|

|

|

|

Welcome to Union Station, our weekly newsletter that keeps you abreast of the legislation, national trends, and public debate surrounding public-sector union policy.

BALLOTPEDIA RELEASES RESULTS FROM RESEARCH ON PUBLIC-SECTOR UNION FINANCES

Our research project analyzing public-sector union membership, finances, and political spending is now complete. In last week's edition, we shared our key findings on membership figures. This week, let's turn our attention to finances.

Methodology

Under federal law, unions representing public-sector employees exclusively are not required to file financial reports with the U.S. Department of Labor. Furthermore, unions' organizational hierarchies make it exceedingly difficult to collect exhaustive data. Because these challenges make it all but impossible to collect comprehensive data on public-sector union finances, we took a more narrowly-tailored approach: identifying the most prominent public-sector unions in each state and compiling financial information disclosed via IRS filings.

For more complete information on our methodology, including a discussion of existing research and the various challenges involved in collecting data, please see this article.

Summary of findings

We collected data for 228 unions nationwide, averaging about five in each state. We identified these unions based on media reports, consultation with experts on the ground, and our own research efforts. Generally speaking, union revenues come largely from members' dues. Unions might also generate revenues through investments, the sale of assets, or non-dues contributions.

Aggregate revenues for these 228 unions during the most recent federal reporting periods totaled $2.1 billion. In terms, the top five revenues were as follows:

- New York, where five unions brought in $459.6 million, approximately 22 percent of the nationwide total.

- California, where six unions brought in $295.6 million, 14 percent of the nationwide total.

- New Jersey, where four unions brought in $140.1 million, 7 percent of the nationwide total.

- Illinois, where five unions brought in $111.3 million, 5 percent of the nationwide total.

- Pennsylvania, where five unions brought $110.5 million, 5 percent of the nationwide total.

Combined revenues from the unions in these five states totaled $1.1 billion, about 53 percent of the nationwide total. Meanwhile, revenues in the 25 states rounding out the bottom of our list totaled $183.6 million—about 9 percent of the nationwide total.

For a complete breakdown of our financial data, including links to state-specific data sets, see this article. Next week, we'll review unions' political spending.

|

THE BIG PICTURE

Number of relevant bills by state

We are currently tracking 102 pieces of legislation dealing with public-sector employee union policy. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here for a complete list of all the bills we're tracking.

Number of relevant bills by current legislative status

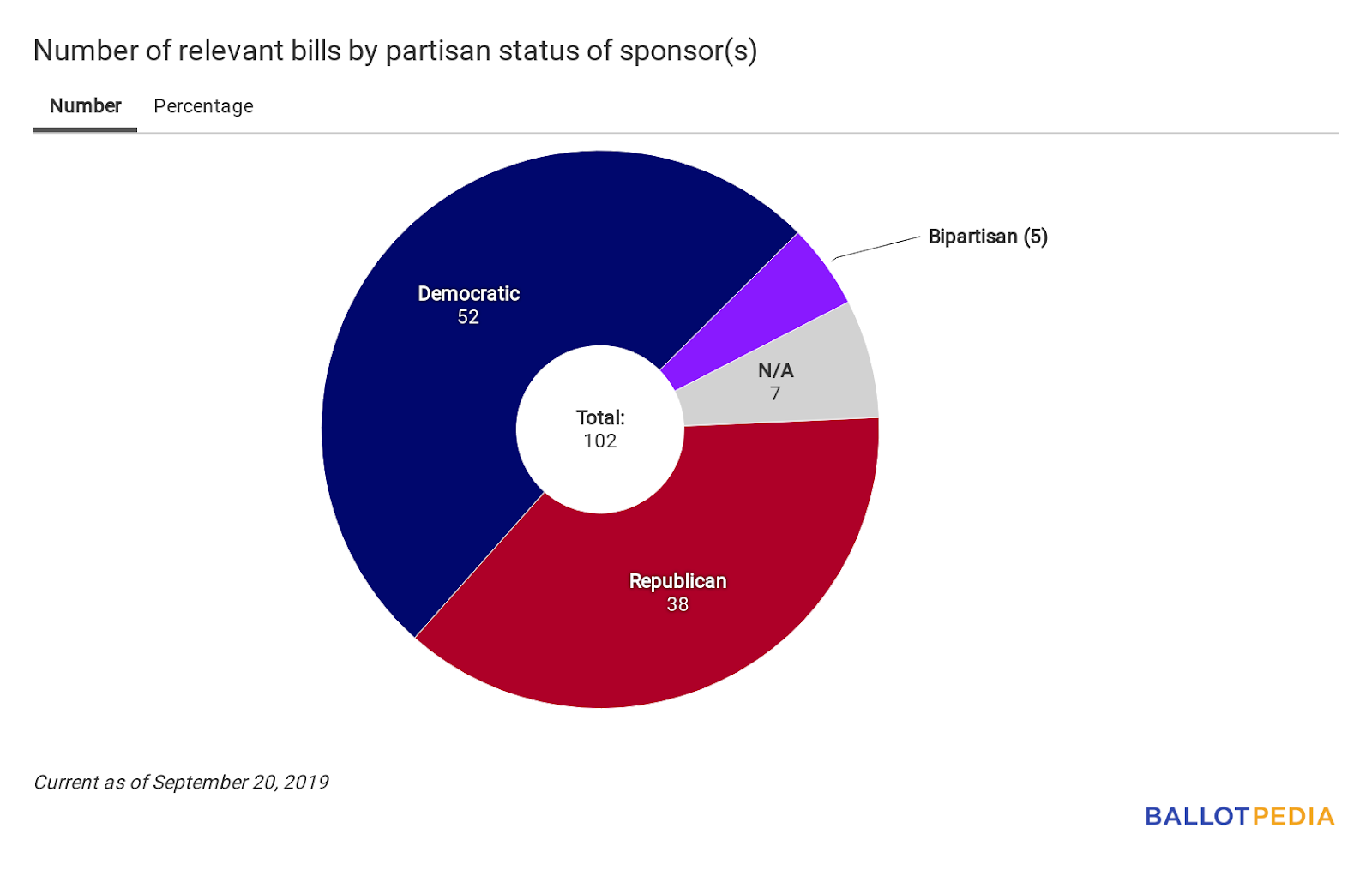

Number of relevant bills by partisan status of sponsor(s)

|

RECENT LEGISLATIVE ACTIONS

Below is a complete list of legislative actions taken since our last issue. Bills are listed in alphabetical order, first by state then by bill number.

- Massachusetts H3854: This bill would authorize employers to disclose personal employee information to unions. It would also permit unions to require non-members to pay for the costs associated with grievance and arbitration proceedings. It would require employers to provide unions with access to employees, and it would allow for dues deduction authorizations to be irrevocable for a period of up to one year.

- Senate overrode governor's veto September 19.

- New Hampshire HB363: This bill would establish the state legislature as a public employer under the state's public-employer labor relations laws.

- Legislative Administration Committee work session scheduled for September 26.

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations. |

|

Ballotpedia depends on the support of our readers.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

|

|

|

|

|