Email

We Stopped the Mileage Tax in San Diego. Now Sacramento Is Trying It Statewide.

| From | Supervisor Jim Desmond <[email protected]> |

| Subject | We Stopped the Mileage Tax in San Diego. Now Sacramento Is Trying It Statewide. |

| Date | February 3, 2026 5:55 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

John --

California politicians are at it again — this time with astatewide Mileage Taxdisguised as “planning.”

A bill that just moved through the Assembly,AB 1421, lays the groundwork to tax Californiansfor every mile they drive. <[link removed]> Not someday in theory — this bill explicitly directs the state to design a system and come back to the Legislature byJanuary 1, 2027 with a plan to implement it.

If this sounds familiar, it should.

SANDAG tried this exact same thing in San Diego County.

They quietly slipped a mileage tax into their regional transportation plan — and only backed offafter residents, commuters, and small businesses rallied together and forced them to retreat.

We stopped it once.

We can — and must — stop it again.

Let’s be clear about what this is:

This is not about “studying options.”

This is not about “future mobility.”

This is acommuter punishmentaimed squarely at working families who have no alternative but to drive.

A mileage tax would mean:

- Tracking how far Californians drive

- Charging driversper mile, on top of:

- Gas taxes

- Vehicle registration fees

- Sales taxes

- Local transportation taxes

Families already paying thousands a year just to get to work would be hit again — even as our roads remain riddled with potholes and congestion.

And here’s the part that makes this especially insulting:

California does not have a revenue problem. It has a spending problem.

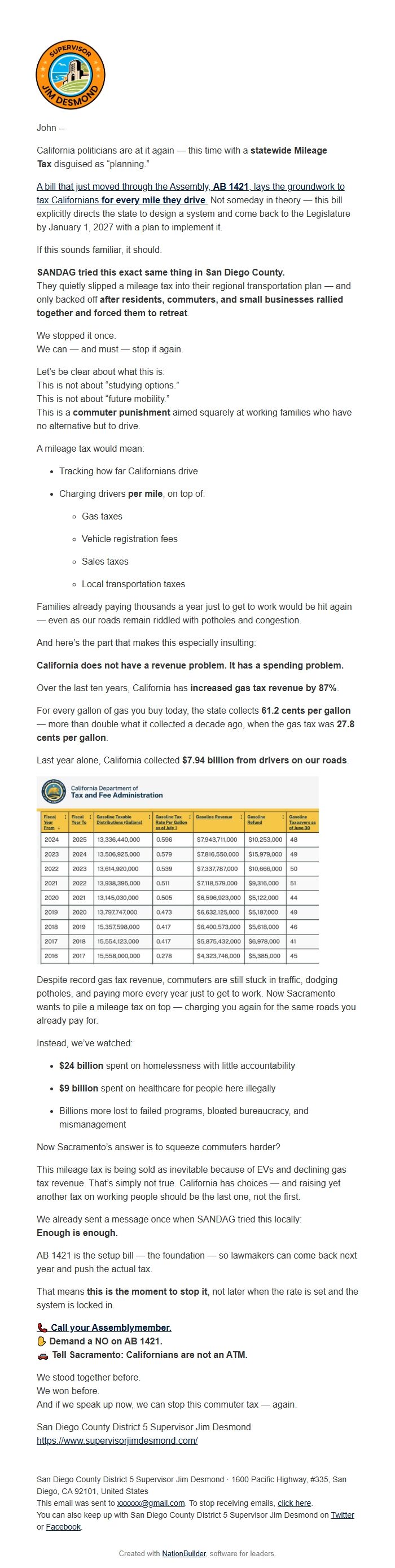

Over the last ten years, California has increased gas tax revenue by 87%.

For every gallon of gas you buy today, the state collects 61.2 cents per gallon — more than double what it collected a decade ago, when the gas tax was 27.8 cents per gallon.

Last year alone, California collected $7.94 billion from drivers on our roads.

Despite record gas tax revenue, commuters are still stuck in traffic, dodging potholes, and paying more every year just to get to work. Now Sacramento wants to pile a mileage tax on top — charging you again for the same roads you already pay for.

Instead, we’ve watched:

- $24 billionspent on homelessness with little accountability

- $9 billionspent on healthcare for people here illegally

- Billions more lost to failed programs, bloated bureaucracy, and mismanagement

Now Sacramento’s answer is to squeeze commuters harder?

This mileage tax is being sold as inevitable because of EVs and declining gas tax revenue. That’s simply not true. California has choices — and raising yet another tax on working people should be the last one, not the first.

We already sent a message once when SANDAG tried this locally:

Enough is enough.

AB 1421 is the setup bill — the foundation — so lawmakers can come back next year and push the actual tax.

That meansthis is the moment to stop it, not later when the rate is set and the system is locked in.

📞 Call your Assemblymember. <[link removed]>

✋ Demand a NO on AB 1421.

🚗 Tell Sacramento: Californians are not an ATM.

We stood together before.

We won before.

And if we speak up now, we can stop this commuter tax — again.

San Diego County District 5 Supervisor Jim Desmond

[link removed]

-=-=-

San Diego County District 5 Supervisor Jim Desmond - 1600 Pacific Highway, #335, San Diego, CA 92101, United States

This email was sent to [email protected]. To stop receiving emails: [link removed]

-=-=-

Created with NationBuilder - [link removed]

California politicians are at it again — this time with astatewide Mileage Taxdisguised as “planning.”

A bill that just moved through the Assembly,AB 1421, lays the groundwork to tax Californiansfor every mile they drive. <[link removed]> Not someday in theory — this bill explicitly directs the state to design a system and come back to the Legislature byJanuary 1, 2027 with a plan to implement it.

If this sounds familiar, it should.

SANDAG tried this exact same thing in San Diego County.

They quietly slipped a mileage tax into their regional transportation plan — and only backed offafter residents, commuters, and small businesses rallied together and forced them to retreat.

We stopped it once.

We can — and must — stop it again.

Let’s be clear about what this is:

This is not about “studying options.”

This is not about “future mobility.”

This is acommuter punishmentaimed squarely at working families who have no alternative but to drive.

A mileage tax would mean:

- Tracking how far Californians drive

- Charging driversper mile, on top of:

- Gas taxes

- Vehicle registration fees

- Sales taxes

- Local transportation taxes

Families already paying thousands a year just to get to work would be hit again — even as our roads remain riddled with potholes and congestion.

And here’s the part that makes this especially insulting:

California does not have a revenue problem. It has a spending problem.

Over the last ten years, California has increased gas tax revenue by 87%.

For every gallon of gas you buy today, the state collects 61.2 cents per gallon — more than double what it collected a decade ago, when the gas tax was 27.8 cents per gallon.

Last year alone, California collected $7.94 billion from drivers on our roads.

Despite record gas tax revenue, commuters are still stuck in traffic, dodging potholes, and paying more every year just to get to work. Now Sacramento wants to pile a mileage tax on top — charging you again for the same roads you already pay for.

Instead, we’ve watched:

- $24 billionspent on homelessness with little accountability

- $9 billionspent on healthcare for people here illegally

- Billions more lost to failed programs, bloated bureaucracy, and mismanagement

Now Sacramento’s answer is to squeeze commuters harder?

This mileage tax is being sold as inevitable because of EVs and declining gas tax revenue. That’s simply not true. California has choices — and raising yet another tax on working people should be the last one, not the first.

We already sent a message once when SANDAG tried this locally:

Enough is enough.

AB 1421 is the setup bill — the foundation — so lawmakers can come back next year and push the actual tax.

That meansthis is the moment to stop it, not later when the rate is set and the system is locked in.

📞 Call your Assemblymember. <[link removed]>

✋ Demand a NO on AB 1421.

🚗 Tell Sacramento: Californians are not an ATM.

We stood together before.

We won before.

And if we speak up now, we can stop this commuter tax — again.

San Diego County District 5 Supervisor Jim Desmond

[link removed]

-=-=-

San Diego County District 5 Supervisor Jim Desmond - 1600 Pacific Highway, #335, San Diego, CA 92101, United States

This email was sent to [email protected]. To stop receiving emails: [link removed]

-=-=-

Created with NationBuilder - [link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- NationBuilder