| From | Fraser Institute <[email protected]> |

| Subject | Tax Freedom Day and A Primer on Modern Monetary Theory |

| Date | May 22, 2021 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

=============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

------------------

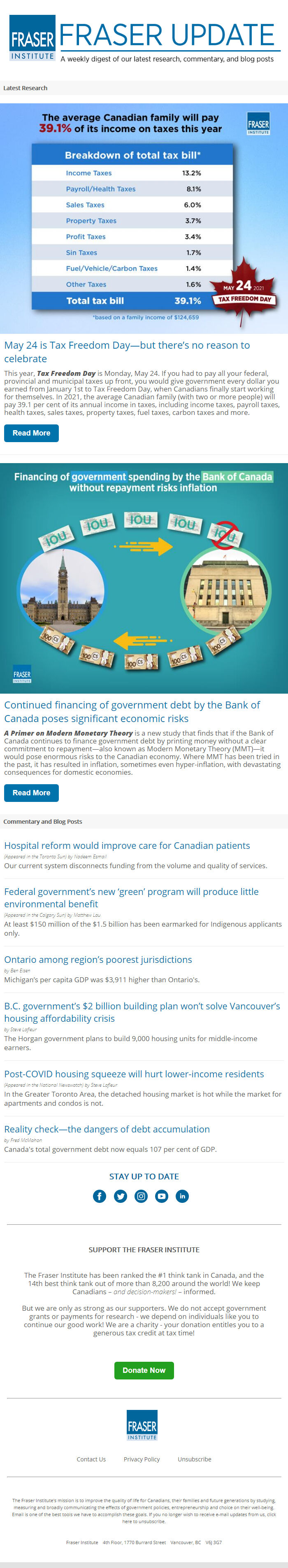

May 24 is Tax Freedom Day—but there’s no reason to celebrate

This year, Tax Freedom Day is Monday, May 24. If you had to pay all your federal, provincial and municipal taxes up front, you would give government every dollar you earned from January 1st to Tax Freedom Day, when Canadians finally start working for themselves. In 2021, the average Canadian family (with two or more people) will pay 39.1 per cent of its annual income in taxes, including income taxes, payroll taxes, health taxes, sales taxes, property taxes, fuel taxes, carbon taxes and more.

Read More [[link removed]]

Continued financing of government debt by the Bank of Canada poses significant economic risks

A Primer on Modern Monetary Theory is a new study that finds that if the Bank of Canada continues to finance government debt by printing money without a clear commitment to repayment—also known as Modern Monetary Theory (MMT)—it would pose enormous risks to the Canadian economy. Where MMT has been tried in the past, it has resulted in inflation, sometimes even hyper-inflation, with devastating consequences for domestic economies.

Read More [[link removed]]

Commentary and Blog Posts

------------------

Hospital reform would improve care for Canadian patients [[link removed]]

(Appeared in the Toronto Sun) by Nadeem Esmail

Our current system disconnects funding from the volume and quality of services.

Federal government’s new ‘green’ program will produce little environmental benefit [[link removed]]

(Appeared in the Calgary Sun) by Matthew Lau

At least $150 million of the $1.5 billion has been earmarked for Indigenous applicants only.

Ontario among region’s poorest jurisdictions [[link removed]]

by Ben Eisen

Michigan’s per capita GDP was $3,911 higher than Ontario's.

B.C. government’s $2 billion building plan won’t solve Vancouver’s housing affordability crisis [[link removed]]

by Steve Lafleur

The Horgan government plans to build 9,000 housing units for middle-income earners.

Post-COVID housing squeeze will hurt lower-income residents [[link removed]]

(Appeared in the National Newswatch) by Steve Lafleur

In the Greater Toronto Area, the detached housing market is hot while the market for apartments and condos is not.

Reality check—the dangers of debt accumulation [[link removed]]

by Fred McMahon

Canada's total government debt now equals 107 per cent of GDP.

SUPPORT THE FRASER INSTITUTE

------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

------------------

May 24 is Tax Freedom Day—but there’s no reason to celebrate

This year, Tax Freedom Day is Monday, May 24. If you had to pay all your federal, provincial and municipal taxes up front, you would give government every dollar you earned from January 1st to Tax Freedom Day, when Canadians finally start working for themselves. In 2021, the average Canadian family (with two or more people) will pay 39.1 per cent of its annual income in taxes, including income taxes, payroll taxes, health taxes, sales taxes, property taxes, fuel taxes, carbon taxes and more.

Read More [[link removed]]

Continued financing of government debt by the Bank of Canada poses significant economic risks

A Primer on Modern Monetary Theory is a new study that finds that if the Bank of Canada continues to finance government debt by printing money without a clear commitment to repayment—also known as Modern Monetary Theory (MMT)—it would pose enormous risks to the Canadian economy. Where MMT has been tried in the past, it has resulted in inflation, sometimes even hyper-inflation, with devastating consequences for domestic economies.

Read More [[link removed]]

Commentary and Blog Posts

------------------

Hospital reform would improve care for Canadian patients [[link removed]]

(Appeared in the Toronto Sun) by Nadeem Esmail

Our current system disconnects funding from the volume and quality of services.

Federal government’s new ‘green’ program will produce little environmental benefit [[link removed]]

(Appeared in the Calgary Sun) by Matthew Lau

At least $150 million of the $1.5 billion has been earmarked for Indigenous applicants only.

Ontario among region’s poorest jurisdictions [[link removed]]

by Ben Eisen

Michigan’s per capita GDP was $3,911 higher than Ontario's.

B.C. government’s $2 billion building plan won’t solve Vancouver’s housing affordability crisis [[link removed]]

by Steve Lafleur

The Horgan government plans to build 9,000 housing units for middle-income earners.

Post-COVID housing squeeze will hurt lower-income residents [[link removed]]

(Appeared in the National Newswatch) by Steve Lafleur

In the Greater Toronto Area, the detached housing market is hot while the market for apartments and condos is not.

Reality check—the dangers of debt accumulation [[link removed]]

by Fred McMahon

Canada's total government debt now equals 107 per cent of GDP.

SUPPORT THE FRASER INSTITUTE

------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor