| From | Fraser Institute <[email protected]> |

| Subject | Fiscal performance of premiers, and Public sector job growth |

| Date | February 7, 2026 6:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

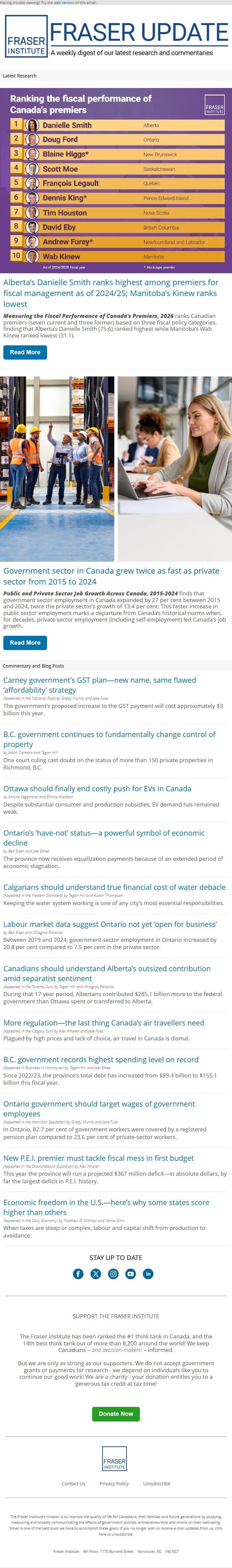

Having trouble viewing? Try the web version [link removed] of this email. Latest Research Alberta’s Danielle Smith ranks highest among premiers for fiscal management as of 2024/25; Manitoba’s Kinew ranks lowest [[link removed]]

Measuring the Fiscal Performance of Canada’s Premiers, 2026 ranks Canadian premiers (seven current and three former) based on three fiscal policy categories, finding that Alberta’s Danielle Smith (75.6) ranked highest while Manitoba’s Wab Kinew ranked lowest (31.1).

Read More [[link removed]] Government sector in Canada grew twice as fast as private sector from 2015 to 2024 [[link removed]]

Public and Private Sector Job Growth Across Canada, 2015-2024 finds that government sector employment in Canada expanded by 27 per cent between 2015 and 2024, twice the private sector’s growth of 13.4 per cent. This faster increase in public sector employment marks a departure from Canada’s historical norms when, for decades, private sector employment (including self-employment) led Canada’s job growth.

Read More [[link removed]] Commentary and Blog Posts Carney government’s GST plan—new name, same flawed ‘affordability’ strategy [[link removed]] (Appeared in the National Post) by Grady Munro and Jake Fuss

The government’s proposed increase to the GST payment will cost approximately $3 billion this year.

B.C. government continues to fundamentally change control of property [[link removed]] by Jason Clemens and Tegan Hill

One court ruling cast doubt on the status of more than 150 private properties in Richmond, B.C.

Ottawa should finally end costly push for EVs in Canada [[link removed]] by Annika Segelhorst and Elmira Aliakbari

Despite substantial consumer and production subsidies, EV demand has remained weak.

Ontario’s ‘have-not’ status—a powerful symbol of economic decline [[link removed]] by Ben Eisen and Joel Emes

The province now receives equalization payments because of an extended period of economic stagnation.

Calgarians should understand true financial cost of water debacle [[link removed]] (Appeared in the Western Standard) by Tegan Hill and Austin Thompson

Keeping the water system working is one of any city’s most essential responsibilities.

Labour market data suggest Ontario not yet ‘open for business’ [[link removed]] by Ben Eisen and Milagros Palacios

Between 2019 and 2024, government-sector employment in Ontario increased by 20.8 per cent compared to 7.5 per cent in the private sector.

Canadians should understand Alberta’s outsized contribution amid separatist sentiment [[link removed]] (Appeared in the Toronto Sun) by Tegan Hill and Milagros Palacios

During that 17-year period, Albertans contributed $285.1 billion more to the federal government than Ottawa spent or transferred to Alberta.

More regulation—the last thing Canada’s air travellers need [[link removed]] (Appeared in the Calgary Sun) by Alex Whalen and Jake Fuss

Plagued by high prices and lack of choice, air travel in Canada is dismal.

B.C. government records highest spending level on record [[link removed]] (Appeared in Business in Vancouver) by Tegan Hill and Joel Emes

Since 2022/23, the province's total debt has increased from $89.4 billion to $155.1 billion this fiscal year.

Ontario government should target wages of government employees [[link removed]] (Appeared in the Hamilton Spectator) by Grady Munro and Jake Fuss

In Ontario, 82.7 per cent of government workers were covered by a registered pension plan compared to 23.6 per cent of private-sector workers.

New P.E.I. premier must tackle fiscal mess in first budget [[link removed]] (Appeared in the Charlottetown Guardian) by Alex Whalen

This year the province will run a projected $367 million deficit—in absolute dollars, by far the largest deficit in P.E.I. history.

Economic freedom in the U.S.—here’s why some states score higher than others [[link removed]] (Appeared in the Daily Economy) by Matthew D. Mitchell and Vance Ginn

When taxes are steep or complex, labour and capital shift from production to avoidance.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Measuring the Fiscal Performance of Canada’s Premiers, 2026 ranks Canadian premiers (seven current and three former) based on three fiscal policy categories, finding that Alberta’s Danielle Smith (75.6) ranked highest while Manitoba’s Wab Kinew ranked lowest (31.1).

Read More [[link removed]] Government sector in Canada grew twice as fast as private sector from 2015 to 2024 [[link removed]]

Public and Private Sector Job Growth Across Canada, 2015-2024 finds that government sector employment in Canada expanded by 27 per cent between 2015 and 2024, twice the private sector’s growth of 13.4 per cent. This faster increase in public sector employment marks a departure from Canada’s historical norms when, for decades, private sector employment (including self-employment) led Canada’s job growth.

Read More [[link removed]] Commentary and Blog Posts Carney government’s GST plan—new name, same flawed ‘affordability’ strategy [[link removed]] (Appeared in the National Post) by Grady Munro and Jake Fuss

The government’s proposed increase to the GST payment will cost approximately $3 billion this year.

B.C. government continues to fundamentally change control of property [[link removed]] by Jason Clemens and Tegan Hill

One court ruling cast doubt on the status of more than 150 private properties in Richmond, B.C.

Ottawa should finally end costly push for EVs in Canada [[link removed]] by Annika Segelhorst and Elmira Aliakbari

Despite substantial consumer and production subsidies, EV demand has remained weak.

Ontario’s ‘have-not’ status—a powerful symbol of economic decline [[link removed]] by Ben Eisen and Joel Emes

The province now receives equalization payments because of an extended period of economic stagnation.

Calgarians should understand true financial cost of water debacle [[link removed]] (Appeared in the Western Standard) by Tegan Hill and Austin Thompson

Keeping the water system working is one of any city’s most essential responsibilities.

Labour market data suggest Ontario not yet ‘open for business’ [[link removed]] by Ben Eisen and Milagros Palacios

Between 2019 and 2024, government-sector employment in Ontario increased by 20.8 per cent compared to 7.5 per cent in the private sector.

Canadians should understand Alberta’s outsized contribution amid separatist sentiment [[link removed]] (Appeared in the Toronto Sun) by Tegan Hill and Milagros Palacios

During that 17-year period, Albertans contributed $285.1 billion more to the federal government than Ottawa spent or transferred to Alberta.

More regulation—the last thing Canada’s air travellers need [[link removed]] (Appeared in the Calgary Sun) by Alex Whalen and Jake Fuss

Plagued by high prices and lack of choice, air travel in Canada is dismal.

B.C. government records highest spending level on record [[link removed]] (Appeared in Business in Vancouver) by Tegan Hill and Joel Emes

Since 2022/23, the province's total debt has increased from $89.4 billion to $155.1 billion this fiscal year.

Ontario government should target wages of government employees [[link removed]] (Appeared in the Hamilton Spectator) by Grady Munro and Jake Fuss

In Ontario, 82.7 per cent of government workers were covered by a registered pension plan compared to 23.6 per cent of private-sector workers.

New P.E.I. premier must tackle fiscal mess in first budget [[link removed]] (Appeared in the Charlottetown Guardian) by Alex Whalen

This year the province will run a projected $367 million deficit—in absolute dollars, by far the largest deficit in P.E.I. history.

Economic freedom in the U.S.—here’s why some states score higher than others [[link removed]] (Appeared in the Daily Economy) by Matthew D. Mitchell and Vance Ginn

When taxes are steep or complex, labour and capital shift from production to avoidance.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor