| From | Center for Jobs and the Economy <[email protected]> |

| Subject | California Employment Report for October 2020 |

| Date | November 23, 2020 7:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] California Employment Report

for October 2020

The Center for Jobs and the Economy has released our initial analysis of the October Employment Report from the California Employment Development Department. For additional information and data about the California economy visit [[link removed]].

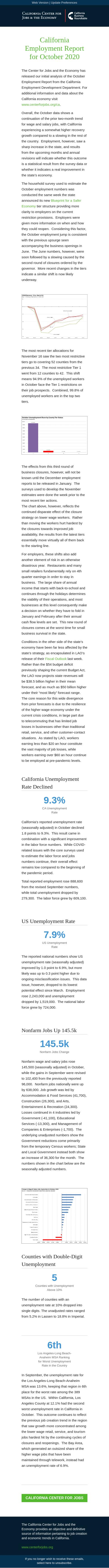

Overall, the October data shows a continuation of the prior two-month trend for wage and salary jobs, with California experiencing a somewhat higher recovery growth compared to a slowing in the rest of the country. Employment, however, saw a sharp increase in the state, and results from the upcoming months and annual revisions will indicate whether this outcome is a statistical result from the survey data or whether it indicates a real improvement in the state’s economy.

The household survey used to estimate the October employment numbers was conducted the same week the state announced its new Blueprint for a Safer Economy [[link removed]] tier structure providing more clarity to employers on the current restriction provisions. Employers were given more information on when and how they could reopen. Considering this factor, the October employment jump is consistent with the previous upsurge seen accompanying the business openings in June. The June numbers, however, were soon followed by a slowing caused by the second round of closures ordered by the governor. More recent changes in the tiers indicate a similar shift is now likely underway.

The most recent tier allocations for November 16 saw the two most restrictive tiers go to covering 52 counties from the previous 34. The most restrictive Tier 1 went from 12 counties to 42. This shift means 94.9% of the unemployed workers in October face the Tier 1 restrictions on their job prospects. Combined, 99.8% of unemployed workers are in the top two tiers.

The effects from this third round of business closures, however, will not be known until the December employment reports to be released in January. The surveys used to develop the November estimates were done the week prior to the most recent tier actions.

The chart above, however, reflects the continued disparate effect of the closure strategy on lower wage workers. Rather than moving the workers hurt hardest by the closures towards improved job availability, the results from the latest tiers essentially move virtually all of them back to the starting line.

For employers, these shifts also add another element of risk in an otherwise disastrous year. Restaurants and many small retailers fundamentally rely on 4th quarter earnings in order to stay in business. The large share of annual income that starts with back-to-school and continues through the holidays determines the viability of their operations, and most businesses at this level consequently make a decision on whether they have to fold in January and February after their annual cash flow levels are set. This new round of closures comes at the worst time for small business survival in the state.

Conditions in the other side of the state’s economy have been far less affected by the state’s strategy, as encapsulated in LAO’s release of their Fiscal Outlook [[link removed]] last week. Rather than the $54 budget deficit previously shaping the current Budget Act, the LAO now projects state revenues will be $38.5 billion higher in their mean forecast, and as much as $50 billion higher under their “most likely” forecast range. The core reason for this wide divergence from prior forecasts is due to the resilience of the higher wage economy under the current crisis conditions, in large part due to telecommuting that has limited job losses in businesses other than traditional retail, service, and other customer-contact situations. As stated by LAO, workers earning less than $20 an hour constitute the vast majority of job losses, while workers earning over $60 an hour continue to be employed at pre-pandemic levels.

California Unemployment Rate Declined 9.3% CA Unemployment

Rate

California's reported unemployment rate (seasonally adjusted) in October declined 1.8 points to 9.3%. This result came in combination with a significant improvement in the labor force numbers. While COVID-related issues with the core surveys used to estimate the labor force and jobs numbers continue, their overall effect remains low compared to the beginning of the pandemic period.

Total reported employment rose 888,600 from the revised September numbers, while total unemployment dropped by 279,300. The labor force grew by 609,100.

US Unemployment Rate 7.9% US Unemployment

Rate

The reported national numbers show US unemployment rate (seasonally adjusted) improved by 1.0 point to 6.9%, but more likely was up to 0.3 point higher due to ongoing misclassification issues. This data issue, however, dropped to its lowest potential effect since March. Employment rose 2,243,000 and unemployment dropped by 1,519,000. The national labor force grew by 724,000.

Nonfarm Jobs Up 145.5k 145.5k Nonfarm Jobs Change

Nonfarm wage and salary jobs rose 145,500 (seasonally adjusted) in October, while the gains in September were revised to 102,400 from the previously reported 96,000. Nonfarm jobs nationally were up by 638,000. Job growth was led by Accommodation & Food Services (41,700), Construction (26,300), and Arts, Entertainment & Recreation (24,300). Losses continued in 4 industries led by Government (-41,100), Educational Services (-13,300), and Management of Companies & Enterprises (-1,700). The underlying unadjusted numbers show the Government reductions come primarily from the temporary Census workers; State and Local Government instead both show an increase of 36,300 for the month. The numbers shown in the chart below are the seasonally adjusted numbers.

Counties with Double-Digit Unemployment 5 Counties with Unemployment

Above 10%

The number of counties with an unemployment rate at 10% dropped into single digits. The unadjusted rates ranged from 5.2% in Lassen to 18.8% in Imperial.

6th Los Angeles-Long Beach-

Anaheim MSA Ranking

for Worst Unemployment

Rate in the Country

In September, the unemployment rate for the Los Angeles-Long Beach-Anaheim MSA was 13.6%, keeping that region in 6th place for the worst rate among the 389 MSAs in the US. Within California, Los Angeles County at 12.1% had the second worst unemployment rate in California in October. This outcome continues to reflect the previous job creation trend in the region that saw growth more concentrated among the lower wage retail, service, and tourism jobs hardest hit by the continuing cycles of closures and reopenings. The Bay Area, which generated an outsized share of the higher wage jobs that have been maintained through telework, instead had an unemployment rate of 6.9%.

California Center for Jobs [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

for October 2020

The Center for Jobs and the Economy has released our initial analysis of the October Employment Report from the California Employment Development Department. For additional information and data about the California economy visit [[link removed]].

Overall, the October data shows a continuation of the prior two-month trend for wage and salary jobs, with California experiencing a somewhat higher recovery growth compared to a slowing in the rest of the country. Employment, however, saw a sharp increase in the state, and results from the upcoming months and annual revisions will indicate whether this outcome is a statistical result from the survey data or whether it indicates a real improvement in the state’s economy.

The household survey used to estimate the October employment numbers was conducted the same week the state announced its new Blueprint for a Safer Economy [[link removed]] tier structure providing more clarity to employers on the current restriction provisions. Employers were given more information on when and how they could reopen. Considering this factor, the October employment jump is consistent with the previous upsurge seen accompanying the business openings in June. The June numbers, however, were soon followed by a slowing caused by the second round of closures ordered by the governor. More recent changes in the tiers indicate a similar shift is now likely underway.

The most recent tier allocations for November 16 saw the two most restrictive tiers go to covering 52 counties from the previous 34. The most restrictive Tier 1 went from 12 counties to 42. This shift means 94.9% of the unemployed workers in October face the Tier 1 restrictions on their job prospects. Combined, 99.8% of unemployed workers are in the top two tiers.

The effects from this third round of business closures, however, will not be known until the December employment reports to be released in January. The surveys used to develop the November estimates were done the week prior to the most recent tier actions.

The chart above, however, reflects the continued disparate effect of the closure strategy on lower wage workers. Rather than moving the workers hurt hardest by the closures towards improved job availability, the results from the latest tiers essentially move virtually all of them back to the starting line.

For employers, these shifts also add another element of risk in an otherwise disastrous year. Restaurants and many small retailers fundamentally rely on 4th quarter earnings in order to stay in business. The large share of annual income that starts with back-to-school and continues through the holidays determines the viability of their operations, and most businesses at this level consequently make a decision on whether they have to fold in January and February after their annual cash flow levels are set. This new round of closures comes at the worst time for small business survival in the state.

Conditions in the other side of the state’s economy have been far less affected by the state’s strategy, as encapsulated in LAO’s release of their Fiscal Outlook [[link removed]] last week. Rather than the $54 budget deficit previously shaping the current Budget Act, the LAO now projects state revenues will be $38.5 billion higher in their mean forecast, and as much as $50 billion higher under their “most likely” forecast range. The core reason for this wide divergence from prior forecasts is due to the resilience of the higher wage economy under the current crisis conditions, in large part due to telecommuting that has limited job losses in businesses other than traditional retail, service, and other customer-contact situations. As stated by LAO, workers earning less than $20 an hour constitute the vast majority of job losses, while workers earning over $60 an hour continue to be employed at pre-pandemic levels.

California Unemployment Rate Declined 9.3% CA Unemployment

Rate

California's reported unemployment rate (seasonally adjusted) in October declined 1.8 points to 9.3%. This result came in combination with a significant improvement in the labor force numbers. While COVID-related issues with the core surveys used to estimate the labor force and jobs numbers continue, their overall effect remains low compared to the beginning of the pandemic period.

Total reported employment rose 888,600 from the revised September numbers, while total unemployment dropped by 279,300. The labor force grew by 609,100.

US Unemployment Rate 7.9% US Unemployment

Rate

The reported national numbers show US unemployment rate (seasonally adjusted) improved by 1.0 point to 6.9%, but more likely was up to 0.3 point higher due to ongoing misclassification issues. This data issue, however, dropped to its lowest potential effect since March. Employment rose 2,243,000 and unemployment dropped by 1,519,000. The national labor force grew by 724,000.

Nonfarm Jobs Up 145.5k 145.5k Nonfarm Jobs Change

Nonfarm wage and salary jobs rose 145,500 (seasonally adjusted) in October, while the gains in September were revised to 102,400 from the previously reported 96,000. Nonfarm jobs nationally were up by 638,000. Job growth was led by Accommodation & Food Services (41,700), Construction (26,300), and Arts, Entertainment & Recreation (24,300). Losses continued in 4 industries led by Government (-41,100), Educational Services (-13,300), and Management of Companies & Enterprises (-1,700). The underlying unadjusted numbers show the Government reductions come primarily from the temporary Census workers; State and Local Government instead both show an increase of 36,300 for the month. The numbers shown in the chart below are the seasonally adjusted numbers.

Counties with Double-Digit Unemployment 5 Counties with Unemployment

Above 10%

The number of counties with an unemployment rate at 10% dropped into single digits. The unadjusted rates ranged from 5.2% in Lassen to 18.8% in Imperial.

6th Los Angeles-Long Beach-

Anaheim MSA Ranking

for Worst Unemployment

Rate in the Country

In September, the unemployment rate for the Los Angeles-Long Beach-Anaheim MSA was 13.6%, keeping that region in 6th place for the worst rate among the 389 MSAs in the US. Within California, Los Angeles County at 12.1% had the second worst unemployment rate in California in October. This outcome continues to reflect the previous job creation trend in the region that saw growth more concentrated among the lower wage retail, service, and tourism jobs hardest hit by the continuing cycles of closures and reopenings. The Bay Area, which generated an outsized share of the higher wage jobs that have been maintained through telework, instead had an unemployment rate of 6.9%.

California Center for Jobs [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor