Email

Unemployment Data Update: March through December 10, 2020

| From | Center for Jobs and the Economy <[email protected]> |

| Subject | Unemployment Data Update: March through December 10, 2020 |

| Date | December 11, 2020 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] Unemployment Data Update: March through December 10, 2020 Unemployment Insurance Claims

Initial claims continued to climb but more sharply during the week of December 5, as all but 6 counties were placed by the state under the most restrictive Tier 1 status—now all but 4 smaller mountain counties in the most recent state orders for December 8. The recent wave of “stay at home” orders is now shutting many businesses especially small businesses who had been able to partially reopen during this most critical cash flow part of their revenue year. Given the timing on the surveys used to estimate the jobs and employment numbers, the effects of this current round will not likely become apparent until the release of the December numbers scheduled for later in January.

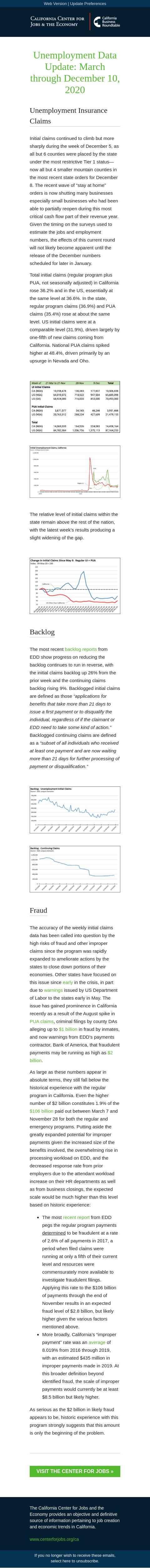

Total initial claims (regular program plus PUA, not seasonally adjusted) in California rose 36.2% and in the US, essentially at the same level at 36.6%. In the state, regular program claims (36.9%) and PUA claims (35.4%) rose at about the same level. US initial claims were at a comparable level (31.9%), driven largely by one-fifth of new claims coming from California. National PUA claims spiked higher at 48.4%, driven primarily by an upsurge in Nevada and Oho.

The relative level of initial claims within the state remain above the rest of the nation, with the latest week’s results producing a slight widening of the gap.

Backlog

The most recent backlog reports [[link removed]] from EDD show progress on reducing the backlog continues to run in reverse, with the initial claims backlog up 26% from the prior week and the continuing claims backlog rising 9%. Backlogged initial claims are defined as those “applications for benefits that take more than 21 days to issue a first payment or to disqualify the individual, regardless of if the claimant or EDD need to take some kind of action.” Backlogged continuing claims are defined as a “subset of all individuals who received at least one payment and are now waiting more than 21 days for further processing of payment or disqualification.”

Fraud

The accuracy of the weekly initial claims data has been called into question by the high risks of fraud and other improper claims since the program was rapidly expanded to ameliorate actions by the states to close down portions of their economies. Other states have focused on this issue since early [[link removed]] in the crisis, in part due to warnings [[link removed]] issued by US Department of Labor to the states early in May. The issue has gained prominence in California recently as a result of the August spike in PUA claims [[link removed]], criminal filings by county DAs alleging up to $1 billion [[link removed]] in fraud by inmates, and now warnings from EDD’s payments contractor, Bank of America, that fraudulent payments may be running as high as $2 billion [[link removed]].

As large as these numbers appear in absolute terms, they still fall below the historical experience with the regular program in California. Even the higher number of $2 billion constitutes 1.9% of the $106 billion [[link removed]] paid out between March 7 and November 28 for both the regular and emergency programs. Putting aside the greatly expanded potential for improper payments given the increased size of the benefits involved, the overwhelming rise in processing workload on EDD, and the decreased response rate from prior employers due to the attendant workload increase on their HR departments as well as from business closings, the expected scale would be much higher than this level based on historic experience:

The most recent report [[link removed]] from EDD pegs the regular program payments determined to be fraudulent at a rate of 2.6% of all payments in 2017, a period when filed claims were running at only a fifth of their current level and resources were commensurately more available to investigate fraudulent filings. Applying this rate to the $106 billion of payments through the end of November results in an expected fraud level of $2.8 billion, but likely higher given the various factors mentioned above. More broadly, California’s “improper payment” rate was an average [[link removed]] of 8.019% from 2016 through 2019, with an estimated $435 million in improper payments made in 2019. At this broader definition beyond identified fraud, the scale of improper payments would currently be at least $8.5 billion but likely higher.

As serious as the $2 billion in likely fraud appears to be, historic experience with this program strongly suggests that this amount is only the beginning of the problem.

Visit The Center For Jobs » [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Initial claims continued to climb but more sharply during the week of December 5, as all but 6 counties were placed by the state under the most restrictive Tier 1 status—now all but 4 smaller mountain counties in the most recent state orders for December 8. The recent wave of “stay at home” orders is now shutting many businesses especially small businesses who had been able to partially reopen during this most critical cash flow part of their revenue year. Given the timing on the surveys used to estimate the jobs and employment numbers, the effects of this current round will not likely become apparent until the release of the December numbers scheduled for later in January.

Total initial claims (regular program plus PUA, not seasonally adjusted) in California rose 36.2% and in the US, essentially at the same level at 36.6%. In the state, regular program claims (36.9%) and PUA claims (35.4%) rose at about the same level. US initial claims were at a comparable level (31.9%), driven largely by one-fifth of new claims coming from California. National PUA claims spiked higher at 48.4%, driven primarily by an upsurge in Nevada and Oho.

The relative level of initial claims within the state remain above the rest of the nation, with the latest week’s results producing a slight widening of the gap.

Backlog

The most recent backlog reports [[link removed]] from EDD show progress on reducing the backlog continues to run in reverse, with the initial claims backlog up 26% from the prior week and the continuing claims backlog rising 9%. Backlogged initial claims are defined as those “applications for benefits that take more than 21 days to issue a first payment or to disqualify the individual, regardless of if the claimant or EDD need to take some kind of action.” Backlogged continuing claims are defined as a “subset of all individuals who received at least one payment and are now waiting more than 21 days for further processing of payment or disqualification.”

Fraud

The accuracy of the weekly initial claims data has been called into question by the high risks of fraud and other improper claims since the program was rapidly expanded to ameliorate actions by the states to close down portions of their economies. Other states have focused on this issue since early [[link removed]] in the crisis, in part due to warnings [[link removed]] issued by US Department of Labor to the states early in May. The issue has gained prominence in California recently as a result of the August spike in PUA claims [[link removed]], criminal filings by county DAs alleging up to $1 billion [[link removed]] in fraud by inmates, and now warnings from EDD’s payments contractor, Bank of America, that fraudulent payments may be running as high as $2 billion [[link removed]].

As large as these numbers appear in absolute terms, they still fall below the historical experience with the regular program in California. Even the higher number of $2 billion constitutes 1.9% of the $106 billion [[link removed]] paid out between March 7 and November 28 for both the regular and emergency programs. Putting aside the greatly expanded potential for improper payments given the increased size of the benefits involved, the overwhelming rise in processing workload on EDD, and the decreased response rate from prior employers due to the attendant workload increase on their HR departments as well as from business closings, the expected scale would be much higher than this level based on historic experience:

The most recent report [[link removed]] from EDD pegs the regular program payments determined to be fraudulent at a rate of 2.6% of all payments in 2017, a period when filed claims were running at only a fifth of their current level and resources were commensurately more available to investigate fraudulent filings. Applying this rate to the $106 billion of payments through the end of November results in an expected fraud level of $2.8 billion, but likely higher given the various factors mentioned above. More broadly, California’s “improper payment” rate was an average [[link removed]] of 8.019% from 2016 through 2019, with an estimated $435 million in improper payments made in 2019. At this broader definition beyond identified fraud, the scale of improper payments would currently be at least $8.5 billion but likely higher.

As serious as the $2 billion in likely fraud appears to be, historic experience with this program strongly suggests that this amount is only the beginning of the problem.

Visit The Center For Jobs » [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor