Email

Research Release: Wealth taxes reduce economic prosperity while raising little revenue, and wealth inequality is already shrinking in Canada

| From | Niels Veldhuis <[email protected]> |

| Subject | Research Release: Wealth taxes reduce economic prosperity while raising little revenue, and wealth inequality is already shrinking in Canada |

| Date | October 15, 2020 11:00 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Dear John,

Today, the Fraser Institute released a new study, Does Canada Need a Wealth Tax? [[link removed]] It finds that not only will implementing a wealth tax reduce Canada’s economic growth and recovery post-COVID, but that it is unnecessary as the wealth inequality gap is shrinking in Canada. A wealth tax in Canada would constrain economic growth by discouraging savings and investment, especially when wealth taxes are layered on top of existing taxes.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

1770 Burrard Street, 4th Floor, Vancouver, BC V6J 3G7

Wealth taxes reduce economic prosperity while raising little revenue, and wealth inequality is already shrinking in Canada

VANCOUVER—If the federal government introduces a wealth tax, it would reduce economic growth, hamper the country’s recovery, and is unnecessary given the wealth inequality gap in Canada is already shrinking, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Rhetoric about a growing wealth gap in Canada and the supposed need for a wealth tax has been imported from the United States without any evidence to support it. The fact is Canada’s wealth gap is actually shrinking,” said Philip Cross, a senior fellow with the Fraser Institute and author of Does Canada Need a Wealth Tax? [[link removed]]

The study finds that implementing a wealth tax in Canada would constrain economic growth by discouraging savings and investment, especially when wealth taxes are layered on top of existing taxes.

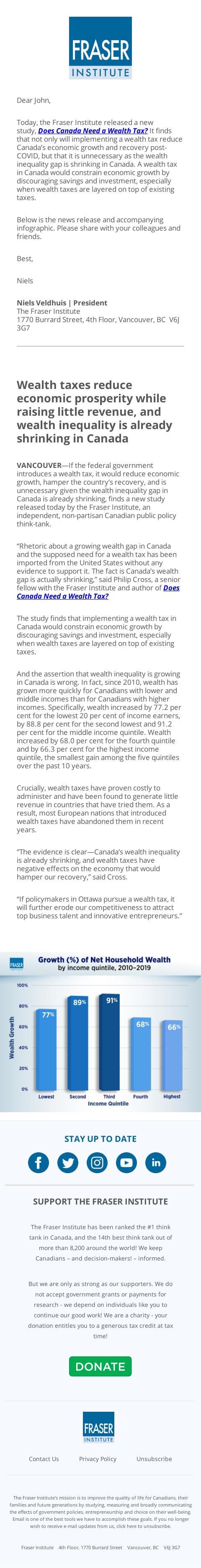

And the assertion that wealth inequality is growing in Canada is wrong. In fact, since 2010, wealth has grown more quickly for Canadians with lower and middle incomes than for Canadians with higher incomes. Specifically, wealth increased by 77.2 per cent for the lowest 20 per cent of income earners, by 88.8 per cent for the second lowest and 91.2 per cent for the middle income quintile. Wealth increased by 68.0 per cent for the fourth quintile and by 66.3 per cent for the highest income quintile, the smallest gain among the five quintiles over the past 10 years.

Crucially, wealth taxes have proven costly to administer and have been found to generate little revenue in countries that have tried them. As a result, most European nations that introduced wealth taxes have abandoned them in recent years.

“The evidence is clear—Canada’s wealth inequality is already shrinking, and wealth taxes have negative effects on the economy that would hamper our recovery,” said Cross.

“If policymakers in Ottawa pursue a wealth tax, it will further erode our competitiveness to attract top business talent and innovative entrepreneurs.”

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Today, the Fraser Institute released a new study, Does Canada Need a Wealth Tax? [[link removed]] It finds that not only will implementing a wealth tax reduce Canada’s economic growth and recovery post-COVID, but that it is unnecessary as the wealth inequality gap is shrinking in Canada. A wealth tax in Canada would constrain economic growth by discouraging savings and investment, especially when wealth taxes are layered on top of existing taxes.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

1770 Burrard Street, 4th Floor, Vancouver, BC V6J 3G7

Wealth taxes reduce economic prosperity while raising little revenue, and wealth inequality is already shrinking in Canada

VANCOUVER—If the federal government introduces a wealth tax, it would reduce economic growth, hamper the country’s recovery, and is unnecessary given the wealth inequality gap in Canada is already shrinking, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Rhetoric about a growing wealth gap in Canada and the supposed need for a wealth tax has been imported from the United States without any evidence to support it. The fact is Canada’s wealth gap is actually shrinking,” said Philip Cross, a senior fellow with the Fraser Institute and author of Does Canada Need a Wealth Tax? [[link removed]]

The study finds that implementing a wealth tax in Canada would constrain economic growth by discouraging savings and investment, especially when wealth taxes are layered on top of existing taxes.

And the assertion that wealth inequality is growing in Canada is wrong. In fact, since 2010, wealth has grown more quickly for Canadians with lower and middle incomes than for Canadians with higher incomes. Specifically, wealth increased by 77.2 per cent for the lowest 20 per cent of income earners, by 88.8 per cent for the second lowest and 91.2 per cent for the middle income quintile. Wealth increased by 68.0 per cent for the fourth quintile and by 66.3 per cent for the highest income quintile, the smallest gain among the five quintiles over the past 10 years.

Crucially, wealth taxes have proven costly to administer and have been found to generate little revenue in countries that have tried them. As a result, most European nations that introduced wealth taxes have abandoned them in recent years.

“The evidence is clear—Canada’s wealth inequality is already shrinking, and wealth taxes have negative effects on the economy that would hamper our recovery,” said Cross.

“If policymakers in Ottawa pursue a wealth tax, it will further erode our competitiveness to attract top business talent and innovative entrepreneurs.”

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor