| From | Center for Jobs and the Economy <[email protected]> |

| Subject | California Employment Report for August 2020 |

| Date | September 18, 2020 10:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] California Employment Report

for August 2020

The Center for Jobs and the Economy has released our initial analysis of the August Employment Report from the California Employment Development Department. For additional information and data about the California economy visit [[link removed]].

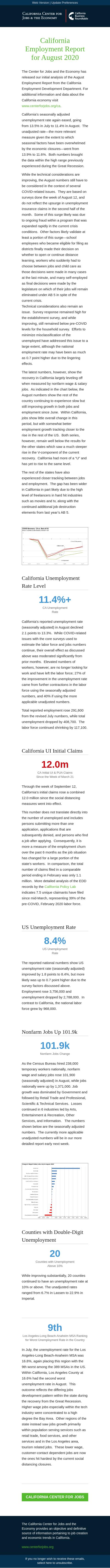

California’s seasonally adjusted unemployment rate again eased, going from 13.5% in July to 11.4% in August. The unadjusted rate—the more relevant measure given the extent to which seasonal factors have been overwhelmed by the economic closures—went from 13.9% to 11.6%. Both numbers brought the data within the high range previously experienced during the Great Recession.

While the technical considerations are improving, the August numbers still have to be considered in the context of several COVID-related issues. They are based on surveys done the week of August 12, and do not reflect the upsurge in unemployment insurance claims in the second half of the month. Some of this surge likely was due to ongoing fraud within a program that was expanded rapidly in the current crisis conditions. Other factors likely validate at least a portion of this surge—school employees who became eligible for filing as districts finally made their decision on whether to open or continue distance learning, workers who suddenly had to choose between jobs and child care as those decisions were made in many cases at the last minute, and many self-employed as final decisions were made by the legislature on which of their jobs will remain eliminated under AB 5 in spite of the current crisis.

Technical considerations also remain an issue. Survey response remained high for the establishment survey, and while improving, still remained below pre-COVID levels for the household survey. Efforts to minimize misclassification of the unemployed have addressed this issue to a large extent, although the national employment rate may have been as much as 0.7 point higher due to the lingering effects.

The latest numbers, however, show the recovery in California largely leveling off when measured by nonfarm wage & salary jobs. As indicated in the chart below, the August numbers show the rest of the country continuing to experience slow but still improving growth in both jobs and employment since June. Within California, jobs show little overall change in this period, but with somewhat better employment growth tracking closer to the rise in the rest of the US. Both series, however, remain well below the results for the other states which saw a much steeper rise in the V-component of the current recovery. California had more of a “U” and has yet to rise to the same level.

The rest of the states have also experienced closer tracking between jobs and employment. The gap has been wider in California in part likely due to the high level of freelancers in hard hit industries such as movies and tv, along with the continued additional job destruction elements from last year’s AB 5.

California Unemployment Rate Level 11.4%+ CA Unemployment

Rate

California's reported unemployment rate (seasonally adjusted) in August declined 2.1 points to 13.3%. While COVID-related issues with the core surveys used to estimate the labor force and jobs numbers continue, their overall effect as discussed above was moderated significantly from prior months. Elevated numbers of workers, however, are no longer looking for work and have left the labor force; 27% of the improvement in the unemployment rate came from further contractions in the labor force using the seasonally adjusted numbers, and 40% if using the more applicable unadjusted numbers.

Total reported employment rose 291,600 from the revised July numbers, while total unemployment dropped by 408,700. The labor force continued shrinking by 117,100.

California UI Initial Claims 12.0m CA Initial UI & PUA Claims

Since the Week of March 21

Through the week of September 12, California’s initial claims rose a combined 12.0 million since the social distancing measures went into effect.

This number does not translate directly into the number of unemployed and includes persons submitting more than one application, applications that are subsequently denied, and persons who find a job after applying. Consequently, it is more a measure of the employment churn over the past 6 months as the job situation has changed for a large portion of the state’s workers. In comparison, the total number of claims filed in a comparable period ending in February was only 1.1 million. More detailed analysis of the EDD records by the California Policy Lab [[link removed]] indicates 7.5 unique claimants have filed since mid-March, representing 39% of the pre-COVID, February 2020 labor force.

US Unemployment Rate 8.4% US Unemployment

Rate

The reported national numbers show US unemployment rate (seasonally adjusted) improved by 1.8 points to 8.4%, but more likely was up to 0.7 point higher due to the survey factors discussed above. Employment rose 3,756,000 and unemployment dropped by 2,788,000. In contrast to California, the national labor force grew by 968,000.

Nonfarm Jobs Up 101.9k 101.9k Nonfarm Jobs Change

As the Census Bureau hired 238,000 temporary workers nationally, nonfarm wage and salary jobs rose 101,900 (seasonally adjusted) in August, while jobs nationally were up by 1,371,000. Job growth was dominated by Government and followed by Retail Trade and Professional, Scientific & Technical Services. Losses continued in 6 industries led by Arts, Entertainment & Recreation, Other Services, and Information. The numbers shown below are the seasonally adjusted numbers. The currently more applicable unadjusted numbers will be in our more detailed report early next week.

Counties with Double-Digit Unemployment 20 Counties with Unemployment

Above 10%

While improving substantially, 20 counties continued to have an unemployment rate at 10% or above. The unadjusted rates ranged from 6.7% in Lassen to 22.9% in Imperial.

9th Los Angeles-Long Beach-Anaheim MSA Ranking for Worst Unemployment Rate in the Country

In July, the unemployment rate for the Los Angeles-Long Beach-Anaheim MSA was 16.8%, again placing this region with the 9th worst among the 389 MSAs in the US. Within California, Los Angeles County at 16.6% had the second worst unemployment rate in August. This outcome reflects the differing jobs development pattern within the state during the recovery from the Great Recession. Higher wage jobs especially within the tech industry were concentrated to a high degree the Bay Area. Other regions of the state instead saw jobs growth primarily within population serving services such as retail trade, food services, and other services and in the Los Angeles area, tourism related jobs. These lower wage, customer-contact dependent jobs are now the ones hit hardest by the current social distancing closures.

California Center for Jobs [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

for August 2020

The Center for Jobs and the Economy has released our initial analysis of the August Employment Report from the California Employment Development Department. For additional information and data about the California economy visit [[link removed]].

California’s seasonally adjusted unemployment rate again eased, going from 13.5% in July to 11.4% in August. The unadjusted rate—the more relevant measure given the extent to which seasonal factors have been overwhelmed by the economic closures—went from 13.9% to 11.6%. Both numbers brought the data within the high range previously experienced during the Great Recession.

While the technical considerations are improving, the August numbers still have to be considered in the context of several COVID-related issues. They are based on surveys done the week of August 12, and do not reflect the upsurge in unemployment insurance claims in the second half of the month. Some of this surge likely was due to ongoing fraud within a program that was expanded rapidly in the current crisis conditions. Other factors likely validate at least a portion of this surge—school employees who became eligible for filing as districts finally made their decision on whether to open or continue distance learning, workers who suddenly had to choose between jobs and child care as those decisions were made in many cases at the last minute, and many self-employed as final decisions were made by the legislature on which of their jobs will remain eliminated under AB 5 in spite of the current crisis.

Technical considerations also remain an issue. Survey response remained high for the establishment survey, and while improving, still remained below pre-COVID levels for the household survey. Efforts to minimize misclassification of the unemployed have addressed this issue to a large extent, although the national employment rate may have been as much as 0.7 point higher due to the lingering effects.

The latest numbers, however, show the recovery in California largely leveling off when measured by nonfarm wage & salary jobs. As indicated in the chart below, the August numbers show the rest of the country continuing to experience slow but still improving growth in both jobs and employment since June. Within California, jobs show little overall change in this period, but with somewhat better employment growth tracking closer to the rise in the rest of the US. Both series, however, remain well below the results for the other states which saw a much steeper rise in the V-component of the current recovery. California had more of a “U” and has yet to rise to the same level.

The rest of the states have also experienced closer tracking between jobs and employment. The gap has been wider in California in part likely due to the high level of freelancers in hard hit industries such as movies and tv, along with the continued additional job destruction elements from last year’s AB 5.

California Unemployment Rate Level 11.4%+ CA Unemployment

Rate

California's reported unemployment rate (seasonally adjusted) in August declined 2.1 points to 13.3%. While COVID-related issues with the core surveys used to estimate the labor force and jobs numbers continue, their overall effect as discussed above was moderated significantly from prior months. Elevated numbers of workers, however, are no longer looking for work and have left the labor force; 27% of the improvement in the unemployment rate came from further contractions in the labor force using the seasonally adjusted numbers, and 40% if using the more applicable unadjusted numbers.

Total reported employment rose 291,600 from the revised July numbers, while total unemployment dropped by 408,700. The labor force continued shrinking by 117,100.

California UI Initial Claims 12.0m CA Initial UI & PUA Claims

Since the Week of March 21

Through the week of September 12, California’s initial claims rose a combined 12.0 million since the social distancing measures went into effect.

This number does not translate directly into the number of unemployed and includes persons submitting more than one application, applications that are subsequently denied, and persons who find a job after applying. Consequently, it is more a measure of the employment churn over the past 6 months as the job situation has changed for a large portion of the state’s workers. In comparison, the total number of claims filed in a comparable period ending in February was only 1.1 million. More detailed analysis of the EDD records by the California Policy Lab [[link removed]] indicates 7.5 unique claimants have filed since mid-March, representing 39% of the pre-COVID, February 2020 labor force.

US Unemployment Rate 8.4% US Unemployment

Rate

The reported national numbers show US unemployment rate (seasonally adjusted) improved by 1.8 points to 8.4%, but more likely was up to 0.7 point higher due to the survey factors discussed above. Employment rose 3,756,000 and unemployment dropped by 2,788,000. In contrast to California, the national labor force grew by 968,000.

Nonfarm Jobs Up 101.9k 101.9k Nonfarm Jobs Change

As the Census Bureau hired 238,000 temporary workers nationally, nonfarm wage and salary jobs rose 101,900 (seasonally adjusted) in August, while jobs nationally were up by 1,371,000. Job growth was dominated by Government and followed by Retail Trade and Professional, Scientific & Technical Services. Losses continued in 6 industries led by Arts, Entertainment & Recreation, Other Services, and Information. The numbers shown below are the seasonally adjusted numbers. The currently more applicable unadjusted numbers will be in our more detailed report early next week.

Counties with Double-Digit Unemployment 20 Counties with Unemployment

Above 10%

While improving substantially, 20 counties continued to have an unemployment rate at 10% or above. The unadjusted rates ranged from 6.7% in Lassen to 22.9% in Imperial.

9th Los Angeles-Long Beach-Anaheim MSA Ranking for Worst Unemployment Rate in the Country

In July, the unemployment rate for the Los Angeles-Long Beach-Anaheim MSA was 16.8%, again placing this region with the 9th worst among the 389 MSAs in the US. Within California, Los Angeles County at 16.6% had the second worst unemployment rate in August. This outcome reflects the differing jobs development pattern within the state during the recovery from the Great Recession. Higher wage jobs especially within the tech industry were concentrated to a high degree the Bay Area. Other regions of the state instead saw jobs growth primarily within population serving services such as retail trade, food services, and other services and in the Los Angeles area, tourism related jobs. These lower wage, customer-contact dependent jobs are now the ones hit hardest by the current social distancing closures.

California Center for Jobs [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor