Email

Powerful Value

| From | Ross Givens <[email protected]> |

| Subject | Powerful Value |

| Date | February 6, 2026 1:15 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Friday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here <[link removed]>

Hey, Ross here:

In yesterday’s newsletter, I highlighted the divergence between the big

decline in software stocks and the powerful surge in semiconductors…

And how said divergences often exist in sideways markets – even if most don’t

notice them.

Today, I want to spotlight another kind of divergence that started in November.

Chart of the Day

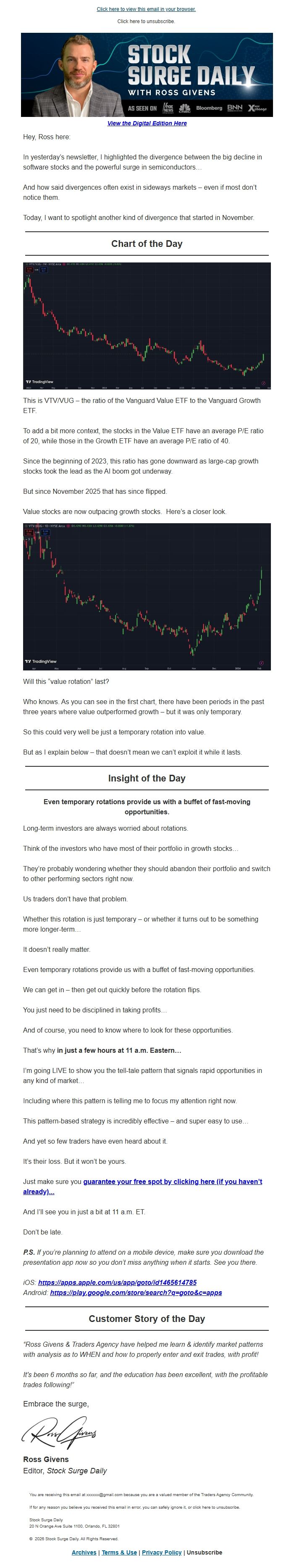

This is VTV/VUG – the ratio of the Vanguard Value ETF to the Vanguard Growth

ETF.

To add a bit more context, the stocks in the Value ETF have an average P/E

ratio of 20, while those in the Growth ETF have an average P/E ratio of 40.

Since the beginning of 2023, this ratio has gone downward as large-cap growth

stocks took the lead as the AI boom got underway.

But since November 2025 that has since flipped.

Value stocks are now outpacing growth stocks. Here’s a closer look.

Will this “value rotation” last?

Who knows. As you can see in the first chart, there have been periods in the

past three years where value outperformed growth – but it was only temporary.

So this could very well be just a temporary rotation into value.

But as I explain below – that doesn’t mean we can’t exploit it while it lasts.

Insight of the Day

Even temporary rotations provide us with a buffet of fast-moving opportunities.

Long-term investors are always worried about rotations.

Think of the investors who have most of their portfolio in growth stocks…

They’re probably wondering whether they should abandon their portfolio and

switch to other performing sectors right now.

Us traders don’t have that problem.

Whether this rotation is just temporary – or whether it turns out to be

something more longer-term…

It doesn’t really matter.

Even temporary rotations provide us with a buffet of fast-moving opportunities.

We can get in – then get out quickly before the rotation flips.

You just need to be disciplined in taking profits…

And of course, you need to know where to look for these opportunities.

That’s why in just a few hours at 11 a.m. Eastern…

I’m going LIVE to show you the tell-tale pattern that signals rapid

opportunities in any kind of market…

Including where this pattern is telling me to focus my attention right now.

This pattern-based strategy is incredibly effective – and super easy to use…

And yet so few traders have even heard about it.

It’s their loss. But it won’t be yours.

Just make sure you guarantee your free spot by clicking here (if you haven’t

already)...

<[link removed]>

And I’ll see you in just a bit at 11 a.m. ET.

Don’t be late.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“Ross Givens & Traders Agency have helped me learn & identify market patterns

with analysis as to WHEN and how to properly enter and exit trades, with profit!

It's been 6 months so far, and the education has been excellent, with the

profitable trades following!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here <[link removed]>

Hey, Ross here:

In yesterday’s newsletter, I highlighted the divergence between the big

decline in software stocks and the powerful surge in semiconductors…

And how said divergences often exist in sideways markets – even if most don’t

notice them.

Today, I want to spotlight another kind of divergence that started in November.

Chart of the Day

This is VTV/VUG – the ratio of the Vanguard Value ETF to the Vanguard Growth

ETF.

To add a bit more context, the stocks in the Value ETF have an average P/E

ratio of 20, while those in the Growth ETF have an average P/E ratio of 40.

Since the beginning of 2023, this ratio has gone downward as large-cap growth

stocks took the lead as the AI boom got underway.

But since November 2025 that has since flipped.

Value stocks are now outpacing growth stocks. Here’s a closer look.

Will this “value rotation” last?

Who knows. As you can see in the first chart, there have been periods in the

past three years where value outperformed growth – but it was only temporary.

So this could very well be just a temporary rotation into value.

But as I explain below – that doesn’t mean we can’t exploit it while it lasts.

Insight of the Day

Even temporary rotations provide us with a buffet of fast-moving opportunities.

Long-term investors are always worried about rotations.

Think of the investors who have most of their portfolio in growth stocks…

They’re probably wondering whether they should abandon their portfolio and

switch to other performing sectors right now.

Us traders don’t have that problem.

Whether this rotation is just temporary – or whether it turns out to be

something more longer-term…

It doesn’t really matter.

Even temporary rotations provide us with a buffet of fast-moving opportunities.

We can get in – then get out quickly before the rotation flips.

You just need to be disciplined in taking profits…

And of course, you need to know where to look for these opportunities.

That’s why in just a few hours at 11 a.m. Eastern…

I’m going LIVE to show you the tell-tale pattern that signals rapid

opportunities in any kind of market…

Including where this pattern is telling me to focus my attention right now.

This pattern-based strategy is incredibly effective – and super easy to use…

And yet so few traders have even heard about it.

It’s their loss. But it won’t be yours.

Just make sure you guarantee your free spot by clicking here (if you haven’t

already)...

<[link removed]>

And I’ll see you in just a bit at 11 a.m. ET.

Don’t be late.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“Ross Givens & Traders Agency have helped me learn & identify market patterns

with analysis as to WHEN and how to properly enter and exit trades, with profit!

It's been 6 months so far, and the education has been excellent, with the

profitable trades following!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost