| From | IPA Financial Inclusion Program <[email protected]> |

| Subject | IPA Consumer Protection Quarterly | Issue 3: June 2021 |

| Date | July 1, 2021 7:02 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

The newest edition of our consumer protection newsletter.

View this email in your browser

[link removed]

[link removed]

More evidence, less poverty

IPA Consumer Protection Quarterly

Issue No. 3 – June 2021

Welcome back to the Consumer Protection Quarterly, IPA's newsletter on the latest consumer protection research across the globe. This newsletter is part of IPA's Consumer Protection Research Initiative

[link removed]

. Each quarter we send you the latest research, insights, and inspiration for financial consumer protection. If you have something to share, please reach out: [email protected]

mailto:[email protected]?subject=Consumer%20Protection%20Quarterly

.

You are receiving this email because of your past participation in IPA consumer protection or financial inclusion events, and/or because you signed up for our consumer protection practitioner's forum mailing interest list

[link removed]

. If there are others you think may benefit from this newsletter, please forward. You can manage your email preferences here

[link removed]

.

What's new and what's next

New: IPA awards first round of consumer protection impact evaluations

IPA’s Consumer Protection Research Initiative has approved the first-ever round of consumer protection impact evaluation grants. The Review Committee approved 3 full randomized controlled trial (RCT) impact evaluations and 5 pilot projects which will test the potential for a full RCT in the future. The projects address several of the key issues facing consumers of digital financial services, including agent conduct, fraud, and effective and accessible redress mechanisms. The researchers on these projects have identified a number of novel new methods to improve consumer protection, such as predictive modeling to identify fraud-vulnerable consumers, crowdsourcing of ratings of agents to reduce agent misconduct, and pro bono legal aid to mediate disputes in digital financial services. The projects cover leading digital financial service (DFS) markets in Bangladesh, Ghana, India, Kenya, Nigeria, and Uganda. Full descriptions of the projects are available here

[link removed]

.

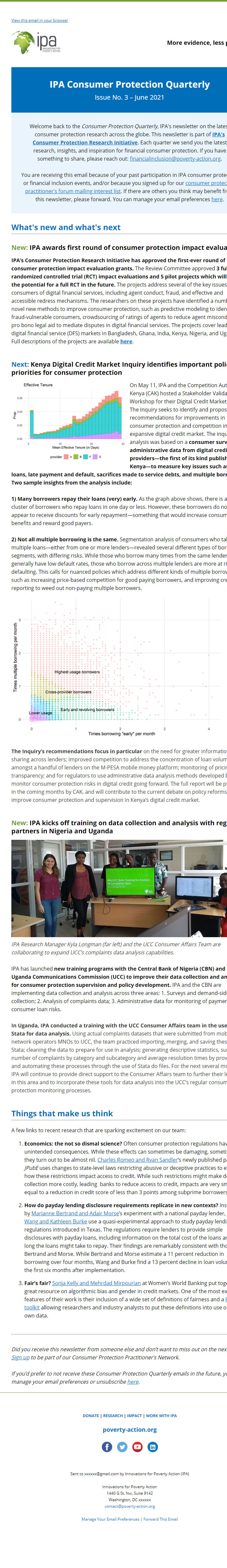

Next: Kenya Digital Credit Market Inquiry identifies important policy priorities for consumer protection

[link removed]

On May 11, IPA and the Competition Authority of Kenya (CAK) hosted a Stakeholder Validation Workshop for their Digital Credit Market Inquiry. The Inquiry seeks to identify and propose policy recommendations for improvements in consumer protection and competition in Kenya’s expansive digital credit market. The inquiry's analysis was based on a consumer survey and administrative data from digital credit providers—the first of its kind published in Kenya—to measure key issues such as cost of loans, late payment and default, sacrifices made to service debts, and multiple borrowing. Two sample insights from the analysis include:

1) Many borrowers repay their loans (very) early. As the graph above shows, there is a large cluster of borrowers who repay loans in one day or less. However, these borrowers do not usually appear to receive discounts for early repayment—something that would increase consumer benefits and reward good payers.

2) Not all multiple borrowing is the same. Segmentation analysis of consumers who take multiple loans—either from one or more lenders—revealed several different types of borrower segments, with differing risks. While those who borrow many times from the same lender generally have low default rates, those who borrow across multiple lenders are more at risk of defaulting. This calls for nuanced policies which address different kinds of multiple borrowing—such as increasing price-based competition for good paying borrowers, and improving credit reporting to weed out non-paying multiple borrowers.

[link removed]

The Inquiry’s recommendations focus in particular on the need for greater information-sharing across lenders; improved competition to address the concentration of loan volumes amongst a handful of lenders on the M-PESA mobile money platform; monitoring of pricing transparency; and for regulators to use administrative data analysis methods developed by IPA to monitor consumer protection risks in digital credit going forward. The full report will be published in the coming months by CAK, and will contribute to the current debate on policy reforms to improve consumer protection and supervision in Kenya’s digital credit market.

New: IPA kicks off training on data collection and analysis with regulator partners in Nigeria and Uganda

IPA Research Manager Kyla Longman (far left) and the UCC Consumer Affairs Team are collaborating to expand UCC’s complaints data analysis capabilities.

IPA has launched new training programs with the Central Bank of Nigeria (CBN) and the Uganda Communications Commission (UCC) to improve their data collection and analysis for consumer protection supervision and policy development. IPA and the CBN are implementing data collection and analysis across three areas: 1. Surveys and demand-side data collection; 2. Analysis of complaints data; 3. Administrative data for monitoring of payments and consumer loan risks.

In Uganda, IPA conducted a training with the UCC Consumer Affairs team in the use of Stata for data analysis. Using actual complaints datasets that were submitted from mobile network operators MNOs to UCC, the team practiced importing, merging, and saving these files in Stata; cleaning the data to prepare for use in analysis; generating descriptive statistics, such as a number of complaints by category and subcategory and average resolution times by provider; and automating these processes through the use of Stata do files. For the next several months, IPA will continue to provide direct support to the Consumer Affairs team to further their learning in this area and to incorporate these tools for data analysis into the UCC’s regular consumer protection monitoring processes.

Things that make us think

A few links to recent research that are sparking excitement on our team:

Economics: the not so dismal science? Often consumer protection regulations have unintended consequences. While these effects can sometimes be damaging, sometimes they turn out to be almost nil. Charles Romeo and Ryan Sandler

[link removed]

’s newly published paper in JPubE uses changes to state-level laws restricting abusive or deceptive practices to examine how these restrictions impact access to credit. While such restrictions might make debt collection more costly, leading banks to reduce access to credit, impacts are very small—equal to a reduction in credit score of less than 3 points among subprime borrowers.

How do payday lending disclosure requirements replicate in new contexts? Inspired by Marianne Bertrand and Adair Morse

[link removed]

’s experiment with a national payday lender, Jialan Wang and Kathleen Burke

[link removed]

use a quasi-experimental approach to study payday lending regulations introduced in Texas. The regulations require lenders to provide simple disclosures with payday loans, including information on the total cost of the loans and how long the loans might take to repay. Their findings are remarkably consistent with those from Bertrand and Morse. While Bertrand and Morse estimate a 11 percent reduction in borrowing over four months, Wang and Burke find a 13 percent decline in loan volume in the first six months after implementation.

Fair’s fair? Sonja Kelly and Mehrdad Mirpourian

[link removed]

at Women’s World Banking put together a great resource on algorithmic bias and gender in credit markets. One of the most exciting features of their work is their inclusion of a wide set of definitions of fairness and a Python toolkit

[link removed]

allowing researchers and industry analysts to put these definitions into use on their own data.

Did you receive this newsletter from someone else and don’t want to miss out on the next one? Sign up

[link removed]

to be part of our Consumer Protection Practitioner’s Network.

If you’d prefer to not receive these Consumer Protection Quarterly emails in the future, you can manage your email preferences or unsubscribe here

[link removed]

.

DONATE

[link removed]

| RESEARCH

[link removed]

| IMPACT

[link removed]

| WORK WITH IPA

[link removed]

poverty-action.org

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

Sent to [email protected] by Innovations for Poverty Action (IPA)

Innovations for Poverty Action

1440 G St. Nw, Suite 9142

Washington, DC xxxxxx

[email protected]

mailto:[email protected]

Manage Your Email Preferences

[link removed]

| Forward This Email

[link removed]

View this email in your browser

[link removed]

[link removed]

More evidence, less poverty

IPA Consumer Protection Quarterly

Issue No. 3 – June 2021

Welcome back to the Consumer Protection Quarterly, IPA's newsletter on the latest consumer protection research across the globe. This newsletter is part of IPA's Consumer Protection Research Initiative

[link removed]

. Each quarter we send you the latest research, insights, and inspiration for financial consumer protection. If you have something to share, please reach out: [email protected]

mailto:[email protected]?subject=Consumer%20Protection%20Quarterly

.

You are receiving this email because of your past participation in IPA consumer protection or financial inclusion events, and/or because you signed up for our consumer protection practitioner's forum mailing interest list

[link removed]

. If there are others you think may benefit from this newsletter, please forward. You can manage your email preferences here

[link removed]

.

What's new and what's next

New: IPA awards first round of consumer protection impact evaluations

IPA’s Consumer Protection Research Initiative has approved the first-ever round of consumer protection impact evaluation grants. The Review Committee approved 3 full randomized controlled trial (RCT) impact evaluations and 5 pilot projects which will test the potential for a full RCT in the future. The projects address several of the key issues facing consumers of digital financial services, including agent conduct, fraud, and effective and accessible redress mechanisms. The researchers on these projects have identified a number of novel new methods to improve consumer protection, such as predictive modeling to identify fraud-vulnerable consumers, crowdsourcing of ratings of agents to reduce agent misconduct, and pro bono legal aid to mediate disputes in digital financial services. The projects cover leading digital financial service (DFS) markets in Bangladesh, Ghana, India, Kenya, Nigeria, and Uganda. Full descriptions of the projects are available here

[link removed]

.

Next: Kenya Digital Credit Market Inquiry identifies important policy priorities for consumer protection

[link removed]

On May 11, IPA and the Competition Authority of Kenya (CAK) hosted a Stakeholder Validation Workshop for their Digital Credit Market Inquiry. The Inquiry seeks to identify and propose policy recommendations for improvements in consumer protection and competition in Kenya’s expansive digital credit market. The inquiry's analysis was based on a consumer survey and administrative data from digital credit providers—the first of its kind published in Kenya—to measure key issues such as cost of loans, late payment and default, sacrifices made to service debts, and multiple borrowing. Two sample insights from the analysis include:

1) Many borrowers repay their loans (very) early. As the graph above shows, there is a large cluster of borrowers who repay loans in one day or less. However, these borrowers do not usually appear to receive discounts for early repayment—something that would increase consumer benefits and reward good payers.

2) Not all multiple borrowing is the same. Segmentation analysis of consumers who take multiple loans—either from one or more lenders—revealed several different types of borrower segments, with differing risks. While those who borrow many times from the same lender generally have low default rates, those who borrow across multiple lenders are more at risk of defaulting. This calls for nuanced policies which address different kinds of multiple borrowing—such as increasing price-based competition for good paying borrowers, and improving credit reporting to weed out non-paying multiple borrowers.

[link removed]

The Inquiry’s recommendations focus in particular on the need for greater information-sharing across lenders; improved competition to address the concentration of loan volumes amongst a handful of lenders on the M-PESA mobile money platform; monitoring of pricing transparency; and for regulators to use administrative data analysis methods developed by IPA to monitor consumer protection risks in digital credit going forward. The full report will be published in the coming months by CAK, and will contribute to the current debate on policy reforms to improve consumer protection and supervision in Kenya’s digital credit market.

New: IPA kicks off training on data collection and analysis with regulator partners in Nigeria and Uganda

IPA Research Manager Kyla Longman (far left) and the UCC Consumer Affairs Team are collaborating to expand UCC’s complaints data analysis capabilities.

IPA has launched new training programs with the Central Bank of Nigeria (CBN) and the Uganda Communications Commission (UCC) to improve their data collection and analysis for consumer protection supervision and policy development. IPA and the CBN are implementing data collection and analysis across three areas: 1. Surveys and demand-side data collection; 2. Analysis of complaints data; 3. Administrative data for monitoring of payments and consumer loan risks.

In Uganda, IPA conducted a training with the UCC Consumer Affairs team in the use of Stata for data analysis. Using actual complaints datasets that were submitted from mobile network operators MNOs to UCC, the team practiced importing, merging, and saving these files in Stata; cleaning the data to prepare for use in analysis; generating descriptive statistics, such as a number of complaints by category and subcategory and average resolution times by provider; and automating these processes through the use of Stata do files. For the next several months, IPA will continue to provide direct support to the Consumer Affairs team to further their learning in this area and to incorporate these tools for data analysis into the UCC’s regular consumer protection monitoring processes.

Things that make us think

A few links to recent research that are sparking excitement on our team:

Economics: the not so dismal science? Often consumer protection regulations have unintended consequences. While these effects can sometimes be damaging, sometimes they turn out to be almost nil. Charles Romeo and Ryan Sandler

[link removed]

’s newly published paper in JPubE uses changes to state-level laws restricting abusive or deceptive practices to examine how these restrictions impact access to credit. While such restrictions might make debt collection more costly, leading banks to reduce access to credit, impacts are very small—equal to a reduction in credit score of less than 3 points among subprime borrowers.

How do payday lending disclosure requirements replicate in new contexts? Inspired by Marianne Bertrand and Adair Morse

[link removed]

’s experiment with a national payday lender, Jialan Wang and Kathleen Burke

[link removed]

use a quasi-experimental approach to study payday lending regulations introduced in Texas. The regulations require lenders to provide simple disclosures with payday loans, including information on the total cost of the loans and how long the loans might take to repay. Their findings are remarkably consistent with those from Bertrand and Morse. While Bertrand and Morse estimate a 11 percent reduction in borrowing over four months, Wang and Burke find a 13 percent decline in loan volume in the first six months after implementation.

Fair’s fair? Sonja Kelly and Mehrdad Mirpourian

[link removed]

at Women’s World Banking put together a great resource on algorithmic bias and gender in credit markets. One of the most exciting features of their work is their inclusion of a wide set of definitions of fairness and a Python toolkit

[link removed]

allowing researchers and industry analysts to put these definitions into use on their own data.

Did you receive this newsletter from someone else and don’t want to miss out on the next one? Sign up

[link removed]

to be part of our Consumer Protection Practitioner’s Network.

If you’d prefer to not receive these Consumer Protection Quarterly emails in the future, you can manage your email preferences or unsubscribe here

[link removed]

.

DONATE

[link removed]

| RESEARCH

[link removed]

| IMPACT

[link removed]

| WORK WITH IPA

[link removed]

poverty-action.org

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

Sent to [email protected] by Innovations for Poverty Action (IPA)

Innovations for Poverty Action

1440 G St. Nw, Suite 9142

Washington, DC xxxxxx

[email protected]

mailto:[email protected]

Manage Your Email Preferences

[link removed]

| Forward This Email

[link removed]

Message Analysis

- Sender: Poverty Action

- Political Party: n/a

- Country: United States

- State/Locality: Washington

- Office: n/a

-

Email Providers:

- Pardot

- Litmus