Email

A $10 Trillion Wipeout

| From | Ross Givens <[email protected]> |

| Subject | A $10 Trillion Wipeout |

| Date | February 2, 2026 3:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Monday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Welcome back to a new trading week.

Now that January is over, I was planning to talk about how stocks have

performed over the month in today’s newsletter.

But I’m moving that to tomorrow’s newsletter…

Because today, we need to talk about the $10 trillion wipeout that happened

in the precious metals markets on Friday.

Chart of the Day

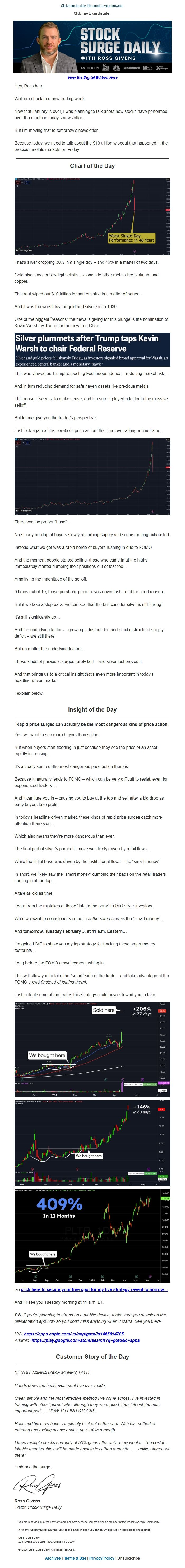

That’s silver dropping 30% in a single day – and 46% in a matter of two days.

Gold also saw double-digit selloffs – alongside other metals like platinum and

copper.

This rout wiped out $10 trillion in market value in a matter of hours…

And it was the worst day for gold and silver since 1980.

One of the biggest “reasons” the news is giving for this plunge is the

nomination of Kevin Warsh by Trump for the new Fed Chair.

This was viewed as Trump respecting Fed independence – reducing market risk…

And in turn reducing demand for safe haven assets like precious metals.

This reason “seems” to make sense, and I’m sure it played a factor in the

massive selloff.

But let me give you the trader’s perspective.

Just look again at this parabolic price action, this time over a longer

timeframe.

There was no proper “base”...

No steady buildup of buyers slowly absorbing supply and sellers getting

exhausted.

Instead what we got was a rabid horde of buyers rushing in due to FOMO.

And the moment people started selling, those who came in at the highs

immediately started dumping their positions out of fear too…

Amplifying the magnitude of the selloff.

9 times out of 10, these parabolic price moves never last – and for good

reason.

But if we take a step back, we can see that the bull case for silver is still

strong.

It’s still significantly up…

And the underlying factors – growing industrial demand amid a structural

supply deficit – are still there.

But no matter the underlying factors…

These kinds of parabolic surges rarely last – and silver just proved it.

And that brings us to a critical insight that’s even more important in today’s

headline-driven market.

I explain below.

Insight of the Day

Rapid price surges can actually be the most dangerous kind of price action.

Yes, we want to see more buyers than sellers.

But when buyers start flooding in just because they see the price of an asset

rapidly increasing…

It’s actually some of the most dangerous price action there is.

Because it naturally leads to FOMO – which can be very difficult to resist,

even for experienced traders…

And it can lure you in – causing you to buy at the top and sell after a big

drop as early buyers take profit.

In today’s headline-driven market, these kinds of rapid price surges catch

more attention than ever…

Which also means they’re more dangerous than ever.

The final part of silver’s parabolic move was likely driven by retail flows…

While the initial base was driven by the institutional flows – the “smart

money”.

In short, we likely saw the “smart money” dumping their bags on the retail

traders coming in at the top…

A tale as old as time.

Learn from the mistakes of those “late to the party” FOMO silver investors.

What we want to do instead is come in at the same time as the “smart money”...

And tomorrow, Tuesday February 3, at 11 a.m. Eastern…

I’m going LIVE to show you my top strategy for tracking these smart money

footprints…

Long before the FOMO crowd comes rushing in.

This will allow you to take the “smart” side of the trade – and take advantage

of the FOMO crowd(instead of joining them).

Just look at some of the trades this strategy could have allowed you to take.

So click here to secure your free spot for my live strategy reveal tomorrow…

<[link removed]>

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

"IF YOU WANNA MAKE MONEY, DO IT.

Hands down the best investment I’ve ever made.

Clear, simple and the most effective method I’ve come across. I’ve invested in

training with other “gurus” who although they were good, they left out the most

important part. … HOW TO FIND STOCKS.

Ross and his crew have completely hit it out of the park. With his method of

entering and exiting my account is up 13% in a month.

I have multiple stocks currently at 50% gains after only a few weeks. The cost

to join his memberships will be made back in less than a month. ….. unlike

others out there"

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Welcome back to a new trading week.

Now that January is over, I was planning to talk about how stocks have

performed over the month in today’s newsletter.

But I’m moving that to tomorrow’s newsletter…

Because today, we need to talk about the $10 trillion wipeout that happened

in the precious metals markets on Friday.

Chart of the Day

That’s silver dropping 30% in a single day – and 46% in a matter of two days.

Gold also saw double-digit selloffs – alongside other metals like platinum and

copper.

This rout wiped out $10 trillion in market value in a matter of hours…

And it was the worst day for gold and silver since 1980.

One of the biggest “reasons” the news is giving for this plunge is the

nomination of Kevin Warsh by Trump for the new Fed Chair.

This was viewed as Trump respecting Fed independence – reducing market risk…

And in turn reducing demand for safe haven assets like precious metals.

This reason “seems” to make sense, and I’m sure it played a factor in the

massive selloff.

But let me give you the trader’s perspective.

Just look again at this parabolic price action, this time over a longer

timeframe.

There was no proper “base”...

No steady buildup of buyers slowly absorbing supply and sellers getting

exhausted.

Instead what we got was a rabid horde of buyers rushing in due to FOMO.

And the moment people started selling, those who came in at the highs

immediately started dumping their positions out of fear too…

Amplifying the magnitude of the selloff.

9 times out of 10, these parabolic price moves never last – and for good

reason.

But if we take a step back, we can see that the bull case for silver is still

strong.

It’s still significantly up…

And the underlying factors – growing industrial demand amid a structural

supply deficit – are still there.

But no matter the underlying factors…

These kinds of parabolic surges rarely last – and silver just proved it.

And that brings us to a critical insight that’s even more important in today’s

headline-driven market.

I explain below.

Insight of the Day

Rapid price surges can actually be the most dangerous kind of price action.

Yes, we want to see more buyers than sellers.

But when buyers start flooding in just because they see the price of an asset

rapidly increasing…

It’s actually some of the most dangerous price action there is.

Because it naturally leads to FOMO – which can be very difficult to resist,

even for experienced traders…

And it can lure you in – causing you to buy at the top and sell after a big

drop as early buyers take profit.

In today’s headline-driven market, these kinds of rapid price surges catch

more attention than ever…

Which also means they’re more dangerous than ever.

The final part of silver’s parabolic move was likely driven by retail flows…

While the initial base was driven by the institutional flows – the “smart

money”.

In short, we likely saw the “smart money” dumping their bags on the retail

traders coming in at the top…

A tale as old as time.

Learn from the mistakes of those “late to the party” FOMO silver investors.

What we want to do instead is come in at the same time as the “smart money”...

And tomorrow, Tuesday February 3, at 11 a.m. Eastern…

I’m going LIVE to show you my top strategy for tracking these smart money

footprints…

Long before the FOMO crowd comes rushing in.

This will allow you to take the “smart” side of the trade – and take advantage

of the FOMO crowd(instead of joining them).

Just look at some of the trades this strategy could have allowed you to take.

So click here to secure your free spot for my live strategy reveal tomorrow…

<[link removed]>

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

"IF YOU WANNA MAKE MONEY, DO IT.

Hands down the best investment I’ve ever made.

Clear, simple and the most effective method I’ve come across. I’ve invested in

training with other “gurus” who although they were good, they left out the most

important part. … HOW TO FIND STOCKS.

Ross and his crew have completely hit it out of the park. With his method of

entering and exiting my account is up 13% in a month.

I have multiple stocks currently at 50% gains after only a few weeks. The cost

to join his memberships will be made back in less than a month. ….. unlike

others out there"

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost