| From | Mike King, Volunteers of America <[email protected]> |

| Subject | This night |

| Date | December 31, 2020 10:17 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

/* ------------- EMAIL CLIENT SPECIFIC STYLES ------------- */

#outlook a { padding:0; } /* Force Outlook to provide a "view in

browser" message */

.ReadMsgBody { width:100%; } .ExternalClass { width:100%; } /* Force

Hotmail to display emails at full width */

.ExternalClass, .ExternalClass p, .ExternalClass span, .ExternalClass

font, .ExternalClass td, .ExternalClass div { line-height: 100%; } /*

Force Hotmail to display normal line spacing */

body, table, td, a { -webkit-text-size-adjust:100%;

-ms-text-size-adjust:100%; } /* Prevent WebKit and Windows mobile

changing default text sizes */

table, td { mso-table-lspace:0pt; mso-table-rspace:0pt; } /* Remove

spacing between tables in Outlook 2007 and up */

img { -ms-interpolation-mode:bicubic; } /* Allow smoother rendering of

resized image in Internet Explorer */

body { margin:0 !important; } div[style*="margin: 16px 0"] {

margin:0 !important; } /* Fix Android 4.4 body centering issue */

/* ------------- RESET STYLES ------------- */

* { -webkit-font-smoothing: antialiased; }

body { Margin: 0; margin:0; padding:0; min-width: 100%;

-webkit-font-smoothing: antialiased; mso-line-height-rule: exactly; }

img { border:0; height:auto; line-height:0px; outline:none;

text-decoration:none;}

table { border-spacing: 0; border-collapse:collapse !important; }

body { height:100% !important; margin:0; padding:0; width:100%

!important; }

/* ------------- UTLIITY CLASSES ------------- */

/* WHEN USING CUSOM FONTS */

[style*="Source Sans Pro"] { font-family: 'Source Sans Pro', Arial,

sans-serif !important } /* Override Outlook to not break on imported

fonts */

/* iOS BLUE LINKS */

.appleBody a { color:#B32317; text-decoration: none; }

.appleFooter a, .appleFooter p { color:#ffffff; text-decoration: none;

}

/* ------------- CUSTOM STYLES ------------- */

body, table, p {

font-family: 'Source Sans Pro', Arial, sans-serif;

}

table {

background-color: #ffffff;

color: #202224;

}

.wrapper {

width: 100%;

table-layout: fixed;

-webkit-text-size-adjust: 100%;

-ms-text-size-adjust: 100%;

}

.webkit {

max-width: 600px;

}

.outer {

Margin: 0 auto;

width: 100%;

max-width: 600px;

}

.full-width-image img {

width: 100%;

max-width: 600px;

height: auto;

}

.inner {

padding: 10px;

}

p, ul, li {

color: #202224;

font-size: 16px;

line-height: 30px;

Margin: 0;

margin-bottom: 25px;

}

p a, ul li a {

color: #B32317;

text-decoration: underline;

font-weight: bold;

}

h1, .h1 {

color: #001A70;

font-size: 32px;

line-height: 35px !important;

Margin-top: 0px;

Margin-bottom: 25px;

font-family: 'Source Sans Pro', Arial, sans-serif;

-webkit-font-smoothing: antialiased;

font-weight: 600;

}

h2, .h2 {

color: #001A70;

font-size: 24px;

line-height: 32px !important;

Margin-top: 0;

Margin-bottom: 20px;

font-family: 'Source Sans Pro', Arial, sans-serif;

-webkit-font-smoothing: antialiased;

font-weight: 500;

}

.img-align-vertical img {

display: inline-block;

vertical-align: middle;

}

/* MOBILE STYLES */

@media screen and (max-width: 600px) {

.logo, .logo img {

width: 250px !important;

}

.mobile-cta-padding {

padding: 15px 0 10px !important;

}

.mobile-body-padding {

padding: 15px 20px !important;

}

.mobile-footer-padding {

padding: 40px 20px 80px !important;

}

.mobile-top-padding {

padding-top: 20px !important;

}

.donate-button, .donate-button a {

width: 120px !important;

padding-left: 0 !important;

padding-right: 0 !important;

font-size: 16px !important;

}

#hero-mobile, #hero-mobile img, .logo {

display: block !important;

max-height: none !important;

overflow: visible !important;

width: 100% !important;

}

.header-second-column, .column, .column img {

width: 100% !important;

max-width: 100% !important;

}

.contents {

min-width: auto !important;

}

.mobile-sponsor-padding {

padding: 20px 0 0 !important;

}

.mobile-block {

display: block !important;

margin: 10px 0 !important;

}

.mobile-hide {

display: none !important;

}

.mobile-center {

text-align: center !important;

padding: 15px 0px !important;

}

.mobile-center-no-pad {

text-align: center !important;

}

.mobile-logo-padding {

padding: 0px 0px 0px 10px !important;

}

.mobile-cta-padding {

padding: 20px 15px !important;

}

.mobile-pad-bottom {

padding-bottom: 20px !important;

}

.mobile-pad-left-right {

padding: 0px 20px !important;

}

.mobile-cta-no-pad-left-right {

padding: 20px 0px !important;

}

.mobile-cta-width {

width: 100% !important;

max-width: 100% !important;

}

.mobile-no-border-link {

border: none !important;

text-decoration: underline !important;

}

}

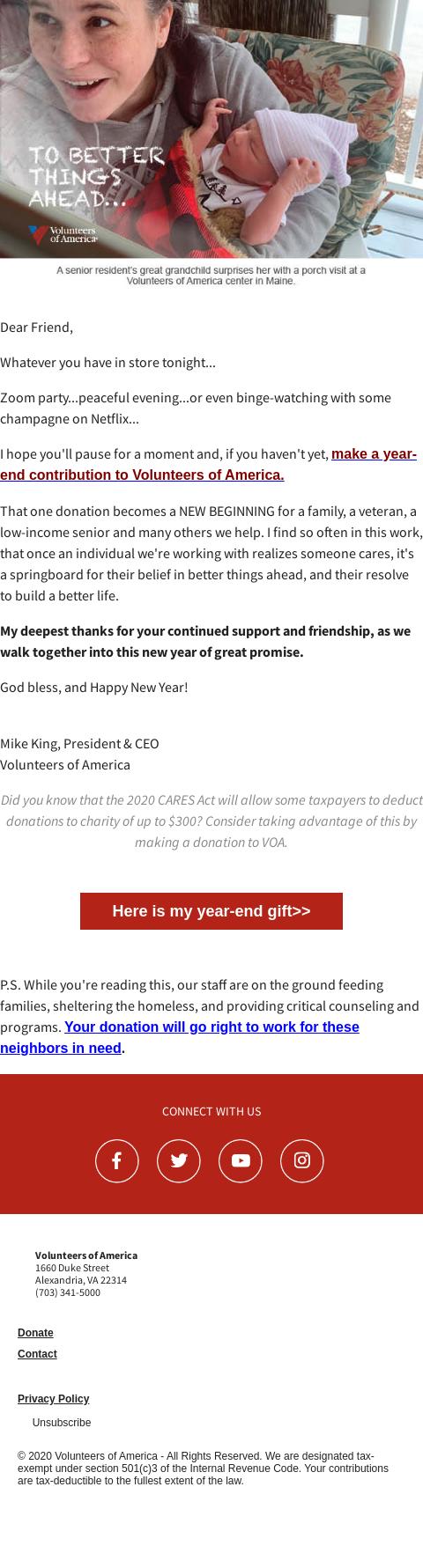

Grandmother at VOA center visited by new great grandchild

[link removed]

Dear Friend,

Whatever you have in store tonight...

Zoom party...peaceful evening...or even binge-watching with some

champagne on Netflix...

I hope you'll pause for a moment and, if you haven't yet, make a

year-end contribution to Volunteers of America.

[link removed]

That one donation becomes a NEW BEGINNING for a family, a veteran, a

low-income senior and many others we help. I find so often in this

work, that once an individual we're working with realizes someone

cares, it's a springboard for their belief in better things ahead, and

their resolve to build a better life.

My deepest thanks for your continued support and friendship, as we

walk together into this new year of great promise.

God bless, and Happy New Year!

Mike King, President & CEO

Volunteers of America

Did you know that the 2020 CARES Act will allow some taxpayers to

deduct donations to charity of up to $300? Consider taking advantage

of this by making a donation to VOA.

Here is my year-end gift>>

[link removed]

P.S. While you're reading this, our staff are on the ground feeding

families, sheltering the homeless, and providing critical counseling

and programs. Your donation will go right to work for these neighbors

in need.

[link removed]

CONNECT WITH US

Facebook

Twitter

YouTube

Instagram

[link removed]

[link removed]

[link removed]

[link removed]

VOLUNTEERS OF AMERICA

[link removed]

1660 Duke Street

Alexandria, VA 22314

(703) 341-5000

Donate

Contact

Privacy Policy

Unsubscribe

[link removed]

[link removed]

[link removed]

[link removed]

© 2020 Volunteers of America

- All Rights Reserved. We are designated tax-exempt under section

501(c)3 of the Internal Revenue Code. Your contributions are

tax-deductible to the fullest extent of the law.

#outlook a { padding:0; } /* Force Outlook to provide a "view in

browser" message */

.ReadMsgBody { width:100%; } .ExternalClass { width:100%; } /* Force

Hotmail to display emails at full width */

.ExternalClass, .ExternalClass p, .ExternalClass span, .ExternalClass

font, .ExternalClass td, .ExternalClass div { line-height: 100%; } /*

Force Hotmail to display normal line spacing */

body, table, td, a { -webkit-text-size-adjust:100%;

-ms-text-size-adjust:100%; } /* Prevent WebKit and Windows mobile

changing default text sizes */

table, td { mso-table-lspace:0pt; mso-table-rspace:0pt; } /* Remove

spacing between tables in Outlook 2007 and up */

img { -ms-interpolation-mode:bicubic; } /* Allow smoother rendering of

resized image in Internet Explorer */

body { margin:0 !important; } div[style*="margin: 16px 0"] {

margin:0 !important; } /* Fix Android 4.4 body centering issue */

/* ------------- RESET STYLES ------------- */

* { -webkit-font-smoothing: antialiased; }

body { Margin: 0; margin:0; padding:0; min-width: 100%;

-webkit-font-smoothing: antialiased; mso-line-height-rule: exactly; }

img { border:0; height:auto; line-height:0px; outline:none;

text-decoration:none;}

table { border-spacing: 0; border-collapse:collapse !important; }

body { height:100% !important; margin:0; padding:0; width:100%

!important; }

/* ------------- UTLIITY CLASSES ------------- */

/* WHEN USING CUSOM FONTS */

[style*="Source Sans Pro"] { font-family: 'Source Sans Pro', Arial,

sans-serif !important } /* Override Outlook to not break on imported

fonts */

/* iOS BLUE LINKS */

.appleBody a { color:#B32317; text-decoration: none; }

.appleFooter a, .appleFooter p { color:#ffffff; text-decoration: none;

}

/* ------------- CUSTOM STYLES ------------- */

body, table, p {

font-family: 'Source Sans Pro', Arial, sans-serif;

}

table {

background-color: #ffffff;

color: #202224;

}

.wrapper {

width: 100%;

table-layout: fixed;

-webkit-text-size-adjust: 100%;

-ms-text-size-adjust: 100%;

}

.webkit {

max-width: 600px;

}

.outer {

Margin: 0 auto;

width: 100%;

max-width: 600px;

}

.full-width-image img {

width: 100%;

max-width: 600px;

height: auto;

}

.inner {

padding: 10px;

}

p, ul, li {

color: #202224;

font-size: 16px;

line-height: 30px;

Margin: 0;

margin-bottom: 25px;

}

p a, ul li a {

color: #B32317;

text-decoration: underline;

font-weight: bold;

}

h1, .h1 {

color: #001A70;

font-size: 32px;

line-height: 35px !important;

Margin-top: 0px;

Margin-bottom: 25px;

font-family: 'Source Sans Pro', Arial, sans-serif;

-webkit-font-smoothing: antialiased;

font-weight: 600;

}

h2, .h2 {

color: #001A70;

font-size: 24px;

line-height: 32px !important;

Margin-top: 0;

Margin-bottom: 20px;

font-family: 'Source Sans Pro', Arial, sans-serif;

-webkit-font-smoothing: antialiased;

font-weight: 500;

}

.img-align-vertical img {

display: inline-block;

vertical-align: middle;

}

/* MOBILE STYLES */

@media screen and (max-width: 600px) {

.logo, .logo img {

width: 250px !important;

}

.mobile-cta-padding {

padding: 15px 0 10px !important;

}

.mobile-body-padding {

padding: 15px 20px !important;

}

.mobile-footer-padding {

padding: 40px 20px 80px !important;

}

.mobile-top-padding {

padding-top: 20px !important;

}

.donate-button, .donate-button a {

width: 120px !important;

padding-left: 0 !important;

padding-right: 0 !important;

font-size: 16px !important;

}

#hero-mobile, #hero-mobile img, .logo {

display: block !important;

max-height: none !important;

overflow: visible !important;

width: 100% !important;

}

.header-second-column, .column, .column img {

width: 100% !important;

max-width: 100% !important;

}

.contents {

min-width: auto !important;

}

.mobile-sponsor-padding {

padding: 20px 0 0 !important;

}

.mobile-block {

display: block !important;

margin: 10px 0 !important;

}

.mobile-hide {

display: none !important;

}

.mobile-center {

text-align: center !important;

padding: 15px 0px !important;

}

.mobile-center-no-pad {

text-align: center !important;

}

.mobile-logo-padding {

padding: 0px 0px 0px 10px !important;

}

.mobile-cta-padding {

padding: 20px 15px !important;

}

.mobile-pad-bottom {

padding-bottom: 20px !important;

}

.mobile-pad-left-right {

padding: 0px 20px !important;

}

.mobile-cta-no-pad-left-right {

padding: 20px 0px !important;

}

.mobile-cta-width {

width: 100% !important;

max-width: 100% !important;

}

.mobile-no-border-link {

border: none !important;

text-decoration: underline !important;

}

}

Grandmother at VOA center visited by new great grandchild

[link removed]

Dear Friend,

Whatever you have in store tonight...

Zoom party...peaceful evening...or even binge-watching with some

champagne on Netflix...

I hope you'll pause for a moment and, if you haven't yet, make a

year-end contribution to Volunteers of America.

[link removed]

That one donation becomes a NEW BEGINNING for a family, a veteran, a

low-income senior and many others we help. I find so often in this

work, that once an individual we're working with realizes someone

cares, it's a springboard for their belief in better things ahead, and

their resolve to build a better life.

My deepest thanks for your continued support and friendship, as we

walk together into this new year of great promise.

God bless, and Happy New Year!

Mike King, President & CEO

Volunteers of America

Did you know that the 2020 CARES Act will allow some taxpayers to

deduct donations to charity of up to $300? Consider taking advantage

of this by making a donation to VOA.

Here is my year-end gift>>

[link removed]

P.S. While you're reading this, our staff are on the ground feeding

families, sheltering the homeless, and providing critical counseling

and programs. Your donation will go right to work for these neighbors

in need.

[link removed]

CONNECT WITH US

YouTube

[link removed]

[link removed]

[link removed]

[link removed]

VOLUNTEERS OF AMERICA

[link removed]

1660 Duke Street

Alexandria, VA 22314

(703) 341-5000

Donate

Contact

Privacy Policy

Unsubscribe

[link removed]

[link removed]

[link removed]

[link removed]

© 2020 Volunteers of America

- All Rights Reserved. We are designated tax-exempt under section

501(c)3 of the Internal Revenue Code. Your contributions are

tax-deductible to the fullest extent of the law.

Message Analysis

- Sender: Volunteers of America

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Convio