| From | Robert Reich <[email protected]> |

| Subject | What if we actually taxed the rich? |

| Date | April 1, 2021 10:55 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

www.inequalitymedia.org [www.inequalitymedia.org]Dear John,

Yesterday, Joe Biden released his infrastructure plan — a $2 trillion investment over eight years. The plan includes some tax increases on corporations to pay for it, but notably excludes any tax increases on wealthy individuals.

This is a mistake.

Income and wealth are now more concentrated at the top than at any time over the last 80 years, and our unjust tax system is a big reason why. The tax code is rigged for the rich, enabling a handful of wealthy individuals to exert undue influence over our economy and democracy.

To pay for what the nation needs — ending poverty, universal health care, infrastructure, reversing climate change, investing in communities, and so much more — the super-wealthy have to pay their fair share.

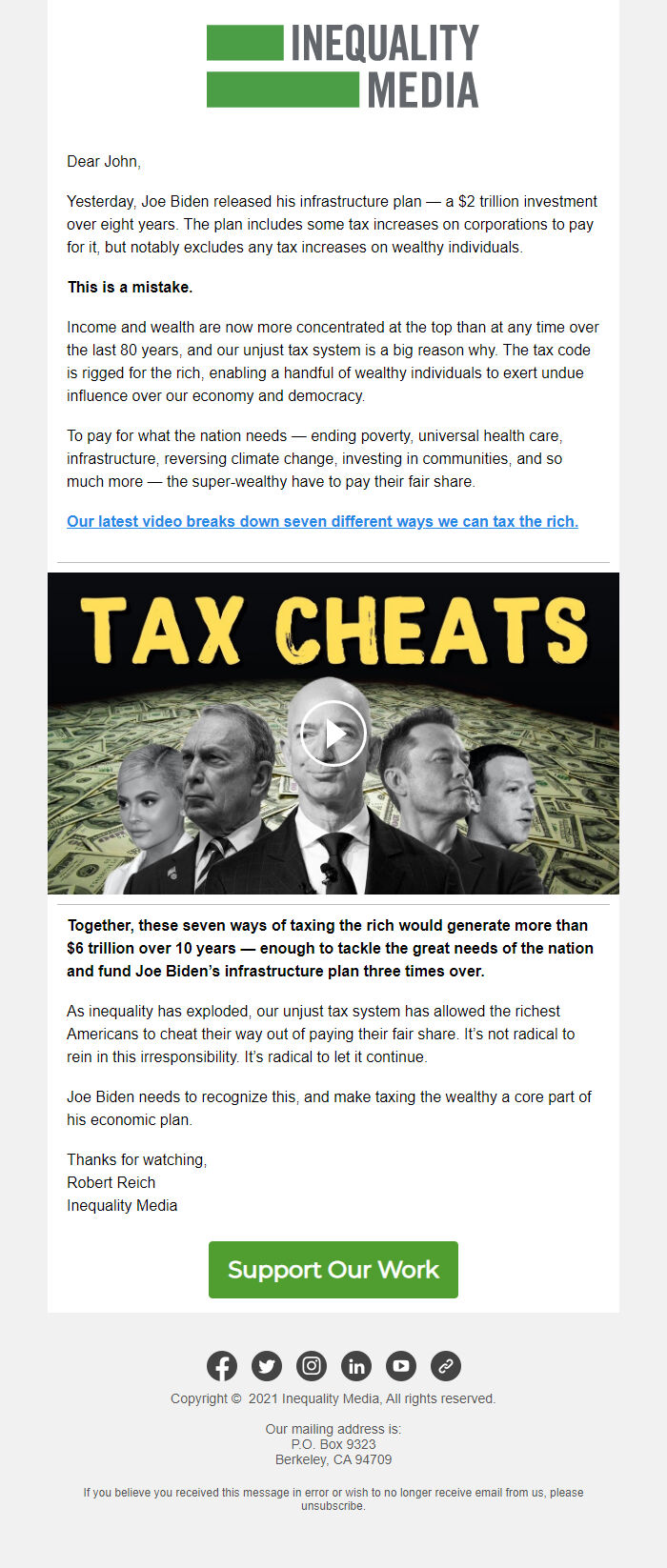

Our latest video breaks down seven different ways we can tax the rich. [[link removed]]

[link removed] [[link removed]]

Together, these seven ways of taxing the rich would generate more than $6 trillion over 10 years — enough to tackle the great needs of the nation and fund Joe Biden’s infrastructure plan three times over.

As inequality has exploded, our unjust tax system has allowed the richest Americans to cheat their way out of paying their fair share. It’s not radical to rein in this irresponsibility. It’s radical to let it continue.

Joe Biden needs to recognize this, and make taxing the wealthy a core part of his economic plan.

Thanks for watching,

Robert Reich

Inequality Media

Support Our Work [[link removed]][link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] www.inequalitymedia.org [www.inequalitymedia.org]

Copyright © 2021 Inequality Media, All rights reserved.

Our mailing address is:

P.O. Box 9323

Berkeley, CA 94709

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Yesterday, Joe Biden released his infrastructure plan — a $2 trillion investment over eight years. The plan includes some tax increases on corporations to pay for it, but notably excludes any tax increases on wealthy individuals.

This is a mistake.

Income and wealth are now more concentrated at the top than at any time over the last 80 years, and our unjust tax system is a big reason why. The tax code is rigged for the rich, enabling a handful of wealthy individuals to exert undue influence over our economy and democracy.

To pay for what the nation needs — ending poverty, universal health care, infrastructure, reversing climate change, investing in communities, and so much more — the super-wealthy have to pay their fair share.

Our latest video breaks down seven different ways we can tax the rich. [[link removed]]

[link removed] [[link removed]]

Together, these seven ways of taxing the rich would generate more than $6 trillion over 10 years — enough to tackle the great needs of the nation and fund Joe Biden’s infrastructure plan three times over.

As inequality has exploded, our unjust tax system has allowed the richest Americans to cheat their way out of paying their fair share. It’s not radical to rein in this irresponsibility. It’s radical to let it continue.

Joe Biden needs to recognize this, and make taxing the wealthy a core part of his economic plan.

Thanks for watching,

Robert Reich

Inequality Media

Support Our Work [[link removed]][link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] www.inequalitymedia.org [www.inequalitymedia.org]

Copyright © 2021 Inequality Media, All rights reserved.

Our mailing address is:

P.O. Box 9323

Berkeley, CA 94709

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Message Analysis

- Sender: Inequality Media Civic Action

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- EveryAction