| From | Center for Jobs and the Economy <[email protected]> |

| Subject | California Energy Price Data for July 2020 |

| Date | August 6, 2020 6:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] California Energy Price Data

for July 2020

Below are the monthly updates from the most current July 2020 fuel price data (GasBuddy.com) and May 2020 electricity and natural gas price data (US Energy Information Agency). To view additional data and analysis related to the California economy visit our website at www.[[link removed]].

California energy prices continued to rise higher, both in absolute terms and compared to the averages for the other states. These outcomes mean that even as many households struggle under the current economic conditions, the state’s energy policies continue to take an increasing share of household incomes both directly in gasoline and utility bills and indirectly as these costs are incorporated into the prices of every other component of the costs of living. Even as the state explores ways to promote a more equitable path in the now delayed economic recovery, the state energy policies continue to ensure that rising costs of living will continue to have a disparate impact on lower and increasingly middle income class households.

The rising energy rates also have important consequences as households shelter in place or maintain their jobs and incomes by working at home. Average residential customer use was up 5% in April compared to the same month a year ago, and up 15% in May. Some households have the potential for offsetting savings from lower gasoline use, but this factor applies primarily to those workers able to continue employment through telework. As indicated by the recent Bureau of Labor Statistics telework data, these workers are generally in higher wage occupations. Lower wage workers in essential industries have had to contend with both cost factors.

California vs. US Fuel Price Gap at 48.9% Premium $1.04 Price Per Gallon

Above US Average

(CA Average)

The July average price per gallon of regular gasoline in California rose 12 cents from June to $3.15. The California premium above the average for the US other than California ($2.12) rose to $1.04, a 48.9% difference.

2nd Ranked by Price

In July, California had the 2nd highest gasoline price among the states and DC, behind only Hawaii. Californians paid $1.31 a gallon more than consumers in Mississippi, the state with the lowest price.

California vs. US Diesel Price $0.97 Price Per Gallon

Above US Average

(CA Average)

The July average price per gallon of diesel in California rose 3 cents from June to $3.34. The California premium above the average for the US other than California ($2.37) rose to 97.2 cents, a 41.0% difference.

2nd Ranked by price

In July, California had the 2nd highest diesel price among the states and DC, behind only Hawaii.

Range Between Highest and Lowest Prices by Region $1.12 Price Per Gallon

Above US Average

(Bay Area Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $0.94 in the Central Valley Region (average July price of $3.06), to $1.12 in Bay Area Region (average July price of $3.24).

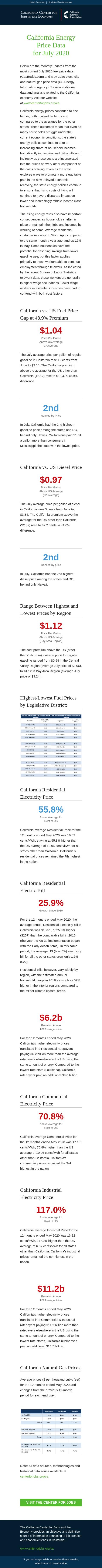

Highest/Lowest Fuel Prices by Legislative District: California Residential Electricity Price 55.8% Above Average for

Rest of US

California average Residential Price for the 12 months ended May 2020 was 19.69 cents/kWh, staying at 55.8% higher than the US average of 12.64 cents/kWh for all states other than California. California’s residential prices remained the 7th highest in the nation.

California Residential Electric Bill 25.9% Growth Since 2010

For the 12 months ended May 2020, the average annual Residential electricity bill in California was $1,251, or 25.9% higher ($257) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 1.6% ($22).

Residential bills, however, vary widely by region, with the estimated annual household usage in 2018 as much as 59% higher in the interior regions compared to the milder climate coastal areas.

$6.2b Premium Above

US Average Price

For the 12 months ended May 2020, California’s higher electricity prices translated into Residential ratepayers paying $6.2 billion more than the average ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate state (Louisiana), California ratepayers paid an additional $9.0 billion.

California Commercial Electricity Price 70.8% Above Average for

Rest of US

California average Commercial Price for the 12 months ended May 2020 was 17.18 cents/kWh, 70.8% higher than the US average of 10.06 cents/kWh for all states other than California. California’s commercial prices remained the 3rd highest in the nation.

California Industrial Electricity Price 117.0% Above Average for

Rest of US

California average Industrial Price for the 12 months ended May 2020 was 13.82 cents/kWh, 117.0% higher than the US average of 6.37 cents/kWh for all states other than California. California’s industrial prices remained the 5th highest in the nation.

$11.2b Premium Above

US Average Price

For the 12 months ended May 2020, California’s higher electricity prices translated into Commercial & Industrial ratepayers paying $11.2 billion more than ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate states, California businesses paid an additional $14.7 billion.

California Natural Gas Prices

Average prices ($ per thousand cubic feet) for the 12 months ended May 2020 and changes from the previous 12-month period for each end user:

Note: All data sources, methodologies and historical data series available at [[link removed]]

Visit the center for jobs [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

for July 2020

Below are the monthly updates from the most current July 2020 fuel price data (GasBuddy.com) and May 2020 electricity and natural gas price data (US Energy Information Agency). To view additional data and analysis related to the California economy visit our website at www.[[link removed]].

California energy prices continued to rise higher, both in absolute terms and compared to the averages for the other states. These outcomes mean that even as many households struggle under the current economic conditions, the state’s energy policies continue to take an increasing share of household incomes both directly in gasoline and utility bills and indirectly as these costs are incorporated into the prices of every other component of the costs of living. Even as the state explores ways to promote a more equitable path in the now delayed economic recovery, the state energy policies continue to ensure that rising costs of living will continue to have a disparate impact on lower and increasingly middle income class households.

The rising energy rates also have important consequences as households shelter in place or maintain their jobs and incomes by working at home. Average residential customer use was up 5% in April compared to the same month a year ago, and up 15% in May. Some households have the potential for offsetting savings from lower gasoline use, but this factor applies primarily to those workers able to continue employment through telework. As indicated by the recent Bureau of Labor Statistics telework data, these workers are generally in higher wage occupations. Lower wage workers in essential industries have had to contend with both cost factors.

California vs. US Fuel Price Gap at 48.9% Premium $1.04 Price Per Gallon

Above US Average

(CA Average)

The July average price per gallon of regular gasoline in California rose 12 cents from June to $3.15. The California premium above the average for the US other than California ($2.12) rose to $1.04, a 48.9% difference.

2nd Ranked by Price

In July, California had the 2nd highest gasoline price among the states and DC, behind only Hawaii. Californians paid $1.31 a gallon more than consumers in Mississippi, the state with the lowest price.

California vs. US Diesel Price $0.97 Price Per Gallon

Above US Average

(CA Average)

The July average price per gallon of diesel in California rose 3 cents from June to $3.34. The California premium above the average for the US other than California ($2.37) rose to 97.2 cents, a 41.0% difference.

2nd Ranked by price

In July, California had the 2nd highest diesel price among the states and DC, behind only Hawaii.

Range Between Highest and Lowest Prices by Region $1.12 Price Per Gallon

Above US Average

(Bay Area Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $0.94 in the Central Valley Region (average July price of $3.06), to $1.12 in Bay Area Region (average July price of $3.24).

Highest/Lowest Fuel Prices by Legislative District: California Residential Electricity Price 55.8% Above Average for

Rest of US

California average Residential Price for the 12 months ended May 2020 was 19.69 cents/kWh, staying at 55.8% higher than the US average of 12.64 cents/kWh for all states other than California. California’s residential prices remained the 7th highest in the nation.

California Residential Electric Bill 25.9% Growth Since 2010

For the 12 months ended May 2020, the average annual Residential electricity bill in California was $1,251, or 25.9% higher ($257) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 1.6% ($22).

Residential bills, however, vary widely by region, with the estimated annual household usage in 2018 as much as 59% higher in the interior regions compared to the milder climate coastal areas.

$6.2b Premium Above

US Average Price

For the 12 months ended May 2020, California’s higher electricity prices translated into Residential ratepayers paying $6.2 billion more than the average ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate state (Louisiana), California ratepayers paid an additional $9.0 billion.

California Commercial Electricity Price 70.8% Above Average for

Rest of US

California average Commercial Price for the 12 months ended May 2020 was 17.18 cents/kWh, 70.8% higher than the US average of 10.06 cents/kWh for all states other than California. California’s commercial prices remained the 3rd highest in the nation.

California Industrial Electricity Price 117.0% Above Average for

Rest of US

California average Industrial Price for the 12 months ended May 2020 was 13.82 cents/kWh, 117.0% higher than the US average of 6.37 cents/kWh for all states other than California. California’s industrial prices remained the 5th highest in the nation.

$11.2b Premium Above

US Average Price

For the 12 months ended May 2020, California’s higher electricity prices translated into Commercial & Industrial ratepayers paying $11.2 billion more than ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate states, California businesses paid an additional $14.7 billion.

California Natural Gas Prices

Average prices ($ per thousand cubic feet) for the 12 months ended May 2020 and changes from the previous 12-month period for each end user:

Note: All data sources, methodologies and historical data series available at [[link removed]]

Visit the center for jobs [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor