|

|

Microsoft tanks 10% on earnings, everything nosedives

DOW, SPY, NASDAQ, and Bitcoin all hit the skids

Hello Capitalists,

Here is everything you should be watching today:

Microsoft tanks and the markets take it in the teeth

Trump Accounts hit 500K sign ups with more to come

Copper explodes off the back of stockpiling

Tesla to cancel two iconic car models

Starbucks seeks to capitalize on its good news

Trump has no time for Powell after rate freeze

Today’s markets + assets:

🔴 DOW: 48893.05 (⬇️ 0.25%)

🔴 S&P: 6932.27 (⬇️ 0.63%)

🔴 NASDAQ: 23537.23 (⬇️ 1.34%)

⚠️✅CBOE VIX Volatility Index: 17.48 (⬆️ 6.91%)

✅ Gold: $5348.80(⬆️ 0.85%)

✅ Silver:$115.40 (⬆️ 1.64%)

🔴 Bitcoin: $83,826.99 (⬇️ 6.01%)

The Capitalist is a reader-supported publication Reject Corporate Left-Wing Journalism

Microsoft’s earnings shock tanks tech sector, markets, and crypto

U.S. stocks tumbled Thursday as Microsoft shares plunged over 10% despite beating earnings estimates, dragging the tech-heavy Nasdaq down 2.5%—its worst drop since October—and pulling the S&P 500 lower by about 1.5% amid investor worries over slowing cloud growth and surging AI capital spending.

Tech Drag Intensifies: Nasdaq suffers steepest decline in months as Microsoft’s sharp sell-off weighs heavily on the index and broader tech sector sentiment.

Cloud Growth Concerns: Azure revenue growth slows to 38-39% from prior quarters, raising fears that AI investments may delay profitability.

Record Spending Alert: Microsoft reports ballooning capital expenditures hitting new highs, fueling investor anxiety about long-term returns on massive AI infrastructure bets.

Mixed Mag7 Reactions: While Microsoft sinks, other tech giants like Meta rise strongly post-earnings, highlighting divergent investor views on AI spending outcomes.

Together with PolitiBrawl Shop

The “Jolly Donald” is the flag you need!

An excellent way to display your American Pride and stand up to the woke MOB!

On your Boat, House or Truck, the message is clear!

Made from 100% durable polyester, this flag is designed to withstand the elements while maintaining vibrant colors and high visibility. With its double-sided design, you can showcase it’s message on both sides, ensuring that it looks great from any angle.

Trump accounts explode 500,000 signups, big reveals coming

Treasury Secretary Scott Bessent teased major announcements on additional state and philanthropist contributions to Trump Accounts as signups surged to 500,000 families ahead of a White House summit, with the program set to provide $1,000 federally funded investment accounts for children born 2025-2028 starting July 4.

Signup Surge Reported: More than 500,000 families have registered for Trump Accounts since the start of tax season, far exceeding early expectations for the initiative.

Program Eligibility Details: Federal $1,000 seed investments target U.S. children born between 2025 and 2028, with accounts growing tax-advantaged until age 18 for uses like college or home purchases.

Major Private Boosts: Philanthropists like Michael and Susan Dell pledged $6.25 billion to add $250 per child for millions in lower-income areas, alongside corporate matches from JPMorgan Chase and Bank of America.

Bipartisan Momentum Highlighted: Bessent emphasized broad support for the program, crediting President Trump’s coalition-building, with potential for up to 20 states to join future contributions.

BREAKING Update:

Treasury Secretary reveals that a million people have signed up for “Trump Accounts” just this week.

Copper explodes to record high in metals frenzy

Copper prices surged to a stunning record high above $13,000 per ton Thursday, up nearly 10% in a single session, fueled by supply disruptions, U.S. tariff threats, and booming demand from AI data centers and electrification—joining gold and silver in 2026’s explosive metals rally.

Tariff turmoil sparks surge: President Trump’s proposed 50% tariffs on copper imports triggered preemptive stockpiling in the U.S., draining global supplies and tightening markets in Europe and Asia despite later clarifications.

Supply shocks hit hard: Major disruptions including earthquakes at Ivanhoe Mines’ Kakula and mudflows at Freeport-McMoRan’s Grasberg mine in Indonesia led to force majeure declarations and reduced output.

AI demand drives future: Copper’s critical role in data centers and AI infrastructure supports long-term growth, with global demand projected to jump from 28 million tons in 2025 to 42 million tons by 2040.

Rally deemed unsustainable: Analysts warn speculative buying has pushed prices beyond fundamentals, with experts like StoneX predicting downward pressure as overdone positioning unwinds.

|

Tesla axes iconic Model S, and X production forever

Tesla is ending production of its flagship Model S sedan and Model X SUV, CEO Elon Musk announced Wednesday on the Q4 earnings call, as the company shifts Fremont factory lines to mass-produce Optimus humanoid robots in a bold pivot to an autonomous and robotics future. Buyers are urged to order now before the models vanish.

Production Wind-Down Timeline: Tesla will phase out Model S and X manufacturing next quarter, fully ending by mid-2026, with no direct replacements planned for these aging luxury EVs.

Factory Reallocation Strategy: Fremont production lines are being replaced with a high-volume Optimus robot assembly capable of 1 million units annually to support Tesla’s robotics ambitions.

Historical Significance Highlighted: As Tesla’s oldest models since 2012 (S) and 2015 (X), they represent the brand’s early EV era but now account for just a tiny fraction of deliveries amid dominance by Model 3 and Y.

Strategic Shift Implications: The move underscores Elon Musk’s focus on autonomy, driverless tech, and humanoid robots over traditional vehicles, coinciding with Tesla’s first annual revenue decline.

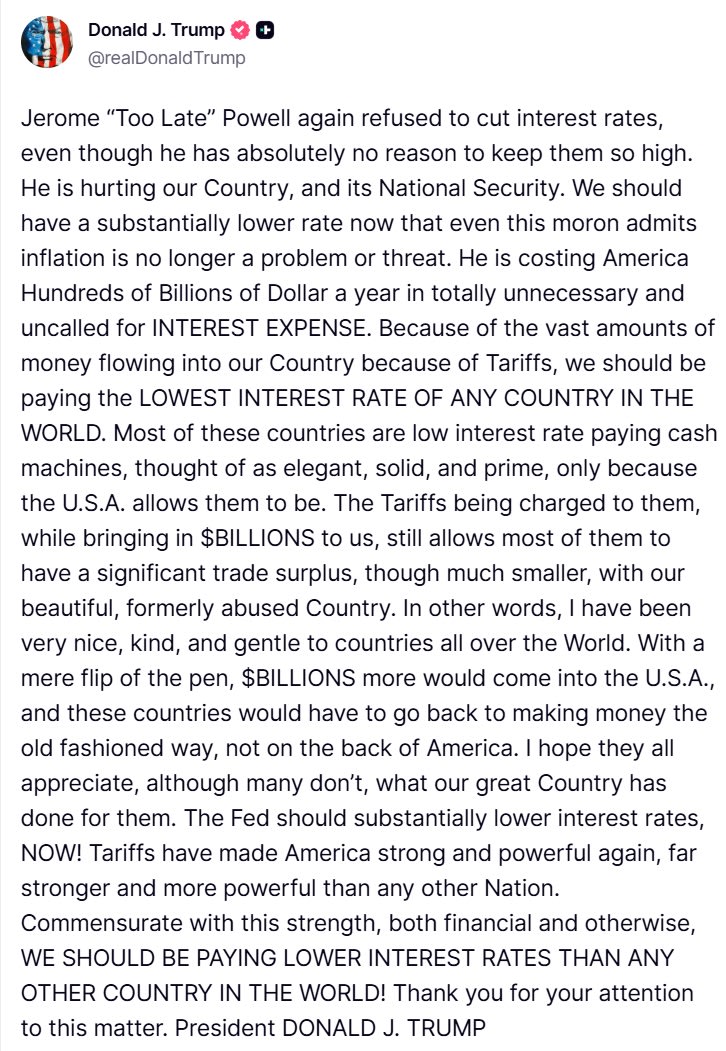

Trump blasts Powell as moron over Fed rate hold

President Donald Trump on Thursday labeled Federal Reserve Chair Jerome Powell a “moron” after the central bank held interest rates steady at 3.5% to 3.75%, defying calls for cuts amid claims inflation is no longer a threat and tariffs boost U.S. revenues. Trump accused Powell of costing the nation billions in unnecessary interest expenses.

Trump escalates feud: Renewed personal attacks include calling Powell “Too Late” and claiming high rates harm national security and economic growth.

Fed decision details: Central bank paused rate cuts on January 28, 2026, citing solid economic expansion and somewhat elevated inflation despite Powell noting no major threat.

Trump demands action : Insists U.S. deserves world’s lowest rates due to tariff inflows, urging immediate substantial reductions to avoid massive interest costs.

Broader tensions rise: Confrontation intensifies with DOJ probe into Powell, Supreme Court case on Fed removals, and hints at potential leadership changes.

Starbucks revives loyalty tiers, as equitable rewards fail, superfans rejoice

Starbucks is bringing back tiered status to its Rewards program starting March 10, aiming to better reward its most frequent customers who visit up to 200 times a year—previously treated the same as once-a-year visitors—as part of CEO Brian Niccol’s turnaround push to boost visits and sales.

Three-Tier Structure Unveiled: Green (under 500 stars), Gold (500+ stars), and Reserve (2,500+ stars) levels launch March 10, with escalating perks like faster star earning and exclusive access.

Key Benefits Upgraded: Gold and Reserve members get never-expiring stars, higher earn rates (1.2 or 1.7 stars per dollar), plus new options like Free Mod Mondays and a $2 discount at 60 stars.

Reverses 2019 Change: Company scraps flat system from 2019 that equalized all members, acknowledging it failed to incentivize top loyalists amid broader efforts to drive frequent visits.

Loyalty Drives Revenue: Program fuels 60% of U.S. sales through linked transactions, with active members hitting record highs as traffic grows for both Rewards and non-members.