Email

Research Release: Nearly 40% of Canadians who pay capital gains taxes earn less than $100,000 a year

| From | Niels Veldhuis <[email protected]> |

| Subject | Research Release: Nearly 40% of Canadians who pay capital gains taxes earn less than $100,000 a year |

| Date | January 19, 2021 12:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Dear John,

Today, the Fraser Institute released a new study, Correcting Common Misunderstandings about Capital Gains Taxes [[link removed]].

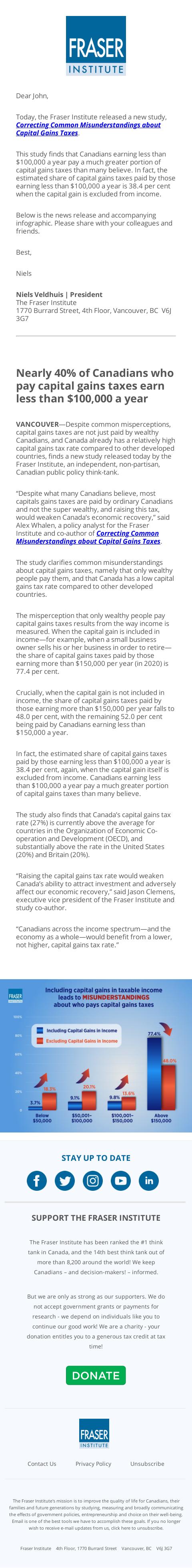

This study finds that Canadians earning less than $100,000 a year pay a much greater portion of capital gains taxes than many believe. In fact, the estimated share of capital gains taxes paid by those earning less than $100,000 a year is 38.4 per cent when the capital gain is excluded from income.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

1770 Burrard Street, 4th Floor, Vancouver, BC V6J 3G7

Nearly 40% of Canadians who pay capital gains taxes earn less than $100,000 a year

VANCOUVER—Despite common misperceptions, capital gains taxes are not just paid by wealthy Canadians, and Canada already has a relatively high capital gains tax rate compared to other developed countries, finds a new study released today by the Fraser Institute, an independent, non-partisan, Canadian public policy think-tank.

“Despite what many Canadians believe, most capitals gains taxes are paid by ordinary Canadians and not the super wealthy, and raising this tax, would weaken Canada’s economic recovery,” said Alex Whalen, a policy analyst for the Fraser Institute and co-author of Correcting Common Misunderstandings about Capital Gains Taxes [[link removed]].

The study clarifies common misunderstandings about capital gains taxes, namely that only wealthy people pay them, and that Canada has a low capital gains tax rate compared to other developed countries.

The misperception that only wealthy people pay capital gains taxes results from the way income is measured. When the capital gain is included in income—for example, when a small business owner sells his or her business in order to retire—the share of capital gains taxes paid by those earning more than $150,000 per year (in 2020) is 77.4 per cent.

Crucially, when the capital gain is not included in income, the share of capital gains taxes paid by those earning more than $150,000 per year falls to 48.0 per cent, with the remaining 52.0 per cent being paid by Canadians earning less than $150,000 a year.

In fact, the estimated share of capital gains taxes paid by those earning less than $100,000 a year is 38.4 per cent, again, when the capital gain itself is excluded from income. Canadians earning less than $100,000 a year pay a much greater portion of capital gains taxes than many believe.

The study also finds that Canada’s capital gains tax rate (27%) is currently above the average for countries in the Organization of Economic Co-operation and Development (OECD), and substantially above the rate in the United States (20%) and Britain (20%).

“Raising the capital gains tax rate would weaken Canada’s ability to attract investment and adversely affect our economic recovery,” said Jason Clemens, executive vice president of the Fraser Institute and study co-author.

“Canadians across the income spectrum—and the economy as a whole—would benefit from a lower, not higher, capital gains tax rate.”

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Today, the Fraser Institute released a new study, Correcting Common Misunderstandings about Capital Gains Taxes [[link removed]].

This study finds that Canadians earning less than $100,000 a year pay a much greater portion of capital gains taxes than many believe. In fact, the estimated share of capital gains taxes paid by those earning less than $100,000 a year is 38.4 per cent when the capital gain is excluded from income.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

1770 Burrard Street, 4th Floor, Vancouver, BC V6J 3G7

Nearly 40% of Canadians who pay capital gains taxes earn less than $100,000 a year

VANCOUVER—Despite common misperceptions, capital gains taxes are not just paid by wealthy Canadians, and Canada already has a relatively high capital gains tax rate compared to other developed countries, finds a new study released today by the Fraser Institute, an independent, non-partisan, Canadian public policy think-tank.

“Despite what many Canadians believe, most capitals gains taxes are paid by ordinary Canadians and not the super wealthy, and raising this tax, would weaken Canada’s economic recovery,” said Alex Whalen, a policy analyst for the Fraser Institute and co-author of Correcting Common Misunderstandings about Capital Gains Taxes [[link removed]].

The study clarifies common misunderstandings about capital gains taxes, namely that only wealthy people pay them, and that Canada has a low capital gains tax rate compared to other developed countries.

The misperception that only wealthy people pay capital gains taxes results from the way income is measured. When the capital gain is included in income—for example, when a small business owner sells his or her business in order to retire—the share of capital gains taxes paid by those earning more than $150,000 per year (in 2020) is 77.4 per cent.

Crucially, when the capital gain is not included in income, the share of capital gains taxes paid by those earning more than $150,000 per year falls to 48.0 per cent, with the remaining 52.0 per cent being paid by Canadians earning less than $150,000 a year.

In fact, the estimated share of capital gains taxes paid by those earning less than $100,000 a year is 38.4 per cent, again, when the capital gain itself is excluded from income. Canadians earning less than $100,000 a year pay a much greater portion of capital gains taxes than many believe.

The study also finds that Canada’s capital gains tax rate (27%) is currently above the average for countries in the Organization of Economic Co-operation and Development (OECD), and substantially above the rate in the United States (20%) and Britain (20%).

“Raising the capital gains tax rate would weaken Canada’s ability to attract investment and adversely affect our economic recovery,” said Jason Clemens, executive vice president of the Fraser Institute and study co-author.

“Canadians across the income spectrum—and the economy as a whole—would benefit from a lower, not higher, capital gains tax rate.”

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor