Email

Southern Company Net-Zero Implementation Plan Filled with Loopholes for Continued Use of Fossil Fuels

| From | Energy and Policy Institute <[email protected]> |

| Subject | Southern Company Net-Zero Implementation Plan Filled with Loopholes for Continued Use of Fossil Fuels |

| Date | September 25, 2020 12:01 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

** Southern Company Net-Zero Implementation Plan Filled with Loopholes for Continued Use of Fossil Fuels ([link removed])

------------------------------------------------------------

By Daniel Tait on Sep 24, 2020 05:08 pm

Southern Company released ([link removed]) more information this week on how it plans to reach “net zero emissions,” and while the plan remains scant on key details, the company has made one thing clear: it is leaning into the continued use of gas through 2050, despite the company’s net-zero goal. Gas is a fossil fuel that emits greenhouse gases when leaked or burned.

Throughout Southern’s new “Implementation Plan,” the company used vague language that may give it the ability to claim that it has met its net-zero goals even if it continues burning fossil fuels past 2050. Some of the mechanisms Southern might use include claiming renewable energy generation toward its total even if it sells the rights to renewable energy credits ([link removed]) , counting the full generation of renewable energy projects even if it owns only portions of those projects ([link removed]) , and relying on its unregulated arm, Southern Power, to develop ([link removed]) renewable energy for other utilities while its regulated utilities – Alabama Power, Georgia Power, and Mississippi Power – continued

burning fossil fuels.

The company also left open the possibility of counting ([link removed]) electrification efforts toward its net-zero goal. Southern Company CEO Tom Fanning had previously floated ([link removed]) transportation electrification as an opportunity for Southern to “take credit for” decarbonization. That accounting would belie the way that climate experts generally assume that “net-zero” goals would work for utilities, because limiting global warming to either 1.5°C or 2°C hinges not only on electrifying transportation, but on doing so into a fully decarbonized power sector. (According to the IPCC, any 1.5°C or 2°C case requires all global electricity to reach zero carbon by 2050.)

As consumers switch to electric transportation from gasoline and diesel, overall emissions drop, as studied and reported ([link removed]) by the Union of Concerned Scientists. However, the switch to electric transportation does not obviate a utility’s need to fully decarbonize. For utilities to reduce emissions in accordance with decarbonization pathways that would avoid the worst impacts of climate change, experts say that they must power the new electrified transportation sector with 100% zero-carbon sources.

Southern did not commit to retirement dates for any of its coal fleet, and instead the report appeared to project coal combustion beyond 2040 ([link removed]) , gas combustion well beyond 2050 ([link removed]) , and carbon capture utilization and sequestration (CCUS) starting around 2040 ([link removed]) , despite Southern’s CCUS failures at its Kemper plant.

The Energy and Policy Institute has previously reported ([link removed]) on Southern’s misleading claims about its net-zero goal when it announced the new goal at its Annual Meeting in May of 2020.

The company also amended Fanning’s greenhouse gas (GHG) incentive to include a key change ([link removed]) in the middle of his performance period, compared to previous versions of the incentive package filed with the Securities and Exchange Commission in 2019 ([link removed]) and 2020 ([link removed]) . The net-zero implementation plan now says that Fanning could receive credit for closing or ceasing continual operations of coal and gas-fired plants. Previous versions did not give Fanning credit for gas-related closures or cessations. Importantly, Fanning’s incentive plan will not penalize him in any way if Southern adds new GHG-emitting gas plants, as the company is planning to do in Alabama

([link removed]) .

** Loosely defining net-zero emissions

------------------------------------------------------------

98% ([link removed]) of Southern Company greenhouse gas emissions come from the burning of fossil fuels for creating electricity, according to the company. Rather than eliminating all greenhouse gas emissions from electricity production, Southern’s implementation plan leans on negative emissions technologies, many of which are not yet commercially viable, and other accounting mechanisms to achieve net-zero emissions while investing in the continued burning of fossil fuels. That sets Southern apart from peer utilities like Consumers Energy ([link removed]) , NIPSCO ([link removed]) , and PSEG

([link removed]) , which have pledged to forgo new gas investments, and APS ([link removed]) and Xcel ([link removed]) , which committed to fully decarbonizing by 2050 without the use of offsets.

Southern Company noted that it may count renewable energy toward its goals, even if it does not own rights to the renewable energy credits. ([link removed]) The company claimed that renewables, as used in its net-zero implementation plan, included renewables “whether we have rights to the renewable energy credits (RECs) associated with energy from the facilities.”

Claiming ownership of renewable energy without the rights to RECs may run afoul of federal regulations. “If a marketer generates renewable electricity but sells renewable energy certificates for all of that electricity, it would be deceptive for the marketer to represent, directly or by implication, that it uses renewable energy,” according ([link removed]) to the Federal Trade Commission.

Southern also stated ([link removed]) it would claim credit for 100% of a renewable energy plant, even if the plant’s ownership was split between it and other parties.

Southern Company appeared ([link removed]) to leave itself room to count electrification, such as switching to an electric vehicle from an internal combustion engine, as part of its net-zero implementation plan. Should Southern Company count electrification toward its net-zero goal, it calls into question whether other parties, such as an automotive manufacturer or the actual purchaser of the vehicle, would have any claim toward its own emission reduction goals. In any case, Southern would still need to decarbonize the electricity it would sell to charge the new electric vehicle in order to achieve its net-zero goal.

** Southern touts distributed energy resources and energy efficiency while operating companies block action

------------------------------------------------------------

Southern Company repeatedly referred to distributed energy resources (DER), such as rooftop solar and energy efficiency, as growing areas of investment needed ([link removed]) to help the company reach its net-zero emissions goal. However, Southern’s operating subsidiaries have routinely blocked action on renewable energy, and often ranks at or near the bottom in the country on energy efficiency. The company lumped DERs into the same category for “facilitates GHG reduction” as gas. Many DERs, such as rooftop solar, energy efficiency and demand response, actively reduce emissions, whereas gas emits greenhouse gases.

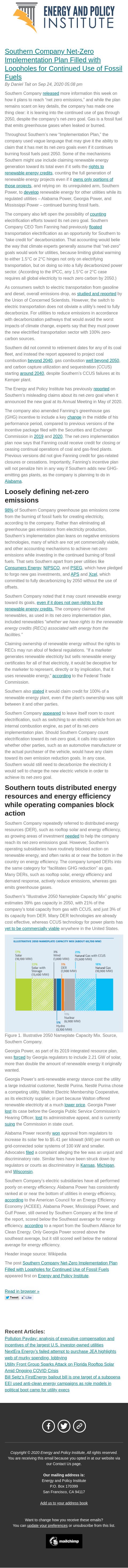

Southern’s “Illustrative 2050 Nameplate Capacity Mix” graphic estimates 39% gas capacity in 2050, with 21% of the company’s total capacity from gas with CCUS, and just 3% of its capacity from DER. Many DER technologies are already cost effective, whereas CCUS technology for power plants has yet to be commercially viable ([link removed]) anywhere in the United States.

Figure 1. Illustrative 2050 Nameplate Capacity Mix. Source, Southern Company.

Georgia Power, as part of its 2019 integrated resource plan, was forced ([link removed]) by Georgia regulators to include 2.21 GW of solar, more than double the amount of renewable energy it originally wanted.

Georgia Power’s anti-renewable energy stance cost the utility a large industrial customer, Nestlé Purina. Nestlé Purina chose a competing utility, Walton Electric Membership Cooperative, as its electricity supplier, in part because Walton offered renewable electricity at a much lower price ([link removed]) . Georgia Power lost ([link removed]) its case before the Georgia Public Service Commission’s Hearing Officer, lost ([link removed]) its administrative appeal, and is currently suing ([link removed]) the Commission in state court.

Alabama Power recently won ([link removed]) approval from regulators to increase its solar fee to $5.41 per kilowatt (kW) per month on grid-connected solar systems of 100 kW and smaller. Advocates filed ([link removed]) a complaint alleging the fee was an unjust and discriminatory rate. Similar fees have been struck down by regulators or courts as discriminatory in Kansas ([link removed]) , Michigan ([link removed]) , and Wisconsin ([link removed]) .

Southern Company’s electric subsidiaries have all performed poorly on energy efficiency. Alabama Power has consistently ranked at or near the bottom of utilities in energy efficiency, according ([link removed]) to the American Council for an Energy Efficiency Economy (ACEEE). Alabama Power, Mississippi Power, and Gulf Power, still owned by Southern Company at the time of the report, scored below the Southeast average for energy efficiency, according ([link removed]) to a report from the Southern Alliance for Clean Energy. Only Georgia Power scored above the southeast average, but it still scored well below the national average for energy efficiency.

Header image source: Wikipedia

The post Southern Company Net-Zero Implementation Plan Filled with Loopholes for Continued Use of Fossil Fuels ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** Pollution Payday: analysis of executive compensation and incentives of the largest U.S. investor-owned utilities ([link removed])

** NextEra Energy’s failed attempt to purchase JEA highlights web of murky spending, lobbying ([link removed])

** Utility Front Group Sparks Attack on Florida Rooftop Solar Amid Ongoing COVID Crisis ([link removed])

** Bill Seitz’s FirstEnergy bailout bill is one target of a subpoena ([link removed])

** EEI used anti-clean energy campaigns as role models in political boot camp for utility execs ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2020 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

------------------------------------------------------------

By Daniel Tait on Sep 24, 2020 05:08 pm

Southern Company released ([link removed]) more information this week on how it plans to reach “net zero emissions,” and while the plan remains scant on key details, the company has made one thing clear: it is leaning into the continued use of gas through 2050, despite the company’s net-zero goal. Gas is a fossil fuel that emits greenhouse gases when leaked or burned.

Throughout Southern’s new “Implementation Plan,” the company used vague language that may give it the ability to claim that it has met its net-zero goals even if it continues burning fossil fuels past 2050. Some of the mechanisms Southern might use include claiming renewable energy generation toward its total even if it sells the rights to renewable energy credits ([link removed]) , counting the full generation of renewable energy projects even if it owns only portions of those projects ([link removed]) , and relying on its unregulated arm, Southern Power, to develop ([link removed]) renewable energy for other utilities while its regulated utilities – Alabama Power, Georgia Power, and Mississippi Power – continued

burning fossil fuels.

The company also left open the possibility of counting ([link removed]) electrification efforts toward its net-zero goal. Southern Company CEO Tom Fanning had previously floated ([link removed]) transportation electrification as an opportunity for Southern to “take credit for” decarbonization. That accounting would belie the way that climate experts generally assume that “net-zero” goals would work for utilities, because limiting global warming to either 1.5°C or 2°C hinges not only on electrifying transportation, but on doing so into a fully decarbonized power sector. (According to the IPCC, any 1.5°C or 2°C case requires all global electricity to reach zero carbon by 2050.)

As consumers switch to electric transportation from gasoline and diesel, overall emissions drop, as studied and reported ([link removed]) by the Union of Concerned Scientists. However, the switch to electric transportation does not obviate a utility’s need to fully decarbonize. For utilities to reduce emissions in accordance with decarbonization pathways that would avoid the worst impacts of climate change, experts say that they must power the new electrified transportation sector with 100% zero-carbon sources.

Southern did not commit to retirement dates for any of its coal fleet, and instead the report appeared to project coal combustion beyond 2040 ([link removed]) , gas combustion well beyond 2050 ([link removed]) , and carbon capture utilization and sequestration (CCUS) starting around 2040 ([link removed]) , despite Southern’s CCUS failures at its Kemper plant.

The Energy and Policy Institute has previously reported ([link removed]) on Southern’s misleading claims about its net-zero goal when it announced the new goal at its Annual Meeting in May of 2020.

The company also amended Fanning’s greenhouse gas (GHG) incentive to include a key change ([link removed]) in the middle of his performance period, compared to previous versions of the incentive package filed with the Securities and Exchange Commission in 2019 ([link removed]) and 2020 ([link removed]) . The net-zero implementation plan now says that Fanning could receive credit for closing or ceasing continual operations of coal and gas-fired plants. Previous versions did not give Fanning credit for gas-related closures or cessations. Importantly, Fanning’s incentive plan will not penalize him in any way if Southern adds new GHG-emitting gas plants, as the company is planning to do in Alabama

([link removed]) .

** Loosely defining net-zero emissions

------------------------------------------------------------

98% ([link removed]) of Southern Company greenhouse gas emissions come from the burning of fossil fuels for creating electricity, according to the company. Rather than eliminating all greenhouse gas emissions from electricity production, Southern’s implementation plan leans on negative emissions technologies, many of which are not yet commercially viable, and other accounting mechanisms to achieve net-zero emissions while investing in the continued burning of fossil fuels. That sets Southern apart from peer utilities like Consumers Energy ([link removed]) , NIPSCO ([link removed]) , and PSEG

([link removed]) , which have pledged to forgo new gas investments, and APS ([link removed]) and Xcel ([link removed]) , which committed to fully decarbonizing by 2050 without the use of offsets.

Southern Company noted that it may count renewable energy toward its goals, even if it does not own rights to the renewable energy credits. ([link removed]) The company claimed that renewables, as used in its net-zero implementation plan, included renewables “whether we have rights to the renewable energy credits (RECs) associated with energy from the facilities.”

Claiming ownership of renewable energy without the rights to RECs may run afoul of federal regulations. “If a marketer generates renewable electricity but sells renewable energy certificates for all of that electricity, it would be deceptive for the marketer to represent, directly or by implication, that it uses renewable energy,” according ([link removed]) to the Federal Trade Commission.

Southern also stated ([link removed]) it would claim credit for 100% of a renewable energy plant, even if the plant’s ownership was split between it and other parties.

Southern Company appeared ([link removed]) to leave itself room to count electrification, such as switching to an electric vehicle from an internal combustion engine, as part of its net-zero implementation plan. Should Southern Company count electrification toward its net-zero goal, it calls into question whether other parties, such as an automotive manufacturer or the actual purchaser of the vehicle, would have any claim toward its own emission reduction goals. In any case, Southern would still need to decarbonize the electricity it would sell to charge the new electric vehicle in order to achieve its net-zero goal.

** Southern touts distributed energy resources and energy efficiency while operating companies block action

------------------------------------------------------------

Southern Company repeatedly referred to distributed energy resources (DER), such as rooftop solar and energy efficiency, as growing areas of investment needed ([link removed]) to help the company reach its net-zero emissions goal. However, Southern’s operating subsidiaries have routinely blocked action on renewable energy, and often ranks at or near the bottom in the country on energy efficiency. The company lumped DERs into the same category for “facilitates GHG reduction” as gas. Many DERs, such as rooftop solar, energy efficiency and demand response, actively reduce emissions, whereas gas emits greenhouse gases.

Southern’s “Illustrative 2050 Nameplate Capacity Mix” graphic estimates 39% gas capacity in 2050, with 21% of the company’s total capacity from gas with CCUS, and just 3% of its capacity from DER. Many DER technologies are already cost effective, whereas CCUS technology for power plants has yet to be commercially viable ([link removed]) anywhere in the United States.

Figure 1. Illustrative 2050 Nameplate Capacity Mix. Source, Southern Company.

Georgia Power, as part of its 2019 integrated resource plan, was forced ([link removed]) by Georgia regulators to include 2.21 GW of solar, more than double the amount of renewable energy it originally wanted.

Georgia Power’s anti-renewable energy stance cost the utility a large industrial customer, Nestlé Purina. Nestlé Purina chose a competing utility, Walton Electric Membership Cooperative, as its electricity supplier, in part because Walton offered renewable electricity at a much lower price ([link removed]) . Georgia Power lost ([link removed]) its case before the Georgia Public Service Commission’s Hearing Officer, lost ([link removed]) its administrative appeal, and is currently suing ([link removed]) the Commission in state court.

Alabama Power recently won ([link removed]) approval from regulators to increase its solar fee to $5.41 per kilowatt (kW) per month on grid-connected solar systems of 100 kW and smaller. Advocates filed ([link removed]) a complaint alleging the fee was an unjust and discriminatory rate. Similar fees have been struck down by regulators or courts as discriminatory in Kansas ([link removed]) , Michigan ([link removed]) , and Wisconsin ([link removed]) .

Southern Company’s electric subsidiaries have all performed poorly on energy efficiency. Alabama Power has consistently ranked at or near the bottom of utilities in energy efficiency, according ([link removed]) to the American Council for an Energy Efficiency Economy (ACEEE). Alabama Power, Mississippi Power, and Gulf Power, still owned by Southern Company at the time of the report, scored below the Southeast average for energy efficiency, according ([link removed]) to a report from the Southern Alliance for Clean Energy. Only Georgia Power scored above the southeast average, but it still scored well below the national average for energy efficiency.

Header image source: Wikipedia

The post Southern Company Net-Zero Implementation Plan Filled with Loopholes for Continued Use of Fossil Fuels ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** Pollution Payday: analysis of executive compensation and incentives of the largest U.S. investor-owned utilities ([link removed])

** NextEra Energy’s failed attempt to purchase JEA highlights web of murky spending, lobbying ([link removed])

** Utility Front Group Sparks Attack on Florida Rooftop Solar Amid Ongoing COVID Crisis ([link removed])

** Bill Seitz’s FirstEnergy bailout bill is one target of a subpoena ([link removed])

** EEI used anti-clean energy campaigns as role models in political boot camp for utility execs ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2020 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: Energy and Policy Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp