| From | Esta Soler <[email protected]> |

| Subject | If You Have Kids, Don’t Leave Money on the Table! |

| Date | May 13, 2021 10:06 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

IMPORTANT: claim your benefits by filing your taxes this year!

Email not displaying correctly?

View it in your browser

[link removed]

.

Why it's important to file your taxes this year:

Right now, we have an unprecedented opportunity to cut childhood poverty dramatically and to support the economic mobility of survivors of domestic violence. It starts with filing your 2020 federal tax returns by next Monday, May 17th.

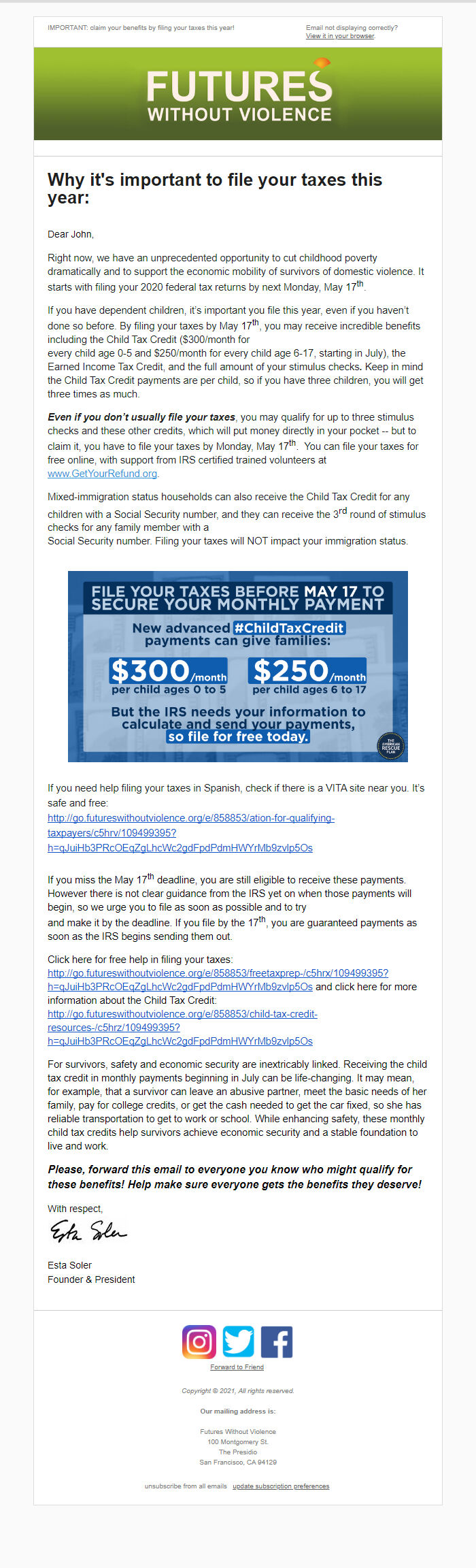

if you have dependent children, it’s important you file this year, even if you haven’t done so before. By filing your taxes by May 17th, you may receive incredible benefits including the Child Tax Credit ($300/month for every child age 0-5 and $250/month for every child age 6-17, starting in July), the Earned Income Tax Credit, and the full amount of your stimulus checks. Keep in mind the Child Tax Credit payments are per child, so if you have three children, you will get three times as much.

Even if you don’t usually file your taxes, you may qualify for up to three stimulus checks and these other credits, which will put money directly in your pocket -- but to claim it, you have to file your taxes by Monday, May 17th. You can file your taxes for free online, with support from IRS certified trained volunteers at www.GetYourRefund.org

[link removed]

.

Mixed-immigration status households can also receive the Child Tax Credit for any children with a Social Security number, and they can receive the 3rd round of stimulus checks for any family member with a Social Security number. Filing your taxes will NOT impact your immigration status.

If you need help filing your taxes in Spanish, check if there is a VITA site near you. It’s safe and free: [link removed]

[link removed]

If you miss the May 17 deadline, you are still eligible to receive these payments. However there is not clear guidance from the IRS yet on when those payments will begin, so we urge you to file as soon as possible and to try and make it by the deadline. If you file by the 17th, you are guaranteed payments as soon as the IRS begins sending them out.

Click here for free help in filing your taxes: [link removed]

[link removed]

and click here for more information about the Child Tax Credit: [link removed]

[link removed]

For survivors, safety and economic security are inextricably linked. Receiving the child tax credit in monthly payments beginning in July can be life-changing. It may mean, for example, that a survivor can leave an abusive partner, meet the basic needs of her family, pay for college credits, or get the cash needed to get the car fixed, so she has reliable transportation to get to work or school. While enhancing safety, these monthly child tax credits help survivors achieve economic security and a stable foundation to live and work.

Please, forward this email to everyone you know who might qualify for these benefits! Help make sure everyone gets the benefits they deserve!

Esta Soler

Founder & President

[link removed]

[link removed]

[link removed]

Forward to Friend

[link removed]

Copyright © 2021, All rights reserved.

Our mailing address is:

Futures Without Violence

100 Montgomery St.

The Presidio

San Francisco, CA 94129

unsubscribe from all emails

[link removed]

update subscription preferences

[link removed]

Email not displaying correctly?

View it in your browser

[link removed]

.

Why it's important to file your taxes this year:

Right now, we have an unprecedented opportunity to cut childhood poverty dramatically and to support the economic mobility of survivors of domestic violence. It starts with filing your 2020 federal tax returns by next Monday, May 17th.

if you have dependent children, it’s important you file this year, even if you haven’t done so before. By filing your taxes by May 17th, you may receive incredible benefits including the Child Tax Credit ($300/month for every child age 0-5 and $250/month for every child age 6-17, starting in July), the Earned Income Tax Credit, and the full amount of your stimulus checks. Keep in mind the Child Tax Credit payments are per child, so if you have three children, you will get three times as much.

Even if you don’t usually file your taxes, you may qualify for up to three stimulus checks and these other credits, which will put money directly in your pocket -- but to claim it, you have to file your taxes by Monday, May 17th. You can file your taxes for free online, with support from IRS certified trained volunteers at www.GetYourRefund.org

[link removed]

.

Mixed-immigration status households can also receive the Child Tax Credit for any children with a Social Security number, and they can receive the 3rd round of stimulus checks for any family member with a Social Security number. Filing your taxes will NOT impact your immigration status.

If you need help filing your taxes in Spanish, check if there is a VITA site near you. It’s safe and free: [link removed]

[link removed]

If you miss the May 17 deadline, you are still eligible to receive these payments. However there is not clear guidance from the IRS yet on when those payments will begin, so we urge you to file as soon as possible and to try and make it by the deadline. If you file by the 17th, you are guaranteed payments as soon as the IRS begins sending them out.

Click here for free help in filing your taxes: [link removed]

[link removed]

and click here for more information about the Child Tax Credit: [link removed]

[link removed]

For survivors, safety and economic security are inextricably linked. Receiving the child tax credit in monthly payments beginning in July can be life-changing. It may mean, for example, that a survivor can leave an abusive partner, meet the basic needs of her family, pay for college credits, or get the cash needed to get the car fixed, so she has reliable transportation to get to work or school. While enhancing safety, these monthly child tax credits help survivors achieve economic security and a stable foundation to live and work.

Please, forward this email to everyone you know who might qualify for these benefits! Help make sure everyone gets the benefits they deserve!

Esta Soler

Founder & President

[link removed]

[link removed]

[link removed]

Forward to Friend

[link removed]

Copyright © 2021, All rights reserved.

Our mailing address is:

Futures Without Violence

100 Montgomery St.

The Presidio

San Francisco, CA 94129

unsubscribe from all emails

[link removed]

update subscription preferences

[link removed]

Message Analysis

- Sender: Futures Without Violence

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Litmus