Email

Is the Market Bottom Over?

| From | Ross Givens <[email protected]> |

| Subject | Is the Market Bottom Over? |

| Date | February 9, 2026 3:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Monday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

After days of fairly heavy selling, the S&P 500 posted its best day since

November last Friday.

Net new highs surged…

And there were 1,664 more stocks advancing than declining.

So the question is – was Thursday the near term bottom?

Let’s take a look.

Chart of the Day

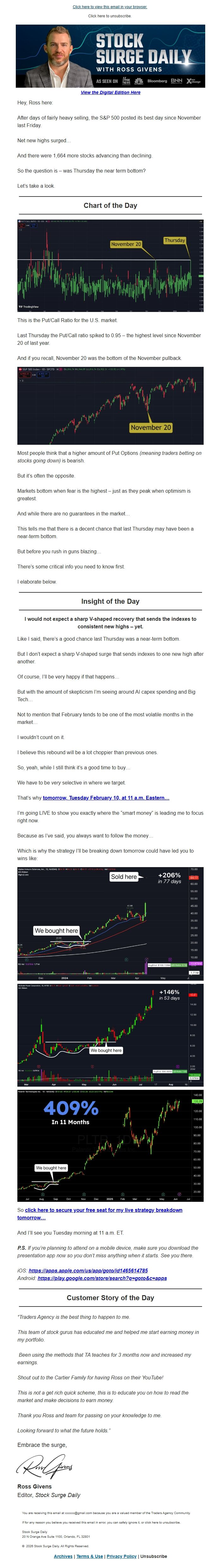

This is the Put/Call Ratio for the U.S. market.

Last Thursday the Put/Call ratio spiked to 0.95 – the highest level since

November 20 of last year.

And if you recall, November 20 was the bottom of the November pullback.

Most people think that a higher amount of Put Options (meaning traders

betting on stocks going down) is bearish.

But it’s often the opposite.

Markets bottom when fear is the highest – just as they peak when optimism is

greatest.

And while there are no guarantees in the market…

This tells me that there is a decent chance that last Thursday may have been a

near-term bottom.

But before you rush in guns blazing…

There’s some critical info you need to know first.

I elaborate below.

Insight of the Day

I would not expect a sharp V-shaped recovery that sends the indexes to

consistent new highs – yet.

Like I said, there’s a good chance last Thursday was a near-term bottom.

But I don’t expect a sharp V-shaped surge that sends indexes to one new high

after another.

Of course, I’ll be very happy if that happens…

But with the amount of skepticism I’m seeing around AI capex spending and Big

Tech…

Not to mention that February tends to be one of the most volatile months in

the market…

I wouldn’t count on it.

I believe this rebound will be a lot choppier than previous ones.

So, yeah, while I still think it’s a good time to buy…

We have to be very selective in where we target.

That’s why tomorrow, Tuesday February 10, at 11 a.m. Eastern…

<[link removed]>

I’m going LIVE to show you exactly where the “smart money” is leading me to

focus right now.

Because as I’ve said, you always want to follow the money…

Which is why the strategy I’ll be breaking down tomorrow could have led you to

wins like:

So click here to secure your free seat for my live strategy breakdown

tomorrow… <[link removed]>

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“Traders Agency is the best thing to happen to me.

This team of stock gurus has educated me and helped me start earning money in

my portfolio.

Been using the methods that TA teaches for 3 months now and increased my

earnings.

Shout out to the Cartier Family for having Ross on their YouTube!

This is not a get rich quick scheme, this is to educate you on how to read the

market and make decisions to earn money.

Thank you Ross and team for passing on your knowledge to me.

Looking forward to what the future holds.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

After days of fairly heavy selling, the S&P 500 posted its best day since

November last Friday.

Net new highs surged…

And there were 1,664 more stocks advancing than declining.

So the question is – was Thursday the near term bottom?

Let’s take a look.

Chart of the Day

This is the Put/Call Ratio for the U.S. market.

Last Thursday the Put/Call ratio spiked to 0.95 – the highest level since

November 20 of last year.

And if you recall, November 20 was the bottom of the November pullback.

Most people think that a higher amount of Put Options (meaning traders

betting on stocks going down) is bearish.

But it’s often the opposite.

Markets bottom when fear is the highest – just as they peak when optimism is

greatest.

And while there are no guarantees in the market…

This tells me that there is a decent chance that last Thursday may have been a

near-term bottom.

But before you rush in guns blazing…

There’s some critical info you need to know first.

I elaborate below.

Insight of the Day

I would not expect a sharp V-shaped recovery that sends the indexes to

consistent new highs – yet.

Like I said, there’s a good chance last Thursday was a near-term bottom.

But I don’t expect a sharp V-shaped surge that sends indexes to one new high

after another.

Of course, I’ll be very happy if that happens…

But with the amount of skepticism I’m seeing around AI capex spending and Big

Tech…

Not to mention that February tends to be one of the most volatile months in

the market…

I wouldn’t count on it.

I believe this rebound will be a lot choppier than previous ones.

So, yeah, while I still think it’s a good time to buy…

We have to be very selective in where we target.

That’s why tomorrow, Tuesday February 10, at 11 a.m. Eastern…

<[link removed]>

I’m going LIVE to show you exactly where the “smart money” is leading me to

focus right now.

Because as I’ve said, you always want to follow the money…

Which is why the strategy I’ll be breaking down tomorrow could have led you to

wins like:

So click here to secure your free seat for my live strategy breakdown

tomorrow… <[link removed]>

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“Traders Agency is the best thing to happen to me.

This team of stock gurus has educated me and helped me start earning money in

my portfolio.

Been using the methods that TA teaches for 3 months now and increased my

earnings.

Shout out to the Cartier Family for having Ross on their YouTube!

This is not a get rich quick scheme, this is to educate you on how to read the

market and make decisions to earn money.

Thank you Ross and team for passing on your knowledge to me.

Looking forward to what the future holds.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost