Email

Will cutting income taxes create jobs, and Costs of waiting for medical treatment

| From | Fraser Institute <[email protected]> |

| Subject | Will cutting income taxes create jobs, and Costs of waiting for medical treatment |

| Date | April 17, 2021 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

=============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

----------------

Federal income tax rate reduction could help create 110,000 new private sector jobs in Canada

Will Cutting Income Taxes Create Jobs for Canadians? is a new study that finds if the federal government reduced the top personal income tax rate from 33 per cent back down to 29 per cent (the rate before the 2016 tax hike), it would facilitate the creation of approximately 110,000 private-sector jobs the following year.

Read More [[link removed]]

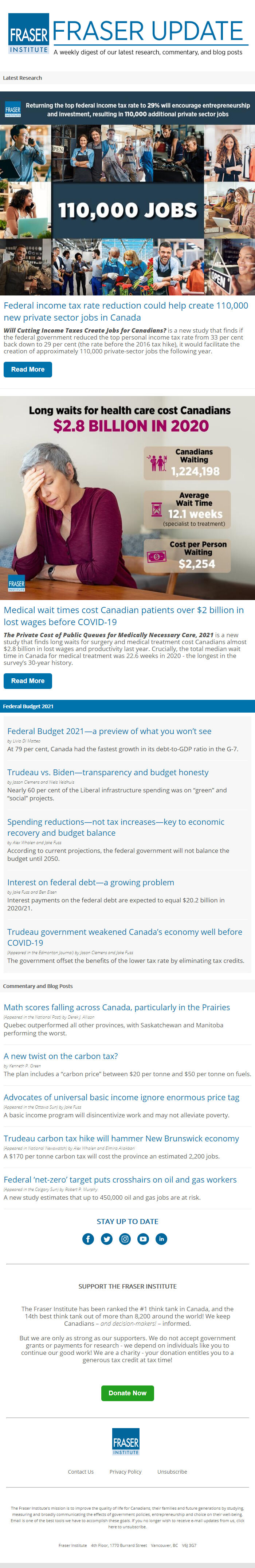

Medical wait times cost Canadian patients over $2 billion in lost wages before COVID-19

The Private Cost of Public Queues for Medically Necessary Care, 2021 is a new study that finds long waits for surgery and medical treatment cost Canadians almost $2.8 billion in lost wages and productivity last year. Crucially, the total median wait time in Canada for medical treatment was 22.6 weeks in 2020 - the longest in the survey’s 30-year history.

Read More [[link removed]]

Federal Budget 2021

----------------

Federal Budget 2021—a preview of what you won’t see [[link removed]]

by Livio Di Matteo

At 79 per cent, Canada had the fastest growth in its debt-to-GDP ratio in the G-7.

Trudeau vs. Biden—transparency and budget honesty [[link removed]]

by Jason Clemens and Niels Veldhuis

Nearly 60 per cent of the Liberal infrastructure spending was on “green” and “social” projects.

Spending reductions—not tax increases—key to economic recovery and budget balance [[link removed]]

by Alex Whalen and Jake Fuss

According to current projections, the federal government will not balance the budget until 2050.

Interest on federal debt—a growing problem [[link removed]]

by Jake Fuss and Ben Eisen

Interest payments on the federal debt are expected to equal $20.2 billion in 2020/21.

Trudeau government weakened Canada’s economy well before COVID-19 [[link removed]] (Appeared in the Edmonton Journal)

by Jason Clemens and Jake Fuss

The government offset the benefits of the lower tax rate by eliminating tax credits.

Commentary and Blog Posts

----------------

Math scores falling across Canada, particularly in the Prairies [[link removed]]

(Appeared in the National Post) by Derek J. Allison

Quebec outperformed all other provinces, with Saskatchewan and Manitoba performing the worst.

A new twist on the carbon tax? [[link removed]]

by Kenneth P. Green

The plan includes a “carbon price” between $20 per tonne and $50 per tonne on fuels.

Advocates of universal basic income ignore enormous price tag [[link removed]]

(Appeared in the Ottawa Sun) by Jake Fuss

A basic income program will disincentivize work and may not alleviate poverty.

Trudeau carbon tax hike will hammer New Brunswick economy [[link removed]]

(Appeared in National Newswatch) by Alex Whalen and Elmira Aliakbari

A $170 per tonne carbon tax will cost the province an estimated 2,200 jobs.

Federal ‘net-zero’ target puts crosshairs on oil and gas workers [[link removed]]

(Appeared in the Calgary Sun) by Robert P. Murphy

A new study estimates that up to 450,000 oil and gas jobs are at risk.

SUPPORT THE FRASER INSTITUTE

----------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

----------------

Federal income tax rate reduction could help create 110,000 new private sector jobs in Canada

Will Cutting Income Taxes Create Jobs for Canadians? is a new study that finds if the federal government reduced the top personal income tax rate from 33 per cent back down to 29 per cent (the rate before the 2016 tax hike), it would facilitate the creation of approximately 110,000 private-sector jobs the following year.

Read More [[link removed]]

Medical wait times cost Canadian patients over $2 billion in lost wages before COVID-19

The Private Cost of Public Queues for Medically Necessary Care, 2021 is a new study that finds long waits for surgery and medical treatment cost Canadians almost $2.8 billion in lost wages and productivity last year. Crucially, the total median wait time in Canada for medical treatment was 22.6 weeks in 2020 - the longest in the survey’s 30-year history.

Read More [[link removed]]

Federal Budget 2021

----------------

Federal Budget 2021—a preview of what you won’t see [[link removed]]

by Livio Di Matteo

At 79 per cent, Canada had the fastest growth in its debt-to-GDP ratio in the G-7.

Trudeau vs. Biden—transparency and budget honesty [[link removed]]

by Jason Clemens and Niels Veldhuis

Nearly 60 per cent of the Liberal infrastructure spending was on “green” and “social” projects.

Spending reductions—not tax increases—key to economic recovery and budget balance [[link removed]]

by Alex Whalen and Jake Fuss

According to current projections, the federal government will not balance the budget until 2050.

Interest on federal debt—a growing problem [[link removed]]

by Jake Fuss and Ben Eisen

Interest payments on the federal debt are expected to equal $20.2 billion in 2020/21.

Trudeau government weakened Canada’s economy well before COVID-19 [[link removed]] (Appeared in the Edmonton Journal)

by Jason Clemens and Jake Fuss

The government offset the benefits of the lower tax rate by eliminating tax credits.

Commentary and Blog Posts

----------------

Math scores falling across Canada, particularly in the Prairies [[link removed]]

(Appeared in the National Post) by Derek J. Allison

Quebec outperformed all other provinces, with Saskatchewan and Manitoba performing the worst.

A new twist on the carbon tax? [[link removed]]

by Kenneth P. Green

The plan includes a “carbon price” between $20 per tonne and $50 per tonne on fuels.

Advocates of universal basic income ignore enormous price tag [[link removed]]

(Appeared in the Ottawa Sun) by Jake Fuss

A basic income program will disincentivize work and may not alleviate poverty.

Trudeau carbon tax hike will hammer New Brunswick economy [[link removed]]

(Appeared in National Newswatch) by Alex Whalen and Elmira Aliakbari

A $170 per tonne carbon tax will cost the province an estimated 2,200 jobs.

Federal ‘net-zero’ target puts crosshairs on oil and gas workers [[link removed]]

(Appeared in the Calgary Sun) by Robert P. Murphy

A new study estimates that up to 450,000 oil and gas jobs are at risk.

SUPPORT THE FRASER INSTITUTE

----------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor