| From | Rachel Prusak <[email protected]> |

| Subject | Help for Restaurants, Landlords, and Other Small Businesses |

| Date | May 4, 2021 1:36 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Thank you small business owners and landlords, and restaurant and bar owners, who have felt the brunt of the public health measures the hardest.

View this email in your browser ([link removed])

Friends and Neighbors,

As COVID-19 variants become increasingly more prevalent in Oregon, the return to Extreme Risk levels has been a blow to businesses, workers, and communities. This news is scary and frustrating for Oregonians who have just started to recover; but together, we can get back on track.

Vaccines are our ticket out of this crisis, so please encourage your friends and families to get vaccinated as soon as possible, and please reach out to my office if you are having trouble finding an appointment. As more people are vaccinated, Oregon will be able to safely open our businesses and schools.

The modeling suggests this is temporary: in the next few weeks, with dedicated work, we can get ahead of the variants. If we continue to wear masks, socially distance, and widely distribute the vaccine, we should be able to lift statewide restrictions no later than the end of June.

In the meantime, many Oregonians remain burdened by the fear and financial instability that has come from our public health restrictions.

I want to say thank you to our small business owners, restaurant and bar owners, and small landlords who have felt the brunt of the public health measures the hardest. I see the many sacrifices you’ve made to keep our neighbors and communities healthy and believe it is my duty, as an elected official, to support you.

I am doing everything I can to make sure you don’t lose the livelihoods you have worked so hard for, and to make sure our vibrant main streets not just recover, but thrive. Below you will find resources for our small businesses, landlords, and families. If you need any additional help, please reach out to my office (mailto:[email protected]?subject=COVID%20Relief%20Help) and we will work to get you connected to the best services available.

** Restaurant Revitalization Fund

------------------------------------------------------------

**

------------------------------------------------------------

Included in the recently passed American Rescue Plan is a $28.6 billion Restaurant Revitalization Fund, designed to offset losses during shutdowns or other operational costs needed to keep their communities safe.

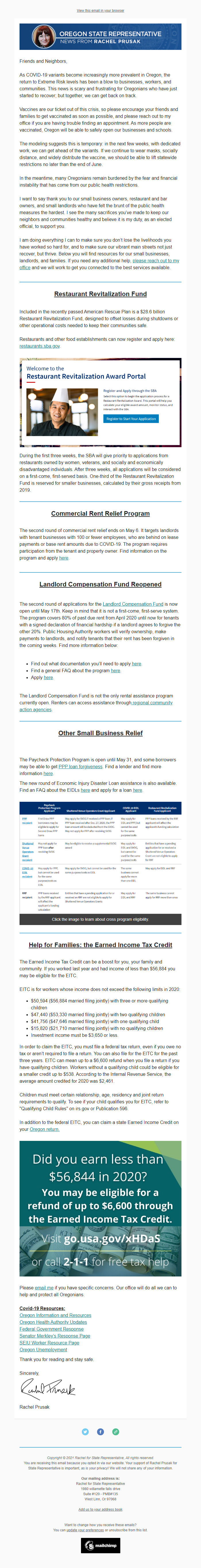

Restaurants and other food establishments can now register and apply here: restaurants.sba.gov ([link removed]) .

[link removed]

During the first three weeks, the SBA will give priority to applications from restaurants owned by women, veterans, and socially and economically disadvantaged individuals. After three weeks, all applications will be considered on a first-come, first-served basis. One-third of the Restaurant Revitalization Fund is reserved for smaller businesses, calculated by their gross receipts from 2019.

** Commercial Rent Relief Program

------------------------------------------------------------

The second round of commercial rent relief ends on May 6. It targets landlords with tenant businesses with 100 or fewer employees, who are behind on lease payments or base rent amounts due to COVID-19. The program requires participation from the tenant and property owner. Find information on the program and apply here ([link removed]) .

** Landlord Compensation Fund Reopened

------------------------------------------------------------

The second round of applications for the Landlord Compensation Fund ([link removed]) is now open until May 17th. Keep in mind that it is not a first-come, first-serve system. The program covers 80% of past due rent from April 2020 until now for tenants with a signed declaration of financial hardship if a landlord agrees to forgive the other 20%. Public Housing Authority workers will verify ownership, make payments to landlords, and notify tenants that their rent has been forgiven in the coming weeks. Find more information below:

* Find out what documentation you’ll need to apply here ([link removed]) .

* Find a general FAQ about the program here ([link removed]) .

* Apply here ([link removed]) .

The Landlord Compensation Fund is not the only rental assistance program currently open. Renters can access assistance throughregional community action agencies ([link removed]) .

** Other Small Business Relief

------------------------------------------------------------

The Paycheck Protection Program is open until May 31, and some borrowers may be able to get PPP loan forgiveness ([link removed]) . Find a lender and find more information here ([link removed]) .

The new round of Economic Injury Disaster Loan assistance is also available. Find an FAQ about the EIDLs here ([link removed]) and apply for a loan here ([link removed]) .

[link removed]

Click the image to learn about cross program eligibility.

** Help for Families: the Earned Income Tax Credit

------------------------------------------------------------

The Earned Income Tax Credit can be a boost for you, your family and community. If you worked last year and had income of less than $56,884 you may be eligible for the EITC.

EITC is for workers whose income does not exceed the following limits in 2020:

* $50,594 ($56,884 married filing jointly) with three or more qualifying children

* $47,440 ($53,330 married filing jointly) with two qualifying children

* $41,756 ($47,646 married filing jointly) with one qualifying child

* $15,820 ($21,710 married filing jointly) with no qualifying children

* Investment income must be $3,650 or less.

In order to claim the EITC, you must file a federal tax return, even if you owe no tax or aren’t required to file a return. You can also file for the EITC for the past three years. EITC can mean up to a $6,600 refund when you file a return if you have qualifying children. Workers without a qualifying child could be eligible for a smaller credit up to $538. According to the Internal Revenue Service, the average amount credited for 2020 was $2,461.

Children must meet certain relationship, age, residency and joint return requirements to qualify. To see if your child qualifies you for EITC, refer to "Qualifying Child Rules" on irs.gov or Publication 596.

In addition to the federal EITC, you can claim a state Earned Income Credit on your Oregon return. ([link removed])

Please email me (mailto:[email protected]) if you have specific concerns. Our office will do all we can to help and protect all Oregonians.

Covid-19 Resources:

Oregon Information and Resources ([link removed])

Oregon Health Authority Updates ([link removed])

Federal Government Response ([link removed])

Senator Merkley’s Response Page ([link removed])

SEIU Worker Resource Page ([link removed])

Oregon Unemployment ([link removed])

Thank you for reading and stay safe.

Sincerely,

Rachel Prusak

============================================================

** Twitter ([link removed])

** Facebook ([link removed])

** Website (oregonlegislature.gov/prusak)

Copyright © 2021 Rachel for State Representative, All rights reserved.

You are receiving this email because you opted in via our website.

Your support of Rachel Prusak for State Representative is important, as is your privacy!

We will not share any of your information.

Our mailing address is:

Rachel for State Representative

1980 willamette falls drive

Suite #120 - PMB#135

West Linn, Or 97068

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

View this email in your browser ([link removed])

Friends and Neighbors,

As COVID-19 variants become increasingly more prevalent in Oregon, the return to Extreme Risk levels has been a blow to businesses, workers, and communities. This news is scary and frustrating for Oregonians who have just started to recover; but together, we can get back on track.

Vaccines are our ticket out of this crisis, so please encourage your friends and families to get vaccinated as soon as possible, and please reach out to my office if you are having trouble finding an appointment. As more people are vaccinated, Oregon will be able to safely open our businesses and schools.

The modeling suggests this is temporary: in the next few weeks, with dedicated work, we can get ahead of the variants. If we continue to wear masks, socially distance, and widely distribute the vaccine, we should be able to lift statewide restrictions no later than the end of June.

In the meantime, many Oregonians remain burdened by the fear and financial instability that has come from our public health restrictions.

I want to say thank you to our small business owners, restaurant and bar owners, and small landlords who have felt the brunt of the public health measures the hardest. I see the many sacrifices you’ve made to keep our neighbors and communities healthy and believe it is my duty, as an elected official, to support you.

I am doing everything I can to make sure you don’t lose the livelihoods you have worked so hard for, and to make sure our vibrant main streets not just recover, but thrive. Below you will find resources for our small businesses, landlords, and families. If you need any additional help, please reach out to my office (mailto:[email protected]?subject=COVID%20Relief%20Help) and we will work to get you connected to the best services available.

** Restaurant Revitalization Fund

------------------------------------------------------------

**

------------------------------------------------------------

Included in the recently passed American Rescue Plan is a $28.6 billion Restaurant Revitalization Fund, designed to offset losses during shutdowns or other operational costs needed to keep their communities safe.

Restaurants and other food establishments can now register and apply here: restaurants.sba.gov ([link removed]) .

[link removed]

During the first three weeks, the SBA will give priority to applications from restaurants owned by women, veterans, and socially and economically disadvantaged individuals. After three weeks, all applications will be considered on a first-come, first-served basis. One-third of the Restaurant Revitalization Fund is reserved for smaller businesses, calculated by their gross receipts from 2019.

** Commercial Rent Relief Program

------------------------------------------------------------

The second round of commercial rent relief ends on May 6. It targets landlords with tenant businesses with 100 or fewer employees, who are behind on lease payments or base rent amounts due to COVID-19. The program requires participation from the tenant and property owner. Find information on the program and apply here ([link removed]) .

** Landlord Compensation Fund Reopened

------------------------------------------------------------

The second round of applications for the Landlord Compensation Fund ([link removed]) is now open until May 17th. Keep in mind that it is not a first-come, first-serve system. The program covers 80% of past due rent from April 2020 until now for tenants with a signed declaration of financial hardship if a landlord agrees to forgive the other 20%. Public Housing Authority workers will verify ownership, make payments to landlords, and notify tenants that their rent has been forgiven in the coming weeks. Find more information below:

* Find out what documentation you’ll need to apply here ([link removed]) .

* Find a general FAQ about the program here ([link removed]) .

* Apply here ([link removed]) .

The Landlord Compensation Fund is not the only rental assistance program currently open. Renters can access assistance throughregional community action agencies ([link removed]) .

** Other Small Business Relief

------------------------------------------------------------

The Paycheck Protection Program is open until May 31, and some borrowers may be able to get PPP loan forgiveness ([link removed]) . Find a lender and find more information here ([link removed]) .

The new round of Economic Injury Disaster Loan assistance is also available. Find an FAQ about the EIDLs here ([link removed]) and apply for a loan here ([link removed]) .

[link removed]

Click the image to learn about cross program eligibility.

** Help for Families: the Earned Income Tax Credit

------------------------------------------------------------

The Earned Income Tax Credit can be a boost for you, your family and community. If you worked last year and had income of less than $56,884 you may be eligible for the EITC.

EITC is for workers whose income does not exceed the following limits in 2020:

* $50,594 ($56,884 married filing jointly) with three or more qualifying children

* $47,440 ($53,330 married filing jointly) with two qualifying children

* $41,756 ($47,646 married filing jointly) with one qualifying child

* $15,820 ($21,710 married filing jointly) with no qualifying children

* Investment income must be $3,650 or less.

In order to claim the EITC, you must file a federal tax return, even if you owe no tax or aren’t required to file a return. You can also file for the EITC for the past three years. EITC can mean up to a $6,600 refund when you file a return if you have qualifying children. Workers without a qualifying child could be eligible for a smaller credit up to $538. According to the Internal Revenue Service, the average amount credited for 2020 was $2,461.

Children must meet certain relationship, age, residency and joint return requirements to qualify. To see if your child qualifies you for EITC, refer to "Qualifying Child Rules" on irs.gov or Publication 596.

In addition to the federal EITC, you can claim a state Earned Income Credit on your Oregon return. ([link removed])

Please email me (mailto:[email protected]) if you have specific concerns. Our office will do all we can to help and protect all Oregonians.

Covid-19 Resources:

Oregon Information and Resources ([link removed])

Oregon Health Authority Updates ([link removed])

Federal Government Response ([link removed])

Senator Merkley’s Response Page ([link removed])

SEIU Worker Resource Page ([link removed])

Oregon Unemployment ([link removed])

Thank you for reading and stay safe.

Sincerely,

Rachel Prusak

============================================================

** Twitter ([link removed])

** Facebook ([link removed])

** Website (oregonlegislature.gov/prusak)

Copyright © 2021 Rachel for State Representative, All rights reserved.

You are receiving this email because you opted in via our website.

Your support of Rachel Prusak for State Representative is important, as is your privacy!

We will not share any of your information.

Our mailing address is:

Rachel for State Representative

1980 willamette falls drive

Suite #120 - PMB#135

West Linn, Or 97068

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: Rachel Prusak

- Political Party: Democratic

- Country: United States

- State/Locality: Oregon

- Office: State Representative

-

Email Providers:

- MailChimp