Email

A “Permanent” Market Rotation?

| From | Ross Givens <[email protected]> |

| Subject | A “Permanent” Market Rotation? |

| Date | February 10, 2026 1:15 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tuesday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

If you’ve been reading this newsletter…

Then you know I’ve been banging the table on the market rotation for quite a

while now(and I’ll keep doing it too).

One question people have asked me is – how long will this rotation last?

Well, I’ve said recently that it doesn’t really matter how long a rotation

will last…

Because as agile traders, we can still take advantage of it – no matter how

temporary.

But as today’s chart shows…

Rotations can last far longer than most think.

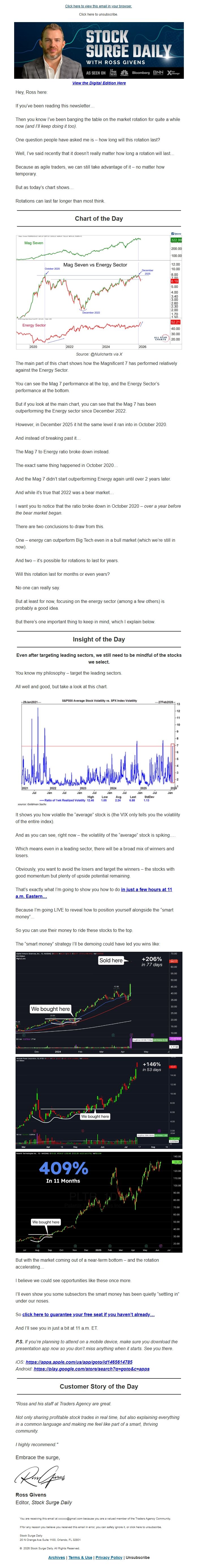

Chart of the Day

Source: @Nullcharts via X

The main part of this chart shows how the Magnificent 7 has performed

relatively against the Energy Sector.

You can see the Mag 7 performance at the top, and the Energy Sector’s

performance at the bottom.

But if you look at the main chart, you can see that the Mag 7 has been

outperforming the Energy sector since December 2022.

However, in December 2025 it hit the same level it ran into in October 2020.

And instead of breaking past it…

The Mag 7 to Energy ratio broke down instead.

The exact same thing happened in October 2020…

And the Mag 7 didn’t start outperforming Energy again until over 2 years later.

And while it’s true that 2022 was a bear market…

I want you to notice that the ratio broke down in October 2020 – over a year

before the bear market began.

There are two conclusions to draw from this.

One – energy can outperform Big Tech even in a bull market (which we’re still

in now).

And two – it’s possible for rotations to last for years.

Will this rotation last for months or even years?

No one can really say.

But at least for now, focusing on the energy sector (among a few others) is

probably a good idea.

But there’s one important thing to keep in mind, which I explain below.

Insight of the Day

Even after targeting leading sectors, we still need to be mindful of the

stocks we select.

You know my philosophy – target the leading sectors.

All well and good, but take a look at this chart.

It shows you how volatile the “average” stock is (the VIX only tells you the

volatility of the entire index).

And as you can see, right now – the volatility of the “average” stock is

spiking….

Which means even in a leading sector, there will be a broad mix of winners and

losers.

Obviously, you want to avoid the losers and target the winners – the stocks

with good momentum but plenty of upside potential remaining.

That’s exactly what I’m going to show you how to do in just a few hours at 11

a.m. Eastern… <[link removed]>

Because I’m going LIVE to reveal how to position yourself alongside the “smart

money”...

So you can use their money to ride these stocks to the top.

The “smart money” strategy I’ll be demoing could have led you wins like:

But with the market coming out of a near-term bottom – and the rotation

accelerating…

I believe we could see opportunities like these once more.

I’ll even show you some subsectors the smart money has been quietly “settling

in” under our noses.

So click here to guarantee your free seat if you haven’t already…

<[link removed]>

And I’ll see you in just a bit at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

"Ross and his staff at Traders Agency are great.

Not only sharing profitable stock trades in real time, but also explaining

everything in a common language and making me feel like part of a smart,

thriving community.

I highly recommend."

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

If you’ve been reading this newsletter…

Then you know I’ve been banging the table on the market rotation for quite a

while now(and I’ll keep doing it too).

One question people have asked me is – how long will this rotation last?

Well, I’ve said recently that it doesn’t really matter how long a rotation

will last…

Because as agile traders, we can still take advantage of it – no matter how

temporary.

But as today’s chart shows…

Rotations can last far longer than most think.

Chart of the Day

Source: @Nullcharts via X

The main part of this chart shows how the Magnificent 7 has performed

relatively against the Energy Sector.

You can see the Mag 7 performance at the top, and the Energy Sector’s

performance at the bottom.

But if you look at the main chart, you can see that the Mag 7 has been

outperforming the Energy sector since December 2022.

However, in December 2025 it hit the same level it ran into in October 2020.

And instead of breaking past it…

The Mag 7 to Energy ratio broke down instead.

The exact same thing happened in October 2020…

And the Mag 7 didn’t start outperforming Energy again until over 2 years later.

And while it’s true that 2022 was a bear market…

I want you to notice that the ratio broke down in October 2020 – over a year

before the bear market began.

There are two conclusions to draw from this.

One – energy can outperform Big Tech even in a bull market (which we’re still

in now).

And two – it’s possible for rotations to last for years.

Will this rotation last for months or even years?

No one can really say.

But at least for now, focusing on the energy sector (among a few others) is

probably a good idea.

But there’s one important thing to keep in mind, which I explain below.

Insight of the Day

Even after targeting leading sectors, we still need to be mindful of the

stocks we select.

You know my philosophy – target the leading sectors.

All well and good, but take a look at this chart.

It shows you how volatile the “average” stock is (the VIX only tells you the

volatility of the entire index).

And as you can see, right now – the volatility of the “average” stock is

spiking….

Which means even in a leading sector, there will be a broad mix of winners and

losers.

Obviously, you want to avoid the losers and target the winners – the stocks

with good momentum but plenty of upside potential remaining.

That’s exactly what I’m going to show you how to do in just a few hours at 11

a.m. Eastern… <[link removed]>

Because I’m going LIVE to reveal how to position yourself alongside the “smart

money”...

So you can use their money to ride these stocks to the top.

The “smart money” strategy I’ll be demoing could have led you wins like:

But with the market coming out of a near-term bottom – and the rotation

accelerating…

I believe we could see opportunities like these once more.

I’ll even show you some subsectors the smart money has been quietly “settling

in” under our noses.

So click here to guarantee your free seat if you haven’t already…

<[link removed]>

And I’ll see you in just a bit at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

"Ross and his staff at Traders Agency are great.

Not only sharing profitable stock trades in real time, but also explaining

everything in a common language and making me feel like part of a smart,

thriving community.

I highly recommend."

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost