Email

WARN ACT + Unemployment Data Update: March through September 17, 2020

| From | Center for Jobs and the Economy <[email protected]> |

| Subject | WARN ACT + Unemployment Data Update: March through September 17, 2020 |

| Date | September 18, 2020 4:02 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] WARN ACT + Unemployment Data Update: March through September 17, 2020

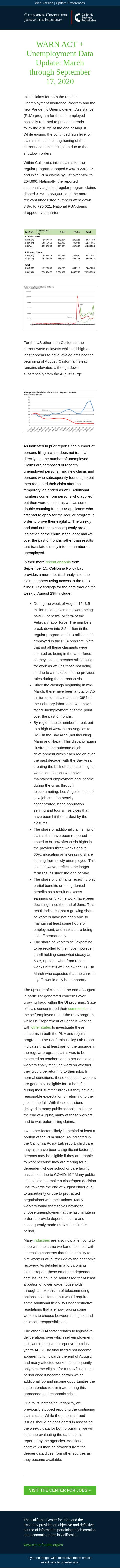

Initial claims for both the regular Unemployment Insurance Program and the new Pandemic Unemployment Assistance (PUA) program for the self-employed basically returned to previous trends following a surge at the end of August. While easing, the continued high level of claims reflects the lengthening of the current economic disruption due to the shutdown orders.

Within California, initial claims for the regular program dropped 5.4% to 230,225, and initial PUA claims by just over 50% to 204,690. Nationally, the reported seasonally adjusted regular program claims dipped 3.7% to 860,000, and the more relevant unadjusted numbers were down 8.8% to 790,021. National PUA claims dropped by a quarter.

For the US other than California, the current wave of layoffs while still high at least appears to have leveled off since the beginning of August. California instead remains elevated, although down substantially from the August surge.

As indicated in prior reports, the number of persons filing a claim does not translate directly into the number of unemployed. Claims are composed of recently unemployed persons filing new claims and persons who subsequently found a job but then reopened their claim after that temporary job ended as well. Additional numbers come from persons who applied but then were denied, as well as some double counting from PUA applicants who first had to apply for the regular program in order to prove their eligibility. The weekly and total numbers consequently are an indication of the churn in the labor market over the past 6 months rather than results that translate directly into the number of unemployed.

In their more recent analysis [[link removed]] from September 15, California Policy Lab provides a more detailed analysis of the claim numbers using access to the EDD filings. Key findings for the data through the week of August 29th include:

During the week of August 15, 3.5 million unique claimants were being paid UI benefits, or 19% of the February labor force. The numbers break down into 2.2 million in the regular program and 1.3 million self-employed in the PUA program. Note that not all these claimants were counted as being in the labor force as they include persons still looking for work as well as those not doing so due to a relaxation of the previous rules during the current crisis. Since the closings beginning in mid-March, there have been a total of 7.5 million unique claimants, or 39% of the February labor force who have faced unemployment at some point over the past 6 months. By region, these numbers break out to a high of 45% in Los Angeles to 32% in the Bay Area (not including Marin and Napa). This disparity again illustrates the outcome of job development within each region over the past decade, with the Bay Area creating the bulk of the state’s higher wage occupations who have maintained employment and income during the crisis through telecommuting. Los Angeles instead saw job creation heavily concentrated in the population serving and tourism services that have been hit the hardest by the closures. The share of additional claims—prior claims that have been reopened—eased to 50.1% after crisis highs in the previous three weeks above 60%, indicating an increasing share coming from newly unemployed. This level, however, reflects the longer term results since the end of May. The share of claimants receiving only partial benefits or being denied benefits as a result of excess earnings or full-time work have been declining since the end of June. This result indicates that a growing share of workers have not been able to maintain at least some hours of employment, and instead are being laid off permanently. The share of workers still expecting to be recalled to their jobs, however, is still holding somewhat steady at 63%, up somewhat from recent weeks but still well below the 90% in March who expected that the current layoffs would only be temporary.

The upsurge of claims at the end of August in particular generated concerns over growing fraud within the UI programs. State officials concentrated their comments [[link removed]] on the self-employed under the PUA program, while US Department of Labor is working with other states [[link removed]] to investigate these concerns in both the PUA and regular programs. The California Policy Lab report indicates that at least part of the upsurge in the regular program claims was to be expected as teachers and other education workers finally received word on whether they would be returning to their jobs. In normal conditions, these education workers are generally ineligible for UI benefits during their summer breaks if they have a reasonable expectation of returning to their jobs in the fall. With these decisions delayed in many public schools until near the end of August, many of these workers had to wait before filing claims.

Two other factors likely lie behind at least a portion of the PUA surge. As indicated in the California Policy Lab report, child care may also have been a significant factor as persons may be eligible if they are unable to work because they are “caring for a dependent whose school or care facility has closed due to COVID-19.” Many public schools did not make a close/open decision until towards the end of August either due to uncertainty or due to protracted negotiations with their unions. Many workers found themselves having to choose unemployment at the last minute in order to provide dependent care and consequently made PUA claims in this period.

Many industries [[link removed]] are also now attempting to cope with the same worker outcomes, with increasing concerns that their inability to hire workers will further delay the economic recovery. As detailed in a forthcoming Center report, these emerging dependent care issues could be addressed for at least a portion of lower wage households through an expansion of telecommuting options in California, but would require some additional flexibility under restrictive regulations that are now forcing some workers to choose between their jobs and child care responsibilities.

The other PUA factor relates to legislative deliberations over which self-employment jobs would be given a reprieve from last year’s AB 5. The final list did not become apparent until towards the end of August, and many affected workers consequently only became eligible for a PUA filing in this period once it became certain which additional job and income opportunities the state intended to eliminate during this unprecedented economic crisis.

Due to its increasing variability, we previously stopped reporting the continuing claims data. While the potential fraud issues should be considered in assessing the weekly data for both programs, we will continue evaluating the data as it is reported by the agencies. Additional context will then be provided from the deeper data dives from other sources as they become available.

Visit The Center For Jobs » [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Initial claims for both the regular Unemployment Insurance Program and the new Pandemic Unemployment Assistance (PUA) program for the self-employed basically returned to previous trends following a surge at the end of August. While easing, the continued high level of claims reflects the lengthening of the current economic disruption due to the shutdown orders.

Within California, initial claims for the regular program dropped 5.4% to 230,225, and initial PUA claims by just over 50% to 204,690. Nationally, the reported seasonally adjusted regular program claims dipped 3.7% to 860,000, and the more relevant unadjusted numbers were down 8.8% to 790,021. National PUA claims dropped by a quarter.

For the US other than California, the current wave of layoffs while still high at least appears to have leveled off since the beginning of August. California instead remains elevated, although down substantially from the August surge.

As indicated in prior reports, the number of persons filing a claim does not translate directly into the number of unemployed. Claims are composed of recently unemployed persons filing new claims and persons who subsequently found a job but then reopened their claim after that temporary job ended as well. Additional numbers come from persons who applied but then were denied, as well as some double counting from PUA applicants who first had to apply for the regular program in order to prove their eligibility. The weekly and total numbers consequently are an indication of the churn in the labor market over the past 6 months rather than results that translate directly into the number of unemployed.

In their more recent analysis [[link removed]] from September 15, California Policy Lab provides a more detailed analysis of the claim numbers using access to the EDD filings. Key findings for the data through the week of August 29th include:

During the week of August 15, 3.5 million unique claimants were being paid UI benefits, or 19% of the February labor force. The numbers break down into 2.2 million in the regular program and 1.3 million self-employed in the PUA program. Note that not all these claimants were counted as being in the labor force as they include persons still looking for work as well as those not doing so due to a relaxation of the previous rules during the current crisis. Since the closings beginning in mid-March, there have been a total of 7.5 million unique claimants, or 39% of the February labor force who have faced unemployment at some point over the past 6 months. By region, these numbers break out to a high of 45% in Los Angeles to 32% in the Bay Area (not including Marin and Napa). This disparity again illustrates the outcome of job development within each region over the past decade, with the Bay Area creating the bulk of the state’s higher wage occupations who have maintained employment and income during the crisis through telecommuting. Los Angeles instead saw job creation heavily concentrated in the population serving and tourism services that have been hit the hardest by the closures. The share of additional claims—prior claims that have been reopened—eased to 50.1% after crisis highs in the previous three weeks above 60%, indicating an increasing share coming from newly unemployed. This level, however, reflects the longer term results since the end of May. The share of claimants receiving only partial benefits or being denied benefits as a result of excess earnings or full-time work have been declining since the end of June. This result indicates that a growing share of workers have not been able to maintain at least some hours of employment, and instead are being laid off permanently. The share of workers still expecting to be recalled to their jobs, however, is still holding somewhat steady at 63%, up somewhat from recent weeks but still well below the 90% in March who expected that the current layoffs would only be temporary.

The upsurge of claims at the end of August in particular generated concerns over growing fraud within the UI programs. State officials concentrated their comments [[link removed]] on the self-employed under the PUA program, while US Department of Labor is working with other states [[link removed]] to investigate these concerns in both the PUA and regular programs. The California Policy Lab report indicates that at least part of the upsurge in the regular program claims was to be expected as teachers and other education workers finally received word on whether they would be returning to their jobs. In normal conditions, these education workers are generally ineligible for UI benefits during their summer breaks if they have a reasonable expectation of returning to their jobs in the fall. With these decisions delayed in many public schools until near the end of August, many of these workers had to wait before filing claims.

Two other factors likely lie behind at least a portion of the PUA surge. As indicated in the California Policy Lab report, child care may also have been a significant factor as persons may be eligible if they are unable to work because they are “caring for a dependent whose school or care facility has closed due to COVID-19.” Many public schools did not make a close/open decision until towards the end of August either due to uncertainty or due to protracted negotiations with their unions. Many workers found themselves having to choose unemployment at the last minute in order to provide dependent care and consequently made PUA claims in this period.

Many industries [[link removed]] are also now attempting to cope with the same worker outcomes, with increasing concerns that their inability to hire workers will further delay the economic recovery. As detailed in a forthcoming Center report, these emerging dependent care issues could be addressed for at least a portion of lower wage households through an expansion of telecommuting options in California, but would require some additional flexibility under restrictive regulations that are now forcing some workers to choose between their jobs and child care responsibilities.

The other PUA factor relates to legislative deliberations over which self-employment jobs would be given a reprieve from last year’s AB 5. The final list did not become apparent until towards the end of August, and many affected workers consequently only became eligible for a PUA filing in this period once it became certain which additional job and income opportunities the state intended to eliminate during this unprecedented economic crisis.

Due to its increasing variability, we previously stopped reporting the continuing claims data. While the potential fraud issues should be considered in assessing the weekly data for both programs, we will continue evaluating the data as it is reported by the agencies. Additional context will then be provided from the deeper data dives from other sources as they become available.

Visit The Center For Jobs » [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor