Email

Unemployment Data Update: March 2020 through July 10, 2021

| From | Center for Jobs and the Economy <[email protected]> |

| Subject | Unemployment Data Update: March 2020 through July 10, 2021 |

| Date | July 15, 2021 11:35 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] Unemployment Data Update: March 2020 through July 10, 2021 Unemployment Insurance Claims

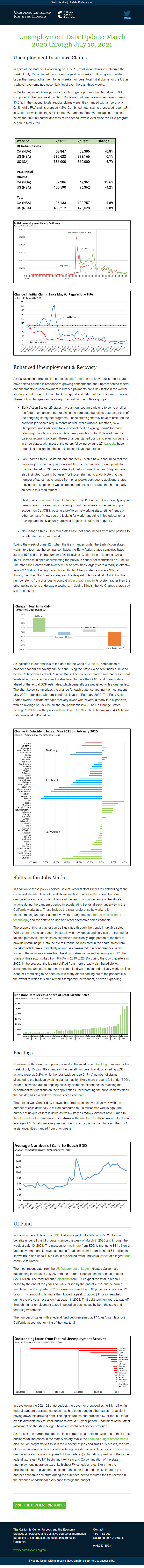

In spite of the state’s full reopening on June 15, total initial claims in California the week of July 10 continued rising over the past two weeks. Following a somewhat larger than usual adjustment to last week’s numbers, total initial claims for the US as a whole have remained essentially level over the past three weeks.

In California, initial claims processed in the regular program notched down 0.8% compared to the prior week, while PUA claims continued a strong expansion, rising 13.6%. In the national totals, regular claims were little changed with a rise of only 0.1%, while PUA claims dropped 4.2%. Combined, total claims processed rose 4.8% in California while dipping 0.8% in the US numbers. The US total again remained below the 500,000 barrier and was at its second-lowest level since the PUA program began in May 2020.

Enhanced Unemployment & Recovery

As discussed in more detail in our latest Job Report [[link removed]] on the May results, most states have shifted policies in response to growing concerns that the unprecedented federal enhancements to unemployment insurance payments are a key factor in the worker shortages that threaten to hold back the speed and extent of the economic recovery. These policy changes can be categorized within one of three groups:

Early Action States: 26 states have announced an early end to some or all of the federal enhancements, retaining the core state benefit structures as part of their ongoing safety net programs. These states generally have reinstituted the previous job search requirements as well, while Arizona, Montana, New Hampshire, and Oklahoma have also included a “signing bonus” for those returning to a job. In addition, Oklahoma provides up to 60 days of free child care for returning workers. These changes started going into effect on June 12 in three states, with most of the others following by June 27. Lawsuits [[link removed]] have been filed challenging these actions in at least four states.

Job Search States: California and another 20 states have announced that the previous job search requirements will be resumed in order for recipients to maintain benefits. Of these states, Colorado, Connecticut, and Virginia have also instituted “signing bonuses” for those returning to a job. Note that the number of states has changed from prior weeks both due to additional states moving to this option as well as recent updates to the states that had already shifted to this requirement.

California’s requirements [[link removed]] went into effect July 11, but do not necessarily require beneficiaries to search for an actual job, with activities such as setting up an account on CalJOBS, posting a profile on networking sites, letting friends or other contacts “know you are looking for work,” engaging in job education or training, and finally actually applying for jobs all sufficient to qualify.

No Change States: Only four states have not announced any related policies to accelerate the return to work.

Taking the week of June 12—when the first changes under the Early Action states went into effect—as the comparison base, the Early Action states combined have seen a 15.8% drop in the number of initial claims. California in this period saw a 15.5% increase in spite of eliminating the previous county tier restrictions on June 15. The other Job Search states—where these provisions largely were already in effect—saw a 3.1% drop. Putting aside Illinois, the No Change states saw a 2.9% rise. Illinois, the other No Change state, saw the deepest cuts overall at 41.4%, but this number stems from changes to combat widespread fraud [[link removed]] in its system rather than the other policy options underway elsewhere. Including Illinois, the No Change states saw a drop of 25.8%.

As indicated in our analysis of the data for the week of June 19 [[link removed]], comparison of broader economic recovery can be done using the State Coincident Index published by the Philadelphia Federal Reserve Bank. The Coincident Index summarizes current levels of economic activity, and is structured to track the GDP trend in each state ahead of the actual GDP estimates, which generally are published with a quarter lag. The chart below summarizes the change for each state, comparing the most recent May 2021 Index data with pre-pandemic levels in February 2020. The Early Action States overall indicate stronger recovery levels with several already into expansion, with an average of 0.5% below the pre-pandemic level. The No Change States average 2.2% below the pre-pandemic level; Job Search States average 4.4% below. California is at 3.4% below.

Shifts in the Jobs Market

In addition to these policy choices, several other factors likely are contributing to the continued elevated level of initial claims in California. One likely contributor as discussed previously is the influence of the length and uncertainty of the state’s actions during the pandemic period in accelerating trends already underway in the California workplace. These include the clear preference by workers for telecommuting and other alternative work arrangements, broader application of technology [[link removed]], and the shift to on-line and other alternative sales channels.

The scope of this last factor can be illustrated through the trends in taxable sales. While there is no clear pattern in state law in how goods and services are treated for taxable purposes, taxable sales comprise a sufficiently large portion of the total to provide useful insights into the overall trends. As indicated in the chart, sales from nonstore retailers—substantially on-line sales—soared in recent quarters. While some of the initial rise stems from taxation of Amazon sales beginning in 2012, the share of this sector spiked from 8.75% in 2019 to 26.3% during the Covid quarters in 2020. In the process, the job mix shifted from more broadly distributed clerks, salespersons, and stockers to more centralized warehouse and delivery workers. The issue still remaining to be seen as with many others coming out of the pandemic is the extent to which this shift remains temporary, permanent, or even expanding.

Backlogs

Combined with revisions to previous weeks, the most recent backlog [[link removed]] numbers for the week of July 10 saw little change in the overall numbers. Backlogs awaiting EDD actions were up 0.2%, while the total backlog rose 0.1%. A number of claims allocated to the backlog awaiting claimant action likely more properly fall under EDD’s column, however, due to ongoing difficulty claimants experience in reaching the department for questions on their applications. Incorporating the prior week revisions, the backlog has exceeded 1 million since February 6.

The related Call Center data shows sharp reductions in overall activity, with the number of calls down to 2.3 million compared to 3.0 million two weeks ago. The number of unique callers is down as well—likely as many claimants have turned to their legislators [[link removed]] for assistance instead—as is the number of calls answered. Up to an average of 10.5 calls were required in order for a unique claimant to reach the EDD assistance, little changed from prior weeks.

UI Fund

In the most recent data from EDD [[link removed]], California paid out a total of $158.2 billion in benefits under all the UI programs since the week of March 7, 2020 and through the week of July 10, 2021. The most current estimate [[link removed]] from EDD is that up to $31 billion of unemployment benefits was paid out to fraudulent claims, consisting of $11 billion in known fraud and up to $20 billion in suspected fraud. Individual cases [[link removed]] of alleged fraud [[link removed]] continue to unfold.

The most recent data from the US Department of Labor [[link removed]] indicates California’s outstanding loans as of July 26 from the Federal Unemployment Account rose to $22.4 billion. The most recent projections [[link removed]] from EDD expect the total to reach $24.3 billion by the end of the year and $26.7 billion by the end of 2022, but the current results for the 2nd quarter of 2021 already exceed the EDD projections by about $2 billion. This amount is far more than twice the peak of about $11 billion reached during the previous recession that began in 2008. That debt took ten years to pay off through higher employment taxes imposed on businesses by both the state and federal governments.

The number of states with a federal fund debt remained at 17 (plus Virgin Islands). California accounted for 41% of the new total.

In developing the 2021-22 state budget, the governor proposed using $1.1 billion in federal pandemic assistance funds—as has been done in other states—to assist in paying down this growing debt. The legislature instead proposed $2 billion, but in tax credits available only to small business over a 10-year period. Enactment of the latest installment on the state budget, however, contained neither provision.

As a result, the current budget also incorporates on a de facto basis one of the largest business tax increases in the state’s history. While the enacted budget amendments [[link removed]] also include programs to assist in the recovery of jobs and small businesses, the size of this tax increase outweighs what is being provided several times over. This tax, as discussed previously, is composed of two parts: (1) automatic imposition of the higher federal tax rates (FUTA) beginning next year and (2) continuation of the state unemployment insurance tax at its highest F+ schedule rates, likely into the foreseeable future given the condition of the state fund and the likelihood of yet another economic downturn during the extended period required for it to recover in the absence of additional assistance through the budget.

visit the center for jobs » [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

In spite of the state’s full reopening on June 15, total initial claims in California the week of July 10 continued rising over the past two weeks. Following a somewhat larger than usual adjustment to last week’s numbers, total initial claims for the US as a whole have remained essentially level over the past three weeks.

In California, initial claims processed in the regular program notched down 0.8% compared to the prior week, while PUA claims continued a strong expansion, rising 13.6%. In the national totals, regular claims were little changed with a rise of only 0.1%, while PUA claims dropped 4.2%. Combined, total claims processed rose 4.8% in California while dipping 0.8% in the US numbers. The US total again remained below the 500,000 barrier and was at its second-lowest level since the PUA program began in May 2020.

Enhanced Unemployment & Recovery

As discussed in more detail in our latest Job Report [[link removed]] on the May results, most states have shifted policies in response to growing concerns that the unprecedented federal enhancements to unemployment insurance payments are a key factor in the worker shortages that threaten to hold back the speed and extent of the economic recovery. These policy changes can be categorized within one of three groups:

Early Action States: 26 states have announced an early end to some or all of the federal enhancements, retaining the core state benefit structures as part of their ongoing safety net programs. These states generally have reinstituted the previous job search requirements as well, while Arizona, Montana, New Hampshire, and Oklahoma have also included a “signing bonus” for those returning to a job. In addition, Oklahoma provides up to 60 days of free child care for returning workers. These changes started going into effect on June 12 in three states, with most of the others following by June 27. Lawsuits [[link removed]] have been filed challenging these actions in at least four states.

Job Search States: California and another 20 states have announced that the previous job search requirements will be resumed in order for recipients to maintain benefits. Of these states, Colorado, Connecticut, and Virginia have also instituted “signing bonuses” for those returning to a job. Note that the number of states has changed from prior weeks both due to additional states moving to this option as well as recent updates to the states that had already shifted to this requirement.

California’s requirements [[link removed]] went into effect July 11, but do not necessarily require beneficiaries to search for an actual job, with activities such as setting up an account on CalJOBS, posting a profile on networking sites, letting friends or other contacts “know you are looking for work,” engaging in job education or training, and finally actually applying for jobs all sufficient to qualify.

No Change States: Only four states have not announced any related policies to accelerate the return to work.

Taking the week of June 12—when the first changes under the Early Action states went into effect—as the comparison base, the Early Action states combined have seen a 15.8% drop in the number of initial claims. California in this period saw a 15.5% increase in spite of eliminating the previous county tier restrictions on June 15. The other Job Search states—where these provisions largely were already in effect—saw a 3.1% drop. Putting aside Illinois, the No Change states saw a 2.9% rise. Illinois, the other No Change state, saw the deepest cuts overall at 41.4%, but this number stems from changes to combat widespread fraud [[link removed]] in its system rather than the other policy options underway elsewhere. Including Illinois, the No Change states saw a drop of 25.8%.

As indicated in our analysis of the data for the week of June 19 [[link removed]], comparison of broader economic recovery can be done using the State Coincident Index published by the Philadelphia Federal Reserve Bank. The Coincident Index summarizes current levels of economic activity, and is structured to track the GDP trend in each state ahead of the actual GDP estimates, which generally are published with a quarter lag. The chart below summarizes the change for each state, comparing the most recent May 2021 Index data with pre-pandemic levels in February 2020. The Early Action States overall indicate stronger recovery levels with several already into expansion, with an average of 0.5% below the pre-pandemic level. The No Change States average 2.2% below the pre-pandemic level; Job Search States average 4.4% below. California is at 3.4% below.

Shifts in the Jobs Market

In addition to these policy choices, several other factors likely are contributing to the continued elevated level of initial claims in California. One likely contributor as discussed previously is the influence of the length and uncertainty of the state’s actions during the pandemic period in accelerating trends already underway in the California workplace. These include the clear preference by workers for telecommuting and other alternative work arrangements, broader application of technology [[link removed]], and the shift to on-line and other alternative sales channels.

The scope of this last factor can be illustrated through the trends in taxable sales. While there is no clear pattern in state law in how goods and services are treated for taxable purposes, taxable sales comprise a sufficiently large portion of the total to provide useful insights into the overall trends. As indicated in the chart, sales from nonstore retailers—substantially on-line sales—soared in recent quarters. While some of the initial rise stems from taxation of Amazon sales beginning in 2012, the share of this sector spiked from 8.75% in 2019 to 26.3% during the Covid quarters in 2020. In the process, the job mix shifted from more broadly distributed clerks, salespersons, and stockers to more centralized warehouse and delivery workers. The issue still remaining to be seen as with many others coming out of the pandemic is the extent to which this shift remains temporary, permanent, or even expanding.

Backlogs

Combined with revisions to previous weeks, the most recent backlog [[link removed]] numbers for the week of July 10 saw little change in the overall numbers. Backlogs awaiting EDD actions were up 0.2%, while the total backlog rose 0.1%. A number of claims allocated to the backlog awaiting claimant action likely more properly fall under EDD’s column, however, due to ongoing difficulty claimants experience in reaching the department for questions on their applications. Incorporating the prior week revisions, the backlog has exceeded 1 million since February 6.

The related Call Center data shows sharp reductions in overall activity, with the number of calls down to 2.3 million compared to 3.0 million two weeks ago. The number of unique callers is down as well—likely as many claimants have turned to their legislators [[link removed]] for assistance instead—as is the number of calls answered. Up to an average of 10.5 calls were required in order for a unique claimant to reach the EDD assistance, little changed from prior weeks.

UI Fund

In the most recent data from EDD [[link removed]], California paid out a total of $158.2 billion in benefits under all the UI programs since the week of March 7, 2020 and through the week of July 10, 2021. The most current estimate [[link removed]] from EDD is that up to $31 billion of unemployment benefits was paid out to fraudulent claims, consisting of $11 billion in known fraud and up to $20 billion in suspected fraud. Individual cases [[link removed]] of alleged fraud [[link removed]] continue to unfold.

The most recent data from the US Department of Labor [[link removed]] indicates California’s outstanding loans as of July 26 from the Federal Unemployment Account rose to $22.4 billion. The most recent projections [[link removed]] from EDD expect the total to reach $24.3 billion by the end of the year and $26.7 billion by the end of 2022, but the current results for the 2nd quarter of 2021 already exceed the EDD projections by about $2 billion. This amount is far more than twice the peak of about $11 billion reached during the previous recession that began in 2008. That debt took ten years to pay off through higher employment taxes imposed on businesses by both the state and federal governments.

The number of states with a federal fund debt remained at 17 (plus Virgin Islands). California accounted for 41% of the new total.

In developing the 2021-22 state budget, the governor proposed using $1.1 billion in federal pandemic assistance funds—as has been done in other states—to assist in paying down this growing debt. The legislature instead proposed $2 billion, but in tax credits available only to small business over a 10-year period. Enactment of the latest installment on the state budget, however, contained neither provision.

As a result, the current budget also incorporates on a de facto basis one of the largest business tax increases in the state’s history. While the enacted budget amendments [[link removed]] also include programs to assist in the recovery of jobs and small businesses, the size of this tax increase outweighs what is being provided several times over. This tax, as discussed previously, is composed of two parts: (1) automatic imposition of the higher federal tax rates (FUTA) beginning next year and (2) continuation of the state unemployment insurance tax at its highest F+ schedule rates, likely into the foreseeable future given the condition of the state fund and the likelihood of yet another economic downturn during the extended period required for it to recover in the absence of additional assistance through the budget.

visit the center for jobs » [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor