Email

WARN ACT + Unemployment Data Update: March through August 29, 2020

| From | Center for Jobs and the Economy <[email protected]> |

| Subject | WARN ACT + Unemployment Data Update: March through August 29, 2020 |

| Date | September 3, 2020 11:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] WARN ACT + Unemployment Data Update: March through

August 29, 2020

Nationally, unemployment Insurance initial claims for the week of August 29 are being reported as dropping 12.9% below the prior week. While still elevated way above pre-crisis levels, the latest report suggests the numbers at least are headed in the right direction. The numbers are, however, misleading for a number of reasons.

First, the numbers being reported are the seasonally adjusted series. Beginning with this week’s report, the method used to calculate the seasonal adjustment was changed substantially. While these revisions bring the adjusted numbers more in line with the more relevant unadjusted numbers, much of the improvement was statistical. In fact, the unadjusted numbers—which are more relevant in the current circumstances given that the crisis overwhelms whatever possible seasonal factors that are still in play—were largely unchanged, growing only 0.9% from the revised numbers of a week ago.

Second, the reported numbers cover only the regular UI program. PUA initial claims by the self-employed grew by 25.0%. Combined regular and PUA claims grew by 11.1%, which even accounting for double-counting in the PUA component shows a rise with this latest report.

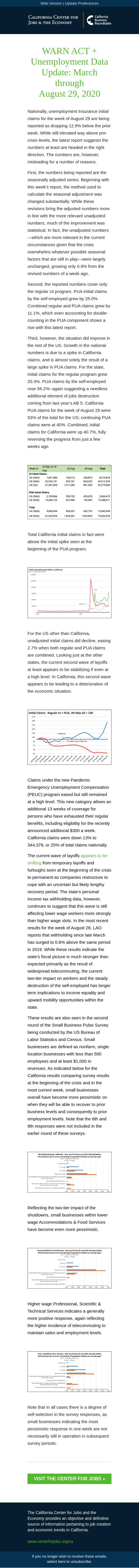

Third, however, the situation did improve in the rest of the US. Growth in the national numbers is due to a spike in California claims, and is almost solely the result of a large spike in PUA claims. For the state, initial claims for the regular program grew 20.3%. PUA claims by the self-employed rose 56.2%--again suggesting a needless additional element of jobs destruction coming from last year’s AB 5. California PUA claims for the week of August 29 were 53% of the total for the US; continuing PUA claims were at 40%. Combined, initial claims for California were up 40.7%, fully reversing the progress from just a few weeks ago.

Total California initial claims in fact were above the initial spike seen at the beginning of the PUA program.

For the US other than California, unadjusted initial claims did decline, easing 2.7% when both regular and PUA claims are combined. Looking just at the other states, the current second wave of layoffs at least appears to be stabilizing if even at a high level. In California, this second wave appears to be leading to a deterioration of the economic situation.

Claims under the new Pandemic Emergency Unemployment Compensation (PEUC) program eased but still remained at a high level. This new category allows an additional 13 weeks of coverage for persons who have exhausted their regular benefits, including eligibility for the recently announced additional $300 a week. California claims were down 13% to 344,378, or 25% of total claims nationally.

The current wave of layoffs appears to be shifting [[link removed]] from temporary layoffs and furloughs seen at the beginning of the crisis to permanent as companies restructure to cope with an uncertain but likely lengthy recovery period. The state’s personal income tax withholding data, however, continues to suggest that this wave is still affecting lower wage workers more strongly than higher wage slots. In the most recent results for the week of August 28, LAO reports that withholding since late March has surged to 0.8% above the same period in 2019. While these results indicate the state’s fiscal picture is much stronger than expected primarily as the result of widespread telecommuting, the current two-tier impact on workers and the steady destruction of the self-employed has longer term implications to income equality and upward mobility opportunities within the state.

These results are also seen in the second round of the Small Business Pulse Survey being conducted by the US Bureau of Labor Statistics and Census. Small businesses are defined as nonfarm, single location businesses with less than 500 employees and at least $1,000 in revenues. As indicated below for the California results comparing survey results at the beginning of the crisis and in the most current week, small businesses overall have become more pessimistic on when they will be able to recover to prior business levels and consequently to prior employment levels. Note that the 6th and 8th responses were not included in the earlier round of these surveys.

Reflecting the two-tier impact of the shutdowns, small businesses within lower wage Accommodations & Food Services have become even more pessimistic.

Higher wage Professional, Scientific & Technical Services indicates a generally more positive response, again reflecting the higher incidence of telecommuting to maintain sales and employment levels.

Note that in all cases there is a degree of self-selection in the survey responses, as small businesses indicating the most pessimistic response in one week are not necessarily still in operation in subsequent survey periods.

Visit The Center For Jobs » [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

August 29, 2020

Nationally, unemployment Insurance initial claims for the week of August 29 are being reported as dropping 12.9% below the prior week. While still elevated way above pre-crisis levels, the latest report suggests the numbers at least are headed in the right direction. The numbers are, however, misleading for a number of reasons.

First, the numbers being reported are the seasonally adjusted series. Beginning with this week’s report, the method used to calculate the seasonal adjustment was changed substantially. While these revisions bring the adjusted numbers more in line with the more relevant unadjusted numbers, much of the improvement was statistical. In fact, the unadjusted numbers—which are more relevant in the current circumstances given that the crisis overwhelms whatever possible seasonal factors that are still in play—were largely unchanged, growing only 0.9% from the revised numbers of a week ago.

Second, the reported numbers cover only the regular UI program. PUA initial claims by the self-employed grew by 25.0%. Combined regular and PUA claims grew by 11.1%, which even accounting for double-counting in the PUA component shows a rise with this latest report.

Third, however, the situation did improve in the rest of the US. Growth in the national numbers is due to a spike in California claims, and is almost solely the result of a large spike in PUA claims. For the state, initial claims for the regular program grew 20.3%. PUA claims by the self-employed rose 56.2%--again suggesting a needless additional element of jobs destruction coming from last year’s AB 5. California PUA claims for the week of August 29 were 53% of the total for the US; continuing PUA claims were at 40%. Combined, initial claims for California were up 40.7%, fully reversing the progress from just a few weeks ago.

Total California initial claims in fact were above the initial spike seen at the beginning of the PUA program.

For the US other than California, unadjusted initial claims did decline, easing 2.7% when both regular and PUA claims are combined. Looking just at the other states, the current second wave of layoffs at least appears to be stabilizing if even at a high level. In California, this second wave appears to be leading to a deterioration of the economic situation.

Claims under the new Pandemic Emergency Unemployment Compensation (PEUC) program eased but still remained at a high level. This new category allows an additional 13 weeks of coverage for persons who have exhausted their regular benefits, including eligibility for the recently announced additional $300 a week. California claims were down 13% to 344,378, or 25% of total claims nationally.

The current wave of layoffs appears to be shifting [[link removed]] from temporary layoffs and furloughs seen at the beginning of the crisis to permanent as companies restructure to cope with an uncertain but likely lengthy recovery period. The state’s personal income tax withholding data, however, continues to suggest that this wave is still affecting lower wage workers more strongly than higher wage slots. In the most recent results for the week of August 28, LAO reports that withholding since late March has surged to 0.8% above the same period in 2019. While these results indicate the state’s fiscal picture is much stronger than expected primarily as the result of widespread telecommuting, the current two-tier impact on workers and the steady destruction of the self-employed has longer term implications to income equality and upward mobility opportunities within the state.

These results are also seen in the second round of the Small Business Pulse Survey being conducted by the US Bureau of Labor Statistics and Census. Small businesses are defined as nonfarm, single location businesses with less than 500 employees and at least $1,000 in revenues. As indicated below for the California results comparing survey results at the beginning of the crisis and in the most current week, small businesses overall have become more pessimistic on when they will be able to recover to prior business levels and consequently to prior employment levels. Note that the 6th and 8th responses were not included in the earlier round of these surveys.

Reflecting the two-tier impact of the shutdowns, small businesses within lower wage Accommodations & Food Services have become even more pessimistic.

Higher wage Professional, Scientific & Technical Services indicates a generally more positive response, again reflecting the higher incidence of telecommuting to maintain sales and employment levels.

Note that in all cases there is a degree of self-selection in the survey responses, as small businesses indicating the most pessimistic response in one week are not necessarily still in operation in subsequent survey periods.

Visit The Center For Jobs » [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor