| From | Jerrick Adams <[email protected]> |

| Subject | IRS proposes donor disclosure exemptions for some nonprofit groups |

| Date | September 30, 2019 5:17 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Under the proposal, only 501(c)(3) and 527 groups would be required to disclose the names of their donors.

------------------------------------------------------------

Welcome to _The Disclosure Digest_, our monthly look at state and federal disclosure policies for nonprofit organizations and their donors.

** IRS PROPOSES DONOR DISCLOSURE EXEMPTIONS FOR SELECT NONPROFIT GROUPS

------------------------------------------------------------

On September 10, the Internal Revenue Service (IRS) and the Department of the Treasury published a proposed regulation ([link removed]) that would exempt some nonprofit groups from existing donor disclosure requirements. In July, a federal judge struck down a similar rule issued in 2018, finding that federal agencies had failed to follow proper procedures in enacting the rule change.

WHAT WOULD CHANGE UNDER THE PROPOSED REGULATION?

Should the proposed regulation be enacted, existing donor disclosure requirements would apply only to groups organized under Sections 501(c)(3) ([link removed]) and 527 ([link removed]) of the Internal Revenue Code. Other 501(c) nonprofits, such as labor unions, trade associations, and social welfare groups, would not be required to disclose the names of their donors to the federal government.

Under both existing regulations and the proposed rule change, donor names disclosed to federal agencies are not publicly released.

WHAT BROUGHT US HERE?

On July 16, 2018, the IRS issued Revenue Procedure 2018-38, a rule change substantively similar to that issued earlier this month. On July 30, Judge Brian Morris, appointed to the U.S. District Court for the District of Montana by President Barack Obama (D), struck down the procedure, finding that the IRS had failed to comply with the public notice-and-comment process required under the Administrative Procedure Act. Morris did not comment on the merits of the rule change.

WHAT ARE THE REACTIONS?

* Ralph Graybill, chief legal counsel for the Montana governor's office, which was a plaintiff in the original challenge to the 2018 rule, said ([link removed]) ,

“

The State of Montana looks forward to giving the IRS a better picture of the devastating impacts its rules could have on state tax agencies as well as efforts to prevent foreign influence in our elections. We appreciate that the agency reversed from its prior course that excluded public comment.

”

* In announcing the original rule change in 2018, Steve Mnuchin, Secretary of the Treasury, said ([link removed]) ,

“

Americans shouldn't be required to send the IRS information that it doesn't need to effectively enforce our tax laws, and the IRS simply does not need tax returns with donor names and addresses to do its job in this area.

”

WHAT COMES NEXT?

Written and electronic comments must be received by December 9. Any request for a public hearing must also be made by that time.

------------------------------------------------------------

[link removed]

------------------------------------------------------------

** WHAT WE'RE READING

------------------------------------------------------------

* NJ Spotlight, "Judge Hears Oral Arguments For and Against State's Dark Money Disclosure Law," September 18, 2019 ([link removed])

* Nonprofit Quarterly, "Settlement with Koch Nonprofit Requires Donor Disclosure: Implications for You," September 25, 2019 ([link removed])

* The Salem News, "Conservative group fights donor disclosure rules," September 16, 2019 ([link removed])

* Reuters, "Koch-founded charity asks for Supreme Court help to keep donor list secret," August 28, 2019 ([link removed])

------------------------------------------------------------

** THE BIG PICTURE

------------------------------------------------------------

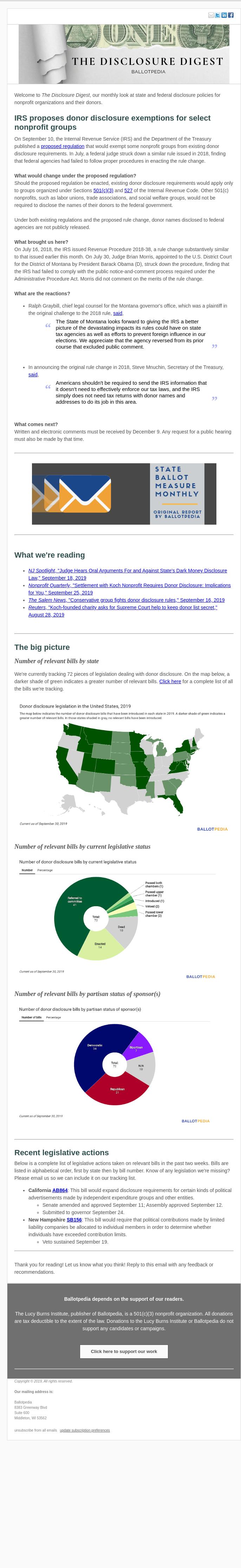

** _NUMBER OF RELEVANT BILLS BY STATE_

------------------------------------------------------------

We're currently tracking 72 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here ([link removed]) for a complete list of all the bills we're tracking.

** _NUMBER OF RELEVANT BILLS BY CURRENT LEGISLATIVE STATUS_

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY PARTISAN STATUS OF SPONSOR(S)_

------------------------------------------------------------

------------------------------------------------------------

** RECENT LEGISLATIVE ACTIONS

------------------------------------------------------------

Below is a complete list of legislative actions taken on relevant bills in the past two weeks. Bills are listed in alphabetical order, first by state then by bill number. Know of any legislation we're missing? Please email us so we can include it on our tracking list.

* CALIFORNIA AB864 ([link removed]) : This bill would expand disclosure requirements for certain kinds of political advertisements made by independent expenditure groups and other entities.

* Senate amended and approved September 11; Assembly approved September 12.

* Submitted to governor September 24.

* NEW HAMPSHIRE SB156 ([link removed]) : This bill would require that political contributions made by limited liability companies be allocated to individual members in order to determine whether individuals have exceeded contribution limits.

* Veto sustained September 19.

------------------------------------------------------------

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations.

============================================================

BALLOTPEDIA DEPENDS ON THE SUPPORT OF OUR READERS.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

** Click here to support our work ([link removed])

-------------------------

_Copyright © 2019, All rights reserved._

OUR MAILING ADDRESS IS:

Ballotpedia

8383 Greenway Blvd

Suite 600

Middleton, WI 53562

** unsubscribe from all emails ( [link removed] )

** update subscription preferences ( [link removed] )

------------------------------------------------------------

Welcome to _The Disclosure Digest_, our monthly look at state and federal disclosure policies for nonprofit organizations and their donors.

** IRS PROPOSES DONOR DISCLOSURE EXEMPTIONS FOR SELECT NONPROFIT GROUPS

------------------------------------------------------------

On September 10, the Internal Revenue Service (IRS) and the Department of the Treasury published a proposed regulation ([link removed]) that would exempt some nonprofit groups from existing donor disclosure requirements. In July, a federal judge struck down a similar rule issued in 2018, finding that federal agencies had failed to follow proper procedures in enacting the rule change.

WHAT WOULD CHANGE UNDER THE PROPOSED REGULATION?

Should the proposed regulation be enacted, existing donor disclosure requirements would apply only to groups organized under Sections 501(c)(3) ([link removed]) and 527 ([link removed]) of the Internal Revenue Code. Other 501(c) nonprofits, such as labor unions, trade associations, and social welfare groups, would not be required to disclose the names of their donors to the federal government.

Under both existing regulations and the proposed rule change, donor names disclosed to federal agencies are not publicly released.

WHAT BROUGHT US HERE?

On July 16, 2018, the IRS issued Revenue Procedure 2018-38, a rule change substantively similar to that issued earlier this month. On July 30, Judge Brian Morris, appointed to the U.S. District Court for the District of Montana by President Barack Obama (D), struck down the procedure, finding that the IRS had failed to comply with the public notice-and-comment process required under the Administrative Procedure Act. Morris did not comment on the merits of the rule change.

WHAT ARE THE REACTIONS?

* Ralph Graybill, chief legal counsel for the Montana governor's office, which was a plaintiff in the original challenge to the 2018 rule, said ([link removed]) ,

“

The State of Montana looks forward to giving the IRS a better picture of the devastating impacts its rules could have on state tax agencies as well as efforts to prevent foreign influence in our elections. We appreciate that the agency reversed from its prior course that excluded public comment.

”

* In announcing the original rule change in 2018, Steve Mnuchin, Secretary of the Treasury, said ([link removed]) ,

“

Americans shouldn't be required to send the IRS information that it doesn't need to effectively enforce our tax laws, and the IRS simply does not need tax returns with donor names and addresses to do its job in this area.

”

WHAT COMES NEXT?

Written and electronic comments must be received by December 9. Any request for a public hearing must also be made by that time.

------------------------------------------------------------

[link removed]

------------------------------------------------------------

** WHAT WE'RE READING

------------------------------------------------------------

* NJ Spotlight, "Judge Hears Oral Arguments For and Against State's Dark Money Disclosure Law," September 18, 2019 ([link removed])

* Nonprofit Quarterly, "Settlement with Koch Nonprofit Requires Donor Disclosure: Implications for You," September 25, 2019 ([link removed])

* The Salem News, "Conservative group fights donor disclosure rules," September 16, 2019 ([link removed])

* Reuters, "Koch-founded charity asks for Supreme Court help to keep donor list secret," August 28, 2019 ([link removed])

------------------------------------------------------------

** THE BIG PICTURE

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY STATE_

------------------------------------------------------------

We're currently tracking 72 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here ([link removed]) for a complete list of all the bills we're tracking.

** _NUMBER OF RELEVANT BILLS BY CURRENT LEGISLATIVE STATUS_

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY PARTISAN STATUS OF SPONSOR(S)_

------------------------------------------------------------

------------------------------------------------------------

** RECENT LEGISLATIVE ACTIONS

------------------------------------------------------------

Below is a complete list of legislative actions taken on relevant bills in the past two weeks. Bills are listed in alphabetical order, first by state then by bill number. Know of any legislation we're missing? Please email us so we can include it on our tracking list.

* CALIFORNIA AB864 ([link removed]) : This bill would expand disclosure requirements for certain kinds of political advertisements made by independent expenditure groups and other entities.

* Senate amended and approved September 11; Assembly approved September 12.

* Submitted to governor September 24.

* NEW HAMPSHIRE SB156 ([link removed]) : This bill would require that political contributions made by limited liability companies be allocated to individual members in order to determine whether individuals have exceeded contribution limits.

* Veto sustained September 19.

------------------------------------------------------------

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations.

============================================================

BALLOTPEDIA DEPENDS ON THE SUPPORT OF OUR READERS.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

** Click here to support our work ([link removed])

-------------------------

_Copyright © 2019, All rights reserved._

OUR MAILING ADDRESS IS:

Ballotpedia

8383 Greenway Blvd

Suite 600

Middleton, WI 53562

** unsubscribe from all emails ( [link removed] )

** update subscription preferences ( [link removed] )

Message Analysis

- Sender: Ballotpedia

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Litmus