Email

Costs and tax implications of a guaranteed annual income, and Changing size of government

| From | Fraser Institute <[email protected]> |

| Subject | Costs and tax implications of a guaranteed annual income, and Changing size of government |

| Date | September 19, 2020 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

=============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

--------------------

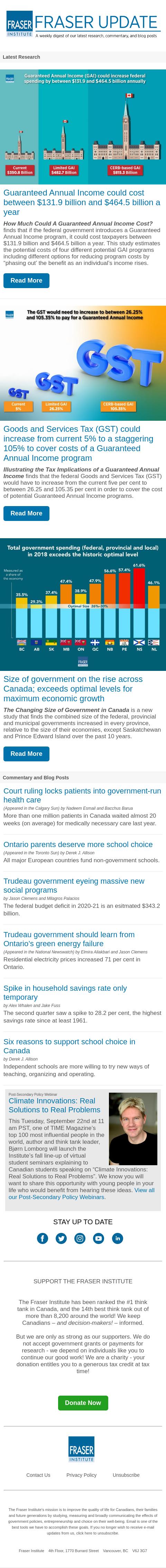

Guaranteed Annual Income could cost between $131.9 billion and $464.5 billion a year

How Much Could A Guaranteed Annual Income Cost? finds that if the federal government introduces a Guaranteed Annual Income program, it could cost taxpayers between $131.9 billion and $464.5 billion a year. This study estimates the potential costs of four different potential GAI programs including different options for reducing program costs by “phasing out’ the benefit as an individual’s income rises.

Read More [[link removed]]

Goods and Services Tax (GST) could increase from current 5% to a staggering 105% to cover costs of a Guaranteed Annual Income program

Illustrating the Tax Implications of a Guaranteed Annual Income finds that the federal Goods and Services Tax (GST) would have to increase from the current five per cent to between 26.25 and 105.35 per cent in order to cover the cost of potential Guaranteed Annual Income programs.

Read More [[link removed]]

Size of government on the rise across Canada; exceeds optimal levels for maximum economic growth [[link removed]]

The Changing Size of Government in Canada is a new study that finds the combined size of the federal, provincial and municipal governments increased in every province, relative to the size of their economies, except Saskatchewan and Prince Edward Island over the past 10 years.

Read More [[link removed]]

Commentary and Blog Posts

------------------

Court ruling locks patients into government-run health care [[link removed]]

(Appeared in the Calgary Sun) by Nadeem Esmail and Bacchus Barua

More than one million patients in Canada waited almost 20 weeks (on average) for medically necessary care last year.

Ontario parents deserve more school choice [[link removed]]

(Appeared in the Toronto Sun) by Derek J. Allison

All major European countries fund non-government schools.

Trudeau government eyeing massive new social programs [[link removed]]

by Jason Clemens and Milagros Palacios

The federal budget deficit in 2020-21 is an esitmated $343.2 billion.

Spike in household savings rate only temporary [[link removed]]

by Alex Whalen and Jake Fuss

The second quarter saw a spike to 28.2 per cent, the highest savings rate since at least 1961.

Trudeau government eyeing massive new social programs [[link removed]]

by Jason Clemens and Milagros Palacios

The federal budget deficit in 2020-21 is an esitmated $343.2 billion.

Trudeau government should learn from Ontario’s green energy failure [[link removed]]

(Appeared in the National Newswatch) by Elmira Aliakbari and Jason Clemens

Residential electricity prices increased 71 per cent in Ontario.

Six reasons to support school choice in Canada [[link removed]]

by Derek J. Allison

Independent schools are more willing to try new ways of teaching, organizing and operating.

Post-Secondary Policy Webinar

Climate Innovations: Real Solutions to Real Problems [[link removed]]

This Tuesday, September 22nd at 11 am PST, one of TIME Magazine’s top 100 most influential people in the world, author and think tank leader, Bjørn Lomborg will launch the Institute’s fall line-up of virtual student seminars explaining to Canadian students speaking on “Climate Innovations: Real Solutions to Real Problems”. We know you will want to share this opportunity with young people in your life who would benefit from hearing these ideas. View all our Post-Secondary Policy Webinars [[link removed]].

SUPPORT THE FRASER INSTITUTE

------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

--------------------

Guaranteed Annual Income could cost between $131.9 billion and $464.5 billion a year

How Much Could A Guaranteed Annual Income Cost? finds that if the federal government introduces a Guaranteed Annual Income program, it could cost taxpayers between $131.9 billion and $464.5 billion a year. This study estimates the potential costs of four different potential GAI programs including different options for reducing program costs by “phasing out’ the benefit as an individual’s income rises.

Read More [[link removed]]

Goods and Services Tax (GST) could increase from current 5% to a staggering 105% to cover costs of a Guaranteed Annual Income program

Illustrating the Tax Implications of a Guaranteed Annual Income finds that the federal Goods and Services Tax (GST) would have to increase from the current five per cent to between 26.25 and 105.35 per cent in order to cover the cost of potential Guaranteed Annual Income programs.

Read More [[link removed]]

Size of government on the rise across Canada; exceeds optimal levels for maximum economic growth [[link removed]]

The Changing Size of Government in Canada is a new study that finds the combined size of the federal, provincial and municipal governments increased in every province, relative to the size of their economies, except Saskatchewan and Prince Edward Island over the past 10 years.

Read More [[link removed]]

Commentary and Blog Posts

------------------

Court ruling locks patients into government-run health care [[link removed]]

(Appeared in the Calgary Sun) by Nadeem Esmail and Bacchus Barua

More than one million patients in Canada waited almost 20 weeks (on average) for medically necessary care last year.

Ontario parents deserve more school choice [[link removed]]

(Appeared in the Toronto Sun) by Derek J. Allison

All major European countries fund non-government schools.

Trudeau government eyeing massive new social programs [[link removed]]

by Jason Clemens and Milagros Palacios

The federal budget deficit in 2020-21 is an esitmated $343.2 billion.

Spike in household savings rate only temporary [[link removed]]

by Alex Whalen and Jake Fuss

The second quarter saw a spike to 28.2 per cent, the highest savings rate since at least 1961.

Trudeau government eyeing massive new social programs [[link removed]]

by Jason Clemens and Milagros Palacios

The federal budget deficit in 2020-21 is an esitmated $343.2 billion.

Trudeau government should learn from Ontario’s green energy failure [[link removed]]

(Appeared in the National Newswatch) by Elmira Aliakbari and Jason Clemens

Residential electricity prices increased 71 per cent in Ontario.

Six reasons to support school choice in Canada [[link removed]]

by Derek J. Allison

Independent schools are more willing to try new ways of teaching, organizing and operating.

Post-Secondary Policy Webinar

Climate Innovations: Real Solutions to Real Problems [[link removed]]

This Tuesday, September 22nd at 11 am PST, one of TIME Magazine’s top 100 most influential people in the world, author and think tank leader, Bjørn Lomborg will launch the Institute’s fall line-up of virtual student seminars explaining to Canadian students speaking on “Climate Innovations: Real Solutions to Real Problems”. We know you will want to share this opportunity with young people in your life who would benefit from hearing these ideas. View all our Post-Secondary Policy Webinars [[link removed]].

SUPPORT THE FRASER INSTITUTE

------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor