| From | Fraser Institute <[email protected]> |

| Subject | Carbon pricing in OECD countries, and Achieving the four-day workweek essays |

| Date | October 24, 2020 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

==============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

----------------

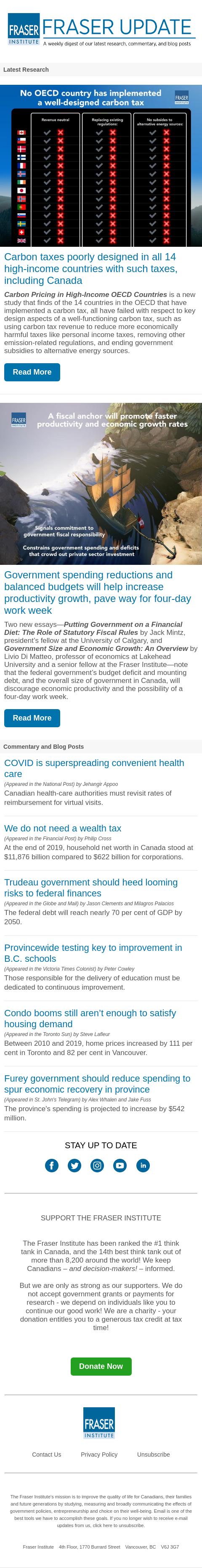

Carbon taxes poorly designed in all 14 high-income countries with such taxes, including Canada

Carbon Pricing in High-Income OECD Countries is a new study that finds of the 14 countries in the OECD that have implemented a carbon tax, all have failed with respect to key design aspects of a well-functioning carbon tax, such as using carbon tax revenue to reduce more economically harmful taxes like personal income taxes, removing other emission-related regulations, and ending government subsidies to alternative energy sources.

Read More [[link removed]]

Government spending reductions and balanced budgets will help increase productivity growth, pave way for four-day work week

Two new essays—Putting Government on a Financial Diet: The Role of Statutory Fiscal Rules by Jack Mintz, president’s fellow at the University of Calgary, and Government Size and Economic Growth: An Overview by Livio Di Matteo, professor of economics at Lakehead University and a senior fellow at the Fraser Institute—note that the federal government’s budget deficit and mounting debt, and the overall size of government in Canada, will discourage economic productivity and the possibility of a four-day work week.

Read More [[link removed]]

Commentary and Blog Posts

----------------

COVID is superspreading convenient health care [[link removed]]

(Appeared in the National Post) by Jehangir Appoo

Canadian health-care authorities must revisit rates of reimbursement for virtual visits.

We do not need a wealth tax [[link removed]]

(Appeared in the Financial Post) by Philip Cross

At the end of 2019, household net worth in Canada stood at $11,876 billion compared to $622 billion for corporations.

Provincewide testing key to improvement in B.C. schools [[link removed]]

(Appeared in the Victoria Times Colonist) by Peter Cowley

Those responsible for the delivery of education must be dedicated to continuous improvement.

Condo booms still aren’t enough to satisfy housing demand [[link removed]]

(Appeared in the Toronto Sun) by Steve Lafleur

Between 2010 and 2019, home prices increased by 111 per cent in Toronto and 82 per cent in Vancouver.

Trudeau government should heed looming risks to federal finances [[link removed]]

(Appeared in the Globe and Mail) by Jason Clemens and Milagros Palacios

The federal debt will reach nearly 70 per cent of GDP by 2050.

Furey government should reduce spending to spur economic recovery in province [[link removed]]

(Appeared in St. John's Telegram) by Alex Whalen and Jake Fuss

The province's spending is projected to increase by $542 million.

SUPPORT THE FRASER INSTITUTE

----------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

----------------

Carbon taxes poorly designed in all 14 high-income countries with such taxes, including Canada

Carbon Pricing in High-Income OECD Countries is a new study that finds of the 14 countries in the OECD that have implemented a carbon tax, all have failed with respect to key design aspects of a well-functioning carbon tax, such as using carbon tax revenue to reduce more economically harmful taxes like personal income taxes, removing other emission-related regulations, and ending government subsidies to alternative energy sources.

Read More [[link removed]]

Government spending reductions and balanced budgets will help increase productivity growth, pave way for four-day work week

Two new essays—Putting Government on a Financial Diet: The Role of Statutory Fiscal Rules by Jack Mintz, president’s fellow at the University of Calgary, and Government Size and Economic Growth: An Overview by Livio Di Matteo, professor of economics at Lakehead University and a senior fellow at the Fraser Institute—note that the federal government’s budget deficit and mounting debt, and the overall size of government in Canada, will discourage economic productivity and the possibility of a four-day work week.

Read More [[link removed]]

Commentary and Blog Posts

----------------

COVID is superspreading convenient health care [[link removed]]

(Appeared in the National Post) by Jehangir Appoo

Canadian health-care authorities must revisit rates of reimbursement for virtual visits.

We do not need a wealth tax [[link removed]]

(Appeared in the Financial Post) by Philip Cross

At the end of 2019, household net worth in Canada stood at $11,876 billion compared to $622 billion for corporations.

Provincewide testing key to improvement in B.C. schools [[link removed]]

(Appeared in the Victoria Times Colonist) by Peter Cowley

Those responsible for the delivery of education must be dedicated to continuous improvement.

Condo booms still aren’t enough to satisfy housing demand [[link removed]]

(Appeared in the Toronto Sun) by Steve Lafleur

Between 2010 and 2019, home prices increased by 111 per cent in Toronto and 82 per cent in Vancouver.

Trudeau government should heed looming risks to federal finances [[link removed]]

(Appeared in the Globe and Mail) by Jason Clemens and Milagros Palacios

The federal debt will reach nearly 70 per cent of GDP by 2050.

Furey government should reduce spending to spur economic recovery in province [[link removed]]

(Appeared in St. John's Telegram) by Alex Whalen and Jake Fuss

The province's spending is projected to increase by $542 million.

SUPPORT THE FRASER INSTITUTE

----------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor