Email

Research Release: Equalization payments to Maritime Canada in jeopardy as Alberta and other “have” provinces struggle

| From | Niels Veldhuis <[email protected]> |

| Subject | Research Release: Equalization payments to Maritime Canada in jeopardy as Alberta and other “have” provinces struggle |

| Date | December 3, 2020 12:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Dear John,

Today, the Fraser Institute released a new study, The Great Convergence: Measuring the Fiscal Gap Between “Have” and “Have-Not” Provinces [[link removed]]. It finds that the gap between the ability of Canada’s richer and poorer provinces to raise revenues is shrinking rapidly. If Alberta’s fiscal capacity gap continues to shrink relative to the rest of Canada, the province could soon become eligible for equalization transfers, which would affect transfers to other so-called “have not” provinces.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

Suite 1207, Duke Tower, 5251 Duke St, Halifax, NS B3J 1P3

Equalization payments to Maritime Canada in jeopardy as Alberta and other “have” provinces struggle

HALIFAX—Economic weakness in Alberta and other “have” provinces is causing the gap between Canada’s richer and poorer provinces to shrink rapidly. If it continues, this trend could result in reduced equalization payments to Maritime Canada. So finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

This convergence has been driven primarily by declining economic strength in high income provinces rather than by growth in the so-called “have-nots”.

“The federal government sets aside a fixed amount of money for equalization each year. If due to economic hardship more provinces become equalization-eligible, that would leave less available for current recipients such as the Maritime provinces,” said Ben Eisen, a senior fellow with the Fraser Institute and co-author of The Great Convergence: Measuring the Fiscal Gap Between “Have” and “Have-Not” Provinces [[link removed]].

The authors note that Newfoundland and Labrador is not currently an equalization recipient, but is likely to become eligible again soon if current trends continue.

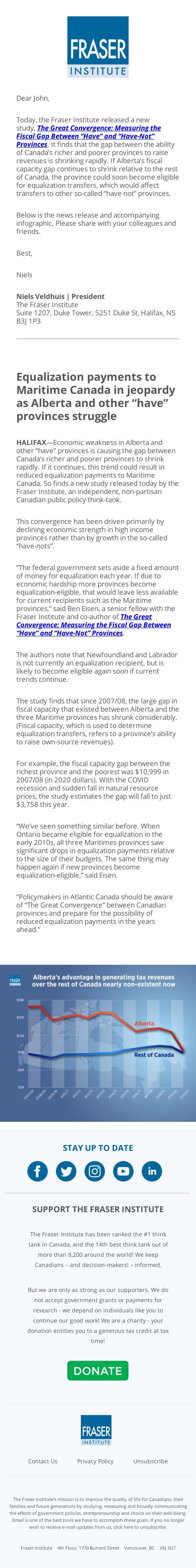

The study finds that since 2007/08, the large gap in fiscal capacity that existed between Alberta and the three Maritime provinces has shrunk considerably. (Fiscal capacity, which is used to determine equalization transfers, refers to a province’s ability to raise own-source revenues).

For example, the fiscal capacity gap between the richest province and the poorest was $10,999 in 2007/08 (in 2020 dollars). With the COVID recession and sudden fall in natural resource prices, the study estimates the gap will fall to just $3,758 this year.

“We’ve seen something similar before. When Ontario became eligible for equalization in the early 2010s, all three Maritimes provinces saw significant drops in equalization payments relative to the size of their budgets. The same thing may happen again if new provinces become equalization-eligible,” said Eisen.

“Policymakers in Atlantic Canada should be aware of “The Great Convergence” between Canadian provinces and prepare for the possibility of reduced equalization payments in the years ahead.”

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Today, the Fraser Institute released a new study, The Great Convergence: Measuring the Fiscal Gap Between “Have” and “Have-Not” Provinces [[link removed]]. It finds that the gap between the ability of Canada’s richer and poorer provinces to raise revenues is shrinking rapidly. If Alberta’s fiscal capacity gap continues to shrink relative to the rest of Canada, the province could soon become eligible for equalization transfers, which would affect transfers to other so-called “have not” provinces.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

Suite 1207, Duke Tower, 5251 Duke St, Halifax, NS B3J 1P3

Equalization payments to Maritime Canada in jeopardy as Alberta and other “have” provinces struggle

HALIFAX—Economic weakness in Alberta and other “have” provinces is causing the gap between Canada’s richer and poorer provinces to shrink rapidly. If it continues, this trend could result in reduced equalization payments to Maritime Canada. So finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

This convergence has been driven primarily by declining economic strength in high income provinces rather than by growth in the so-called “have-nots”.

“The federal government sets aside a fixed amount of money for equalization each year. If due to economic hardship more provinces become equalization-eligible, that would leave less available for current recipients such as the Maritime provinces,” said Ben Eisen, a senior fellow with the Fraser Institute and co-author of The Great Convergence: Measuring the Fiscal Gap Between “Have” and “Have-Not” Provinces [[link removed]].

The authors note that Newfoundland and Labrador is not currently an equalization recipient, but is likely to become eligible again soon if current trends continue.

The study finds that since 2007/08, the large gap in fiscal capacity that existed between Alberta and the three Maritime provinces has shrunk considerably. (Fiscal capacity, which is used to determine equalization transfers, refers to a province’s ability to raise own-source revenues).

For example, the fiscal capacity gap between the richest province and the poorest was $10,999 in 2007/08 (in 2020 dollars). With the COVID recession and sudden fall in natural resource prices, the study estimates the gap will fall to just $3,758 this year.

“We’ve seen something similar before. When Ontario became eligible for equalization in the early 2010s, all three Maritimes provinces saw significant drops in equalization payments relative to the size of their budgets. The same thing may happen again if new provinces become equalization-eligible,” said Eisen.

“Policymakers in Atlantic Canada should be aware of “The Great Convergence” between Canadian provinces and prepare for the possibility of reduced equalization payments in the years ahead.”

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor