| From | American Energy Alliance <[email protected]> |

| Subject | Dead as a dinosaur 🦖 |

| Date | June 7, 2021 3:09 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Your Morning Energy News

View this email in your browser ([link removed])

MORNING ENERGY NEWS | 06/07/2021

Subscribe Now ([link removed])

** Apparently the coal guys didn't get the memo.

------------------------------------------------------------

Reuters ([link removed]) (6/3/21) reports: "The world's coal producers are currently planning as many as 432 new mine projects with 2.28 billion tonnes of annual output capacity, research published on Thursday showed, putting targets for slowing global climate change at risk. China, Australia, India and Russia account for more than three quarters of the new projects, according to a study by U.S. think-tank Global Energy Monitor. China alone is now building another 452 million tonnes of annual production capacity, it said. 'While the IEA (International Energy Agency) has just called for a giant leap toward net zero emissions, coal producers' plans to expand capacity 30% by 2030 would be a leap backward,' said Ryan Driskell Tate, Global Energy Monitor research analyst and lead author of the report. The report said four Chinese provinces and regions alone -

Inner Mongolia, Xinjiang, Shaanxi and Shanxi - account for nearly a quarter of all the proposed new coal mine capacity. China has pledged to bring its emissions to a peak by 2030 and to net zero by 2060. President Xi Jinping said earlier this year that the country would start to cut coal production, but not until 2026."

** "State legislators should not mandate the use of renewable sources in electricity generation, and should not make any attempt at total electrification, as doing so would be incredibly unpopular, have a minimal effect on the environment while simultaneously being extremely expensive, and most of the burden of this shift would fall directly on those lower-income families who could least afford it."

------------------------------------------------------------

– Tim Benson, Heartland Institute ([link removed])

============================================================

IEA invents new genre: TechFi.

** CFACT ([link removed])

(6/5/21) blog: "Looking for laughs? The International Energy Agency has produced a laugh filled report, grandly titled: “Net Zero by 2050: A roadmap for the global energy system“. Redesigning the global energy system. My, oh my. Below are a few highlights, out of many. To begin with it is not a roadmap, as it does not tell us how to get there. In fact you cannot get there from here, which makes their there very amusing. This is perhaps the most elaborate net zero fantasy concocted so far. IEA Executive Director Faith Birol explains where the fantasy comes from: '…combining for the first time the complex models of our two flagship series, the World Energy Outlook and Energy Technology Perspectives.' So two, not just one, complex computer models, that have never before been combined. I feel better already. Instead of the world energy outlook, it is IEA’s outlook for the world energy. I hope they are not predicting this, because there is zero chance of it happening. Since it is loaded with

fantastical technologies, you might think this is at least a technology assessment, but it is not, for two reasons. First of all, there is heavy emphasis on what they call 'behavioral changes.' When the technocrats start talking about behavioral changes it is time to step back and shut the door, because it is something they know nothing about. So there is nothing about how these deep behavioral changes will be brought about, most likely including by force."

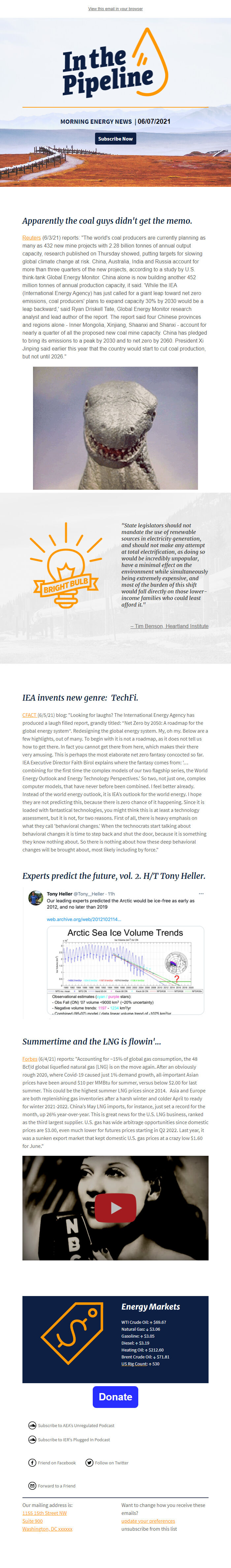

Experts predict the future, vol. 2. H/T Tony Heller.

** ([link removed])

Summertime and the LNG is flowin'...

** Forbes ([link removed])

(6/4/21) reports: "Accounting for ~15% of global gas consumption, the 48 Bcf/d global liquefied natural gas (LNG) is on the move again. After an obviously rough 2020, where Covid-19 caused just 1% demand growth, all-important Asian prices have been around $10 per MMBtu for summer, versus below $2.00 for last summer. This could be the highest summer LNG prices since 2014. Asia and Europe are both replenishing gas inventories after a harsh winter and colder April to ready for winter 2021-2022. China’s May LNG imports, for instance, just set a record for the month, up 26% year-over-year. This is great news for the U.S. LNG business, ranked as the third largest supplier. U.S. gas has wide arbitrage opportunities since domestic prices are $3.00, even much lower for futures prices starting in Q2 2022. Last year, it was a sunken export market that kept domestic U.S. gas prices at a crazy low $1.60 for June."

** ([link removed])

Energy Markets

WTI Crude Oil: ↑ $69.67

Natural Gas: ↓ $3.06

Gasoline: ↑ $3.05

Diesel: ↑ $3.19

Heating Oil: ↑ $212.60

Brent Crude Oil: ↓ $71.81

** US Rig Count ([link removed])

: ↑ 530

** Donate ([link removed])

** Subscribe to AEA's Unregulated Podcast ([link removed])

** Subscribe to AEA's Unregulated Podcast ([link removed])

** Subscribe to IER's Plugged In Podcast ([link removed])

** Subscribe to IER's Plugged In Podcast ([link removed])

** Friend on Facebook ([link removed])

** Friend on Facebook ([link removed])

** Follow on Twitter ([link removed])

** Follow on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 900 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

View this email in your browser ([link removed])

MORNING ENERGY NEWS | 06/07/2021

Subscribe Now ([link removed])

** Apparently the coal guys didn't get the memo.

------------------------------------------------------------

Reuters ([link removed]) (6/3/21) reports: "The world's coal producers are currently planning as many as 432 new mine projects with 2.28 billion tonnes of annual output capacity, research published on Thursday showed, putting targets for slowing global climate change at risk. China, Australia, India and Russia account for more than three quarters of the new projects, according to a study by U.S. think-tank Global Energy Monitor. China alone is now building another 452 million tonnes of annual production capacity, it said. 'While the IEA (International Energy Agency) has just called for a giant leap toward net zero emissions, coal producers' plans to expand capacity 30% by 2030 would be a leap backward,' said Ryan Driskell Tate, Global Energy Monitor research analyst and lead author of the report. The report said four Chinese provinces and regions alone -

Inner Mongolia, Xinjiang, Shaanxi and Shanxi - account for nearly a quarter of all the proposed new coal mine capacity. China has pledged to bring its emissions to a peak by 2030 and to net zero by 2060. President Xi Jinping said earlier this year that the country would start to cut coal production, but not until 2026."

** "State legislators should not mandate the use of renewable sources in electricity generation, and should not make any attempt at total electrification, as doing so would be incredibly unpopular, have a minimal effect on the environment while simultaneously being extremely expensive, and most of the burden of this shift would fall directly on those lower-income families who could least afford it."

------------------------------------------------------------

– Tim Benson, Heartland Institute ([link removed])

============================================================

IEA invents new genre: TechFi.

** CFACT ([link removed])

(6/5/21) blog: "Looking for laughs? The International Energy Agency has produced a laugh filled report, grandly titled: “Net Zero by 2050: A roadmap for the global energy system“. Redesigning the global energy system. My, oh my. Below are a few highlights, out of many. To begin with it is not a roadmap, as it does not tell us how to get there. In fact you cannot get there from here, which makes their there very amusing. This is perhaps the most elaborate net zero fantasy concocted so far. IEA Executive Director Faith Birol explains where the fantasy comes from: '…combining for the first time the complex models of our two flagship series, the World Energy Outlook and Energy Technology Perspectives.' So two, not just one, complex computer models, that have never before been combined. I feel better already. Instead of the world energy outlook, it is IEA’s outlook for the world energy. I hope they are not predicting this, because there is zero chance of it happening. Since it is loaded with

fantastical technologies, you might think this is at least a technology assessment, but it is not, for two reasons. First of all, there is heavy emphasis on what they call 'behavioral changes.' When the technocrats start talking about behavioral changes it is time to step back and shut the door, because it is something they know nothing about. So there is nothing about how these deep behavioral changes will be brought about, most likely including by force."

Experts predict the future, vol. 2. H/T Tony Heller.

** ([link removed])

Summertime and the LNG is flowin'...

** Forbes ([link removed])

(6/4/21) reports: "Accounting for ~15% of global gas consumption, the 48 Bcf/d global liquefied natural gas (LNG) is on the move again. After an obviously rough 2020, where Covid-19 caused just 1% demand growth, all-important Asian prices have been around $10 per MMBtu for summer, versus below $2.00 for last summer. This could be the highest summer LNG prices since 2014. Asia and Europe are both replenishing gas inventories after a harsh winter and colder April to ready for winter 2021-2022. China’s May LNG imports, for instance, just set a record for the month, up 26% year-over-year. This is great news for the U.S. LNG business, ranked as the third largest supplier. U.S. gas has wide arbitrage opportunities since domestic prices are $3.00, even much lower for futures prices starting in Q2 2022. Last year, it was a sunken export market that kept domestic U.S. gas prices at a crazy low $1.60 for June."

** ([link removed])

Energy Markets

WTI Crude Oil: ↑ $69.67

Natural Gas: ↓ $3.06

Gasoline: ↑ $3.05

Diesel: ↑ $3.19

Heating Oil: ↑ $212.60

Brent Crude Oil: ↓ $71.81

** US Rig Count ([link removed])

: ↑ 530

** Donate ([link removed])

** Subscribe to AEA's Unregulated Podcast ([link removed])

** Subscribe to AEA's Unregulated Podcast ([link removed])

** Subscribe to IER's Plugged In Podcast ([link removed])

** Subscribe to IER's Plugged In Podcast ([link removed])

** Friend on Facebook ([link removed])

** Friend on Facebook ([link removed])

** Follow on Twitter ([link removed])

** Follow on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 900 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

Message Analysis

- Sender: American Energy Alliance (AEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp