| From | Jerrick Adams <[email protected]> |

| Subject | U.S. Solicitor General urges SCOTUS to take up donor disclosure appeal |

| Date | December 15, 2020 8:48 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

What's at issue, and how lower courts have ruled

[Disclosure Digest by Ballotpedia]

** WELCOME TO DISCLOSURE DIGEST

------------------------------------------------------------

** DECEMBER 15, 2020

EXPLORE THE LEGISLATION, LITIGATION, AND ADVOCACY SURROUNDING NONPROFIT DONOR DISCLOSURE WITH _THE DISCLOSURE DIGEST_, A BALLOTPEDIA NEWSLETTER.

UNDER FEDERAL LAW, NONPROFITS ARE GENERALLY NOT REQUIRED TO DISCLOSE TO THE PUBLIC INFORMATION ABOUT THEIR DONORS. STATE LAWS, HOWEVER, MAY REQUIRE SUCH DISCLOSURE. SOME SAY EXPANDED DONOR DISCLOSURE PROVISIONS MINIMIZE THE POTENTIAL FOR FRAUD AND ESTABLISH PUBLIC ACCOUNTABILITY. MEANWHILE, OTHERS SAY THAT DISCLOSING TO THE PUBLIC INFORMATION ABOUT DONORS VIOLATES PRIVACY RIGHTS AND CAN INHIBIT CHARITABLE ACTIVITY.

------------------------------------------------------------

[link removed]

** SHARE THIS NEWSLETTER

------------------------------------------------------------

[link removed] out this info I found from Ballotpedia&body=[link removed]

** U.S. SOLICITOR GENERAL URGES SCOTUS TO TAKE UP DONOR DISCLOSURE APPEALE

------------------------------------------------------------

On Nov. 24, Acting U.S. Solicitor General Jeffrey Wall urged ([link removed]) the U.S. Supreme Court to take up an appeal involving a California law requiring nonprofits to disclose their donors' identities to the state's attorney general.

WHAT'S AT ISSUE, AND HOW LOWER COURTS HAVE RULED

California law ([link removed]) requires nonprofits to file copies of their IRS 990 forms with the state. Schedule B of this form includes the names and addresses of all individuals who donated more than $5,000 to the nonprofit in a given tax year. The California law requires nonprofits to give the state copies of their Schedule B forms. Although the law does not allow the public access to Schedule B information, court documents indicate inadvertent disclosures have occurred.

In 2014, Americans for Prosperity Foundation (AFPF), a 501(c)(3) nonprofit, filed suit in U.S. district court, alleging the California law violated its First Amendment rights. In 2016, Judge Manuel Real ([link removed]) of the U.S. District Court for the Central District of California found ([link removed]) in favor of AFPF and barred the state from collecting Schedule B information from the group. Real was appointed to the court by Lyndon Johnson (D).

In 2015, the Thomas More Law Center (TMLC), also a 501(c)(3) nonprofit, filed a similar suit in the same U.S. district court. In a separate 2016 ruling, Real also found ([link removed]) in favor of TMLC and prevented the state from collecting Schedule B information from the group.

The two suits were combined on appeal. A three-judge panel of the U.S. Court of Appeals for the Ninth Circuit unanimously overturned ([link removed]) Real's rulings in 2018. Judges Raymond Fisher ([link removed]) , Richard Paez ([link removed]) , and Jacqueline Nguyen ([link removed]) issued the ruling. Fisher and Paez are Bill Clinton (D) appointees. Barack Obama (D) appointed Nguyen.

Writing for the court, Fisher said:

It is clear that the disclosure requirement serves an important governmental interest. In _Center for Competitive Politics_, we recognized the [California] Attorney General's argument that 'there is a compelling law enforcement interest in the disclosure of the names of significant donors.' The Attorney General observed that 'such information is necessary to determine whether a charity is actually engaged in a charitable purpose, or is instead violating California law by engaging in self-dealing, improper loans, or other unfair business practices,' and we agreed[.]

The plaintiffs petitioned the Ninth Circuit for en banc review. That petition was rejected March 29, 2019. On Aug. 26, 2019, the plaintiffs appealed to the Supreme Court.

WHAT THE SOLICITOR GENERAL SAYS

In his Nov. 24 brief ([link removed]) , Wall wrote:

As this Court’s precedents make clear, compelled disclosures that carry a reasonable probability of harassment, reprisals, and similar harms are subject to exacting scrutiny, which requires a form of narrow tailoring. ... And given the district court’s factual findings that respondent routinely discloses Schedule B forms, thereby creating a risk of harassment, and that those forms have proved unnecessary to respondent’s regulatory enforcement duties, the compelled disclosures here are subject to narrow tailoring but lack a reasonable fit to the asserted governmental interest. The court of appeals’ contrary holding compromises important associational interests protected by the First Amendment, is of nationwide importance given California’s outsized role, and is in tension with decisions of this Court and other courts of appeals.

MORE ABOUT THE SOLICITOR GENERAL: The U.S. Solicitor General ([link removed]) argues cases on behalf of the federal government before the Supreme Court and in all federal appellate courts. The federal government is involved either as a party or as an amicus curiae in approximately two-thirds of all cases before the Supreme Court.

Wall became Acting Solicitor General on July 3 after Noel Francisco, who had served in the post since 2017, resigned. Wall had previously served as Principal Deputy Solicitor General. He clerked for Associate Justice Clarence Thomas.

WHAT COMES NEXT

The Supreme Court has not yet indicated whether it will hear the appeal, and the case has not yet been scheduled for conference. The case name and number are Americans for Prosperity Foundation v. Becerra ([link removed]) (19-251).

[link removed]

** THE BIG PICTURE

------------------------------------------------------------

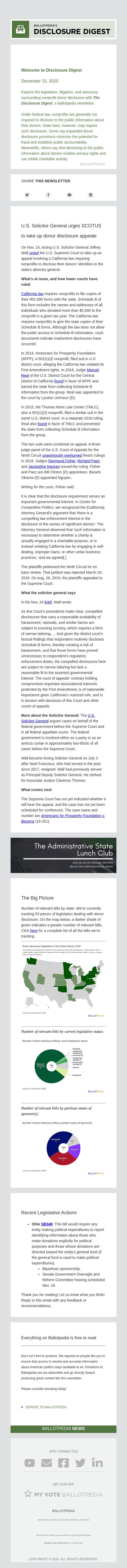

Number of relevant bills by state: We're currently tracking 53 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here ([link removed]) for a complete list of all the bills we're tracking.

------------------------------------------------------------

[link removed]

------------------------------------------------------------

Number of relevant bills by current legislative status:

[link removed]

------------------------------------------------------------

Number of relevant bills by partisan status of sponsor(s):

[link removed]

** RECENT LEGISLATIVE ACTIONS

------------------------------------------------------------

* OHIO SB349 ([link removed]) : This bill would require any entity making political expenditures to report identifying information about those who make donations explicitly for political purposes and those whose donations are directed toward the entity's general fund (if the general fund is used to make political expenditures).

* Bipartisan sponsorship.

* Senate Government Oversight and Reform Committee hearing scheduled Nov. 18.

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations.

** EVERYTHING ON BALLOTPEDIA IS FREE TO READ

------------------------------------------------------------

------------------------------------------------------------

But it isn't free to produce. We depend on people like you to ensure that access to neutral and accurate information about American politics stays available to all. Donations to Ballotpedia are tax deductible and go directly toward producing great content like this newsletter.

Please consider donating today!

> DONATE TO BALLOTPEDIA ([link removed])

BALLOTPEDIA NEWS ([link removed])

STAY CONNECTED

[link removed] [link removed] [link removed] [link removed] [link removed]

------------------------------------------------------------

GET OUR APP

[link removed]

BALLOTPEDIA

8383 Greenway Blvd | Suite 600 | Middleton, WI 53562

Decide which emails you would like to get from Ballotpedia

Update your preferences ( [link removed] ) | Unsubscribe ( [link removed] )

COPYRIGHT © 2020. ALL RIGHTS RESERVED.

[Disclosure Digest by Ballotpedia]

** WELCOME TO DISCLOSURE DIGEST

------------------------------------------------------------

** DECEMBER 15, 2020

EXPLORE THE LEGISLATION, LITIGATION, AND ADVOCACY SURROUNDING NONPROFIT DONOR DISCLOSURE WITH _THE DISCLOSURE DIGEST_, A BALLOTPEDIA NEWSLETTER.

UNDER FEDERAL LAW, NONPROFITS ARE GENERALLY NOT REQUIRED TO DISCLOSE TO THE PUBLIC INFORMATION ABOUT THEIR DONORS. STATE LAWS, HOWEVER, MAY REQUIRE SUCH DISCLOSURE. SOME SAY EXPANDED DONOR DISCLOSURE PROVISIONS MINIMIZE THE POTENTIAL FOR FRAUD AND ESTABLISH PUBLIC ACCOUNTABILITY. MEANWHILE, OTHERS SAY THAT DISCLOSING TO THE PUBLIC INFORMATION ABOUT DONORS VIOLATES PRIVACY RIGHTS AND CAN INHIBIT CHARITABLE ACTIVITY.

------------------------------------------------------------

[link removed]

** SHARE THIS NEWSLETTER

------------------------------------------------------------

[link removed] out this info I found from Ballotpedia&body=[link removed]

** U.S. SOLICITOR GENERAL URGES SCOTUS TO TAKE UP DONOR DISCLOSURE APPEALE

------------------------------------------------------------

On Nov. 24, Acting U.S. Solicitor General Jeffrey Wall urged ([link removed]) the U.S. Supreme Court to take up an appeal involving a California law requiring nonprofits to disclose their donors' identities to the state's attorney general.

WHAT'S AT ISSUE, AND HOW LOWER COURTS HAVE RULED

California law ([link removed]) requires nonprofits to file copies of their IRS 990 forms with the state. Schedule B of this form includes the names and addresses of all individuals who donated more than $5,000 to the nonprofit in a given tax year. The California law requires nonprofits to give the state copies of their Schedule B forms. Although the law does not allow the public access to Schedule B information, court documents indicate inadvertent disclosures have occurred.

In 2014, Americans for Prosperity Foundation (AFPF), a 501(c)(3) nonprofit, filed suit in U.S. district court, alleging the California law violated its First Amendment rights. In 2016, Judge Manuel Real ([link removed]) of the U.S. District Court for the Central District of California found ([link removed]) in favor of AFPF and barred the state from collecting Schedule B information from the group. Real was appointed to the court by Lyndon Johnson (D).

In 2015, the Thomas More Law Center (TMLC), also a 501(c)(3) nonprofit, filed a similar suit in the same U.S. district court. In a separate 2016 ruling, Real also found ([link removed]) in favor of TMLC and prevented the state from collecting Schedule B information from the group.

The two suits were combined on appeal. A three-judge panel of the U.S. Court of Appeals for the Ninth Circuit unanimously overturned ([link removed]) Real's rulings in 2018. Judges Raymond Fisher ([link removed]) , Richard Paez ([link removed]) , and Jacqueline Nguyen ([link removed]) issued the ruling. Fisher and Paez are Bill Clinton (D) appointees. Barack Obama (D) appointed Nguyen.

Writing for the court, Fisher said:

It is clear that the disclosure requirement serves an important governmental interest. In _Center for Competitive Politics_, we recognized the [California] Attorney General's argument that 'there is a compelling law enforcement interest in the disclosure of the names of significant donors.' The Attorney General observed that 'such information is necessary to determine whether a charity is actually engaged in a charitable purpose, or is instead violating California law by engaging in self-dealing, improper loans, or other unfair business practices,' and we agreed[.]

The plaintiffs petitioned the Ninth Circuit for en banc review. That petition was rejected March 29, 2019. On Aug. 26, 2019, the plaintiffs appealed to the Supreme Court.

WHAT THE SOLICITOR GENERAL SAYS

In his Nov. 24 brief ([link removed]) , Wall wrote:

As this Court’s precedents make clear, compelled disclosures that carry a reasonable probability of harassment, reprisals, and similar harms are subject to exacting scrutiny, which requires a form of narrow tailoring. ... And given the district court’s factual findings that respondent routinely discloses Schedule B forms, thereby creating a risk of harassment, and that those forms have proved unnecessary to respondent’s regulatory enforcement duties, the compelled disclosures here are subject to narrow tailoring but lack a reasonable fit to the asserted governmental interest. The court of appeals’ contrary holding compromises important associational interests protected by the First Amendment, is of nationwide importance given California’s outsized role, and is in tension with decisions of this Court and other courts of appeals.

MORE ABOUT THE SOLICITOR GENERAL: The U.S. Solicitor General ([link removed]) argues cases on behalf of the federal government before the Supreme Court and in all federal appellate courts. The federal government is involved either as a party or as an amicus curiae in approximately two-thirds of all cases before the Supreme Court.

Wall became Acting Solicitor General on July 3 after Noel Francisco, who had served in the post since 2017, resigned. Wall had previously served as Principal Deputy Solicitor General. He clerked for Associate Justice Clarence Thomas.

WHAT COMES NEXT

The Supreme Court has not yet indicated whether it will hear the appeal, and the case has not yet been scheduled for conference. The case name and number are Americans for Prosperity Foundation v. Becerra ([link removed]) (19-251).

[link removed]

** THE BIG PICTURE

------------------------------------------------------------

Number of relevant bills by state: We're currently tracking 53 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here ([link removed]) for a complete list of all the bills we're tracking.

------------------------------------------------------------

[link removed]

------------------------------------------------------------

Number of relevant bills by current legislative status:

[link removed]

------------------------------------------------------------

Number of relevant bills by partisan status of sponsor(s):

[link removed]

** RECENT LEGISLATIVE ACTIONS

------------------------------------------------------------

* OHIO SB349 ([link removed]) : This bill would require any entity making political expenditures to report identifying information about those who make donations explicitly for political purposes and those whose donations are directed toward the entity's general fund (if the general fund is used to make political expenditures).

* Bipartisan sponsorship.

* Senate Government Oversight and Reform Committee hearing scheduled Nov. 18.

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations.

** EVERYTHING ON BALLOTPEDIA IS FREE TO READ

------------------------------------------------------------

------------------------------------------------------------

But it isn't free to produce. We depend on people like you to ensure that access to neutral and accurate information about American politics stays available to all. Donations to Ballotpedia are tax deductible and go directly toward producing great content like this newsletter.

Please consider donating today!

> DONATE TO BALLOTPEDIA ([link removed])

BALLOTPEDIA NEWS ([link removed])

STAY CONNECTED

[link removed] [link removed] [link removed] [link removed] [link removed]

------------------------------------------------------------

GET OUR APP

[link removed]

BALLOTPEDIA

8383 Greenway Blvd | Suite 600 | Middleton, WI 53562

Decide which emails you would like to get from Ballotpedia

Update your preferences ( [link removed] ) | Unsubscribe ( [link removed] )

COPYRIGHT © 2020. ALL RIGHTS RESERVED.

Message Analysis

- Sender: Ballotpedia

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Litmus