Email

Research Release: Carbon taxes poorly designed in all 14 high-income countries with such taxes, including Canada

| From | Niels Veldhuis <[email protected]> |

| Subject | Research Release: Carbon taxes poorly designed in all 14 high-income countries with such taxes, including Canada |

| Date | October 20, 2020 11:00 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Dear John,

Today, the Fraser Institute released a new study, Carbon Pricing in High-Income OECD Countries [[link removed]]. It finds that of the 14 countries in the OECD that have implemented a carbon tax, all have failed with respect to key design aspects of a well-functioning carbon tax, such as using carbon tax revenue to reduce more economically harmful taxes like personal income taxes, removing other emission-related regulations, and ending government subsidies to alternative energy sources.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

1770 Burrard Street, 4th Floor, Vancouver, BC V6J 3G7

Carbon taxes poorly designed in all 14 high-income countries with such taxes, including Canada

VANCOUVER—Carbon taxes in high-income countries around the world are poorly designed, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Overall, no high-income OECD country with a carbon tax has implemented it based on sound design,” said Elmira Aliakbari, associate director of natural resource studies at the Fraser Institute and co-author of Carbon Pricing in High-Income OECD Countries [[link removed]].

The study examines 31 high-income countries in the Organization for Economic Co-operation and Development (OECD), including Canada, that have implemented a carbon tax, a carbon emissions trading system, or a combination of both.

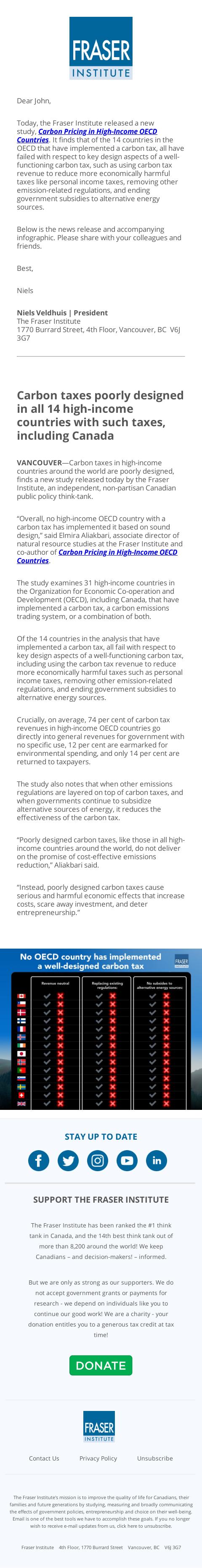

Of the 14 countries in the analysis that have implemented a carbon tax, all fail with respect to key design aspects of a well-functioning carbon tax, including using the carbon tax revenue to reduce more economically harmful taxes such as personal income taxes, removing other emission-related regulations, and ending government subsidies to alternative energy sources.

Crucially, on average, 74 per cent of carbon tax revenues in high-income OECD countries go directly into general revenues for government with no specific use, 12 per cent are earmarked for environmental spending, and only 14 per cent are returned to taxpayers.

The study also notes that when other emissions regulations are layered on top of carbon taxes, and when governments continue to subsidize alternative sources of energy, it reduces the effectiveness of the carbon tax.

“Poorly designed carbon taxes, like those in all high-income countries around the world, do not deliver on the promise of cost-effective emissions reduction,” Aliakbari said.

“Instead, poorly designed carbon taxes cause serious and harmful economic effects that increase costs, scare away investment, and deter entrepreneurship.”

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Today, the Fraser Institute released a new study, Carbon Pricing in High-Income OECD Countries [[link removed]]. It finds that of the 14 countries in the OECD that have implemented a carbon tax, all have failed with respect to key design aspects of a well-functioning carbon tax, such as using carbon tax revenue to reduce more economically harmful taxes like personal income taxes, removing other emission-related regulations, and ending government subsidies to alternative energy sources.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

1770 Burrard Street, 4th Floor, Vancouver, BC V6J 3G7

Carbon taxes poorly designed in all 14 high-income countries with such taxes, including Canada

VANCOUVER—Carbon taxes in high-income countries around the world are poorly designed, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Overall, no high-income OECD country with a carbon tax has implemented it based on sound design,” said Elmira Aliakbari, associate director of natural resource studies at the Fraser Institute and co-author of Carbon Pricing in High-Income OECD Countries [[link removed]].

The study examines 31 high-income countries in the Organization for Economic Co-operation and Development (OECD), including Canada, that have implemented a carbon tax, a carbon emissions trading system, or a combination of both.

Of the 14 countries in the analysis that have implemented a carbon tax, all fail with respect to key design aspects of a well-functioning carbon tax, including using the carbon tax revenue to reduce more economically harmful taxes such as personal income taxes, removing other emission-related regulations, and ending government subsidies to alternative energy sources.

Crucially, on average, 74 per cent of carbon tax revenues in high-income OECD countries go directly into general revenues for government with no specific use, 12 per cent are earmarked for environmental spending, and only 14 per cent are returned to taxpayers.

The study also notes that when other emissions regulations are layered on top of carbon taxes, and when governments continue to subsidize alternative sources of energy, it reduces the effectiveness of the carbon tax.

“Poorly designed carbon taxes, like those in all high-income countries around the world, do not deliver on the promise of cost-effective emissions reduction,” Aliakbari said.

“Instead, poorly designed carbon taxes cause serious and harmful economic effects that increase costs, scare away investment, and deter entrepreneurship.”

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor