| From | Fraser Institute <[email protected]> |

| Subject | Is the CCB targeted to those in need?, and Job creation and housing |

| Date | October 10, 2020 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

=============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

---------------------

Households earning less than $40,000 now receive 16% of total federal child benefits—down from more than 21%

Is the Canada Child Benefit Targeted to those Most in Need?, part one of an essay series on the Canada Child Benefit (CCB), finds that families with less than $40,000 of annual household income receive 16.2 per cent of total benefits from the CCB program—compared to 21.8 per cent under two child benefit programs scrapped by the federal government in 2016.

Read More [[link removed]]

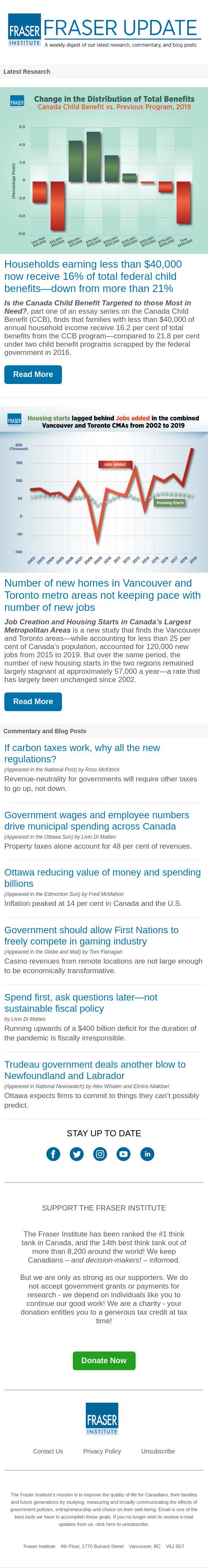

Number of new homes in Vancouver and Toronto metro areas not keeping pace with number of new jobs

Job Creation and Housing Starts in Canada’s Largest Metropolitan Areas is a new study that finds the Vancouver and Toronto areas—while accounting for less than 25 per cent of Canada’s population, accounted for 120,000 new jobs from 2015 to 2019. But over the same period, the number of new housing starts in the two regions remained largely stagnant at approximately 57,000 a year—a rate that has largely been unchanged since 2002.

Read More [[link removed]]

Commentary and Blog Posts

-------------------

If carbon taxes work, why all the new regulations? [[link removed]]

(Appeared in the National Post) by Ross McKitrick

Revenue-neutrality for governments will require other taxes to go up, not down.

Government wages and employee numbers drive municipal spending across Canada [[link removed]]

(Appeared in the Ottawa Sun) by Livio Di Matteo

Property taxes alone account for 48 per cent of revenues.

Ottawa reducing value of money and spending billions [[link removed]]

(Appeared in the Edmonton Sun) by Fred McMahon

Inflation peaked at 14 per cent in Canada and the U.S.

Government should allow First Nations to freely compete in gaming industry [[link removed]]

(Appeared in the Globe and Mail) by Tom Flanagan

Casino revenues from remote locations are not large enough to be economically transformative.

Spend first, ask questions later—not sustainable fiscal policy [[link removed]]

by Livio Di Matteo

Running upwards of a $400 billion deficit for the duration of the pandemic is fiscally irresponsible.

Trudeau government deals another blow to Newfoundland and Labrador [[link removed]]

(Appeared in National Newswatch) by Alex Whalen, Elmira Aliakbari

Ottawa expects firms to commit to things they can’t possibly predict.

SUPPORT THE FRASER INSTITUTE

------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

---------------------

Households earning less than $40,000 now receive 16% of total federal child benefits—down from more than 21%

Is the Canada Child Benefit Targeted to those Most in Need?, part one of an essay series on the Canada Child Benefit (CCB), finds that families with less than $40,000 of annual household income receive 16.2 per cent of total benefits from the CCB program—compared to 21.8 per cent under two child benefit programs scrapped by the federal government in 2016.

Read More [[link removed]]

Number of new homes in Vancouver and Toronto metro areas not keeping pace with number of new jobs

Job Creation and Housing Starts in Canada’s Largest Metropolitan Areas is a new study that finds the Vancouver and Toronto areas—while accounting for less than 25 per cent of Canada’s population, accounted for 120,000 new jobs from 2015 to 2019. But over the same period, the number of new housing starts in the two regions remained largely stagnant at approximately 57,000 a year—a rate that has largely been unchanged since 2002.

Read More [[link removed]]

Commentary and Blog Posts

-------------------

If carbon taxes work, why all the new regulations? [[link removed]]

(Appeared in the National Post) by Ross McKitrick

Revenue-neutrality for governments will require other taxes to go up, not down.

Government wages and employee numbers drive municipal spending across Canada [[link removed]]

(Appeared in the Ottawa Sun) by Livio Di Matteo

Property taxes alone account for 48 per cent of revenues.

Ottawa reducing value of money and spending billions [[link removed]]

(Appeared in the Edmonton Sun) by Fred McMahon

Inflation peaked at 14 per cent in Canada and the U.S.

Government should allow First Nations to freely compete in gaming industry [[link removed]]

(Appeared in the Globe and Mail) by Tom Flanagan

Casino revenues from remote locations are not large enough to be economically transformative.

Spend first, ask questions later—not sustainable fiscal policy [[link removed]]

by Livio Di Matteo

Running upwards of a $400 billion deficit for the duration of the pandemic is fiscally irresponsible.

Trudeau government deals another blow to Newfoundland and Labrador [[link removed]]

(Appeared in National Newswatch) by Alex Whalen, Elmira Aliakbari

Ottawa expects firms to commit to things they can’t possibly predict.

SUPPORT THE FRASER INSTITUTE

------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor