| From | Sidney Williams <[email protected]> |

| Subject | Let's put money back in the pockets of hard working Washingtonians |

| Date | February 1, 2021 7:01 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Hi John,

The Recovery Rebate – an updated version of the Working Families Tax Credit – would provide much-needed cash to households across Washington.

Washington state has the most upside-down tax code in the country, with families living on the lowest incomes paying up to six times more in state and local taxes, as a share of their income, compared to those with the highest incomes. With COVID-19 magnifying existing racial and wealth gaps, those already facing hardship now have an even greater need for policies that put cash back in their pockets.

If passed, the Working Families Tax Credit/Recovery Rebate [[link removed]] ( HB 1297 [[link removed]] / SB 5387 [[link removed]] ) would refund a portion of the state sales tax to low- and moderate-income households. This annual credit would be one step toward advancing racial equity, deepening support for immigrant communities, and providing a boost to Washington state's economy.

Those who are eligible for the federal Earned Income Tax Credit (EITC) and those who file their taxes using an Individual Taxpayer Identification Number (ITIN) would receive a $500-$950 direct payment depending on family size. During the 2021 Legislative Session, your lawmakers have the opportunity to pass the Working Families Tax Credit.

THIS WEEK there will be two hearings on the Working Families Tax Credit/Recovery Rebate:

TUESDAY, February 2, at 1:30pm, the House Finance Committee will hold a hearing on HB 1297.

THURSDAY, February 4, at 1:30pm, the Senate Human Services, Reentry & Rehabilitation Committee will hold a hearing on SB 5387.

Two actions to take now:

1. E-mail your state lawmakers [povertyaction.org/advocacy-actions/working-families-tax-credit/] urging them to prioritize the financial wellbeing of Washington's low-income communities by supporting the Working Families Tax Credit/Recovery Rebate.

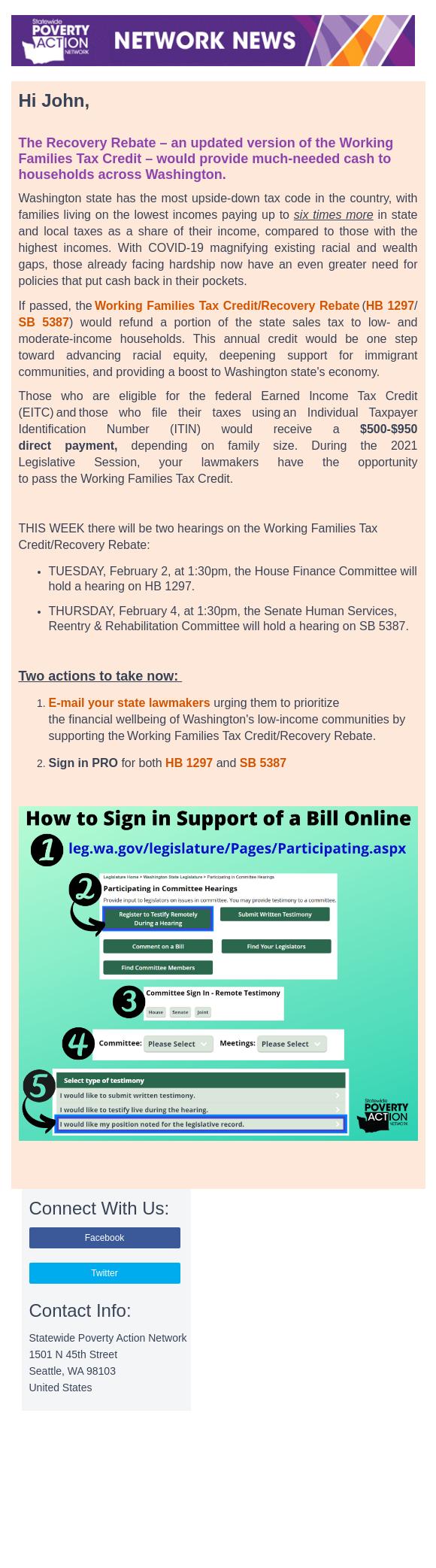

2. Sign in PRO for HB 1297 [bit.ly/ProWFTC] and SB 5387 [bit.ly/ProWFTCSB5387]

[[link removed]]

Connect With Us:

Facebook [[link removed]]

Twitter [[link removed]]

Contact Info:Statewide Poverty Action Network

1501 N 45th Street

Seattle, WA 98103

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

We have recently moved to a new data system, please let us know if you are experiencing any issues with our new system.

The Recovery Rebate – an updated version of the Working Families Tax Credit – would provide much-needed cash to households across Washington.

Washington state has the most upside-down tax code in the country, with families living on the lowest incomes paying up to six times more in state and local taxes, as a share of their income, compared to those with the highest incomes. With COVID-19 magnifying existing racial and wealth gaps, those already facing hardship now have an even greater need for policies that put cash back in their pockets.

If passed, the Working Families Tax Credit/Recovery Rebate [[link removed]] ( HB 1297 [[link removed]] / SB 5387 [[link removed]] ) would refund a portion of the state sales tax to low- and moderate-income households. This annual credit would be one step toward advancing racial equity, deepening support for immigrant communities, and providing a boost to Washington state's economy.

Those who are eligible for the federal Earned Income Tax Credit (EITC) and those who file their taxes using an Individual Taxpayer Identification Number (ITIN) would receive a $500-$950 direct payment depending on family size. During the 2021 Legislative Session, your lawmakers have the opportunity to pass the Working Families Tax Credit.

THIS WEEK there will be two hearings on the Working Families Tax Credit/Recovery Rebate:

TUESDAY, February 2, at 1:30pm, the House Finance Committee will hold a hearing on HB 1297.

THURSDAY, February 4, at 1:30pm, the Senate Human Services, Reentry & Rehabilitation Committee will hold a hearing on SB 5387.

Two actions to take now:

1. E-mail your state lawmakers [povertyaction.org/advocacy-actions/working-families-tax-credit/] urging them to prioritize the financial wellbeing of Washington's low-income communities by supporting the Working Families Tax Credit/Recovery Rebate.

2. Sign in PRO for HB 1297 [bit.ly/ProWFTC] and SB 5387 [bit.ly/ProWFTCSB5387]

[[link removed]]

Connect With Us:

Facebook [[link removed]]

Twitter [[link removed]]

Contact Info:Statewide Poverty Action Network

1501 N 45th Street

Seattle, WA 98103

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

We have recently moved to a new data system, please let us know if you are experiencing any issues with our new system.

Message Analysis

- Sender: Poverty Action

- Political Party: n/a

- Country: United States

- State/Locality: Washington

- Office: n/a

-

Email Providers:

- EveryAction