Email

An Extremely Frustrating Market

| From | Ross Givens <[email protected]> |

| Subject | An Extremely Frustrating Market |

| Date | February 11, 2026 2:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Wednesday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

Hey, Ross here:

It must be pretty frustrating to be an “S&P 500 only” index investor right now.

Today’s charts show you why.

Chart of the Day

For the past 3 months, the S&P 500 has been struggling to definitively move

past its late-October highs.

And yet, for the past 2.5 months, we’ve had a barely unbroken streak of Net

New Highs.

This means that we have hundreds of stocks hitting new highs every day…

And yet the index has gone practically nowhere.

Like I said – it must be frustrating to be an “S&P 500 only” index investor

right now…

Especially because two-thirds of S&P 500 stocks are currently outperforming

the index.

This is just another symptom of the rotation that’s been happening.

Mega-cap tech is down – and it’s dragged the market-cap weighted index down

with it.

Meanwhile, the “average” stock is doing fine.

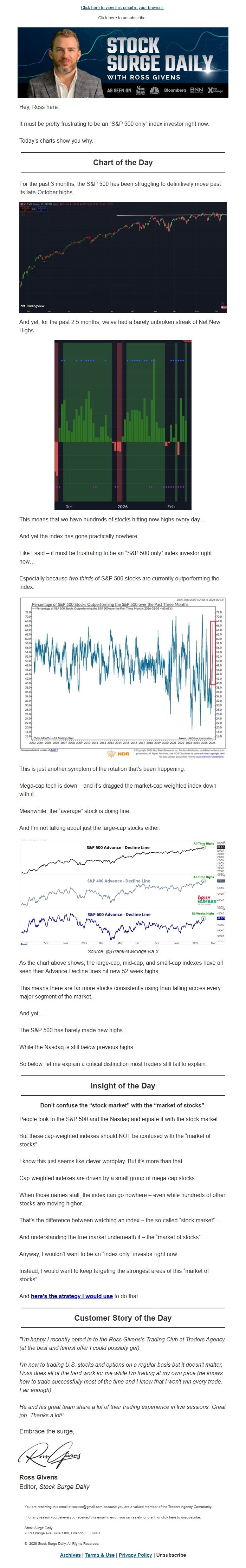

And I’m not talking about just the large-cap stocks either.

Source: @GrantHawkridge via X

As the chart above shows, the large-cap, mid-cap, and small-cap indexes have

all seen their Advance-Decline lines hit new 52-week highs.

This means there are far more stocks consistently rising than falling across

every major segment of the market.

And yet…

The S&P 500 has barely made new highs…

While the Nasdaq is still below previous highs.

So below, let me explain a critical distinction most traders still fail to

explain.

Insight of the Day

Don’t confuse the “stock market” with the “market of stocks”.

People look to the S&P 500 and the Nasdaq and equate it with the stock market.

But these cap-weighted indexes should NOT be confused with the “market of

stocks”.

I know this just seems like clever wordplay. But it’s more than that.

Cap-weighted indexes are driven by a small group of mega-cap stocks.

When those names stall, the index can go nowhere – even while hundreds of

other stocks are moving higher.

That’s the difference between watching an index – the so-called “stock market”…

And understanding the true market underneath it – the “market of stocks”.

Anyway, I wouldn’t want to be an “index only” investor right now.

Instead, I would want to keep targeting the strongest areas of this “market of

stocks”.

And here’s the strategy I would use

<[link removed]> to do that.

Customer Story of the Day

"I'm happy I recently opted in to the Ross Givens's Trading Club at Traders

Agency (at the best and fairest offer I could possibly get).

I'm new to trading U.S. stocks and options on a regular basis but it doesn't

matter, Ross does all of the hard work for me while I'm trading at my own pace

(he knows how to trade successfully most of the time and I know that I won't

win every trade. Fair enough).

He and his great team share a lot of their trading experience in live

sessions. Great job. Thanks a lot!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

Hey, Ross here:

It must be pretty frustrating to be an “S&P 500 only” index investor right now.

Today’s charts show you why.

Chart of the Day

For the past 3 months, the S&P 500 has been struggling to definitively move

past its late-October highs.

And yet, for the past 2.5 months, we’ve had a barely unbroken streak of Net

New Highs.

This means that we have hundreds of stocks hitting new highs every day…

And yet the index has gone practically nowhere.

Like I said – it must be frustrating to be an “S&P 500 only” index investor

right now…

Especially because two-thirds of S&P 500 stocks are currently outperforming

the index.

This is just another symptom of the rotation that’s been happening.

Mega-cap tech is down – and it’s dragged the market-cap weighted index down

with it.

Meanwhile, the “average” stock is doing fine.

And I’m not talking about just the large-cap stocks either.

Source: @GrantHawkridge via X

As the chart above shows, the large-cap, mid-cap, and small-cap indexes have

all seen their Advance-Decline lines hit new 52-week highs.

This means there are far more stocks consistently rising than falling across

every major segment of the market.

And yet…

The S&P 500 has barely made new highs…

While the Nasdaq is still below previous highs.

So below, let me explain a critical distinction most traders still fail to

explain.

Insight of the Day

Don’t confuse the “stock market” with the “market of stocks”.

People look to the S&P 500 and the Nasdaq and equate it with the stock market.

But these cap-weighted indexes should NOT be confused with the “market of

stocks”.

I know this just seems like clever wordplay. But it’s more than that.

Cap-weighted indexes are driven by a small group of mega-cap stocks.

When those names stall, the index can go nowhere – even while hundreds of

other stocks are moving higher.

That’s the difference between watching an index – the so-called “stock market”…

And understanding the true market underneath it – the “market of stocks”.

Anyway, I wouldn’t want to be an “index only” investor right now.

Instead, I would want to keep targeting the strongest areas of this “market of

stocks”.

And here’s the strategy I would use

<[link removed]> to do that.

Customer Story of the Day

"I'm happy I recently opted in to the Ross Givens's Trading Club at Traders

Agency (at the best and fairest offer I could possibly get).

I'm new to trading U.S. stocks and options on a regular basis but it doesn't

matter, Ross does all of the hard work for me while I'm trading at my own pace

(he knows how to trade successfully most of the time and I know that I won't

win every trade. Fair enough).

He and his great team share a lot of their trading experience in live

sessions. Great job. Thanks a lot!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost