Email

Research Release: Federal transfers make up more than 25 per cent of Atlantic Canada’s economy

| From | Niels Veldhuis <[email protected]> |

| Subject | Research Release: Federal transfers make up more than 25 per cent of Atlantic Canada’s economy |

| Date | January 28, 2021 12:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Dear John,

Today, the Fraser Institute released a new study, Fiscal Federalism and the Dependency of Atlantic Canada [[link removed]].

This study finds that from 2007 to 2019, federal spending (including Employment Insurance, equalization, health care, and various other subsidies and programs) in Atlantic Canada equaled more than a quarter—27.5 per cent—of the region’s economy. The study examines Atlantic Canada’s dependency on fiscal transfers from Ottawa and highlights how the region is vulnerable to any significant changes in fiscal federalism.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

Suite 1207, Duke Tower, 5251 Duke St, Halifax, NS B3J 1P3

Federal transfers make up more than 25 per cent of Atlantic Canada’s economy

HALIFAX—Atlantic Canada’s dependency on federal spending—equaling over a quarter of the regional economy—leaves it vulnerable to any significant change in transfers from Ottawa, finds a new study released today by the Fraser Institute, an independent, non-partisan, Canadian public policy think-tank.

“The economic crisis in the energy sector, particularly in Alberta and Saskatchewan, may shake the foundations of transfers from Ottawa to the provinces,’ said Fred McMahon, a resident fellow at the Fraser Institute and author of Fiscal Federalism and the Dependency of Atlantic Canada [[link removed]].

“Alberta’s net contributions to the federal government—the difference between federal revenues and spending—financed the lion’s share of the funds transferred (net of tax revenues) into Atlantic Canada and Quebec. Those surpluses from Alberta will shrink and perhaps disappear. So where will the money going to Atlantic Canada come from?”

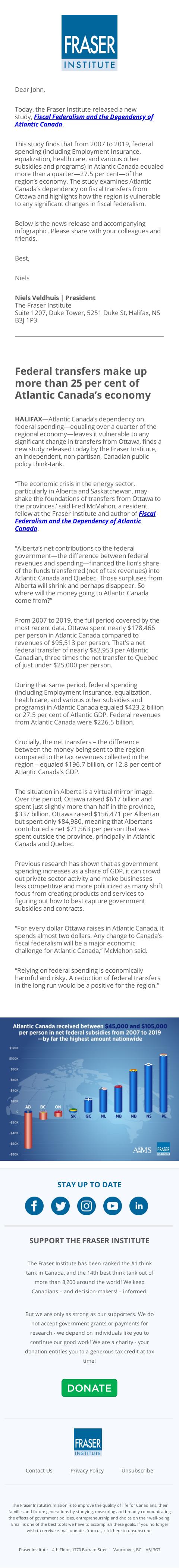

From 2007 to 2019, the full period covered by the most recent data, Ottawa spent nearly $178,466 per person in Atlantic Canada compared to revenues of $95,513 per person. That’s a net federal transfer of nearly $82,953 per Atlantic Canadian, three times the net transfer to Quebec of just under $25,000 per person.

During that same period, federal spending (including Employment Insurance, equalization, health care, and various other subsidies and programs) in Atlantic Canada equaled $423.2 billion or 27.5 per cent of Atlantic GDP. Federal revenues from Atlantic Canada were $226.5 billion.

Crucially, the net transfers – the difference between the money being sent to the region compared to the tax revenues collected in the region – equaled $196.7 billion, or 12.8 per cent of Atlantic Canada’s GDP.

The situation in Alberta is a virtual mirror image. Over the period, Ottawa raised $617 billion and spent just slightly more than half in the province, $337 billion. Ottawa raised $156,471 per Albertan but spent only $84,980, meaning that Albertans contributed a net $71,563 per person that was spent outside the province, principally in Atlantic Canada and Quebec.

Previous research has shown that as government spending increases as a share of GDP, it can crowd out private sector activity and make businesses less competitive and more politicized as many shift focus from creating products and services to figuring out how to best capture government subsidies and contracts.

“For every dollar Ottawa raises in Atlantic Canada, it spends almost two dollars. Any change to Canada’s fiscal federalism will be a major economic challenge for Atlantic Canada,” McMahon said.

“Relying on federal spending is economically harmful and risky. A reduction of federal transfers in the long run would be a positive for the region.”

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Today, the Fraser Institute released a new study, Fiscal Federalism and the Dependency of Atlantic Canada [[link removed]].

This study finds that from 2007 to 2019, federal spending (including Employment Insurance, equalization, health care, and various other subsidies and programs) in Atlantic Canada equaled more than a quarter—27.5 per cent—of the region’s economy. The study examines Atlantic Canada’s dependency on fiscal transfers from Ottawa and highlights how the region is vulnerable to any significant changes in fiscal federalism.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

Suite 1207, Duke Tower, 5251 Duke St, Halifax, NS B3J 1P3

Federal transfers make up more than 25 per cent of Atlantic Canada’s economy

HALIFAX—Atlantic Canada’s dependency on federal spending—equaling over a quarter of the regional economy—leaves it vulnerable to any significant change in transfers from Ottawa, finds a new study released today by the Fraser Institute, an independent, non-partisan, Canadian public policy think-tank.

“The economic crisis in the energy sector, particularly in Alberta and Saskatchewan, may shake the foundations of transfers from Ottawa to the provinces,’ said Fred McMahon, a resident fellow at the Fraser Institute and author of Fiscal Federalism and the Dependency of Atlantic Canada [[link removed]].

“Alberta’s net contributions to the federal government—the difference between federal revenues and spending—financed the lion’s share of the funds transferred (net of tax revenues) into Atlantic Canada and Quebec. Those surpluses from Alberta will shrink and perhaps disappear. So where will the money going to Atlantic Canada come from?”

From 2007 to 2019, the full period covered by the most recent data, Ottawa spent nearly $178,466 per person in Atlantic Canada compared to revenues of $95,513 per person. That’s a net federal transfer of nearly $82,953 per Atlantic Canadian, three times the net transfer to Quebec of just under $25,000 per person.

During that same period, federal spending (including Employment Insurance, equalization, health care, and various other subsidies and programs) in Atlantic Canada equaled $423.2 billion or 27.5 per cent of Atlantic GDP. Federal revenues from Atlantic Canada were $226.5 billion.

Crucially, the net transfers – the difference between the money being sent to the region compared to the tax revenues collected in the region – equaled $196.7 billion, or 12.8 per cent of Atlantic Canada’s GDP.

The situation in Alberta is a virtual mirror image. Over the period, Ottawa raised $617 billion and spent just slightly more than half in the province, $337 billion. Ottawa raised $156,471 per Albertan but spent only $84,980, meaning that Albertans contributed a net $71,563 per person that was spent outside the province, principally in Atlantic Canada and Quebec.

Previous research has shown that as government spending increases as a share of GDP, it can crowd out private sector activity and make businesses less competitive and more politicized as many shift focus from creating products and services to figuring out how to best capture government subsidies and contracts.

“For every dollar Ottawa raises in Atlantic Canada, it spends almost two dollars. Any change to Canada’s fiscal federalism will be a major economic challenge for Atlantic Canada,” McMahon said.

“Relying on federal spending is economically harmful and risky. A reduction of federal transfers in the long run would be a positive for the region.”

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor