_TIP - This is a 1-minute brief bullet-point summary. It is a tool

that gives investors and financial a fast and simple list of what to

watch for and talking points for the week._

* Global growth remains solid into 2H, but likely dented by Delta

variation

* Stocks and bonds rally on dovish ECB and easing in Fed QE tapering

worries

* The congressional budget battle over raising the debt limit and

Infrastructure Bill

* FOMC expected to say “substantial further progress” yet to be

made

* Heavy earnings calendar: Tesla, Apple, Microsoft, Facebook, Pfizer,

Amazon

* U.S. data: Q2 GDP, new home sales, durables, confidence, income,

ECI

* Japan docket has PPI, retail sales, unemployment, production,

confidence

* Eurozone GDP, PMI, ESI confidence, unemployment, and HICP due

* German Ifo business sentiment, unemployment, HICP, import prices

* UK monitors Brexit agreement on Northern Ireland protocol

WEEK AHEAD: DELTA DENTS GLOBAL GROWTH

On July 26, 2021

Optimism over global growth continues to dominate forecasts and a

strong 2H is generally expected. While the accelerating spread in the

Delta covid variant has caused considerable consternation and renewed

downside risks, we suspect the virus will only dent growth.

Indeed, the increased vaccination rates, especially in the West, along

with 1H momentum amid more fully opened economies and the pull from

pent-up demand should help mitigate considerably the bearish impacts.

Additionally, supply constraints are also easing in many areas. And

most importantly, central bank accommodation will remain in place.

Though there has been increased worry over QE tapering, the risks from

Delta are likely to delay any such moves from the FOMC or ECB. In

fact, as seen in last week’s ECB stance, the bar for a tightening in

policy has been raised.

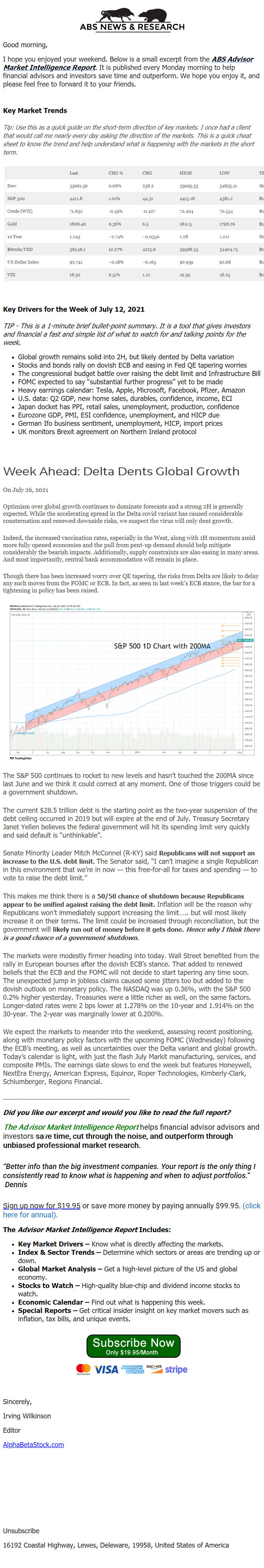

The S&P 500 continues to rocket to new levels and hasn’t touched the

200MA since last June and we think it could correct at any moment. One

of those triggers could be a government shutdown.

The current $28.5 trillion debt is the starting point as the two-year

suspension of the debt ceiling occurred in 2019 but will expire at the

end of July. Treasury Secretary Janet Yellen believes the federal

government will hit its spending limit very quickly and said default

is “unthinkable”.

Senate Minority Leader Mitch McConnel (R-KY) said REPUBLICANS WILL NOT

SUPPORT AN INCREASE TO THE U.S. DEBT LIMIT. The Senator said, “I

can’t imagine a single Republican in this environment that we’re

in now — this free-for-all for taxes and spending — to vote to

raise the debt limit.”

This makes me think there is a 50/50 CHANCE OF SHUTDOWN BECAUSE

REPUBLICANS APPEAR TO BE UNIFIED AGAINST RAISING THE DEBT

LIMIT. Inflation will be the reason why Republicans won’t

immediately support increasing the limit….. but will most likely

increase it on their terms. The limit could be increased through

reconciliation, but the government will LIKELY RUN OUT OF MONEY BEFORE

IT GETS DONE. _HENCE WHY I THINK THERE IS A GOOD CHANCE OF A

GOVERNMENT SHUTDOWN._

The markets were modestly firmer heading into today. Wall Street

benefited from the rally in European bourses after the dovish ECB’s

stance. That added to renewed beliefs that the ECB and the FOMC will

not decide to start tapering any time soon. The unexpected jump in

jobless claims caused some jitters too but added to the dovish outlook

on monetary policy. The NASDAQ was up 0.36%, with the S&P 500 0.2%

higher yesterday. Treasuries were a little richer as well, on the same

factors. Longer-dated rates were 2 bps lower at 1.278% on the 10-year

and 1.914% on the 30-year. The 2-year was marginally lower at 0.200%.

We expect the markets to meander into the weekend, assessing recent

positioning, along with monetary policy factors with the upcoming FOMC

(Wednesday) following the ECB’s meeting, as well as uncertainties

over the Delta variant and global growth. Today’s calendar is

light, with just the flash July Markit manufacturing, services, and

composite PMIs. The earnings slate slows to end the week but

features Honeywell, NextEra Energy, American Express, Equinor, Roper

Technologies, Kimberly-Clark, Schlumberger, Regions Financial.

---------------------------------------------------------------

_DID YOU LIKE OUR EXCERPT AND WOULD YOU LIKE TO READ THE FULL

REPORT?__ _

_THE ADVISOR MARKET INTELLIGENCE REPORT_ helps financial advisor

advisors and investors SAVE TIME, CUT THROUGH THE NOISE, AND

OUTPERFORM THROUGH UNBIASED PROFESSIONAL MARKET RESEARCH.

_“Better info than the big investment companies. Your report is the

only thing I consistently read to know what is happening and when to

adjust portfolios.” Dennis_

_Sign up now for $19.95_ [[link removed]]_ or __save

more money by paying annually $99.95. (click here for annual)

[[link removed]].

_

THE _ADVISOR MARKET INTELLIGENCE REPORT _INCLUDES:

* KEY MARKET DRIVERS – Know what is directly affecting the

markets.

* INDEX & SECTOR TRENDS – Determine which sectors or areas are

trending up or down.

* GLOBAL MARKET ANALYSIS – Get a high-level picture of the US and

global economy.

* STOCKS TO WATCH – High-quality blue-chip and dividend income

stocks to watch.

* ECONOMIC CALENDAR – Find out what is happening this week.

* SPECIAL REPORTS – Get critical insider insight on key market

movers such as inflation, tax bills, and unique events.

[[link removed]]

Sincerely,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Good morning,

I hope you enjoyed your weekend. Below is a small excerpt from

the _ABS ADVISOR MARKET INTELLIGENCE REPORT_

[[link removed]]. It is published every Monday

morning to help financial advisors and investors save time and

outperform. We hope you enjoy it, and please feel free to forward it

to your friends.

KEY MARKET TRENDS

_Tip: Use this as a quick guide on the short-term direction of key

markets. I once had a client that would call me nearly every day

asking the direction of the markets. This is a quick cheat sheet to

know the trend and help understand what is happening with the markets

in the short term._

__

KEY DRIVERS FOR THE WEEK OF JULY 12, 2021

_TIP - This is a 1-minute brief bullet-point summary. It is a tool

that gives investors and financial a fast and simple list of what to

watch for and talking points for the week._

* Global growth remains solid into 2H, but likely dented by Delta

variation

* Stocks and bonds rally on dovish ECB and easing in Fed QE tapering

worries

* The congressional budget battle over raising the debt limit and

Infrastructure Bill

* FOMC expected to say “substantial further progress” yet to be

made

* Heavy earnings calendar: Tesla, Apple, Microsoft, Facebook, Pfizer,

Amazon

* U.S. data: Q2 GDP, new home sales, durables, confidence, income,

ECI

* Japan docket has PPI, retail sales, unemployment, production,

confidence

* Eurozone GDP, PMI, ESI confidence, unemployment, and HICP due

* German Ifo business sentiment, unemployment, HICP, import prices

* UK monitors Brexit agreement on Northern Ireland protocol

WEEK AHEAD: DELTA DENTS GLOBAL GROWTH

On July 26, 2021

Optimism over global growth continues to dominate forecasts and a

strong 2H is generally expected. While the accelerating spread in the

Delta covid variant has caused considerable consternation and renewed

downside risks, we suspect the virus will only dent growth.

Indeed, the increased vaccination rates, especially in the West, along

with 1H momentum amid more fully opened economies and the pull from

pent-up demand should help mitigate considerably the bearish impacts.

Additionally, supply constraints are also easing in many areas. And

most importantly, central bank accommodation will remain in place.

Though there has been increased worry over QE tapering, the risks from

Delta are likely to delay any such moves from the FOMC or ECB. In

fact, as seen in last week’s ECB stance, the bar for a tightening in

policy has been raised.

The S&P 500 continues to rocket to new levels and hasn’t touched the

200MA since last June and we think it could correct at any moment. One

of those triggers could be a government shutdown.

The current $28.5 trillion debt is the starting point as the two-year

suspension of the debt ceiling occurred in 2019 but will expire at the

end of July. Treasury Secretary Janet Yellen believes the federal

government will hit its spending limit very quickly and said default

is “unthinkable”.

Senate Minority Leader Mitch McConnel (R-KY) said REPUBLICANS WILL NOT

SUPPORT AN INCREASE TO THE U.S. DEBT LIMIT. The Senator said, “I

can’t imagine a single Republican in this environment that we’re

in now — this free-for-all for taxes and spending — to vote to

raise the debt limit.”

This makes me think there is a 50/50 CHANCE OF SHUTDOWN BECAUSE

REPUBLICANS APPEAR TO BE UNIFIED AGAINST RAISING THE DEBT

LIMIT. Inflation will be the reason why Republicans won’t

immediately support increasing the limit….. but will most likely

increase it on their terms. The limit could be increased through

reconciliation, but the government will LIKELY RUN OUT OF MONEY BEFORE

IT GETS DONE. _HENCE WHY I THINK THERE IS A GOOD CHANCE OF A

GOVERNMENT SHUTDOWN._

The markets were modestly firmer heading into today. Wall Street

benefited from the rally in European bourses after the dovish ECB’s

stance. That added to renewed beliefs that the ECB and the FOMC will

not decide to start tapering any time soon. The unexpected jump in

jobless claims caused some jitters too but added to the dovish outlook

on monetary policy. The NASDAQ was up 0.36%, with the S&P 500 0.2%

higher yesterday. Treasuries were a little richer as well, on the same

factors. Longer-dated rates were 2 bps lower at 1.278% on the 10-year

and 1.914% on the 30-year. The 2-year was marginally lower at 0.200%.

We expect the markets to meander into the weekend, assessing recent

positioning, along with monetary policy factors with the upcoming FOMC

(Wednesday) following the ECB’s meeting, as well as uncertainties

over the Delta variant and global growth. Today’s calendar is

light, with just the flash July Markit manufacturing, services, and

composite PMIs. The earnings slate slows to end the week but

features Honeywell, NextEra Energy, American Express, Equinor, Roper

Technologies, Kimberly-Clark, Schlumberger, Regions Financial.

---------------------------------------------------------------

_DID YOU LIKE OUR EXCERPT AND WOULD YOU LIKE TO READ THE FULL

REPORT?__ _

_THE ADVISOR MARKET INTELLIGENCE REPORT_ helps financial advisor

advisors and investors SAVE TIME, CUT THROUGH THE NOISE, AND

OUTPERFORM THROUGH UNBIASED PROFESSIONAL MARKET RESEARCH.

_“Better info than the big investment companies. Your report is the

only thing I consistently read to know what is happening and when to

adjust portfolios.” Dennis_

_Sign up now for $19.95_ [[link removed]]_ or __save

more money by paying annually $99.95. (click here for annual)

[[link removed]].

_

THE _ADVISOR MARKET INTELLIGENCE REPORT _INCLUDES:

* KEY MARKET DRIVERS – Know what is directly affecting the

markets.

* INDEX & SECTOR TRENDS – Determine which sectors or areas are

trending up or down.

* GLOBAL MARKET ANALYSIS – Get a high-level picture of the US and

global economy.

* STOCKS TO WATCH – High-quality blue-chip and dividend income

stocks to watch.

* ECONOMIC CALENDAR – Find out what is happening this week.

* SPECIAL REPORTS – Get critical insider insight on key market

movers such as inflation, tax bills, and unique events.

[[link removed]]

Sincerely,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a