Email

NAFCU shares supervisory guidance recommendations with NCUA, CFPB

| From | NAFCU Today <[email protected]> |

| Subject | NAFCU shares supervisory guidance recommendations with NCUA, CFPB |

| Date | December 31, 2020 12:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Also: Senate moves towards NDAA override vote; Top compliance issues of 2020

NAFCU TODAY | The News You Need Daily.

December 31, 2020

----------

----------

NAFCU shares recommendations related to supervisory guidance with NCUA, CFPB [ [link removed] ]

In response to the NCUA and CFPB's notices of proposed rulemaking on the role of supervisory guidance, NAFCU Wednesday shared its support of the agencies' commitment to working with other federal banking regulators and clarification of ambiguities stemming from a previous statement.

NDAA update: Senate moves forward on override vote [ [link removed] ]

Senate leader Mitch McConnell, R-Ky., Wednesday filed cloture on consideration of a measure to override President Donald Trump's veto of the fiscal year 2021 National Defense Authorization Act (NDAA). The chamber is expected to resume consideration of the measure, which was passed in the House earlier this week, today.

Top 5 compliance issues of 2020: Forbearances, stimulus payments, more [ [link removed] ]

As credit unions work to meet the needs of more than 123 million Americans during the coronavirus pandemic, our award-winning Regulatory Compliance Team works daily to offer compliance assistance and services to keep credit unions informed of the ever-changing regulatory environment. This year, the team answered numerous member questions, while authoring blog posts, articles, charts, guides and tools to ensure that NAFCU member credit unions stayed up to date.

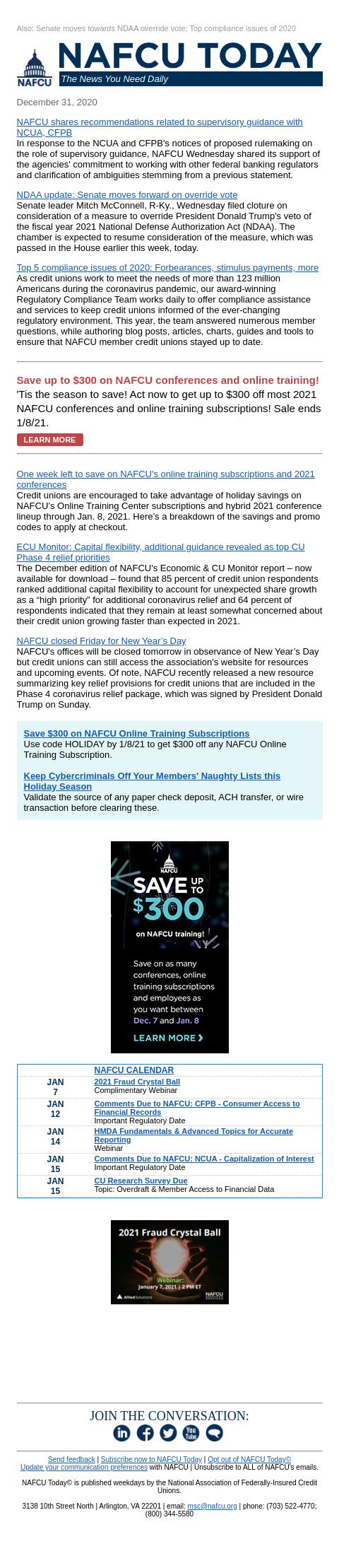

One week left to save on NAFCU's online training subscriptions and 2021 conferences [ [link removed] ]

Credit unions are encouraged to take advantage of holiday savings on NAFCU’s Online Training Center subscriptions and hybrid 2021 conference lineup through Jan. 8, 2021. Here’s a breakdown of the savings and promo codes to apply at checkout.

ECU Monitor: Capital flexibility, additional guidance revealed as top CU Phase 4 relief priorities [ [link removed] ]

The December edition of NAFCU's Economic & CU Monitor report – now available for download – found that 85 percent of credit union respondents ranked additional capital flexibility to account for unexpected share growth as a “high priority” for additional coronavirus relief and 64 percent of respondents indicated that they remain at least somewhat concerned about their credit union growing faster than expected in 2021.

NAFCU closed Friday for New Year’s Day [ [link removed] ]

NAFCU's offices will be closed tomorrow in observance of New Year’s Day but credit unions can still access the association's website for resources and upcoming events. Of note, NAFCU recently released a new resource summarizing key relief provisions for credit unions that are included in the Phase 4 coronavirus relief package, which was signed by President Donald Trump on Sunday.

----------

----------

----------

NAFCU Calendar: [link removed]

----------

--------------------------------------------

JOIN THE CONVERSATION:

LINKEDIN: [link removed]

FACEBOOK: [link removed]

TWITTER: [link removed]

YOUTUBE: [link removed]

BLOGS: [link removed] ]

---------------------------------------------

Send feedback [ mailto:[email protected] ]

Subscribe now to NAFCU Today [ [link removed] ]

Opt out of NAFCU Today? [ [link removed] ]

Update your communication preferences [ [link removed] ]

Unsubscribe to ALL of NAFCU's emails. [ [link removed] ]

NAFCU Today? is published weekdays by the National Association of Federal Credit Unions.

3138 10th Street North | Arlington, VA 22201 | email: [email protected] [ mailto:[email protected] ] | phone: (703) 522-4770; (800) 344-5580

?

Powered by Higher Logic [link removed]

NAFCU TODAY | The News You Need Daily.

December 31, 2020

----------

----------

NAFCU shares recommendations related to supervisory guidance with NCUA, CFPB [ [link removed] ]

In response to the NCUA and CFPB's notices of proposed rulemaking on the role of supervisory guidance, NAFCU Wednesday shared its support of the agencies' commitment to working with other federal banking regulators and clarification of ambiguities stemming from a previous statement.

NDAA update: Senate moves forward on override vote [ [link removed] ]

Senate leader Mitch McConnell, R-Ky., Wednesday filed cloture on consideration of a measure to override President Donald Trump's veto of the fiscal year 2021 National Defense Authorization Act (NDAA). The chamber is expected to resume consideration of the measure, which was passed in the House earlier this week, today.

Top 5 compliance issues of 2020: Forbearances, stimulus payments, more [ [link removed] ]

As credit unions work to meet the needs of more than 123 million Americans during the coronavirus pandemic, our award-winning Regulatory Compliance Team works daily to offer compliance assistance and services to keep credit unions informed of the ever-changing regulatory environment. This year, the team answered numerous member questions, while authoring blog posts, articles, charts, guides and tools to ensure that NAFCU member credit unions stayed up to date.

One week left to save on NAFCU's online training subscriptions and 2021 conferences [ [link removed] ]

Credit unions are encouraged to take advantage of holiday savings on NAFCU’s Online Training Center subscriptions and hybrid 2021 conference lineup through Jan. 8, 2021. Here’s a breakdown of the savings and promo codes to apply at checkout.

ECU Monitor: Capital flexibility, additional guidance revealed as top CU Phase 4 relief priorities [ [link removed] ]

The December edition of NAFCU's Economic & CU Monitor report – now available for download – found that 85 percent of credit union respondents ranked additional capital flexibility to account for unexpected share growth as a “high priority” for additional coronavirus relief and 64 percent of respondents indicated that they remain at least somewhat concerned about their credit union growing faster than expected in 2021.

NAFCU closed Friday for New Year’s Day [ [link removed] ]

NAFCU's offices will be closed tomorrow in observance of New Year’s Day but credit unions can still access the association's website for resources and upcoming events. Of note, NAFCU recently released a new resource summarizing key relief provisions for credit unions that are included in the Phase 4 coronavirus relief package, which was signed by President Donald Trump on Sunday.

----------

----------

----------

NAFCU Calendar: [link removed]

----------

--------------------------------------------

JOIN THE CONVERSATION:

LINKEDIN: [link removed]

FACEBOOK: [link removed]

TWITTER: [link removed]

YOUTUBE: [link removed]

BLOGS: [link removed] ]

---------------------------------------------

Send feedback [ mailto:[email protected] ]

Subscribe now to NAFCU Today [ [link removed] ]

Opt out of NAFCU Today? [ [link removed] ]

Update your communication preferences [ [link removed] ]

Unsubscribe to ALL of NAFCU's emails. [ [link removed] ]

NAFCU Today? is published weekdays by the National Association of Federal Credit Unions.

3138 10th Street North | Arlington, VA 22201 | email: [email protected] [ mailto:[email protected] ] | phone: (703) 522-4770; (800) 344-5580

?

Powered by Higher Logic [link removed]

Message Analysis

- Sender: National Association of Federally-Insured Credit Unions

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a