Email

Basin Electric faces growing pressure on coal from co-ops, insurers, and banks

| From | Energy and Policy Institute <[email protected]> |

| Subject | Basin Electric faces growing pressure on coal from co-ops, insurers, and banks |

| Date | November 24, 2020 1:02 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

** Basin Electric faces growing pressure on coal from co-ops, insurers, and banks ([link removed])

------------------------------------------------------------

By Joe Smyth on Nov 23, 2020 10:55 pm

The generation and transmission association that provides electricity to large swaths of the rural West and Upper Midwest is facing increasing pressure from its member cooperatives and lenders about its reliance on coal, challenges to its rates in proceedings at the Federal Energy Regulatory Commission, and efforts by some member cooperatives to end their contracts in order to purchase wholesale power from other providers.

Those challenges facing Basin Electric reflect the growing tension between some of the electric cooperatives that provide electricity to much of rural America, and the generation and transmission associations that sell wholesale power to those co-ops largely generated with increasingly uneconomic coal plants.

As one co-op director put it ([link removed]) , “Across America, the generation and transmission model is being challenged by the distribution cooperatives who own them. We want more flexibility and local control to help us manage and even reduce costs.”

** Basin Electric affects millions of ratepayers in nine states

------------------------------------------------------------

Although the name Basin Electric doesn’t show up on customers’ electric bills, its decisions, power plants, policies, and rates affect millions of families and businesses in a vast region stretching from the borders with Canada to Mexico. As a generation and transmission association, Basin Electric operates power plants and sells wholesale power, which is ultimately distributed by more than 100 electric cooperatives ([link removed]) to homes and businesses in Minnesota, Iowa, North Dakota, South Dakota, Nebraska, Montana, Wyoming, Colorado, and New Mexico.

Basin Electric reported $2.3 billion in revenue in 2019, more than any other generation and transmission association, according ([link removed]) to the National Cooperative Bank. It sold 20.1 million megawatt hours of electricity in 2018, making it the 39th largest power provider in the U.S. – and among the most carbon-intensive, according to M.J. Bradley’s latest Benchmarking Air Emissions report ([link removed]) . Basin Electric emitted more tons of carbon pollution in 2018 than any other cooperatively owned utility or generation and transmission association, according to the report.

Somewhat unusually for generation and transmission associations, Basin Electric sells wholesale power mostly to other generation and transmission associations, so it is sometimes called a “Super G&T.” The generation and transmission associations that buy wholesale power from Basin Electric include East River Electric Power Cooperative, Northwestern Power Cooperative, Central Power Electric Cooperative, Rushmore Electric Power Cooperative, Central Montana Power Electric Cooperative, Upper Missouri Electric Cooperative, Corn Belt Power Cooperative, Members 1st Electric Cooperative, and Tri-State Generation and Transmission Association. Those entities then sell that power to electric cooperatives, which distribute it to retail customers.

Tri-State, which sells power to cooperatives in Colorado, New Mexico, Wyoming and Nebraska, purchases a portion of that power from Basin Electric, although Tri-State generates more from its own power plants.

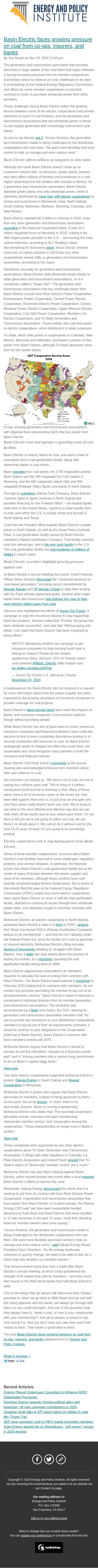

A map showing generation and transmission associations, with diagonal lines representing G&Ts that buy power from Basin Electric

** Basin Electric owns and operates a sprawling array of coal facilities

------------------------------------------------------------

Basin Electric is heavily reliant on coal, and owns a fleet of coal plants and a coal gasification facility, along with ownership stakes in coal mines.

Basin operates ([link removed]) four coal plants; the 1700 megawatt Laramie River Station and the 385 megawatt Dry Fork Station in Wyoming, and the 666 megawatt Leland Olds and 900 megawatt Antelope Valley lignite coal plants in North Dakota.

Through its subsidiary ([link removed]) Dakota Coal Company, Basin Electric “controls rights to lignite reserves in North Dakota and provides financing for the Freedom Mine” – the largest lignite coal mine in the United States. Lignite is a lower-quality form of coal, and within the U.S. is mostly mined and burned in North Dakota and Texas.

Coal from the Freedom Mine supplies Basin Electric’s power plants in North Dakota, as well as the Great Plains Synfuels Plant, a coal gasification facility owned by Basin Electric subsidiary Dakota Gasification Company. That facility converts coal into natural gas, and is the only such facility ([link removed].) in the U.S. The coal gasification facility has lost hundreds of millions of dollars ([link removed]) in recent years.

** Basin Electric executives highlight growing pressure against coal

------------------------------------------------------------

At Basin Electric’s annual meeting this month, Chief Financial Officer Steve Johnson discussed ([link removed]) the “continued pressure on coal-based generation,” including recent commitments by Morgan Stanley ([link removed]) and JP Morgan Chase ([link removed]) to align their lending with the Paris climate agreement goals. Several other major banks have also announced new policies this year to help push electric utilities away from coal ([link removed]) .

Johnson also highlighted the efforts of Insure Our Future ([link removed]) , a campaign to urge the insurance industry to stop supporting fossil fuel projects. Johnson noted that “Frankly, the group has been relatively successful,” and said that “Without going into detail, I can state that Basin Electric has been impacted by these efforts.”

WATCH: Wondering whether our campaign to get insurance companies to stop insuring fossil fuels is having an impact? Please let our newest spokesman Steve Johnson, CFO of *checks notes* coal-powered @Basin_Electric ([link removed]) utility explain how. pic.twitter.com/eqicvNAYHe ([link removed])

— Insure Our Future U.S. (@Insure_Future) November 20, 2020 ([link removed])

A spokesperson for Basin Electric did not respond to a request for more information about how the power supplier has been impacted by the growing reluctance of insurance companies to provide coverage for coal projects.

Basin Electric’s latest annual report ([link removed]) also noted the impacts of banks’ and insurance companies’ coal exclusion policies, though without providing details:

While Basin Electric has lots of good news to share, numerous insurance companies and financial institutions have made the decision to limit or even completely discontinue lending to or insuring companies with exposure to coal. As Basin Electric strategically works to mitigate the effect this could have, the cooperative also must recognize many partners in both the insurance and financial markets.

Basin Electric CEO Paul Sukut’s comments ([link removed]) at the annual meeting also acknowledged pressure from members about their over reliance on coal:

Our members are asking us, “We have a lot of coal, and we’re seeing less reliance upon coal.” We’re living in a carbon-constrained world and we’re listening to that. Many of those plants have a lot of economic value on the books yet, they have debt against them and so, to just drop an end gate and shut them down really doesn’t work very well. We’re trying to see what is the most efficient and effective way that we can write them off the books and be less reliant upon them. I’m not here to tell you we’re not going to utilize our coal, we are, there’s no doubt about it. We cannot do it without coal for the next 15-20 years at least; it’s just going to be something gradual.

** Electric cooperatives seek to stop buying power from Basin Electric

------------------------------------------------------------

Some of those member cooperatives’ concerns about Basin Electric’s coal facilities have led to court challenges, regulatory protests, and contract disputes. In particular, the financial losses from Basin Electric’s coal gasification facility are at the center of years of tension between the power supplier and some of its members, although those conflicts have until recently remained largely behind closed doors. But a series of documents filed this year at the Federal Energy Regulatory Commission (FERC) reveal how some electric cooperatives have urged Basin Electric to close or sell the coal gasification facility, objected to covering its losses through their wholesale power rates, and ultimately sought to end their contracts with Basin Electric.

McKenzie Electric, an electric cooperative in North Dakota, protested Basin Electric’s rates in a filing ([link removed]) to FERC, arguing ([link removed]) that “Basin has forced DGC’s (Dakota Gasification Company) bailout on its membership” – and that this isn’t allowed under the Federal Power Act, since the facility isn’t used to generate or transmit electricity. McKenzie Electric’s filing includes dozens of documents ([link removed]) detailing its struggles with Basin Electric, from a letter ([link removed]) last year asking about the process of ending its contract, to a resolution

([link removed]) opposing the coal gasification facility dating back to 1988.

Basin Electric aggressively responded to its members’ requests to calculate the cost of ending their contracts with Basin Electric. The Basin Electric board passed a resolution ([link removed]) in February 2019 stating that its contracts with members “do not contain any provision permitting the member to buy-out of its all-requirements contract.” Basin Electric’s board of directors is comprised of individual directors from its member generation and transmission associations. The resolution was accompanied by a letter ([link removed]) from Sukut, the CEO, warning its generation and transmission association members that “for you to provide any assistance to your [distribution cooperative] members in buying out of their all-requirements contracts, it would be contrary to your obligations to the

Cooperative” [referring to Basin Electric]. Basin Electric’s contracts with most members extend until 2075.

McKenzie Electric argues that Basin Electric’s refusal to provide an exit fee calculation “equates to a financial suicide pact” and is “locking members into a century-long commitment to act as Basin’s captive piggy bank.”

View note ([link removed])

Two other electric cooperatives supported McKenzie Electric’s protest: Dakota Energy ([link removed]) in South Dakota and Meeker Cooperative ([link removed]) in Minnesota.

McKenzie Electric’s protest also argues that Basin Electric dominates its members, instead of being governed by them – at one point, the co-op argues ([link removed]) : “In short, there is no democratic process. Basin is running a dictatorship.” McKenzie Electric also states that “The essential cooperative principles include ‘voluntary and open membership,’ ‘democratic member control,’ and ‘cooperation among the cooperatives.’ These characteristics no longer exist in Basin’s system.”

View note ([link removed])

Those complaints echo arguments by two other electric cooperatives about Tri-State Generation and Transmission Association; in filings with state regulators in Colorado, La Plata Electric Association and United Power argued ([link removed]) that Tri-State’s claims of “democratic member control” are a “myth.”

McKenzie Electric has also filed a lawsuit against Basin Electric, which moved forward last month after a court rejected ([link removed]) Basin Electric’s efforts to dismiss the case.

Meanwhile, Dakota Energy announced ([link removed]) this month that it is seeking to exit from its contract with East River Electric Power Cooperative, a generation and transmission association that buys power from Basin Electric. In a press release, the Dakota Energy CEO said “we have been involuntarily handed decisions by East River and Basin Electric that have resulted in 12 rate increases in the past 15 years, more than doubling what our member-owners were once paying.”

“Across America, the generation and transmission model is being challenged by the distribution cooperatives who own them. We want more flexibility and local control to help us manage and even reduce costs,” said ([link removed]) Dakota Energy Board President Garry Dearborn. “As the energy landscape continues to quickly change, we need to be able to plan for a future that truly benefits our member-owners.”

That announcement came less than a week after Basin Electric’s annual meeting, at which Sukut proclaimed the strength of its relationship with its members – and how much that means to the Wall Street banks that hold Basin Electric’s debt:

One of the things that we always talk about and that I always gravitate to, when we go back to Wall Street and we visit with the rating agencies and the banks, we always go through with them our key credit strengths. And one of the questions that they always have is: “what is your, or how is your, relationship with your membership?” And we’re always so proud to say how strong it is. And you don’t have any idea how much that means to them. That means a great deal to them.

The post Basin Electric faces growing pressure on coal from co-ops, insurers, and banks ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** Entergy Placed Undercover Consultant to Influence MISO Stakeholder Processes ([link removed])

** Dominion Energy rewards Virginia political allies with bipartisan, off-year campaign contributions in 2020 ([link removed])

** Jonathan Scott talks to EPI about taking on utilities in solar film “Power Trip” ([link removed])

** AEP gave campaign cash to HB 6 repeal committee members ([link removed])

** Duke Energy spends big on Republicans, “soft money” groups in 2020 election ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2020 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

------------------------------------------------------------

By Joe Smyth on Nov 23, 2020 10:55 pm

The generation and transmission association that provides electricity to large swaths of the rural West and Upper Midwest is facing increasing pressure from its member cooperatives and lenders about its reliance on coal, challenges to its rates in proceedings at the Federal Energy Regulatory Commission, and efforts by some member cooperatives to end their contracts in order to purchase wholesale power from other providers.

Those challenges facing Basin Electric reflect the growing tension between some of the electric cooperatives that provide electricity to much of rural America, and the generation and transmission associations that sell wholesale power to those co-ops largely generated with increasingly uneconomic coal plants.

As one co-op director put it ([link removed]) , “Across America, the generation and transmission model is being challenged by the distribution cooperatives who own them. We want more flexibility and local control to help us manage and even reduce costs.”

** Basin Electric affects millions of ratepayers in nine states

------------------------------------------------------------

Although the name Basin Electric doesn’t show up on customers’ electric bills, its decisions, power plants, policies, and rates affect millions of families and businesses in a vast region stretching from the borders with Canada to Mexico. As a generation and transmission association, Basin Electric operates power plants and sells wholesale power, which is ultimately distributed by more than 100 electric cooperatives ([link removed]) to homes and businesses in Minnesota, Iowa, North Dakota, South Dakota, Nebraska, Montana, Wyoming, Colorado, and New Mexico.

Basin Electric reported $2.3 billion in revenue in 2019, more than any other generation and transmission association, according ([link removed]) to the National Cooperative Bank. It sold 20.1 million megawatt hours of electricity in 2018, making it the 39th largest power provider in the U.S. – and among the most carbon-intensive, according to M.J. Bradley’s latest Benchmarking Air Emissions report ([link removed]) . Basin Electric emitted more tons of carbon pollution in 2018 than any other cooperatively owned utility or generation and transmission association, according to the report.

Somewhat unusually for generation and transmission associations, Basin Electric sells wholesale power mostly to other generation and transmission associations, so it is sometimes called a “Super G&T.” The generation and transmission associations that buy wholesale power from Basin Electric include East River Electric Power Cooperative, Northwestern Power Cooperative, Central Power Electric Cooperative, Rushmore Electric Power Cooperative, Central Montana Power Electric Cooperative, Upper Missouri Electric Cooperative, Corn Belt Power Cooperative, Members 1st Electric Cooperative, and Tri-State Generation and Transmission Association. Those entities then sell that power to electric cooperatives, which distribute it to retail customers.

Tri-State, which sells power to cooperatives in Colorado, New Mexico, Wyoming and Nebraska, purchases a portion of that power from Basin Electric, although Tri-State generates more from its own power plants.

A map showing generation and transmission associations, with diagonal lines representing G&Ts that buy power from Basin Electric

** Basin Electric owns and operates a sprawling array of coal facilities

------------------------------------------------------------

Basin Electric is heavily reliant on coal, and owns a fleet of coal plants and a coal gasification facility, along with ownership stakes in coal mines.

Basin operates ([link removed]) four coal plants; the 1700 megawatt Laramie River Station and the 385 megawatt Dry Fork Station in Wyoming, and the 666 megawatt Leland Olds and 900 megawatt Antelope Valley lignite coal plants in North Dakota.

Through its subsidiary ([link removed]) Dakota Coal Company, Basin Electric “controls rights to lignite reserves in North Dakota and provides financing for the Freedom Mine” – the largest lignite coal mine in the United States. Lignite is a lower-quality form of coal, and within the U.S. is mostly mined and burned in North Dakota and Texas.

Coal from the Freedom Mine supplies Basin Electric’s power plants in North Dakota, as well as the Great Plains Synfuels Plant, a coal gasification facility owned by Basin Electric subsidiary Dakota Gasification Company. That facility converts coal into natural gas, and is the only such facility ([link removed].) in the U.S. The coal gasification facility has lost hundreds of millions of dollars ([link removed]) in recent years.

** Basin Electric executives highlight growing pressure against coal

------------------------------------------------------------

At Basin Electric’s annual meeting this month, Chief Financial Officer Steve Johnson discussed ([link removed]) the “continued pressure on coal-based generation,” including recent commitments by Morgan Stanley ([link removed]) and JP Morgan Chase ([link removed]) to align their lending with the Paris climate agreement goals. Several other major banks have also announced new policies this year to help push electric utilities away from coal ([link removed]) .

Johnson also highlighted the efforts of Insure Our Future ([link removed]) , a campaign to urge the insurance industry to stop supporting fossil fuel projects. Johnson noted that “Frankly, the group has been relatively successful,” and said that “Without going into detail, I can state that Basin Electric has been impacted by these efforts.”

WATCH: Wondering whether our campaign to get insurance companies to stop insuring fossil fuels is having an impact? Please let our newest spokesman Steve Johnson, CFO of *checks notes* coal-powered @Basin_Electric ([link removed]) utility explain how. pic.twitter.com/eqicvNAYHe ([link removed])

— Insure Our Future U.S. (@Insure_Future) November 20, 2020 ([link removed])

A spokesperson for Basin Electric did not respond to a request for more information about how the power supplier has been impacted by the growing reluctance of insurance companies to provide coverage for coal projects.

Basin Electric’s latest annual report ([link removed]) also noted the impacts of banks’ and insurance companies’ coal exclusion policies, though without providing details:

While Basin Electric has lots of good news to share, numerous insurance companies and financial institutions have made the decision to limit or even completely discontinue lending to or insuring companies with exposure to coal. As Basin Electric strategically works to mitigate the effect this could have, the cooperative also must recognize many partners in both the insurance and financial markets.

Basin Electric CEO Paul Sukut’s comments ([link removed]) at the annual meeting also acknowledged pressure from members about their over reliance on coal:

Our members are asking us, “We have a lot of coal, and we’re seeing less reliance upon coal.” We’re living in a carbon-constrained world and we’re listening to that. Many of those plants have a lot of economic value on the books yet, they have debt against them and so, to just drop an end gate and shut them down really doesn’t work very well. We’re trying to see what is the most efficient and effective way that we can write them off the books and be less reliant upon them. I’m not here to tell you we’re not going to utilize our coal, we are, there’s no doubt about it. We cannot do it without coal for the next 15-20 years at least; it’s just going to be something gradual.

** Electric cooperatives seek to stop buying power from Basin Electric

------------------------------------------------------------

Some of those member cooperatives’ concerns about Basin Electric’s coal facilities have led to court challenges, regulatory protests, and contract disputes. In particular, the financial losses from Basin Electric’s coal gasification facility are at the center of years of tension between the power supplier and some of its members, although those conflicts have until recently remained largely behind closed doors. But a series of documents filed this year at the Federal Energy Regulatory Commission (FERC) reveal how some electric cooperatives have urged Basin Electric to close or sell the coal gasification facility, objected to covering its losses through their wholesale power rates, and ultimately sought to end their contracts with Basin Electric.

McKenzie Electric, an electric cooperative in North Dakota, protested Basin Electric’s rates in a filing ([link removed]) to FERC, arguing ([link removed]) that “Basin has forced DGC’s (Dakota Gasification Company) bailout on its membership” – and that this isn’t allowed under the Federal Power Act, since the facility isn’t used to generate or transmit electricity. McKenzie Electric’s filing includes dozens of documents ([link removed]) detailing its struggles with Basin Electric, from a letter ([link removed]) last year asking about the process of ending its contract, to a resolution

([link removed]) opposing the coal gasification facility dating back to 1988.

Basin Electric aggressively responded to its members’ requests to calculate the cost of ending their contracts with Basin Electric. The Basin Electric board passed a resolution ([link removed]) in February 2019 stating that its contracts with members “do not contain any provision permitting the member to buy-out of its all-requirements contract.” Basin Electric’s board of directors is comprised of individual directors from its member generation and transmission associations. The resolution was accompanied by a letter ([link removed]) from Sukut, the CEO, warning its generation and transmission association members that “for you to provide any assistance to your [distribution cooperative] members in buying out of their all-requirements contracts, it would be contrary to your obligations to the

Cooperative” [referring to Basin Electric]. Basin Electric’s contracts with most members extend until 2075.

McKenzie Electric argues that Basin Electric’s refusal to provide an exit fee calculation “equates to a financial suicide pact” and is “locking members into a century-long commitment to act as Basin’s captive piggy bank.”

View note ([link removed])

Two other electric cooperatives supported McKenzie Electric’s protest: Dakota Energy ([link removed]) in South Dakota and Meeker Cooperative ([link removed]) in Minnesota.

McKenzie Electric’s protest also argues that Basin Electric dominates its members, instead of being governed by them – at one point, the co-op argues ([link removed]) : “In short, there is no democratic process. Basin is running a dictatorship.” McKenzie Electric also states that “The essential cooperative principles include ‘voluntary and open membership,’ ‘democratic member control,’ and ‘cooperation among the cooperatives.’ These characteristics no longer exist in Basin’s system.”

View note ([link removed])

Those complaints echo arguments by two other electric cooperatives about Tri-State Generation and Transmission Association; in filings with state regulators in Colorado, La Plata Electric Association and United Power argued ([link removed]) that Tri-State’s claims of “democratic member control” are a “myth.”

McKenzie Electric has also filed a lawsuit against Basin Electric, which moved forward last month after a court rejected ([link removed]) Basin Electric’s efforts to dismiss the case.

Meanwhile, Dakota Energy announced ([link removed]) this month that it is seeking to exit from its contract with East River Electric Power Cooperative, a generation and transmission association that buys power from Basin Electric. In a press release, the Dakota Energy CEO said “we have been involuntarily handed decisions by East River and Basin Electric that have resulted in 12 rate increases in the past 15 years, more than doubling what our member-owners were once paying.”

“Across America, the generation and transmission model is being challenged by the distribution cooperatives who own them. We want more flexibility and local control to help us manage and even reduce costs,” said ([link removed]) Dakota Energy Board President Garry Dearborn. “As the energy landscape continues to quickly change, we need to be able to plan for a future that truly benefits our member-owners.”

That announcement came less than a week after Basin Electric’s annual meeting, at which Sukut proclaimed the strength of its relationship with its members – and how much that means to the Wall Street banks that hold Basin Electric’s debt:

One of the things that we always talk about and that I always gravitate to, when we go back to Wall Street and we visit with the rating agencies and the banks, we always go through with them our key credit strengths. And one of the questions that they always have is: “what is your, or how is your, relationship with your membership?” And we’re always so proud to say how strong it is. And you don’t have any idea how much that means to them. That means a great deal to them.

The post Basin Electric faces growing pressure on coal from co-ops, insurers, and banks ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** Entergy Placed Undercover Consultant to Influence MISO Stakeholder Processes ([link removed])

** Dominion Energy rewards Virginia political allies with bipartisan, off-year campaign contributions in 2020 ([link removed])

** Jonathan Scott talks to EPI about taking on utilities in solar film “Power Trip” ([link removed])

** AEP gave campaign cash to HB 6 repeal committee members ([link removed])

** Duke Energy spends big on Republicans, “soft money” groups in 2020 election ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2020 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: Energy and Policy Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp