| From | Center for Jobs and the Economy <[email protected]> |

| Subject | California Employment Report for July 2020 |

| Date | August 21, 2020 9:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

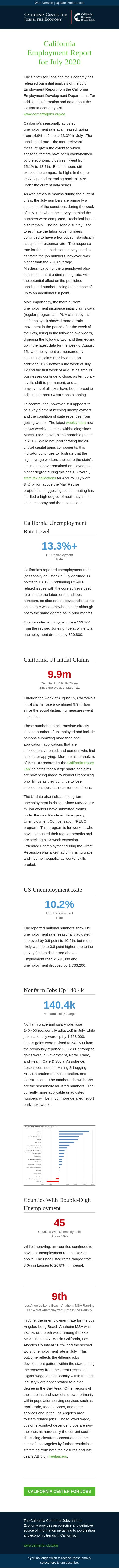

Web Version [link removed] | Update Preferences [link removed] [link removed] California Employment Report

for July 2020

The Center for Jobs and the Economy has released our initial analysis of the July Employment Report from the California Employment Development Department. For additional information and data about the California economy visit [[link removed]].

California’s seasonally adjusted unemployment rate again eased, going from 14.9% in June to 13.3% in July. The unadjusted rate—the more relevant measure given the extent to which seasonal factors have been overwhelmed by the economic closures—went from 15.1% to 13.7%. Both numbers still exceed the comparable highs in the pre-COVID period extending back to 1976 under the current data series.

As with previous months during the current crisis, the July numbers are primarily a snapshot of the conditions during the week of July 12th when the surveys behind the numbers were completed. Technical issues also remain. The household survey used to estimate the labor force numbers continued to have a low but still statistically acceptable response rate. The response rate for the establishment survey used to estimate the job numbers, however, was higher than the 2019 average. Misclassification of the unemployed also continues, but at a diminishing rate, with the potential effect on the published unadjusted numbers being an increase of up to an additional 0.8 point.

More importantly, the more current unemployment insurance initial claims data (regular program and PUA claims by the self-employed) showed more erratic movement in the period after the week of the 12th, rising in the following two weeks, dropping the following two, and then edging up in the latest data for the week of August 15. Unemployment as measured by continuing claims rose by about an additional 18% between the week of July 12 and the first week of August as smaller businesses continue to close, as temporary layoffs shift to permanent, and as employers of all sizes have been forced to adjust their post-COVID jobs planning.

Telecommuting, however, still appears to be a key element keeping unemployment and the condition of state revenues from getting worse. The latest weekly dat [[link removed]] a now shows weekly state tax withholding since March 0.9% above the comparable period in 2019. While not incorporating the all-critical capital gains components, this indicator continues to illustrate that the higher wage workers subject to the state’s income tax have remained employed to a higher degree during this crisis. Overall, state tax collections [[link removed]] for April to July were $4.3 billion above the May Revise projections, suggesting telecommuting has instilled a high degree of resiliency in the state economy and fiscal conditions.

California Unemployment Rate Level 13.3%+ CA Unemployment

Rate

California's reported unemployment rate (seasonally adjusted) in July declined 1.6 points to 13.3%. Continuing COVID-related issues with the core surveys used to estimate the labor force and jobs numbers, as discussed above, indicate the actual rate was somewhat higher although not to the same degree as in prior months.

Total reported employment rose 153,700 from the revised June numbers, while total unemployment dropped by 320,800.

California UI Initial Claims 9.9m CA Initial UI & PUA Claims

Since the Week of March 21

Through the week of August 15, California’s initial claims rose a combined 9.9 million since the social distancing measures went into effect.

These numbers do not translate directly into the number of unemployed and include persons submitting more than one application, applications that are subsequently denied, and persons who find a job after applying. More detailed analysis of the EDD records by the California Policy Lab [[link removed]] indicates that a large share of claims are now being made by workers reopening prior filings as they continue to lose subsequent jobs in the current conditions.

The UI data also indicates long-term unemployment is rising. Since May 23, 2.5 million workers have submitted claims under the new Pandemic Emergency Unemployment Compensation (PEUC) program. This program is for workers who have exhausted their regular benefits and are seeking a 13-week extension. Extended unemployment during the Great Recession was a key factor in rising wage and income inequality as worker skills eroded.

US Unemployment Rate 10.2% US Unemployment

Rate

The reported national numbers show US unemployment rate (seasonally adjusted) improved by 0.9 point to 10.2%, but more likely was up to 0.8 point higher due to the survey factors discussed above. Employment rose 2,591,000 and unemployment dropped by 1,733,200.

Nonfarm Jobs Up 140.4k 140.4k Nonfarm Jobs Change

Nonfarm wage and salary jobs rose 140,400 (seasonally adjusted) in July, while jobs nationally were up by 1,763,000. June's gains were revised to 542,500 from the previously reported 558,200. Strongest gains were in Government, Retail Trade, and Health Care & Social Assistance. Losses continued in Mining & Logging, Arts, Entertainment & Recreation, and Construction. The numbers shown below are the seasonally adjusted numbers. The currently more applicable unadjusted numbers will be in our more detailed report early next week.

Counties With Double-Digit Unemployment 45 Counties With Unemployment

Above 10%

While improving, 45 counties continued to have an unemployment rate at 10% or above. The unadjusted rates ranged from 8.6% in Lassen to 26.8% in Imperial.

9th Los Angeles-Long Beach-Anaheim MSA Ranking

For Worst Unemployment Rate in the Country

In June, the unemployment rate for the Los Angeles-Long Beach-Anaheim MSA was 18.1%, or the 9th worst among the 389 MSAs in the US. Within California, Los Angeles County at 18.2% had the second worst unemployment rate in July. This outcome reflects the differing jobs development pattern within the state during the recovery from the Great Recession. Higher wage jobs especially within the tech industry were concentrated to a high degree in the Bay Area. Other regions of the state instead saw jobs growth primarily within population serving services such as retail trade, food services, and other services and in the Los Angeles area, tourism related jobs. These lower wage, customer-contact dependent jobs are now the ones hit hardest by the current social distancing closures, accentuated in the case of Los Angeles by further restrictions stemming from both the closures and last year’s AB 5 on freelancers [[link removed]].

California Center for Jobs [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

for July 2020

The Center for Jobs and the Economy has released our initial analysis of the July Employment Report from the California Employment Development Department. For additional information and data about the California economy visit [[link removed]].

California’s seasonally adjusted unemployment rate again eased, going from 14.9% in June to 13.3% in July. The unadjusted rate—the more relevant measure given the extent to which seasonal factors have been overwhelmed by the economic closures—went from 15.1% to 13.7%. Both numbers still exceed the comparable highs in the pre-COVID period extending back to 1976 under the current data series.

As with previous months during the current crisis, the July numbers are primarily a snapshot of the conditions during the week of July 12th when the surveys behind the numbers were completed. Technical issues also remain. The household survey used to estimate the labor force numbers continued to have a low but still statistically acceptable response rate. The response rate for the establishment survey used to estimate the job numbers, however, was higher than the 2019 average. Misclassification of the unemployed also continues, but at a diminishing rate, with the potential effect on the published unadjusted numbers being an increase of up to an additional 0.8 point.

More importantly, the more current unemployment insurance initial claims data (regular program and PUA claims by the self-employed) showed more erratic movement in the period after the week of the 12th, rising in the following two weeks, dropping the following two, and then edging up in the latest data for the week of August 15. Unemployment as measured by continuing claims rose by about an additional 18% between the week of July 12 and the first week of August as smaller businesses continue to close, as temporary layoffs shift to permanent, and as employers of all sizes have been forced to adjust their post-COVID jobs planning.

Telecommuting, however, still appears to be a key element keeping unemployment and the condition of state revenues from getting worse. The latest weekly dat [[link removed]] a now shows weekly state tax withholding since March 0.9% above the comparable period in 2019. While not incorporating the all-critical capital gains components, this indicator continues to illustrate that the higher wage workers subject to the state’s income tax have remained employed to a higher degree during this crisis. Overall, state tax collections [[link removed]] for April to July were $4.3 billion above the May Revise projections, suggesting telecommuting has instilled a high degree of resiliency in the state economy and fiscal conditions.

California Unemployment Rate Level 13.3%+ CA Unemployment

Rate

California's reported unemployment rate (seasonally adjusted) in July declined 1.6 points to 13.3%. Continuing COVID-related issues with the core surveys used to estimate the labor force and jobs numbers, as discussed above, indicate the actual rate was somewhat higher although not to the same degree as in prior months.

Total reported employment rose 153,700 from the revised June numbers, while total unemployment dropped by 320,800.

California UI Initial Claims 9.9m CA Initial UI & PUA Claims

Since the Week of March 21

Through the week of August 15, California’s initial claims rose a combined 9.9 million since the social distancing measures went into effect.

These numbers do not translate directly into the number of unemployed and include persons submitting more than one application, applications that are subsequently denied, and persons who find a job after applying. More detailed analysis of the EDD records by the California Policy Lab [[link removed]] indicates that a large share of claims are now being made by workers reopening prior filings as they continue to lose subsequent jobs in the current conditions.

The UI data also indicates long-term unemployment is rising. Since May 23, 2.5 million workers have submitted claims under the new Pandemic Emergency Unemployment Compensation (PEUC) program. This program is for workers who have exhausted their regular benefits and are seeking a 13-week extension. Extended unemployment during the Great Recession was a key factor in rising wage and income inequality as worker skills eroded.

US Unemployment Rate 10.2% US Unemployment

Rate

The reported national numbers show US unemployment rate (seasonally adjusted) improved by 0.9 point to 10.2%, but more likely was up to 0.8 point higher due to the survey factors discussed above. Employment rose 2,591,000 and unemployment dropped by 1,733,200.

Nonfarm Jobs Up 140.4k 140.4k Nonfarm Jobs Change

Nonfarm wage and salary jobs rose 140,400 (seasonally adjusted) in July, while jobs nationally were up by 1,763,000. June's gains were revised to 542,500 from the previously reported 558,200. Strongest gains were in Government, Retail Trade, and Health Care & Social Assistance. Losses continued in Mining & Logging, Arts, Entertainment & Recreation, and Construction. The numbers shown below are the seasonally adjusted numbers. The currently more applicable unadjusted numbers will be in our more detailed report early next week.

Counties With Double-Digit Unemployment 45 Counties With Unemployment

Above 10%

While improving, 45 counties continued to have an unemployment rate at 10% or above. The unadjusted rates ranged from 8.6% in Lassen to 26.8% in Imperial.

9th Los Angeles-Long Beach-Anaheim MSA Ranking

For Worst Unemployment Rate in the Country

In June, the unemployment rate for the Los Angeles-Long Beach-Anaheim MSA was 18.1%, or the 9th worst among the 389 MSAs in the US. Within California, Los Angeles County at 18.2% had the second worst unemployment rate in July. This outcome reflects the differing jobs development pattern within the state during the recovery from the Great Recession. Higher wage jobs especially within the tech industry were concentrated to a high degree in the Bay Area. Other regions of the state instead saw jobs growth primarily within population serving services such as retail trade, food services, and other services and in the Los Angeles area, tourism related jobs. These lower wage, customer-contact dependent jobs are now the ones hit hardest by the current social distancing closures, accentuated in the case of Los Angeles by further restrictions stemming from both the closures and last year’s AB 5 on freelancers [[link removed]].

California Center for Jobs [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor