Email

Research Release: Households earning less than $40,000 now receive 16% of total federal child benefits—down from more than 21%

| From | Niels Veldhuis <[email protected]> |

| Subject | Research Release: Households earning less than $40,000 now receive 16% of total federal child benefits—down from more than 21% |

| Date | October 6, 2020 11:00 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Dear John,

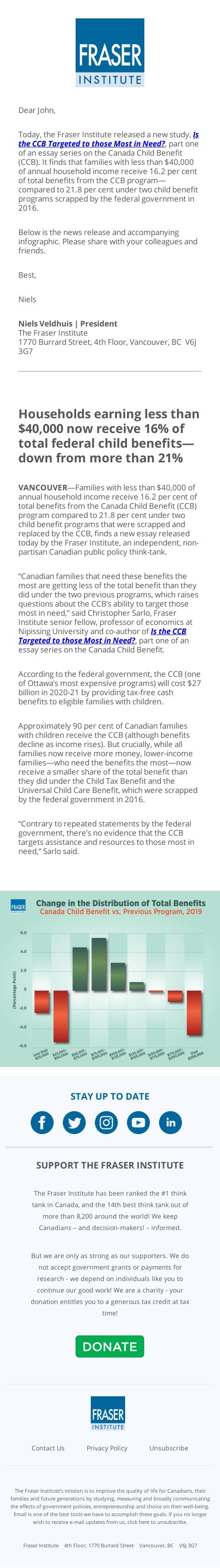

Today, the Fraser Institute released a new study, Is the CCB Targeted to those Most in Need? [[link removed]], part one of an essay series on the Canada Child Benefit (CCB). It finds that families with less than $40,000 of annual household income receive 16.2 per cent of total benefits from the CCB program—compared to 21.8 per cent under two child benefit programs scrapped by the federal government in 2016.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

1770 Burrard Street, 4th Floor, Vancouver, BC V6J 3G7

Households earning less than $40,000 now receive 16% of total federal child benefits—down from more than 21%

VANCOUVER—Families with less than $40,000 of annual household income receive 16.2 per cent of total benefits from the Canada Child Benefit (CCB) program compared to 21.8 per cent under two child benefit programs that were scrapped and replaced by the CCB, finds a new essay released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Canadian families that need these benefits the most are getting less of the total benefit than they did under the two previous programs, which raises questions about the CCB’s ability to target those most in need,” said Christopher Sarlo, Fraser Institute senior fellow, professor of economics at Nipissing University and co-author of Is the CCB Targeted to those Most in Need? [[link removed]], part one of an essay series on the Canada Child Benefit.

According to the federal government, the CCB (one of Ottawa’s most expensive programs) will cost $27 billion in 2020-21 by providing tax-free cash benefits to eligible families with children.

Approximately 90 per cent of Canadian families with children receive the CCB (although benefits decline as income rises). But crucially, while all families now receive more money, lower-income families—who need the benefits the most—now receive a smaller share of the total benefit than they did under the Child Tax Benefit and the Universal Child Care Benefit, which were scrapped by the federal government in 2016.

“Contrary to repeated statements by the federal government, there’s no evidence that the CCB targets assistance and resources to those most in need,” Sarlo said.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Today, the Fraser Institute released a new study, Is the CCB Targeted to those Most in Need? [[link removed]], part one of an essay series on the Canada Child Benefit (CCB). It finds that families with less than $40,000 of annual household income receive 16.2 per cent of total benefits from the CCB program—compared to 21.8 per cent under two child benefit programs scrapped by the federal government in 2016.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

1770 Burrard Street, 4th Floor, Vancouver, BC V6J 3G7

Households earning less than $40,000 now receive 16% of total federal child benefits—down from more than 21%

VANCOUVER—Families with less than $40,000 of annual household income receive 16.2 per cent of total benefits from the Canada Child Benefit (CCB) program compared to 21.8 per cent under two child benefit programs that were scrapped and replaced by the CCB, finds a new essay released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Canadian families that need these benefits the most are getting less of the total benefit than they did under the two previous programs, which raises questions about the CCB’s ability to target those most in need,” said Christopher Sarlo, Fraser Institute senior fellow, professor of economics at Nipissing University and co-author of Is the CCB Targeted to those Most in Need? [[link removed]], part one of an essay series on the Canada Child Benefit.

According to the federal government, the CCB (one of Ottawa’s most expensive programs) will cost $27 billion in 2020-21 by providing tax-free cash benefits to eligible families with children.

Approximately 90 per cent of Canadian families with children receive the CCB (although benefits decline as income rises). But crucially, while all families now receive more money, lower-income families—who need the benefits the most—now receive a smaller share of the total benefit than they did under the Child Tax Benefit and the Universal Child Care Benefit, which were scrapped by the federal government in 2016.

“Contrary to repeated statements by the federal government, there’s no evidence that the CCB targets assistance and resources to those most in need,” Sarlo said.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor