Email

Research Release: Average Canadian family spent 42.6% of annual income on taxes—more than housing, food and clothing combined

| From | Niels Veldhuis <[email protected]> |

| Subject | Research Release: Average Canadian family spent 42.6% of annual income on taxes—more than housing, food and clothing combined |

| Date | September 1, 2020 11:00 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Dear John,

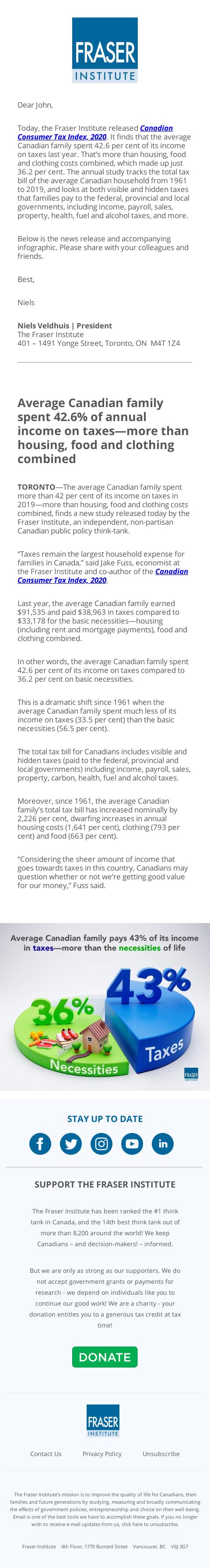

Today, the Fraser Institute released Canadian Consumer Tax Index, 2020 [[link removed]]. It finds that the average Canadian family spent 42.6 per cent of its income on taxes last year. That’s more than housing, food and clothing costs combined, which made up just 36.2 per cent. The annual study tracks the total tax bill of the average Canadian household from 1961 to 2019, and looks at both visible and hidden taxes that families pay to the federal, provincial and local governments, including income, payroll, sales, property, health, fuel and alcohol taxes, and more.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

401 – 1491 Yonge Street, Toronto, ON M4T 1Z4

Average Canadian family spent 42.6% of annual income on taxes—more than housing, food and clothing combined

TORONTO—The average Canadian family spent more than 42 per cent of its income on taxes in 2019—more than housing, food and clothing costs combined, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Taxes remain the largest household expense for families in Canada,” said Jake Fuss, economist at the Fraser Institute and co-author of the Canadian Consumer Tax Index, 2020 [[link removed]].

Last year, the average Canadian family earned $91,535 and paid $38,963 in taxes compared to $33,178 for the basic necessities—housing (including rent and mortgage payments), food and clothing combined.

In other words, the average Canadian family spent 42.6 per cent of its income on taxes compared to 36.2 per cent on basic necessities.

This is a dramatic shift since 1961 when the average Canadian family spent much less of its income on taxes (33.5 per cent) than the basic necessities (56.5 per cent).

The total tax bill for Canadians includes visible and hidden taxes (paid to the federal, provincial and local governments) including income, payroll, sales, property, carbon, health, fuel and alcohol taxes.

Moreover, since 1961, the average Canadian family’s total tax bill has increased nominally by 2,226 per cent, dwarfing increases in annual housing costs (1,641 per cent), clothing (793 per cent) and food (663 per cent).

“Considering the sheer amount of income that goes towards taxes in this country, Canadians may question whether or not we’re getting good value for our money,” Fuss said.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Today, the Fraser Institute released Canadian Consumer Tax Index, 2020 [[link removed]]. It finds that the average Canadian family spent 42.6 per cent of its income on taxes last year. That’s more than housing, food and clothing costs combined, which made up just 36.2 per cent. The annual study tracks the total tax bill of the average Canadian household from 1961 to 2019, and looks at both visible and hidden taxes that families pay to the federal, provincial and local governments, including income, payroll, sales, property, health, fuel and alcohol taxes, and more.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

401 – 1491 Yonge Street, Toronto, ON M4T 1Z4

Average Canadian family spent 42.6% of annual income on taxes—more than housing, food and clothing combined

TORONTO—The average Canadian family spent more than 42 per cent of its income on taxes in 2019—more than housing, food and clothing costs combined, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Taxes remain the largest household expense for families in Canada,” said Jake Fuss, economist at the Fraser Institute and co-author of the Canadian Consumer Tax Index, 2020 [[link removed]].

Last year, the average Canadian family earned $91,535 and paid $38,963 in taxes compared to $33,178 for the basic necessities—housing (including rent and mortgage payments), food and clothing combined.

In other words, the average Canadian family spent 42.6 per cent of its income on taxes compared to 36.2 per cent on basic necessities.

This is a dramatic shift since 1961 when the average Canadian family spent much less of its income on taxes (33.5 per cent) than the basic necessities (56.5 per cent).

The total tax bill for Canadians includes visible and hidden taxes (paid to the federal, provincial and local governments) including income, payroll, sales, property, carbon, health, fuel and alcohol taxes.

Moreover, since 1961, the average Canadian family’s total tax bill has increased nominally by 2,226 per cent, dwarfing increases in annual housing costs (1,641 per cent), clothing (793 per cent) and food (663 per cent).

“Considering the sheer amount of income that goes towards taxes in this country, Canadians may question whether or not we’re getting good value for our money,” Fuss said.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor